Bronchial Thermoplasty Catheter Market Outlook:

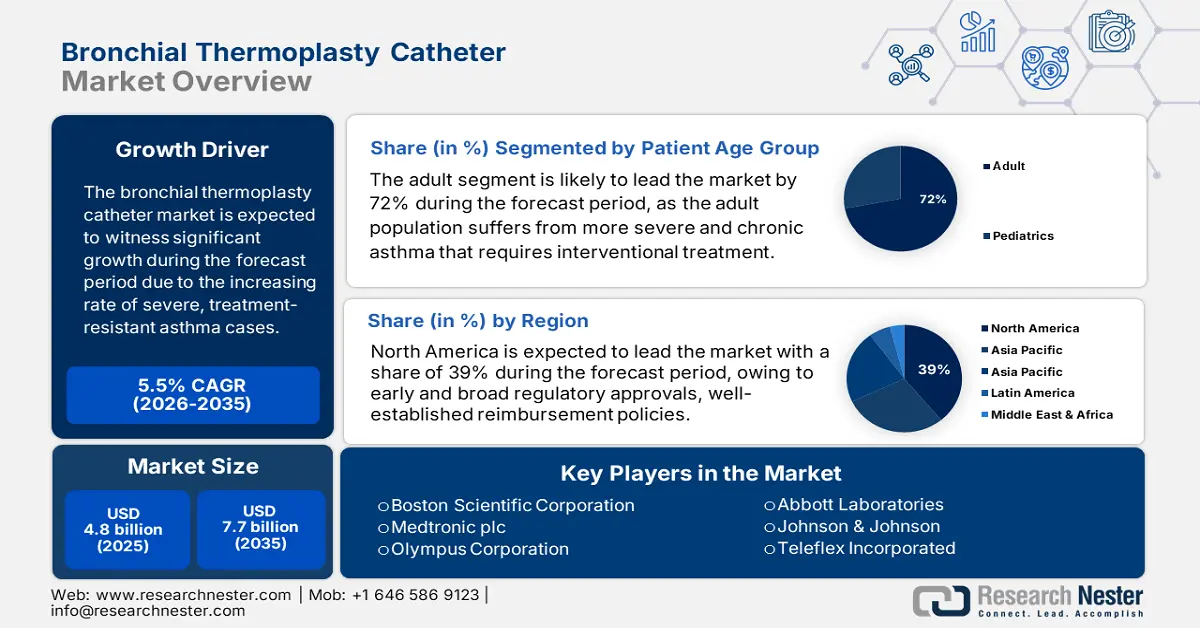

Bronchial Thermoplasty Catheter Market size is valued at USD 4.8 billion in 2025 and is projected to reach USD 7.7 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of bronchial thermoplasty catheter is estimated at USD 5 billion.

The primary growth driver for the market is the increasing rate of severe, treatment-resistant asthma cases. As per a report by the CDC in November 2024, nearly 26,799,588 patients reported having current asthma in the U.S. in the year 2022, equal to roughly 8.2% of the population. A significant proportion of this population in this group had at least one asthma attack in the last twelve months, thus suggesting the massive unmet need for non-pharmacologic interventions. Such a demand base keeps growing steadily, mostly among specialty clinics and pulmonary care centers where biological drugs or inhaled therapies do not help. Strategic partnerships and developments in materials science are further improving production efficacy and device performance.

The bronchial thermoplasty catheter market operates within the broader interventional pulmonary and medical device landscape, which is heavily dependent on cross-border trade and manufacturing networks. According to the WITS September 2025 report, in 2023, the U.S. imports of needles, catheters, and cannulae totaled USD 7,558,504.1 thousand with a quantity of 911,388,000 items. Designs and operational effectiveness of catheters continue to be enhanced by NIH-funded research, hence the continued innovation. The global manufacture and supply chains for these devices are highly interconnected through strict systems of quality control and regulatory compliance. Although, the manufacturers in market are facing additional challenges, such as raw material availability and geopolitics affecting logistics.

