Carbon Fiber Prepreg Market Outlook:

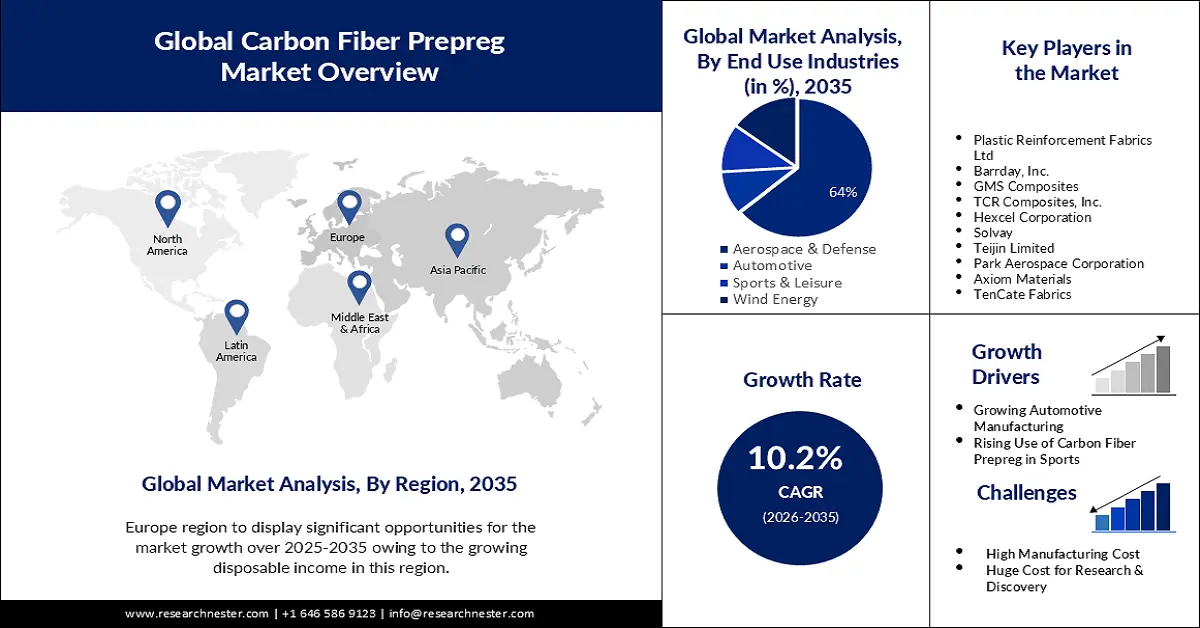

Carbon Fiber Prepreg Market size was over USD 12.44 billion in 2025 and is poised to exceed USD 32.86 billion by 2035, witnessing over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon fiber prepreg is estimated at USD 13.58 billion.

The carbon fiber prepreg market is witnessing significant growth, driven by the increasing demand across various end-user industries. Carbon fiber prepreg, known for its superior tensile strength and lightweight properties, is becoming a preferred alternative to traditional metal components. Its ability to enhance performance while reducing weight makes it an ideal material for manufacturing advanced machine components. This has led many industries, particularly aerospace, automotive, and sports, to adopt carbon fiber composites instead of conventional materials.

The automotive and aerospace sectors are key contributors to carbon fiber prepreg market expansion. The shift towards fuel efficiency and performance optimization has led to a surge in the use of carbon fiber prepreg in these industries. In addition, the sports industry is increasingly utilizing this material to produce high-performance and durable equipment such as bicycles, tennis rackets, golf shafts, and hockey sticks. The renewable energy sector is another major growth avenue, where carbon fiber prepreg is used in the production of lightweight and strong wind turbine blades, supporting the global transition to clean energy sources.

Growing investments in research and development, along with innovation in prepreg manufacturing, are expected to further boost carbon fiber prepreg market dynamics. For instance, Hexcel Corporation, a leading manufacturer in the composite materials industry, continues to develop advanced prepreg solutions tailored for next-generation aircraft and performance vehicles, thereby reinforcing the market’s upward trajectory. As demand for lightweight, durable, and high-strength materials increases, the carbon fiber prepreg market is poised for robust growth during the forecast period.

