Labyrinthitis Market Outlook:

Labyrinthitis Market size was valued at USD 838.8 million in 2025 and is projected to reach USD 1340.4 million by the end of 2035, rising at a CAGR of 4.8% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of labyrinthitis is estimated at USD 879.0 million.

The labyrinthitis market comprises a patient pool, which is estimated that 69 million people in the U.S. with aged above 50 experience vestibular dysfunction, as per the Vestibular report in 2025. Besides, hospitalizations for severe bacterial labyrinthitis account for ENT admissions in developed regions, highly driven by antibiotic resistance and delayed diagnosis. The supply chain facility for labyrinthitis treatment depends on generic antibiotics, corticosteroids, and antivirals, out of which active pharmaceutical ingredients (APIs) are readily sourced from China and India. Also, medical devices, such as vestibular rehab equipment and electronystagmography (ENG) systems, are manufactured, and imported from Southeast Asia, thereby driving the market growth worldwide.

Investment in research, development, and deployment (RDD) is important, and the NIDCD report in March 2024 states that USD 1.6 million is funded for research into hearing and balance disorders, which specifically supports basic and clinical investigations into the pathophysiology and treatment of labyrinthitis. In terms of trade, U.S. import values for medicaments containing corticosteroids (HS code 3004.32) are consistently higher than export values, with major trade partners including the European Union and Switzerland, according to International Trade Administration data.

Key Labyrinthitis Market Insights Summary:

Regional Highlights:

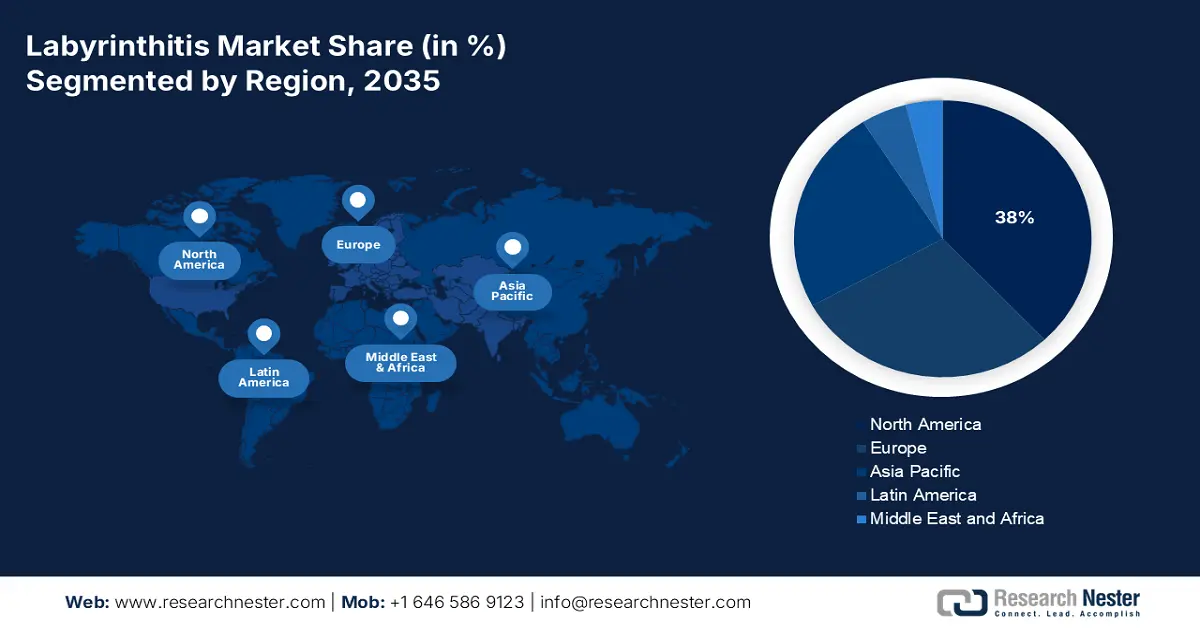

- The North America market is projected to hold a 38% share by 2035, owing to favorable reimbursement policies, advanced healthcare infrastructure, and integration of digital health systems.

- The Asia Pacific market is expected to be the fastest-growing region by 2035, driven by an aging population, expanding healthcare access, and government-led initiatives improving treatment affordability.

Segment Insights:

- The medication sub-segment is projected to hold 65% share by 2035, driven by the predominance of pharmacologic management using multi-drug therapy for vertigo, nausea, and inflammation.

- The oral drug delivery sub-segment is expected to lead by 2035, impelled by its simplicity, affordability, and high patient compliance for long-term therapy.

