Central Fill Pharmacy Automation Market Outlook:

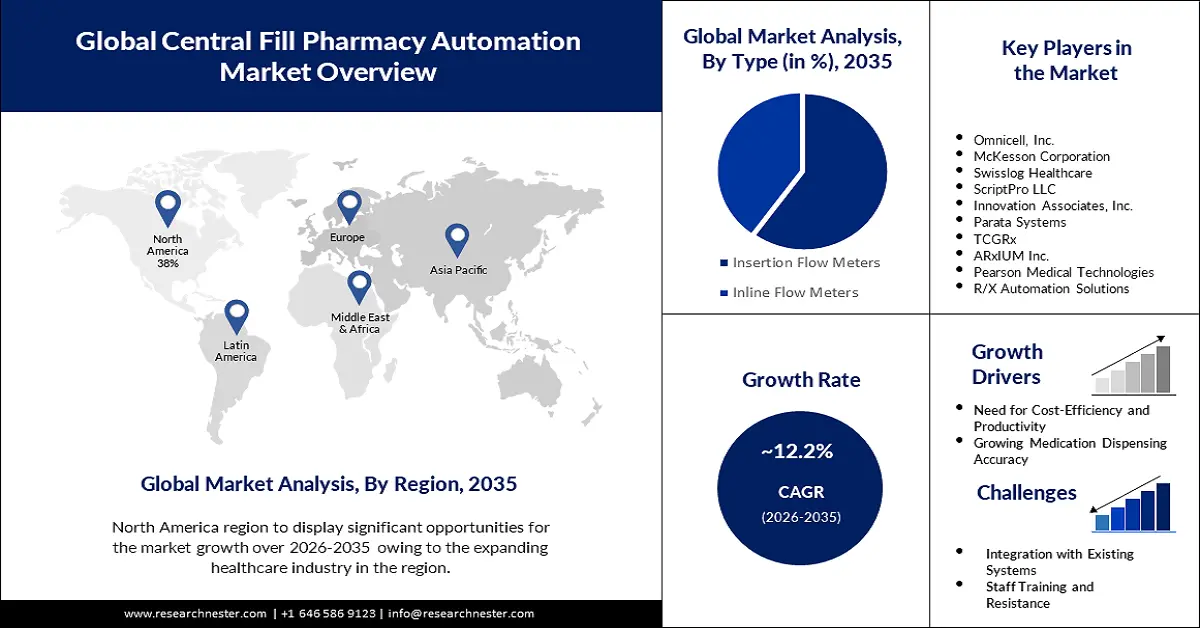

Central Fill Pharmacy Automation Market size was over USD 1.04 billion in 2025 and is poised to exceed USD 3.29 billion by 2035, witnessing over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of central fill pharmacy automation is estimated at USD 1.15 billion.

The rising integration with telehealth services is one of the main growth drivers propelling the market. A significant growth driver for the market is the seamless integration of automation systems with telehealth services. The convergence of central fill pharmacy automation and telehealth creates a synergistic approach that addresses both prescription fulfillment efficiency and patient convenience, especially in the context of evolving healthcare delivery models. Telehealth utilization in the United States increased by approximately 38 times in April 2020 compared to the same month in 2019, according to the Centers for Disease Control and Prevention (CDC).

Automated systems that verify the accuracy of prescription orders to reduce errors in dispensing medications. Barcoding technology is used to ensure accurate prescription labeling and tracking throughout the prescription fulfillment process. The central fill pharmacy automation market has grown significantly in response to the need for cost-effective and efficient prescription fulfillment, especially in large pharmacy chains and healthcare organizations. It helps reduce the burden on individual retail pharmacies, increases accuracy, and allows pharmacists to focus on patient care and consultation.

Key Central Fill Pharmacy Automation Market Insights Summary:

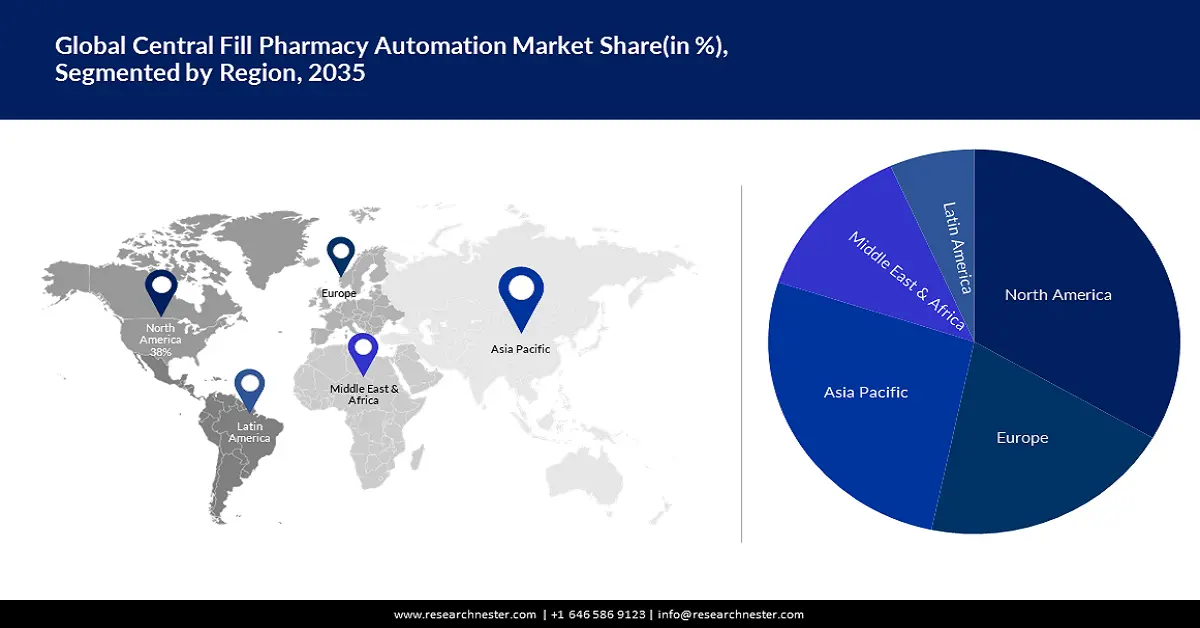

Regional Highlights:

- The North America central fill pharmacy automation market will dominate more than 40% share by 2035, driven by continuously increasing prescription volume due to population growth, aging demographics, and prevalence of chronic diseases.

- The Asia Pacific market will secure the second largest share by 2035, attributed to increasing demand for healthcare services due to a rapidly aging population, urbanization, and prevalence of chronic diseases.

Segment Insights:

- The patients segment in the central fill pharmacy automation market is projected to capture a 66% share by 2035, influenced by patient preference for sustainable and environmentally responsible pharmacy practices.

- The conveyor systems segment in the central fill pharmacy automation market is expected to experience substantial growth through 2035, driven by advances in robotics and tracking enhancing efficiency in pharmacy automation.

Key Growth Trends:

- Rising Demand for Cost-Efficiency and Productivity

- Increasing Medication Dispensing Accuracy

Major Challenges:

- Initial Investment Costs

- Integration with Existing Systems

Key Players: Omnicell, Inc., McKesson Corporation, Swisslog Healthcare, ScriptPro LLC, Innovation Associates, Inc., Parata Systems.

Global Central Fill Pharmacy Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.04 billion

- 2026 Market Size: USD 1.15 billion

- Projected Market Size: USD 3.29 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Canada, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Central Fill Pharmacy Automation Market Growth Drivers and Challenges:

Growth Drivers

- Rising Demand for Cost-Efficiency and Productivity: One of the primary drivers of the central fill pharmacy automation market has been the growing demand for cost-efficiency and productivity in the healthcare sector. Central fill pharmacies are increasingly being adopted by pharmacy chains and healthcare organizations to streamline the prescription filling process, reduce labor costs, and enhance overall operational efficiency. The potential cost savings associated with automation is a significant driver of growth in this market. According to the U.S. Bureau of Labor Statistics, as of 2020, the median annual wage for pharmacy technicians in the United States was USD 35,100.

- Increasing Medication Dispensing Accuracy: Medication errors can have serious consequences for patients, including health risks and legal liabilities for healthcare providers. Central fill pharmacy automation systems are designed to significantly reduce the risk of human error in prescription filling. These systems use robotics and advanced technologies to precisely measure and dispense medications, ensuring that the right drug, dosage, and quantity are provided for each prescription.

- Pharmacy Workforce Shortages: The healthcare industry, including pharmacies, has been facing a shortage of qualified personnel, including pharmacists and pharmacy technicians. The demand for healthcare services is on the rise, but the supply of healthcare professionals has not kept pace. Central fill automation systems help alleviate this workforce shortage by handling repetitive, time-consuming tasks, such as prescription filling, which would otherwise require more pharmacy staff. As a result, pharmacies can reallocate their staff to more patient-facing and value-added roles, which not only addresses workforce shortages but also enhances patient care quality.