Key Bronchial Thermoplasty Cathete Market Insights Summary:

Regional Highlights:

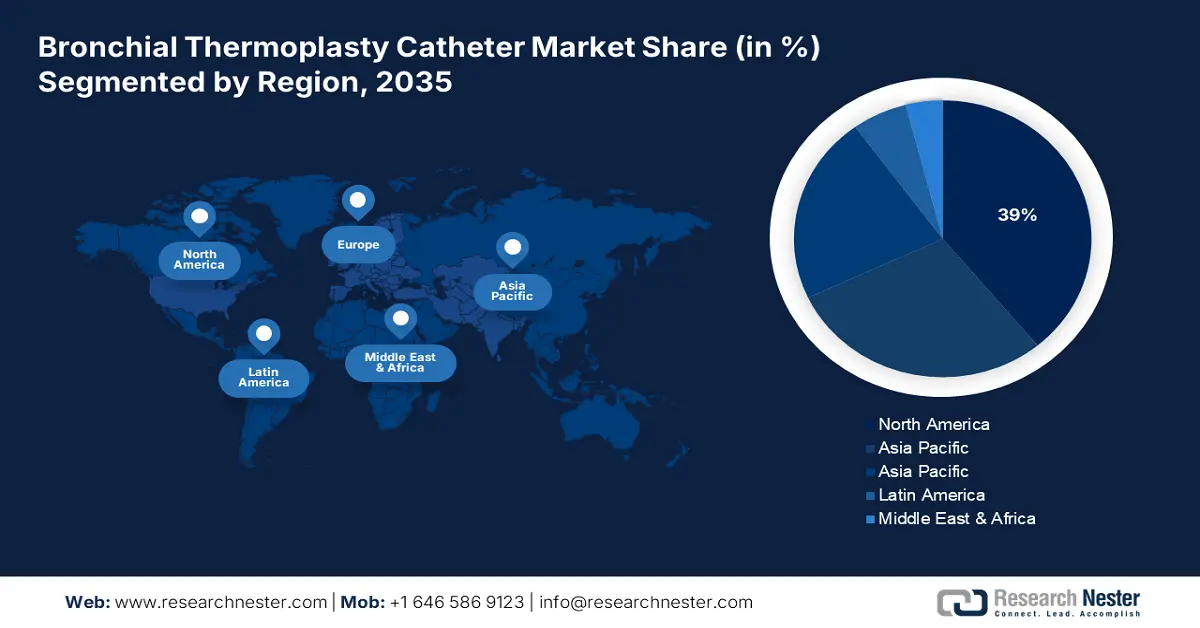

- The North America market is expected to hold a 39% share by 2035, owing to early regulatory approvals, robust reimbursement policies, high severe asthma rates, and dense specialist infrastructure.

- The Europe market is projected to be the fastest-growing region by 2035, propelled by rising severe asthma prevalence, wider acceptance of interventional pulmonology, and government support.

Segment Insights:

- The adult sub-segment is projected to account for 72% share by 2035, impelled by the higher prevalence of severe and chronic asthma among adults requiring interventional treatment.

- The elective procedures sub-segment is expected to hold the largest revenue share by 2035, driven by the planned and non-acute nature of bronchial thermoplasty interventions.