Key Growth Trends:

- Government reimbursement and healthcare spending

- Increasing disease prevalence and aging population

Major Challenges:

- Delays in regulatory components

- Underutilization of diagnostic

Key Players: Pfizer Inc., Novartis AG, GlaxoSmithKline (GSK), Roche Holding AG, Merck & Co., Sanofi S.A., AbbVie Inc., AstraZeneca PLC, Johnson & Johnson, Teva Pharmaceutical, Takeda Pharmaceutical, Daiichi Sankyo, Mylan N.V. (now part of Viatris), Sun Pharmaceutical, CSL Limited, Bayer AG, LG Chem, Hikma Pharmaceuticals, Dr. Reddy's Laboratories, Hovid Berhad

Global Labyrinthitis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 838.8 million

- 2026 Market Size: USD 879.0 million

- Projected Market Size: USD 1340.4 million by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 23 October, 2025

Labyrinthitis Market - Growth Drivers and Challenges

Growth Drivers

- Government reimbursement and healthcare spending: Strong government reimbursement, especially in the U.S., drives market demand directly by providing patient access to treatment. Medicare expenditure on vestibular disorder care, such as labyrinthitis, has been steadily increasing annually, with significant increased coverage of vestibular testing. The increase in reimbursement for therapeutics and diagnostics lowers the costs of barriers to the aging population, which is at greater risk. Such policies provide a stable source of revenue for manufacturers and encourage new product development to fit public insurance formularies, and therefore government payers are a key driver of market growth.

- Increasing disease prevalence and aging population: The rising worldwide incidence of vestibular disorders, is driven by an aging population, which is a basic demand driver. The February 2025 WHO report explains that more than 5% of the population needs to be addressed for the hearing disorder. In Europe, the Federal Ministry of Health of Germany estimates that the pool of patients is growing for chronic vertigo conditions every year. This growing, treatment-requiring population base ensures a steadily rising market for both short-term symptom control and long-term vestibular rehabilitation treatments, influencing long-term R&D and commercial strategy.

- Cost-effectiveness and improvement in healthcare quality: Healthcare systems are focusing on early intervention to overcome labyrinthitis-specified hospitalizations. In this regard, a clinical study was published by NLM in June 2022 depicts that the bed occupancy for ENT patient is 98% and the mean unit cost for one bed-day in IP was USD 35.30. Meanwhile, the telemedicine for vertigo triage in Germany eventually decreased ER visits, thus driving the market growth.

Mechanism of Action and Dosage of Vestibular Neuritis Drugs

|

Drug Class |

Drug |

Mechanism(s) of Action |

Dosage Suggested |

Route of Administration |

|

Histamine Analog |

Betahistine |

Strong antagonist of histamine H3 receptors and weak agonist of H1 receptors (40, 41) |

24-48 mg daily (40) |

OS |

|

Benzodiazepines |

Diazepam |

Allosteric modulation of GABA<sub>A</sub> receptor (42, 43) |

4-60 mg/day (OS); 10-60 mg/day (IV, IM) (44) |

OS, IV, IM, Rectal |

|

Benzodiazepines |

Lorazepam |

Allosteric modulation of GABA<sub>A</sub> receptor (42, 43) |

2-10 mg/day (45, 46) |

OS, IM, IV |

|

Anticholinergics |

Atropine |

Non-selective muscarinic blocker (47) |

0.3-4 mg (depending on clinical indication) (47, 48) |

IV, IM, SC |

Source: NLM September 2022

Challenges

- Delays in regulatory components: The presence of bureaucratic bottlenecks causes hindrance in the labyrinthitis market that negatively impacts the treatment rollout. For instance, the Central Drugs Standard Control Organization (CDSCO) in India requires time for the latest drug acceptances, which is twice the EMA and FDA timeline. Meanwhile, the ANVISA backlog in Brazil has deferred few vestibular drugs since 2022, resulting in the market growth limit. Therefore, these gaps pressurize organizations to deprioritize high-need regions, thereby worsening untreated and undiagnosed cases worldwide.

- Underutilization of diagnostic: The aspect of misdiagnosis is a huge barrier to the labyrinthitis market development. As stated in an article published by the AHRQ, labyrinthitis cases are plagued by mistreatment since primary care physicians frequently complicate it with stroke or migraine. In the U.S., vestibular evaluation hubs are established, and meanwhile, in Brazil, SUS is deprived of ENG equipment in clinics. However, to combat this, telemedicine pilots have been integrated in arctic regions of Canada, which constitute the capability to reduce diagnostic delays, therefore suitable for the market.