Challenges

- Initial Investment Costs: Implementing central fill pharmacy automation systems can require a significant upfront investment. Costs include the purchase of automation equipment, software, and integration with existing pharmacy systems. Smaller pharmacies and healthcare facilities may find it challenging to justify and afford these initial expenses. One of the most substantial expenses is the purchase of automation equipment. This includes robotic dispensing systems, automated pill counters, conveyor systems, prescription verification technology, barcode scanners, label printers, and other hardware necessary for the automation process. The cost of this equipment can vary depending on the complexity and scale of the automation system.

- Integration with Existing Systems

- Staff Training and Resistance

Central Fill Pharmacy Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 1.04 billion |

|

Forecast Year Market Size (2035) |

USD 3.29 billion |

|

Regional Scope |

|

Central Fill Pharmacy Automation Market Segmentation:

Type Segment Analysis

The conveyor systems segment is estimated to account for 60% share of the global central fill pharmacy automation market in the year 2035. Conveyor systems are continually advancing, integrating cutting-edge technology such as robotics and sophisticated tracking systems. This enhances their efficiency, adaptability, and compatibility with evolving pharmacy automation needs. Technological progress is a significant driver of adoption, as pharmacies seek the most advanced and effective solutions. The global pharmacy automation industry was valued at nearly USD 3.6 billion in 2019. As the world emphasizes environmental sustainability, conveyor systems contribute by reducing the need for excess packaging and manual handling. Automation minimizes waste generation, a key environmental concern. Pharmacies that prioritize sustainability align with the global commitment to eco-friendly practices.

End User Segment Analysis

Central fill pharmacy automation market from the patients segment is expected to garner a significant share in the year 2035. Patients are increasingly concerned about environmental sustainability. Automation in central fill pharmacies contributes to sustainability by reducing the need for excess packaging and minimizing waste. Patients appreciate environmentally responsible practices in healthcare. A survey found that 66% of respondents were willing to pay more for products and services from companies committed to positive environmental and social impact. Automation systems in central fill pharmacies free up pharmacists and healthcare staff to spend more time on patient counseling and education. Patients benefit from personalized guidance on medication usage, potential side effects, and lifestyle adjustments. Enhanced counseling leads to better patient understanding and overall health outcomes.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Central Fill Pharmacy Automation Market Regional Analysis:

North American Market Insights

The central fill pharmacy automation market in the North America region is projected to hold the largest revenue share of 40% by the end of 2035. One of the primary growth drivers for the market in North America is the continuously increasing prescription volume. The United States and Canada have been experiencing a rise in the demand for prescription medications, influenced by factors such as population growth, aging demographics, and the increasing prevalence of chronic diseases. This surge in prescription volume necessitates automation to efficiently manage the medication fulfillment process. In the United States, prescription drug expenditures were estimated to have reached USD 370.7 billion in 2019. Enhancing patient safety and medication accuracy is a critical driver for the adoption of central fill pharmacy automation.

APAC Market Insights

The central fill pharmacy automation market in the Asia Pacific region is projected to hold the second largest share during the forecast period. One of the primary drivers for the market in the APAC region is the increasing demand for healthcare services. This demand is propelled by several factors, including a rapidly aging population, urbanization, and the prevalence of chronic diseases. As the demand for healthcare services surges, so does the need for efficient prescription fulfillment, making central fill pharmacy automation a critical solution. The World Health Organization (WHO) notes that Asia Pacific is experiencing an aging population, with a projected increase in the number of people aged 60 and over from 549 million in 2019 to 1.3 billion in 2050. Ensuring medication safety and accuracy is paramount in healthcare, and medication errors can have severe consequences for patients. Central fill pharmacy automation significantly reduces the risk of errors by automating the medication dispensing process, ensuring precise dosages and proper labeling. This enhances patient safety and builds trust in healthcare services. Efficiency in workflow is a crucial driver for central fill pharmacy automation in the APAC region.

Central Fill Pharmacy Automation Market Players:

- Omnicell, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- McKesson Corporation

- Swisslog Healthcare

- ScriptPro LLC

- Innovation Associates, Inc.

- Parata Systems

- TCGRx

- ARxIUM Inc.

- Pearson Medical Technologies

- R/X Automation Solutions

Recent Developments

- McKesson acquired RxCrossroads, a US-based pharmacy services company, for USD 1.4 billion. The acquisition expanded McKesson's portfolio of pharmacy services and solutions.

- McKesson acquired BrightSpring Health Services, a US-based home health and hospice care provider, for USD 3.1 billion. The acquisition expanded McKesson's presence in the home health and hospice care market.

- Report ID: 5392

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.