Key Growth Trends:

- Rising mortality rates

- Supportive healthcare policies and reimbursement

Major Challenges:

- High procedure costs and limited reimbursement

Key Players: Boston Scientific Corporation, Medtronic plc, Olympus Corporation, Abbott Laboratories, Johnson & Johnson, Teleflex Incorporated, Cook Medical LLC, Terumo Corporation, Smith & Nephew plc, Merit Medical Systems, Inc., AngioDynamics, Inc., Transcath Medical, Seawon Meditech Co. Ltd., Sungwon Medical Co., Ltd., Genoss Co Ltd

Global Bronchial Thermoplasty Cathete Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.8 billion

- 2026 Market Size: USD 5.5 billion

- Projected Market Size: USD 7.7 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 24 September, 2025

Bronchial Thermoplasty Catheter Market - Growth Drivers and Challenges

Growth Drivers

- Rising mortality rates: Asthmatic deaths continue to remain a serious driver of the bronchial thermoplasty catheter market as public health concerns are increasing. The need for newer treatment methods, such as bronchial thermoplasty (BT), is thus generated. According to a report by AAFA in April 2025, about 3,190 asthma deaths occurred in the U.S. in 2023, nearly 9 deaths per day. This statistic highlights the inadequacies of treatment for severe asthma patients, who are least affected by mainstream arrays of medications. As health professionals try to reduce the rate of deaths from asthma and improve patient outcomes, there will be further adoption of BT procedures and hence increased demand for BT catheters.

- Supportive healthcare policies and reimbursement: Bronchial thermoplasty procedures become more accessible in the market with the help of favorable healthcare policies and reimbursement structures. Increased insurance coverage and government support for the treatment of asthma allow for a greater population to undergo bronchial thermoplasty interventions, which expands the market. Such policies assist bronchial thermoplasty's accessibility to patients directly, while also providing some encouragement to health providers to adopt this form of treatment for themselves. As reimbursement structures continue to evolve, the financial burden on patients decreases, leading to higher adoption rates of bronchial thermoplasty.

- Increasing prevalence of severe asthma: The increasing frequency of asthma, particularly severe and uncontrolled cases, is a significant driver of growth for the bronchial thermoplasty catheter market. According to a report by AAFA in April 2025, medical expenses for an asthmatic would be approximately USD 3,266 a year more than the medical expenses for a non-asthmatic. In essence, asthma is a leading cause of absenteeism from work or school for persons with asthma. Bronchial thermoplasty is a minimally invasive treatment without medication that intends to shrink airway smooth muscle, resulting in improved asthma control in these challenging patients.

Global Trade Dynamics in Medical Devices: Catheters and Cannulae

Exporters and Importers of Needles, Catheters, Cannulae (2023)

|

Country |

Export Value |

Import Value |

|

U.S. |

6.9 billion |

7.6 billion |

|

Mexico |

4.3 billion |

817 million |

|

Ireland |

4.4 billion |

747 million |

|

Netherlands |

2.9 billion |

4.9 billion |

|

China |

1.9 billion |

2.1 billion |

|

Japan |

1.3 billion |

1.7 billion |

|

Costa Rica |

2.4 billion |

— |

|

Brazil |

— |

423 million |

|

India |

388 million |

— |

Source: OEC, August 2025

Challenge

- High procedure costs and limited reimbursement: High costs and affordability are some of the main hurdles faced by the market. bronchial thermoplasty requires specific equipment and trained healthcare professionals, making it a rather costly procedure, especially when compared with conventional measures for asthma. Another major barrier to patients accessing this technology is the lack of standardized insurance reimbursement and the significant variation in coverage policies across different regions.. The costs may act as an impediment for both the doctors and patients to overcome the barrier to going for BT, which would majorly slow down market development.

Bronchial Thermoplasty Catheter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 4.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.7 billion |

|

Regional Scope |

|

Bronchial Thermoplasty Catheter Market Segmentation:

Patient Age Group Segment Analysis

The adult sub-segment is expected to have the highest market share of 72% in the patient age group segment of the bronchial thermoplasty catheter market, as the adult population suffers from more severe and chronic asthma that requires interventional treatment. Adults will have more comorbidities and fewer sensitivities to controller medication alone and hence require more advanced procedures. According to the report published by the CDC in May 2023, a total of 8.0% (20,288,399) of U.S. adults suffer from asthma. As adults bear the largest percentage of severe asthma cases and are more likely to go for non-pharmacological therapy, uptake of bronchial thermoplasty catheters is stronger among them. Additionally, cost-benefit conditions are more apparent in adult treatment due to reimbursement and healthcare policy in most countries.