Labyrinthitis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 838.8 million |

|

Forecast Year Market Size (2035) |

USD 1340.4 million |

|

Regional Scope |

|

Labyrinthitis Market Segmentation:

Treatment Type Segment Analysis

The medication leads the treatment type segment and is expected to hold the market share of 65% by the end of 2035. The segment is mainly driven due to the labyrinthitis management is primarily pharmacologic. The treatment paradigm focuses on a multi-drug technique to control symptoms like vertigo (antihistamines), nausea (anti-emetics), and underlying inflammation (corticosteroids). According to the NLM study in July 2025, the usual time period for acute vertigo of labyrinthitis medication is 48 to 72 hours that are managed with prescription medications in an outpatient setting, with surgery reserved for rare, intractable cases. This high reliance on pharmaceutical interventions sets a dominant revenue share.

Route of Administration Segment Analysis

Under the drug delivery segment, oral is leading the segment in the labyrinthitis market. The segment is fueled by the condition treatment pathway, initially commencing with injectable forms in the acute setting but rapidly transferring to oral medications for long-term therapy and ambulatory treatment. Oral corticosteroids and antihistamines are the norm for follow-up therapy, necessitating a multi-week course. Oral administration is the most popular and economically significant method in both public and private healthcare systems due to its simplicity, affordability, and high patient compliance.

Dosage Form Segment Analysis

In the dosage form segment, tablets are dominating the segment due to their paramount advantages in outpatient care. Further, tablets are driven by their stability, precise dosing, and ease of administration which makes it as the preferred choice for the oral corticosteroids and antivertigo drugs that form the cornerstone of long-term management. According to the Medsafe January 2022 report, betahistine tablets come in 8 mg, 16 mg, and 24 mg forms and are usually prescribed oral tablets for vestibular conditions such as labyrinthitis and Meniere's disease. Following initial acute care, patients are prescribed to take a multi-week oral taper, which drives the high-volume tablet prescriptions. This convenience for chronic symptom management and high patient compliance solidifies tablets as the most commercially significant dosage form in the market.

Our in-depth analysis of the labyrinthitis market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

Dosage Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Labyrinthitis Market - Regional Analysis

North America Market Insights

North America in the labyrinthitis market is projected to account for the highest share of 38% in the labyrinthitis market during the forecast timeline. The region’s growth is effectively attributed to suitable reimbursement policies and the presence of advanced healthcare infrastructure. The market is further driven by favorable reimbursement policies via Medicare and Medicaid. To position the region as a leader in both market value and advanced care models, strategic initiatives are increasingly focused on creating targeted biologic medications and integrating digital health systems for vestibular rehabilitation and remote patient monitoring.

The U.S. labyrinthitis market is immensely expanding and largely supported by Medicaid and Medicare policies covering branded medications. Furthermore, the January 2024 Frontiers report cited the fact that vestibular disorder prevalence among adults in the U.S. was 11.9%. Meanwhile, Medicaid expenditures for labyrinthitis-related treatments in 2023 underscore the substantial fiscal impact on public health systems. The key trends are moving towards precision biologic treatments and incorporating telemedicine for post-diagnosis care and vestibular rehabilitation, enhancing management in chronic cases.

The labyrinthitis market in Canada is experiencing evolution shaped by universal healthcare and a strategic focus on cost-effective management. This growth is readily propelled by the presence and availability of generous provincial health and medical investments. Based on this factor, Rotary Ride for Hearing's report in 2025 has stated they have raised nearly USD 3.9 million for research, restorative care, and recovery for patients with hearing disorders. Also, the aspect of telehealth service, especially in rural areas of the country, has improved accessibility, thereby creating a prolific opportunity for market expansion.

Statistical Data on Labyrinthitis Conducted in the U.S. and Canada in 2023

|

Trial Focus |

Location |

Year |

Key Data / Outcomes |

|

Idiopathic Labyrinthitis Clinical Study |

The Netherlands* (Closely related region) |

2023 |

61 patients studied; 72.5% had persistent balance problems after median 61 months follow-up; 20% reported subjective hearing recovery |

|

Drug Therapy and Rehabilitation Analysis |

Canada |

2023 |

Emphasis on corticosteroid regimens, antivertigo drugs, vestibular rehabilitation post-acute phase; aim to reduce chronic dizziness |

Source: NLM November 2023, Balance and Dizziness Canada September 2021

APAC Market Insights

The labyrinthitis market in Asia Pacific is the fastest-growing region and is fueled by a combination of huge, aging population, growing healthcare accessibility, and increasing diagnostic rates. Key drivers include government-led healthcare expansion initiatives, such as China's Healthy China 2030 and India's Ayushman Bharat, which are integrating specialist care into primary health networks. A major trend is the fast pace of localization of API and generic drug production, lessening import reliance and increasing affordability of treatments.

