Carbon Fiber Thread Market Outlook:

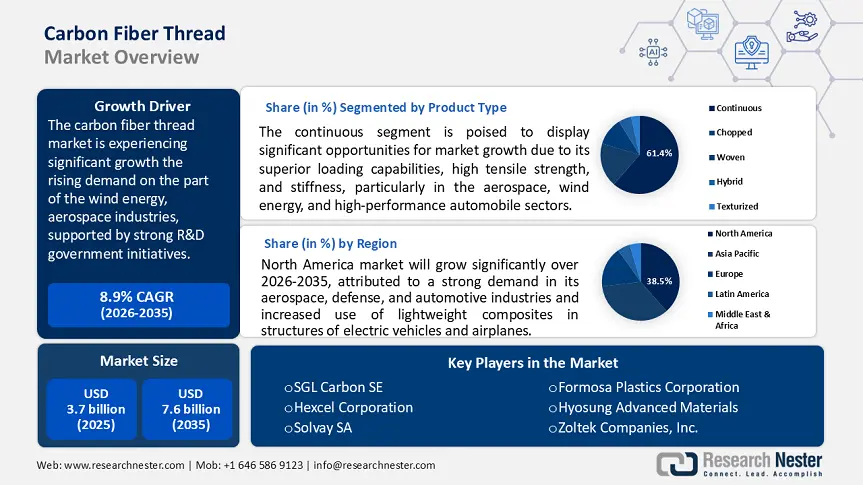

Carbon Fiber Thread Market size was valued at USD 3.7 billion in 2025 and is projected to reach USD 7.6 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period, from 2026 to 2035. In 2026, the industry size of carbon fiber threads is estimated at USD 4.0 billion.

The global carbon fiber thread market is witnessing significant growth, primarily driven by the rising demand on the part of the wind energy, aerospace industries, which are supported by rigorous research and development initiatives by the government. According to the U.S. Department of Energy, the demand for carbon fiber used in making wind turbine blades is expected to triple by 2027. Currently, carbon fiber makes up almost 24% of the total fiber demand in wind applications. The Feedstock Sourcing Issues have also been facilitated by the Federal Transit Administration supporting programs through the University of Tennessee Space Institute in terms of minimizing the cost of carbon fiber with alternative feedstocks like the pitch-based precursors. The strategies involve decreasing the cost of production, enhancing the affordability, and expanding the user base of the industries where the activities are critical. In addition, energy and transportation departments have invested in scaling the use of carbon fiber threads in light-weighting initiatives that also feed demand through the commercial aviation and public transportation sector projects.

The carbon fiber thread supply chain is highly dependent on polyacrylonitrile (PAN) formulation, which is widely imported from Japan. The U.S. does not levy duties on the imports of carbon fiber products, whereas China levies duties that amount to 15 to 17.5%, which affect international competitiveness. As per the Bureau of Industry and Security, commercial sales of carbon fiber composites in the U.S reported an annual rate of growth of 19% which surpassed other composites between 2010 and 2013. With the Producer Price Index (PPI) for carbon fiber thread manufacturing (including Fiber, Yarn, and Thread Mills) reached 166.314, steady monthly increase from 162.970 in February 2025, the carbon fiber thread market has seen higher investments in expanding domestic capacity, especially large-tow capacity manufacturing lines, which can cater to the conditions in the wind and automotive sectors. Examples of research and development by national laboratories revolve around finding cost-effective processes of treatment and surface modification. Trade in carbon fiber threads and composite uses Foreign Trade Zones that are under the control of the U.S. Customs and Border Protection to facilitate inventories used in imported precursors and exported finished commodities.

Key Carbon Fiber Thread Market Insights Summary:

Regional Highlights:

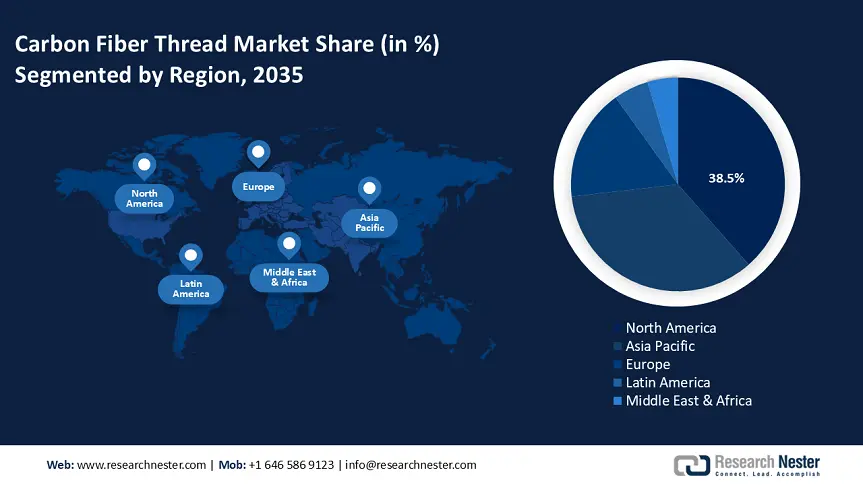

- By 2035, the North America carbon fiber thread market is anticipated to capture a 38.5% share, arising from strong demand across aerospace, defense, and automotive industries due to lightweight composite adoption.

- The Asia Pacific region is projected to account for 34.7% of the market share by 2035, sustained by rising requirements in wind energy, electric vehicles, and industrial machinery.

Segment Insights:

- The continuous carbon fiber segment in the carbon fiber thread market is forecasted to command a 61.4% share by 2035, bolstered by its superior loading capabilities, tensile strength, and stiffness.

- The PAN-based segment is projected to secure a 58.4% share by 2035, reinforced by its structural integrity, high modulus, and compatibility with resin matrices.

Key Growth Trends:

- Advanced catalytic and recycling technologies

- Decarbonization and reducing lifecycle emissions efforts

Major Challenges:

- WTO limits and tariff-evading carbon border fees

- Waste disposal and recycling requirements

Key Players: SGL Carbon SE, Hexcel Corporation, Solvay SA, Formosa Plastics Corporation, Hyosung Advanced Materials, Zoltek Companies, Inc. (Toray Subsidiary), DowAksa Advanced Composites, Jiangsu Hengshen Co., Ltd., Zhongfu Shenying Carbon Fiber Co., Ltd., Reliance Industries Limited, LeMond Carbon, Inc., Carbon Revolution Limited.

Global Carbon Fiber Thread Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Saudi Arabia

Key Regional Dynamics:

Last updated on : 11 August, 2025

Carbon Fiber Thread Market - Growth Drivers and Challenges

Growth Drivers

-

Advanced catalytic and recycling technologies: Advanced catalytic processes have enhanced carbon fiber production with an up to 20% cost reduction, according to the estimates of the U.S. Department of Energy. These inventions have led to low energy consumption up to 75% during oxidation and reduced raw materials dependence to improve the cost competitiveness on an industrial scale. Chemical recycling via solvolysis or peracetic acid treatment has achieved up to 97% resin decomposition, with recovered carbon fibers retaining around 90-95% of their mechanical properties. In 2023, the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management (FECM) announced up to USD 54.4 million in funding to support carbon conversion technologies. This initiative includes pathways for converting captured carbon into carbon fiber and other high-value materials, favouring carbon fiber manufacturers.

-

Decarbonization and reducing lifecycle emissions efforts: Over 68% of the top 100 chemical producers have set a target to reduce their carbon emissions by 2050 and are switching to low-emission products in their supply chain processes. The ORNL study by LCA showed that using renewable lignin precursors and enhanced processing can lead to a life-cycle climate impact reduction of up to 16.3% in the production of carbon fiber and a reduction of fossil resource consumption by approximately 30% compared to conventional PAN-based CFRP production. Furthermore, by adopting measures including low-carbon production, energy improvements, and material effectiveness, industrial manufacturing may cut its lifetime emissions and carbon footprint by 43% by 2030 compared to 2019 levels, according to the International Energy Agency.

-

Increasing industrial utilization of chemical processing equipment: The application of carbon fiber threads is rising in chemical plants in the form of chemical tanks, piping, and reactor vessels due to their high tensile strength and resistance to erosion. The emissions limits of Hazardous Air Pollutants at ≤0.16 kg/ kilogram of coating solids (\60 g/L) under Subpart PPPP OF 40 CFR § 63.4490, imposed by the EPA, obligate industries and manufacturers to phase out the use of solvent-based coatings. The adoption of solvent-free, high-performance composites is accelerated by this regulatory change, leading to increased demand for carbon fiber thread due to its compatibility with low-emission production techniques. The market statistics indicate that the global demand for corrosion-resistant composite materials is expected to increase to USD 10.8 billion by 2025, with a CAGR of 6.4% from 2025 to 2030. The trend has a direct advantage of leading to the greater use of carbon fiber thread in industrial equipment applications.