Key Carbon Fiber Prepreg Market Insights Summary:

Regional Highlights:

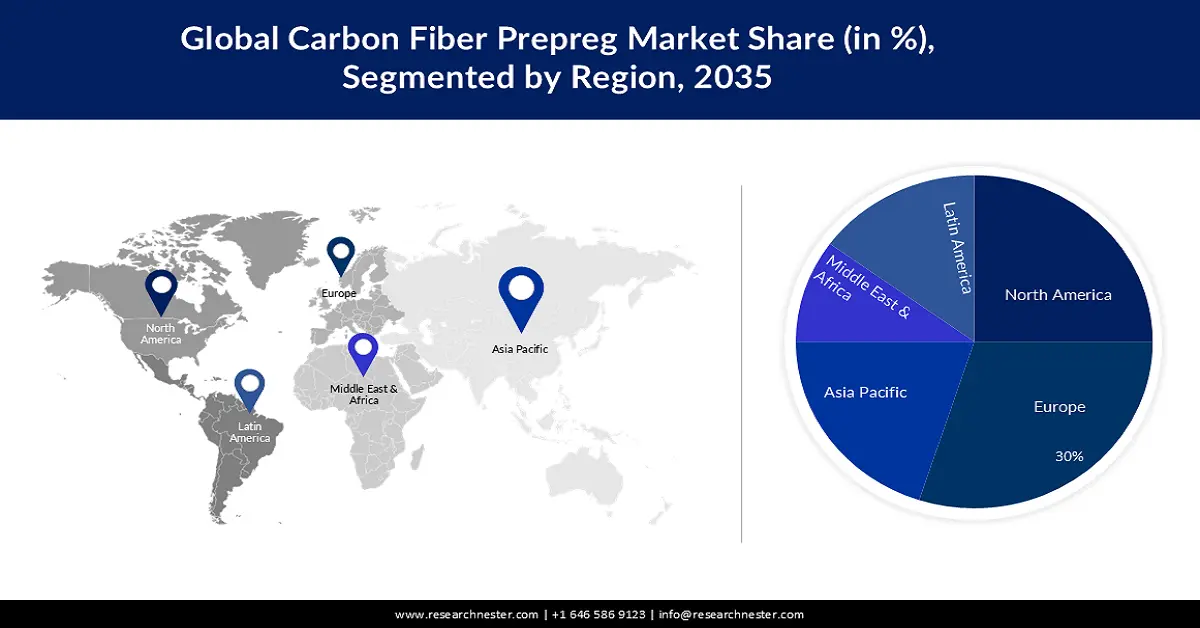

- The Europe carbon fiber prepreg market will dominate more than 36.70% share by 2035, propelled by rising investments in aerospace, defense, and infrastructure modernization.

Segment Insights:

- The hot melt segment in the carbon fiber prepreg market is forecasted to capture a 44.80% share by 2035, driven by hot melt’s reliability and effectiveness in producing high-performance prepregs.

- The aerospace & defense segment in the carbon fiber prepreg market is expected to hold a dominant share by 2035, driven by the superior strength-to-weight ratio essential for aerospace systems.

Key Growth Trends:

- Increasing demand in aerospace and defense

- The increasing demand from the wind energy industry

Major Challenges:

- Processing complexity

- Restricted recycling solutions

Key Players: Teijin Limited, Victrex plc, AOC Aliancys AG, Barrday Corporation, Park Aerospace Corp, Gurit Holding AG, Toray Industries, Inc., SGL Carbon SE, Axiom Materials Inc..

Global Carbon Fiber Prepreg Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.44 billion

- 2026 Market Size: USD 13.58 billion

- Projected Market Size: USD 32.86 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 19 May, 2025

Carbon Fiber Prepreg Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand in aerospace and defense: The carbon fiber prepreg market is witnessing a surge due to its exceptional performance, characteristics, and high customizability, driven by the aerospace and defense sectors. These advanced materials offer engineers significant design flexibility, allowing them to tailor material properties to meet the specific demands of various applications. In the aerospace and military systems, where components are subject to vastly different stress and performance conditions, this adaptability becomes crucial. Engineers can manipulate factors such as fiber orientation, resin composition, and curing techniques to achieve optimal mechanical properties, including strength, stiffness, and durability.