The labyrinthitis market in Japan is driven by its advanced healthcare system and rising elderly population, which results in a constant need for labyrinthitis therapies. The Ministry of Health, Labour and Welfare (MHLW) has prioritized vestibular disorders within its broader neurology focus. In the NLM June 2022 report, the hearing-aid adoption rate in Japan is 14.4% due to the social awareness and being prescribed by doctors. Further, various awareness campaigns are conducted in the nation, which are crucial to manage the rehabilitation of hearing impairments.

The labyrinthitis market in China is defined by its size and rapid development and is driven by systemic healthcare expansion and patient awareness. Government initiatives are actively increasing the availability of treatments and diagnostics through public health networks. A mature domestic pharmaceutical sector ensures a reliable supply of essential drugs and active ingredients. Evolving regulatory channels and increasing standards of living are boosting the demand for low-cost generics and novel therapies, creating a highly competitive and dynamic environment for manufacturers.

Europe Market Insights

Europe in the labyrinthitis market is projected to account for a considerable share during the forecast period. The market’s upliftment is propelled by aging demographics, as well as the availability of standardized EU care protocols such as VERTIGO-CARE initiative, which can diminish diagnostic delays. An important trend is the European Health Data Space (EHDS) program, which aims to speed up clinical research and the development of individualized treatments for diseases like labyrinthitis by facilitating cross-border health data interchange. Furthermore, stringent regulatory oversight from the European Medicines Agency (EMA) ensures high standards for drug approvals, fostering a competitive environment for both novel biologics and generic medications.

The labyrinthitis market in Germany is gaining increased exposure by grabbing the majority of the region’s revenue through standard policy support, along with the presence of a strong health and medical infrastructure. Besides, the prevalence of hearing loss in the NLM study in July 2024 is 14.2%, highlighting the demand for treatment coverage benefits through statutory health insurance. Also, the adoption of artificial intelligence-driven ENG diagnostics in domestic hospitals has reduced mistreatment rates, thus a prolific way to evolve the market in the country.

The labyrinthitis market in the UK is growing, owing to the provision of private funding and NHS reforms. The NLM study in May 2023 states that the prevalence of vestibular disorder in England accounts for 47.6% respectively. Growing awareness, advanced diagnostic tools, and government programs are promoting vestibular rehabilitation and are all propelling the market's growth and opening doors for treatments, equipment, and specialized clinical services aimed at problems related to hearing loss, vertigo, and balance.

Key Labyrinthitis Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- GlaxoSmithKline (GSK)

- Roche Holding AG

- Merck & Co.

- Sanofi S.A.

- AbbVie Inc.

- AstraZeneca PLC

- Johnson & Johnson

- Teva Pharmaceutical

- Takeda Pharmaceutical

- Daiichi Sankyo

- Mylan N.V. (now part of Viatris)

- Sun Pharmaceutical

- CSL Limited

- Bayer AG

- LG Chem

- Hikma Pharmaceuticals

- Dr. Reddy's Laboratories

- Hovid Berhad

The labyrinthitis market is considered to be oligopolistic with the presence of key players, including GSK, Novartis, and Pfizer, all collectively holding the highest global market share. These organizations implement strategies, such as organizational partnerships and collaborations, tactical investments, research and development activities, along with service expansion. For instance, in 2025, Pfizer made an investment in mRNA-based vertigo vaccines, while a partnership was formed between Novartis AG and the Mayo Clinic to escalate drug studies. Meanwhile, GSK expanded its service in India by initiating the API plant, thus readily uplifting the market internationally.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Touchstone announced the acquisition of the ARC-EX System from ONWARD Medical, positioning it as one of the first facilities in Arizona to provide this FDA-approved therapy for patients with chronic spinal cord injuries, as well as for vertigo, dizziness management, labyrinthitis, and vestibular rehabilitation.

- In June 2025, Bertec announced the introduction of its advanced virtual reality Head Mounted Display system at Mountain View Therapy, MRH, aimed at improving outcomes in vestibular rehabilitation for patients with complex balance disorders, including those recovering from labyrinthitis.

- Report ID: 7714

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Labyrinthitis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.