1. Automotive Sector Trends in Carbon Fiber Thread Demand and Value (2012-2023)

Carbon Fiber Thread in Automobiles (2024 Focus)

|

Metric / Trend |

Exact Value / Insight |

|

Chemistry value in an average automobile |

Nearly $4,400 |

|

Growth in chemistry value per vehicle |

more than $1,000 (31%) |

|

Plastics/composites' share of vehicle weight |

nearly 10% (426 pounds) of the average weight |

|

a mid-size EV contains |

Nearly $1,500 in carbon fiber, which accounts for $10 in chemistry value in an ICE vehicle |

(Source: plasticmakers.org)

2. Capacity vs. Demand Trends

Regional CF Manufacturing Capacity vs. Demand (2020)

|

Region |

2020 Capacity (in tons) |

% of Total Cap. |

2020 Demand (in tons) |

% of Total Demand |

Excess Capacity (in tons) |

|

North America |

31,487 |

27.5 % |

33,140 |

23.4 % |

-1,653 |

|

Europe |

28,995 |

25.3 % |

60,550 |

42.7 % |

-31,555 |

|

Asia (Japan & China) |

48,149 |

42.0 % |

43,330 |

30.6 % |

+4,819 |

|

Rest of World |

5,957 |

5.2 % |

4,700 |

3.3 % |

+1,257 |

|

Total |

114,588 |

100 % |

141,720 |

100 % |

-27,132 |

(Source: nrel.gov)

Carbon Fiber Demand by Application (2018-2022)

|

Application |

2018 Demand (Lucintel) |

% Total (2018) |

2020 Demand (Industry Experts) |

% Total (2020) |

2022 Demand (Red & Zimm) |

% Total (2022) |

|

Wind |

14,837 |

17.8 % |

36,350 |

25.6 % |

47,390 |

38.6 % |

|

Aerospace |

20,644 |

24.8 % |

23,170 |

16.3 % |

21,370 |

17.4 % |

|

Automotive / Pressure Vessels |

12,613 |

15.2 % |

22,620 |

16.0 % |

11,200 (Pressure Vessels) |

9.1 % |

(Source: nrel.gov)

3. Japan’s Carbon Fiber Annual Shipment Growth Rate (%) (2018-2023)

|

Year |

Shipment Quantity (tons) |

Annual Growth Rate (%) |

|

2018 |

24,755 |

+19.2% |

|

2019 |

24,876 |

+0.5 % |

|

2020 |

20,645 |

−17.0 % |

|

2021 |

23,928 |

+15.9 % |

|

2022 |

24,853 |

+3.9 % |

Challenges

-

WTO limits and tariff-evading carbon border fees: The carbon footprint legislation is becoming increasingly common, most recently being supported by the EU single-handedly with its proposal of import taxes, based on the carbon intensity of a particular product. Such frontier tariffs might increase the price of imports of such carbon-intensive precursors by 10%. The regulations of the World Trade Organization enforcement opportunities, however, pose a threat to enforcement as they stipulate that foreign goods must receive treatment no less favourable than domestic goods in taxes, charges, and regulations. To be able to compete and adhere to these standards, manufacturers have been forced to invest in decarbonizing their upstream processes.

-

Waste disposal and recycling requirements: Composite waste is strongly prohibited in landfill sites in the European Union, imposing an expensive existence on carbon fiber reinforced polymer (CFRP) threads. The average cost of recycling CFRP is about USD 1518/ kilogram unless the economies of scale reach over 100 tons per year. The UK raised its standard Landfill Tax to £103.70 per ton in April 2024, with a further increase to £126.15 per ton planned for April 2025, equivalent to nearly USD 120 per ton. This steep rise is driving manufacturers and suppliers to adopt closed-loop recycling systems to avoid escalating disposal costs. Due to this, the manufacturers are converting to pyrolysis and solvolysis-based recycling that can potentially recycle the fibre content. These requirements increase the operational expenses of global suppliers, particularly within the small markets.