Carbon fiber prepregs not only contribute to weight reduction, which is critical for fuel efficiency and maneuverability, but also enhance structural integrity and reliability in mission-critical applications. This makes them ideal for use in aircraft fuselages, wings, military drones, satellite structures, and defense-grade protective gear. The precise engineering of these materials ensures they meet stringent industry standards and operational requirements. A notable instance is Toray Advanced Composites, a leading supplier of high-performance composite materials. The company has been instrumental in providing specialized carbon fiber prepreg solutions for both commercial aerospace and military applications, supporting innovation and safety in next-generation aircraft and defense systems. This growing adoption underscores the material’s vital role in the future of aerospace and defense technology. - The increasing demand from the wind energy industry: The wind energy sector, particularly the offshore segment, is becoming a significant catalyst for the need for carbon fiber prepregs. These advanced composite materials are increasingly used in the production of longer, more efficient wind turbine blades. Carbon fiber prepregs offer an optimal stiffness-to-weight ratio, which is essential for reducing overall blade weight while maintaining structural integrity. This not only enhances the performance and energy output of wind turbines but also helps prevent issues such as tower strikes caused by sudden wind gusts. Additionally, lightweight blades contribute to minimizing cyclical compression, which is critical for maintaining long-term structural stability.

The offshore wind sector is experiencing rapid growth during the forecast period. Annual installations are expected to quadruple by 2025, significantly boosting the demand for high-performance materials like carbon fiber prepregs. An instance of industry leadership in this area is Siemens Gamesa Renewable Energy. The company has pioneered the use of carbon fiber prepregs in its next-generation wind turbine blades, enabling the production of lighter, stronger, and longer blades that support efficient energy generation while lowering overall operational costs. This strategic material integration underscores the role of carbon fiber prepregs in the future of sustainable energy infrastructure.

Challenges

-

Processing complexity: Carbon fiber prepregs require controlled storage conditions, typically refrigeration to maintain their properties, and have limited shelf life. Additionally, the curing process also demands precise temperature and pressure conditions, often requiring autoclaves. This not only increases manufacturing complexity but also increases the operational costs and limits scalability for mass production. Such stringent processing requirements can hinder adoption, especially among small and mid-sized manufacturers lacking the infrastructure and technical expertise to handle advanced composite materials efficiently.

-

Restricted recycling solutions: Recycling carbon fiber prepregs presents a major challenge due to technical and economic constraints. The complex structure of these composites makes it difficult to separate and recover fibers without degrading their mechanical properties. Current recycling methods are limited, costly, and not yet scalable for widespread industrial use. As a result, end-of-life disposal of carbon fiber prepregs often leads to environmental concerns, as they are not biodegradable and contribute to waste accumulation. The lack of efficient and economically viable recycling solutions remains a barrier to sustainability in the carbon fiber industry, prompting the need for innovation in material recovery technologies.

Carbon Fiber Prepreg Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 12.44 billion |

|

Forecast Year Market Size (2035) |

USD 32.86 billion |

|

Regional Scope |

|

Carbon Fiber Prepreg Market Segmentation:

Process Segment Analysis

The hot melt segment is predicted to gain the largest carbon fiber prepreg market share of 44.8% during the projected period. This supremacy is ascribed to the effectiveness, reliability, and adaptability of the hot melt process. The technique enables the production of both unidirectional and fabric-based prepregs, widely used across aerospace, automotive, and sporting goods industries. The process involves two primary steps: first, a thin layer of heated resin is applied to a paper substrate, then, through a prepreg machine, the resin is combined with the reinforcing carbon fibers under controlled pressure and temperature. This ensures uniform resin distribution and optimal fiber impregnation, resulting in high-performance prepreg materials that are wound around a core for further processing.

A key industry player, SGL Carbon is a notable player in the hot melt segment of the carbon fiber prepreg market. The company leverages hot melt processing to manufacture high-performance prepregs for automotive, aerospace, and wind energy applications, delivering consistent resin distribution, enhanced fiber impregnation, and reliable material performance tailored to demanding industrial standards.

Application Segment Analysis

The aerospace & defense segment emerged as the dominant sector in the carbon fiber prepreg market, driven by the material’s exceptional strength-to-weight ratio, high stiffness, and superior resistance to corrosion and fatigue. These properties are critical for high-performance applications in aircraft, spacecraft, missiles, and defense systems, where reliability and precision are paramount. Carbon fiber prepregs offer unmatched customization through varying resin systems, fiber orientations, and curing methods, allowing manufacturers to meet stringent design and operational requirements. The demand for tailored composite solutions continues to rise as aerospace and defense programs evolve with more complex and lightweight structural needs.

