Genetic Testing Market Outlook:

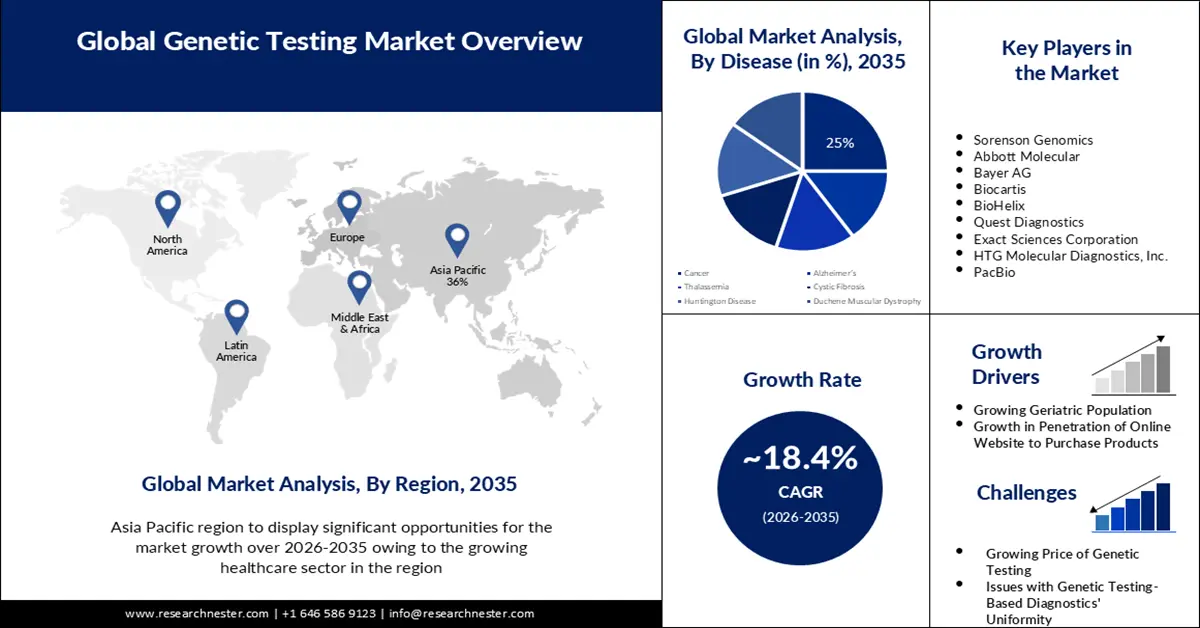

Genetic Testing Market size was valued at USD 17.21 billion in 2025 and is set to exceed USD 93.17 billion by 2035, expanding at over 18.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of genetic testing is estimated at USD 20.06 billion.

The major growth factor in the market is impelled by the rising prevalence of hereditary illnesses. 72-80% of rare diseases across the globe are caused by genetic mutations (2021 Frontiers article). An NLM study from February 2025 revealed that 93.4% of the 2799 subjects from the Undiagnosed Diseases Network (UDN) were detected to have genetic disease. In addition, congenital birth defects took 240,000 newborns’ lives within 28 days of delivery and it affected approximately 6.0% of these adolescents worldwide, according to a 2023 WHO report. This highlights the importance of prenatal tests to help parents make crucial decisions about the early diagnosis, treatment, and prevention for infants at higher risk, propelling adoption in this field.

The growing popularity of reproductive health and genomic sequencing for understanding disease characteristics is influencing more residents to invest in this category. On this note, NLM published results from an in-person survey in April 2022. It concluded a willingness to pay USD 25.0, USD 25.0-500.0, and over USD 500.0 for these tests among 64.0%, 29.3%, and less than 10.0% of 677 participants, respectively. This signifies that the broad penetration of the market requires a standardized payers’ pricing to attract maximum consumers. Furthermore, the integration of advanced technologies such as AI and machine learning is revolutionizing the capabilities of this kind of diagnosis with better accuracy and improved accessibility.

Key Genetic Testing Market Insights Summary:

Regional Highlights:

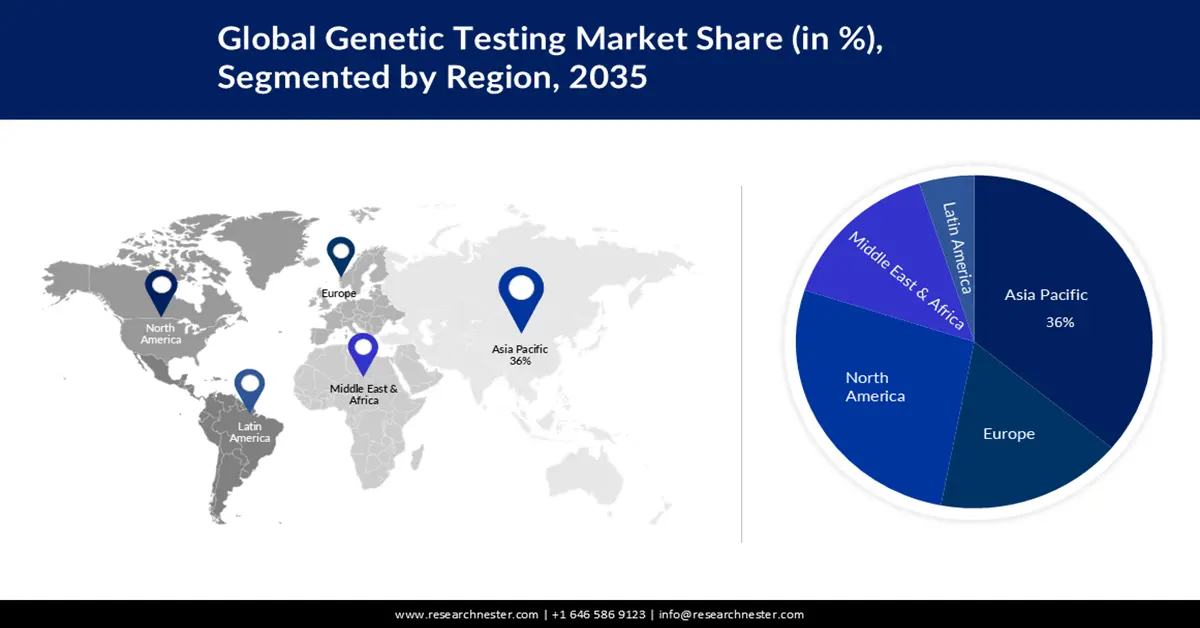

- Asia Pacific genetic testing market is predicted to capture 36% share by 2035, driven by expanding healthcare infrastructure, rising awareness of genetic testing benefits, and improved accessibility in emerging countries.

- North America market will exhibit notable growth during the forecast timeline, attributed to technological innovations, strong healthcare infrastructure, and high adoption of advanced genetic testing solutions.

Segment Insights:

- The cancer segment in the genetic testing market is projected to capture a 25% share by 2035, fueled by the growing prevalence of cancers owing to hereditary causes.

- The diagnostic testing segment in the genetic testing market is expected to achieve a notable revenue share by 2035, attributed to the rising need for early diagnosis of chronic diseases.

Key Growth Trends:

- Rising utilization in developing personalized therapies

- Improved availability of user-friendly tools

Major Challenges:

- Economic disparity and variability

Key Players: Genentech Inc., Sorenson Genomics, Abbott Molecular, Bayer AG, Biocartis, BioHelix, Quest Diagnostics, Exact Sciences Corporation, HTG Molecular Diagnostics, Inc., PacBio.

Global Genetic Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.21 billion

- 2026 Market Size: USD 20.06 billion

- Projected Market Size: USD 93.17 billion by 2035

- Growth Forecasts: 18.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Genetic Testing Market Growth Drivers and Challenges:

Growth Drivers

- Rising utilization in developing personalized therapies: As the targeted therapeutics industry gain traction, demand in the genetic testing market is propelling. The significant contribution of precision medicine to making diagnosis and treatment more effective and with fewer errors is pushing pharma developers to analyze the individual genetic composition of each patient. For instance, in June 2023, Illumina an AI-powered software, PrimateAI-3D, to detect disease-causing genetic mutations in patients, helping tailor therapies as per need.

- Improved availability of user-friendly tools: With the growing popularity of direct-to-customer (D2C) commercialization, the services and products available in the market are becoming more accessible to individuals. For instance, in 2021, MedGenome launched its new D2C subsidiary, Genessense, in this field, targeting the consumers seeking easy detection tool to identify genetic susceptibility to various lifestyle diseases. Additionally, the widespread e-commerce retailing is also improving public access to associated commodities. Furthermore, initiatives from several government bodies are also promoting their advantages in preventive healthcare. On this note, in 2022, a total of 6214 new genetic tests were made available worldwide (NLM).

Challenges

- Economic disparity and variability: The intricacy of the associated processes is the primary cause of the heightened cost of commodities from the market. The price is determined by several elements, including the test's type. In some particular situations, the patient's age affects the cost as well. Moreover, the three major factors involved in genetic testing are the time-consuming process, the need for advanced-level medical technology, and the large workforce, making it more expensive. All of these variables also make it difficult for companies to offer generalized affordable options while maintaining the quality and accuracy.

Genetic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.4% |

|

Base Year Market Size (2025) |

USD 17.21 billion |

|

Forecast Year Market Size (2035) |

USD 93.17 billion |

|

Regional Scope |

|

Genetic Testing Market Segmentation:

by Disease Segment Analysis

The cancer segment is estimated to hold 25% share of the genetic testing market throughout the assessed timeline. The growing prevalence of cancers, owing to genetic inherent, is considered as the major driver of this segment’s proprietorship. It has been clinically proven that if a cancer-risk-raising genetic mutation exists in a parent's sperm or egg cells, it could be transmitted to the newborn. According to the estimations from a 2020 NLM article, over 10.0% of the cancer cases worldwide were diagnosed with hereditary causes. It also mentioned that a cancer-positive family history was discovered among more than 20.0% of residents with malignancy. In such cases, genetic testing is highly recommended for early determination, fueling demand in this sector.