Carbon Fiber Thread Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 3.7 billion |

|

Forecast Year Market Size (2035) |

USD 7.6 billion |

|

Regional Scope |

|

Carbon Fiber Thread Market Segmentation:

Product Type Segment Analysis

The continuous carbon fiber segment is anticipated to grow at the highest carbon fiber thread market share of 61.4% by 2035, driven by its superior loading capabilities, high tensile strength, and stiffness, particularly in the aerospace, wind energy, and high-performance automobile sectors. It can make the weight reduction by 25 to 30% compared to traditional materials, to increase fuel efficiency and structural integrity. As per the study, the use of continuous carbon fiber in wind turbine blades is projected to grow at a CAGR of above 12% between the years 2025 and 2033, owing to an increase in the demand for renewable infrastructure.

Raw Material Segment Analysis

The PAN-based segment is anticipated to grow at a revenue carbon fiber thread market share of 58.4% during the projected years, owing to its good structural integrity, high modulus, and can be compatible with resin matrices in the composites. DOE and ORNL research indicate that by adopting textile-grade PAN precursors and advanced stabilization methods, manufacturers can reduce overall carbon fiber production costs by at least 25% compared to conventional aerospace-grade processes. This shift supports large-scale, cost-effective deployment across industrial sectors. The defense and wind energy industries have also leapfrogged through government-funded consortia like the Institute for Advanced Composites Manufacturing Innovation (IACMI) on scalable PAN-processing lines. Through such advancements, procurement safety is sustained in the long run, and the satisfied market share of the PAN-based thread is further consolidated.

End use Industry Segment Analysis

The aerospace & defense segment held the revenue carbon fiber thread market share of 53.8% in 2025, with an estimation to rise substantially by 2035, attributed to the needs of the industry's need for lightweight, high tensile strength materials with high thermal resistance. Carbon fiber thread highly helps decrease the mass of aircraft by a margin of up to 25% thus improving fuel efficiency and compliance with emission reduction goals proposed by international aviation authorities. According to the U.S. Department of Energy and Oak Ridge National Laboratory (ORNL), next-generation aircraft are significantly moving away from conventional metal structures and towards carbon fiber composites to reduce weight and increase fuel efficiency. This shift is further demonstrated by the construction of aircraft like the Boeing 787 and Airbus A350, where 50% of the structure is made from Carbon-fiber-reinforced polymer (CFRP).

Our in-depth analysis of the carbon fiber thread market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Raw Material |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Fiber Thread Market - Regional Analysis

North America Market Insights

The North America carbon fiber thread market is projected to grow at the highest share of 38.5% and reach USD 1.2 billion by 2035 at a CAGR of 10.5% between 2026 to 2035 due to a strong demand in its aerospace, defence, and automotive industries. Consumption in the region is rising because of the increasing use of lightweight composites in structures of electric vehicles and airplanes. For instance, the total consumption of carbon fiber thread in North America is projected to rise significantly from approximately 61.0 kilotons in 2025 to 134.1 kilotons by 2030, reflecting a robust compound annual growth rate (CAGR) of around 16.8%. Clean energy and advanced materials investments are increasing the capacities of composite manufacturing due to federal funding. The benefits experienced by the players in the industry include regulatory clarity and good supply chain integration. The environmental safety programs and the working quality have also established efficiencies in the local production. Permanent development of high-strength fibers favours a long-term increase.

The U.S. carbon fiber thread market is estimated to dominate the North American region with a compound annual growth rate of 11% from 2026 to 2035. Higher domestic production growth is being scaled up by federal programs, like the Department of Energy, Advanced Manufacturing Office. For example, the U.S. Department of Energy’s Advanced Manufacturing Office is sponsoring critical domestic scale-up of carbon fiber thread production through support of the Carbon Fiber Technology Facility (CFTF) at Oak Ridge National Laboratory. This semi-production demonstration facility enables manufacturers to validate low-cost precursor conversion and scale carbon fiber supply up to 25 tons/year, bridging lab innovation with industrial deployment. Additionally, according to the U.S. Department of Energy, the federal government awarded USD 78 million in 2023 to decarbonize chemical manufacturing and support clean composite infrastructure. Implementation of continuous PAN-based thread in fuel cells and tanks of hydrogen storage and light mobility is expected to widen the reach of the market.