Procedure Type Segment Analysis

The elective procedures sub-segment is expected to hold the highest revenue share in the procedure type segment in the bronchial thermoplasty catheter market. Bronchial thermoplasty is a planned intervention and not acute. Elective scheduling allows for pre-procedure evaluation, patient optimization, and optimal facility utilization. Bronchial thermoplasty is reserved for those patients with asthma who cannot be optimized with medication, and therefore, it is a scheduled alternative approach and not an acute rescue approach. This points to the fact that its application is typically scheduled following other options being evaluated. Government programs for reviewing whether bronchial thermoplasty is covered also emphasize procedure protocols, patient selection, and safety features of elective procedures.

End user Segment Analysis

The hospital sub-segment in the end user segment of the bronchial thermoplasty catheter market is expected to have the highest market share within the forecast period, as the volume of specialized interventional pulmonology and respiratory procedures is large in hospitals. Hospitals possess the necessary infrastructure, i.e., advanced bronchoscopy suites, anesthesia services, and post-procedure care units, that are essential for the safe administration of bronchial thermoplasty. The availability of multidisciplinary teams with pulmonologists, anesthesiologists, and respiratory therapists further makes hospitals the preferred option for undertaking these procedures. Hospitals are also bound to be approved providers under the public and private insurance plans, making it easier to access the procedure.

Our in-depth analysis of the bronchial thermoplasty catheter market includes the following segments:

|

Segment |

Sub-Segments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Procedure Type |

|

|

Distribution Channel |

|

|

Patient Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bronchial Thermoplasty Catheter Market - Regional Analysis

North America Market Insight

The bronchial thermoplasty catheter market in North America is expected to hold the highest market share of 39% within the forecast period due to early and broad regulatory approvals, well-established reimbursement policies, high rates of severe asthma, and dense specialist infrastructure and networks of hospitals. Misperceptions regarding control of asthma and controller drugs are common in North America. The NLM April 2022 study found that 60% to 77% of the patients believed their asthma was well under control, but only 8% to 29% had clinically well-controlled asthma. The perception-reality mismatch is bringing pressure for the patients, which shows an urgent need for better long-term interventions such as bronchial thermoplasty, especially in those with refractory symptom control on treatment.

The bronchial thermoplasty catheter market in Canada is growing due to rising pulmonologists and patients awareness of its treatment for severe asthma, an increase in reimbursement coverage, an increase in hospitalization of asthma cases, and investment in respiratory care facilities. As per a report by the Government of Canada, in February 2024, in March 2023, Canada Health Transfer deductions exceeding USD 82.5 million were imposed upon provinces that allowed patient charges for medically necessary services, thus marking the first instance of enforcement under the Canada Health Act's Diagnostic Services Policy. This commitment by the Government for equitable access has a positive impact towards more adoption of bronchial thermoplasty, as out-of-pocket barriers are no longer limited, and access through public funding is enhanced.

Asthma prevalence and mortality in the population of North America (2022)

|

Country / Region |

Population (Millions)* |

Asthma Prevalence (%)† |

Mortality (per 100,000) |

GDP per Capita ($)‡ |

GDP on Healthcare (%)§ |

Education Index‖ |

HAQ Index¶ |

|

Adults |

Children |

||||||

|

U.S. |

329.0 |

10.9 |

18.5 |

1.2 |

65,544 |

16.9 |

0.9 |

|

Canada |

37.4 |

4.8 |

9.9 |

0.8 |

43,242 |

10.8 |

0.8 |

|

Mexico |

127.6 |

2.8 |

6.8 |

1.3 |

8,347 |

5.4 |

0.7 |

Source: NLM April 2022

Europe Market Insight

The bronchial thermoplasty catheter market in Europe is expected to hold the fastest-growing market within the forecast period due to an increasing trend in the prevalence of severe asthma across many countries, wider acceptance of interventional pulmonology procedures, support from governments, and inclusion in asthma management guidelines. According to a report by NLM in May 2025, the prevalence of asthma in most countries, such as France, Germany, Italy, Spain, and the UK, was 6.7%. Of the respondents, nearly 52.0% had mild asthma, 27.9% moderate asthma, and 20.1% severe asthma. The huge number of severe cases provides a demand for more novel treatments such as bronchial thermoplasty.