Supporting this trend, Teijin Limited is a prominent player in the aerospace & defense segment of the carbon fiber prepreg market. Through its subsidiary Teijin Carbon, the company supplies advanced carbon fiber prepregs used in military aircraft, commercial aviation, and defense systems. Teijin's materials are esteemed for their exceptional tensile strength, lightweight characteristics, and resilience in extreme conditions. The company continues to invest in aerospace-certified prepregs technologies, supporting global defense programs and next-generation aircraft with customized, high-performance composite solutions.

Our in-depth analysis of the carbon fiber prepreg market includes the following segments:

|

Process |

|

|

Application |

|

|

Type

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Fiber Prepreg Market Regional Analysis:

Europe Market Insights

Europe’s carbon fiber prepreg market is poised to hold a 36.7% share by the end of 2035, with the UK and Germany merging as key contributors. In the UK, rising investments in aerospace and defense, particularly through initiatives such as the Tempest fighter jet program and continued development in commercial aviation, have spurred significant demand for high-performance composite materials. The UK also emphasizes modernization of infrastructure, where carbon fiber prepregs are used for their corrosion resistance, strength, and long-term durability.

Germany, home to one of the world’s largest automotive industries, is rapidly integrating carbon fiber prepregs in lightweight vehicle components to improve performance and reduce emissions. Additionally, Germany’s robust aerospace sector, supported by companies like Airbus, continues to adopt advanced composites in aircraft manufacturing. A notable instance is Gurit, a Swiss-based company with strong operations across the UK and Germany, which supplies carbon fiber prepregs for industrial applications. Gurit’s focus on innovation and sustainable composites aligns well with the growing demand in both nations for lightweight, durable, and efficient material solutions.

North America Market Insights

The U.S. and Canada represent significant markets for carbon fiber prepregs in North America, driven by strong demand across renewable energy sectors. In Canada, the carbon fiber prepreg market is growing steadily, supported by the expansion of its aerospace cluster, particularly in Quebec, and increasing investments in wind energy projects. The country’s emphasis on sustainable construction and lightweight transportation solutions is also contributing to the adoption of carbon fiber composites

On the other hand, in the U.S., the presence of major aerospace manufacturers such as Boeing, Lockheed Martin, and Northrop Grumman fuels substantial demand for high-performance prepregs in aircraft structures, defense systems, and space exploration programs. Government investments in defense modernization and clean energy technologies further support carbon fiber prepreg market growth. Additionally, the U.S. automotive industry is increasingly adopting carbon fiber prepregs to produce lightweight, fuel-efficient vehicles and high-performance sports cars. Park Aerospace is a prominent entity in the sector, focusing on the design and production of advanced and defense-related applications. The company’s materials are used in both commercial and military aircraft, highlighting North America’s strategic role in the carbon fiber prepreg market.

Carbon Fiber Prepreg Market Players:

- Hexcel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teijin Limited

- Victrex plc

- AOC Aliancys AG

- Barrday Corporation

- Park Aerospace Corp

- Gurit Holding AG

- Toray Industries, Inc.

- SGL Carbon SE

- Axiom Materials Inc.

Key players leverage advanced technologies such as hot melt impregnation, automated fiber placement (AFP), and out-of-autoclave (OOA) curing. These innovations enable superior material performance, faster production cycles, and tailored prepreg solutions, helping them maintain leadership in the competitive carbon fiber prepreg market.

Recent Developments

- In September 2022, Solvay launched LTM 350, an advanced carbon fiber epoxy prepreg tooling material aimed at providing substantial time and cost efficiencies for the industrial, aerospace, automotive, and motorsport sectors. This carbon fiber epoxy tooling material offers a rapid curing cycle of 3 hours at 60°C, with the capability to cure at temperatures as low as 45°C through an extended post-curing process. Tools manufactured from LTM 350 can withstand continuous cycling at temperatures reaching 150°C, resulting in highly precise composite components.

- In June 2022, Hexcel Corporation entered into a long-term agreement with Sikorsky, a division of Lockheed Martin, to supply advanced composite structures for the CH-53K King Stallion heavy lift helicopter initiative. This agreement greatly enhances the composite materials supplied by Hexcel for the aircraft.

- Report ID: 5114

- Published Date: May 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Fiber Prepreg Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.