Canada’s carbon fiber thread market is likely to rise at a steady pace at a CAGR rate of 9.1% to reach an estimated value of around USD 179.9 million by 2035. Low-emission materials, supply chains in electric cars, and any clean technology are promoted by government incentives that make the market conditions favourable. For example, through the fiscal year 2034-2035, Canada’s renewable Economy Investment Tax Credits (ITCs) would provide over C$93 billion in federal incentives to support manufacturing and renewable energy. Among these is a tax credit that can be refunded up to 30% of capital expenditures for qualified investments in vital mineral processing and clean technology. The persistent needs in Ontario and Quebec are found in the aerospace and automotive industries. Early-stage pilot programs of fiber recycling have been made possible through domestic R&D grants and frameworks of partnerships. Long-term expansion of infrastructures and sustained trading connections with the U.S. facilitate unmanned supply chains and longevity.

Asia Pacific Market Insights

The carbon fiber thread market in the Asia Pacific is estimated to hold 34.7% of the revenue share with a projection of a value of USD1.04 billion in 2035, with a CAGR of 11.7% between 2026 and 2035, owing to the increasing demand for wind energy, electric vehicles, and industrial machinery. Malaysia and South Korea are stepping up their green chemistry initiatives, while China, India, and Japan are at the forefront of innovation. Government-backed carbon neutrality guidelines and composite programs are encouraging more people to invest. For example, South Korea, backed by synchronized regional frameworks under the APEC Carbon-Free Alliance, is growing offshore wind capacity on Jeju Island from 1 GW to 7 GW, increasing wind power's share from 20% to over 70%, to attain 100% renewable energy and hydrogen integration by 2035. Furthermore, high-level infrastructure and fast industrialization are speeding up uptake, and carbon recycling is also opening up the market through regional cooperation.

By 2035, China’s carbon fiber thread market is anticipated to dominate the region with an estimated revenue of over USD 399.6 million. Increase in expenditure on sustainable chemical technologies is over 25% over the period 2019-2024. Furthermore, significant innovations in chemicals have also fuelled the market growth in the country. For instance, Under the guidance of MIIT’s 14th Five-Year Plan (2021-2025), China has achieved multiple sci-tech advancements, including the direct conversion of CO₂ and water into formic acid, synthesis of starch from CO₂, hydrogenation of acetylene to ethylene under mild conditions, and producing chemicals from exhaust gas streams, all with reduced energy use and carbon emissions. Further, ChemChina and Sinopec are building up their capacity to make carbon fiber thread in the country. For instance, Sinopec Shanghai Petrochemical (a ChemChina subsidiary) is investing around RMB 3.2 billion (~USD 450 million) to expand its carbon fiber capacity. The project targets 60,000 t/year of large‑tow precursor production in Shanghai and 30,000 t/year of carbon fiber output in Inner Mongolia. The long-term adoption of the composites gains support in China as the country has carbon trading, encompassing 40 percent of the emissions.