The bronchial thermoplasty catheter market in the UK is growing due to an increase in clinical evidence and the inclusion of bronchial thermoplasty in asthma treatment guidelines. Better NHS reimbursement pathways are being structured along with the community, thus raising awareness among physicians and the general public, while investments are also made into specialized respiratory centers and ambulatory surgical units. According to a report by NLM in May 2025, the UK has the highest rates of asthma prevalence at 10.4% and this increasing number of severe asthma patients fuels demand for long-term treatment options sustained by bronchial thermoplasty which is increasing the bronchial thermoplasty catheter market.

Asia Pacific Market Insight

The bronchial thermoplasty catheter market in the Asia Pacific is expected to grow steadily within the forecast period due to increasingly heavy burdens of asthma and respiratory disorders caused by urbanization, air pollution, an aging population, and healthcare expenditure. Governments across the region have taken to launching awareness campaigns and funding programs. With heavy investments in research and development, these technologies are being fostered to innovate along with catheter production so as to provide better safety and efficacy. Another way to expedite the availability of good products would be working with public health agencies and private medical device companies. There are also training courses for pulmonologists that will further ensure skilled utilization of bronchial thermoplasty procedures.

The bronchial thermoplasty catheter market in China is growing due to strong government emphasis on the growth of healthcare infrastructure, a large patient population with increasing prevalence of asthma and respiratory disorders, and rising disposable incomes and health insurance coverage. According to a report by NLM in October 2024, the total prevalence of asthma in Mainland China is 2.2% for ever asthma, 2.1% for current asthma, 14.3% for ever asthma-symptoms, and 3.0% for current asthma-symptoms. This immense burden of respiratory symptoms engenders an urgent need for effective treatment methods such as bronchial thermoplasty, thereby increasing demand in both urban and rural areas.

Key Bronchial Thermoplasty Catheter Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Olympus Corporation

- Abbott Laboratories

- Johnson & Johnson

- Teleflex Incorporated

- Cook Medical LLC

- Terumo Corporation

- Smith & Nephew plc

- Merit Medical Systems, Inc.

- AngioDynamics, Inc.

- Transcath Medical

- Seawon Meditech Co. Ltd.

- Sungwon Medical Co., Ltd.

- Genoss Co Ltd

The market for bronchial thermoplasty catheters is extremely concentrated, with market leaders such as Boston Scientific likely to continue in a leadership role through consistent innovation, regulatory clearance, and global expansion. Second-tier market players such as Medtronic, Olympus, and Abbott, will fight for marginal gains in improved catheter design, energy delivery, and procedure workflow. Asia Pacific expansion (Australia, South Korea, Malaysia, India) is likely to occur, with domestic low-cost production, partnerships, and reimbursement-friendly strategies propelling it. Adjunct technology or specialization (e.g., imaging, smart catheters) can be a niche players' survival tactic.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Kaneka Corporation launched sales of the broncho dilatation balloon catheter, which is called SUKEDACHI. This is developed by the University of Osaka, combining precision molding technology, including balloon catheters of Kaneka.

- In March 2022, Apollo Multispecialty Hospitals Kolkata launched Bronchial Thermoplasty for the first time as an effective, painless treatment of severe asthma. Bronchial Thermoplasty was performed at Apollo Multispeciality Hospitals on two patients first.

- Report ID: 7757

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.