Test Type Segment Analysis

Genetic testing market from the diagnostic testing segment is set to garner a notable share by 2035. The growing incidence of chronic disease that need to be diagnosed at an early stage for better patient outcomes. These medical conditions and their repercussions could frequently be avoided or effectively managed by effective behavior change initiatives, adequate medical therapy, and thorough monitoring. Hence, the need for diagnostic tests is growing, further boosting the segment’s significance in this field. As per NLM, more than 90.0% of the total clinically available genetic tests in the world had the ability to be utilized in diagnosis in 2022.

Our in-depth analysis of the global genetic testing market includes the following segments:

|

Test Type |

|

|

Disease |

|

|

Technology |

|

|

Application |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Genetic Testing Market Regional Analysis:

APAC Market Insights

Genetic testing market in Asia Pacific is predicted to account for the largest share of 36% over the analyzed timeframe. The region’s leadership is impelled by the growing healthcare territory and increasing awareness about the benefits of these solutions. Improving accessibility in developing countries, such as India and China, is also presenting a large consumer base for this field. On this note, NLM projected the total number of established healthcare institutions in the mainland China to be 1,030,935 by 2021, backed by the meticulous efforts from the governing bodies. Moreover, habitats in the region are increasingly gaining knowledge about the importance of disease prevention, which is directly bringing greater business flow in this sector.

Several factors are driving the India market, including continuous capital influx, government initiatives, and increased public healthcare expenditure and access to advanced medical facilities. In this regard, IBEF reported that DNA Wellness invested USD 23.9 million to cultivate a nationwide network of over 100 cervical cancer screening labs by 2027, with the rights to offer CERViSure DNA Ploidy Test. Simultaneously, it highlighted the significant increment in cash inflow to the hospitals and diagnostic centres, maintaining an industry value of USD 11.1 billion from 2000 to 2024. This indicates the country’s contribution to a promising future with lucrative opportunities for this sector.

North American Market Insights

The North America genetic testing market is poised to be propagate with a notable pace of growth by the end of 2035. The rising number of technological innovations and well-established healthcare infrastructure in this region is solidifying its progress. As a result of remarkably heightened availability of clinical technology, the advanced testing solutions are being widely adopted and utilized in various disciplines. Moreover, more efficient, cost-effective, and precise genetic insights from these offerings are highly desired for both clinical and academic entities, inspiring companies to invest in this landscape. For instance, in February 2025, Foundation Medicine, in collaboration with Fulgent Genetics, launched two new germline tests, FoundationOneGermline and FoundationOneGermline More, in the U.S. market.

The U.S. is one of the largest contributors in the regional captivity on the global market with improved accessibility and presence of global pioneers. On this note, NLM revealed that the number of newly available genetic tests accounted for 51,803 in 2022, in comparison to 607 in 2012. It also mentioned the estimated size of the U.S. diagnostic testing industry to reach USD 40.1 billion by 2026. Another NLM study concluded the total count of Clinical Laboratory Improvement Amendments (CLIA)-certified laboratories to surpass 320,000 around the country’s territory in 2021. On the other hand, most of the genetic tests originate from and are performed in these CLIA-certified entities, testifying the improved availability in this sector.

Genetic Testing Market Players:

- Genentech Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sorenson Genomics

- Abbott Molecular

- Bayer AG

- Biocartis

- BioHelix

- Quest Diagnostics

- Exact Sciences Corporation

- HTG Molecular Diagnostics, Inc.

- PacBio

- GeneDx Holdings Corp.

- BioAro Inc.

- ProPhase Labs, Inc.

The quality and quantity of offerings from the market is evolving with the integration of AI and machine learning (ML). Thus, key players in this field are meticulously engaging their resources to cultivate such advanced portfolio. For instance, in March 2025, GeneDx launched an AI-based decision support tool, Multiscore, to leverage the capabilities of its interpretation platform. The embedded gene ranker is specifically designed to provide faster and more efficient clinical analysis. These revolutionary findings and creations are propelling growth and productivity in this sector and attracting more MedTech pioneers to invest in more innovation cohorts. Such key players are:

Recent Developments

- In April 2025, GeneDx shared its plans to acquire a global leader in AI-powered genomic interpretation, Fabric Genomics, to globalize its rare disease data asset. With this acquisition, the company aimed at establishing a large-scale decentralized AI-based testing platform to escalate its abilities in newborn screening and genomic data sharing.

- In February 2025, BioAro announced the commercial launch of its groundbreaking AI-powered platform, PanOmiQ, at the Precision Medicine World Conference (PMWC) in Silicon Valley. This whole genome sequencing solution is intended to reduce analysis and variant call format files generation times up to 2 hours and 5 minutes, respectively.

- In November 2024, ProPhase Labs inaugurated its new wholly owned subsidiary, DNA Complete, Inc., to garner a strong foundation for its direct-to-consumer genetic testing business. This division is dedicated to offer DNA test that sequences virtually 100% of a customer’s genome, with in-depth insights on health, wellness, and ancestry.

- Report ID: 4745

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Genetic Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.