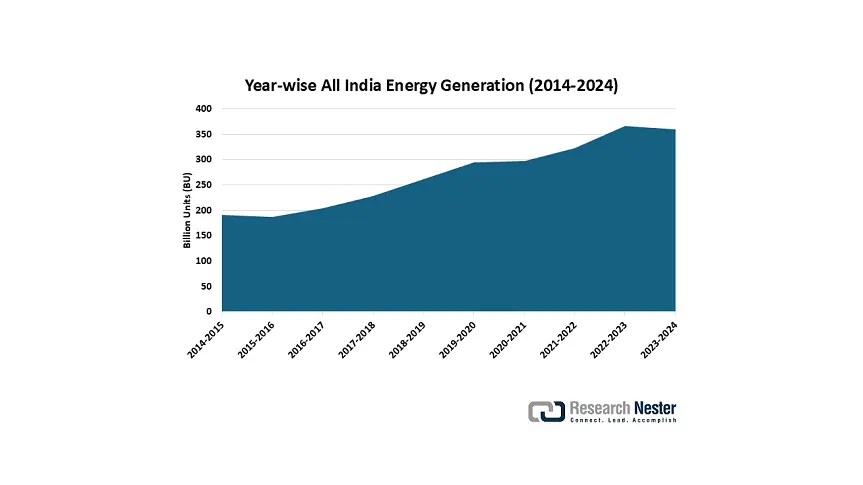

The carbon fiber thread market in India is set to grow at the highest CAGR of 15% throughout the 2026-2035 period, with an estimated value of USD 179.9 million by 2035. In 2023, the Technology Development Board invested INR 94 crore by the government to stimulate eco-friendly chemical development. More than 2 million companies have resorted to green chemical practices. The National Technical Textiles Mission intends to have carbon fiber production in India by 2026. For instance, India is expected to begin domestic carbon fiber production by 2025-26, under the scope of the National Technical Textiles Mission (NTTM). This initiative aims to reduce reliance on imports and position India in aerospace, defense, and civil engineering applications by approving 156 research projects. Moreover, the market for carbon fiber thread is expanding as a result of India's growing total energy generation, which provides a steady and affordable power source for its extremely energy-intensive production processes. Higher capacity utilization, fewer production disruptions, and lower manufacturing costs are all made possible by dependable power from growing thermal and renewable sources. Increased output capacity and efficiency improve domestic supply, increase export potential, and draw in fresh capital for India's advanced materials industry.

(Source: Renewable Energy Statistics 2023-2024)

Europe Market Insights

The European market is likely to grow to USD 521 million by 2035, with a CAGR of 8.3% between 2026 and 2035, due to aerospace, automotive, wind energy, and industrial application demand. Germany is a major contributor that invests heavily in green chemical technology. In 2024, the expenditure of Germany on the production of sustainable chemicals was Euro 3.5 billion. carbon fiber thread In 2022, the UK government announced a £95 million allocation (in November 2022) to support research in advanced materials, including sustainable manufacturing, quantum technologies, and recycling innovations, via the Henry Royce Institute. Furthermore, in 2023-24, the European Union allocated approximately €13.5 billion to Horizon Europe’s research and innovation agenda, with major funding directed toward industrial decarbonization and circular economy efforts, including chemical and advanced materials innovation. Safety and cleaner chemical manufacturing are being promoted under the REACH regulations implemented by ECHA.

Key Carbon Fiber Thread Market Players:

- SGL Carbon SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hexcel Corporation

- Solvay SA

- Formosa Plastics Corporation

- Hyosung Advanced Materials

- Zoltek Companies, Inc. (Toray Subsidiary)

- DowAksa Advanced Composites

- Jiangsu Hengshen Co., Ltd.

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Reliance Industries Limited

- LeMond Carbon, Inc.

- Carbon Revolution Limited

The global carbon fiber thread market in the world is considered moderately concentrated, with 44.5% share owned by Japanese companies, Toray and Teijin, and Mitsubishi Chemical. These companies are committing a huge amount of investment in powder development, proprietary precursors and global scale-up of production plants. Hexcel, SGL Carbon, and Solvay (U.S. and European players) are interested in aerospace-quality thread and highly performing composites. China and India are putting more emphasis on local production by means of public-private research and development programs to curb their dependence. Key trends are strategic alliances, technology licensing, recycling innovations, and carbon-neutral operations. To ensure competitive advantage among regions, manufacturers are turning out to be more aligned with the policies of sustainability and EV industry needs.

Top Global Carbon Fiber Thread Manufacturers:

Recent Developments

- In March 2025, Teijin Carbon launched a range of sustainable composite materials, Tenax Next HTS45 E23 24K filament yarn, at JEC World 2025. The new yarn can reduce CO2 emissions by 35% compared to traditional filament yarn and is manufactured using renewable energy, which makes it stand on a higher sustainability pedestal. The yarn is certified under ISCC PLUS standards and aims at low-carbon automotive, aerospace, and industrial engineering applications. The standards were developed due to the increased demand for ESG-compliant material insisted on by manufacturers and governments. The yarn can sustain the high tensile strength and low weight characteristics of high-end carbon products of Teijin.

- In March 2024, Hexcel launched its HexTow IM9 24K, an intermediate modulus carbon fiber that was a significant product milestone in high-performance composites. The fiber has a tensile strength of above 6,300 MPa, which is 12% more as compared to that of the IM7 fiber typically utilized within the aerospace industry. The 24K tow form is suitable for large structural contour areas (like engine fan blades and fuselage reinforcements), and high-throughput manufacturing. It facilitates lines of scalable volume production with consistent performance. Hexcel has positioned the product in some advanced aerospace and defense programs that demanded high strength-to-weight ratios.

- Report ID: 7995

- Published Date: Aug 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Fiber Thread Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.