Bladder Volume Manometer Catheter Market Outlook:

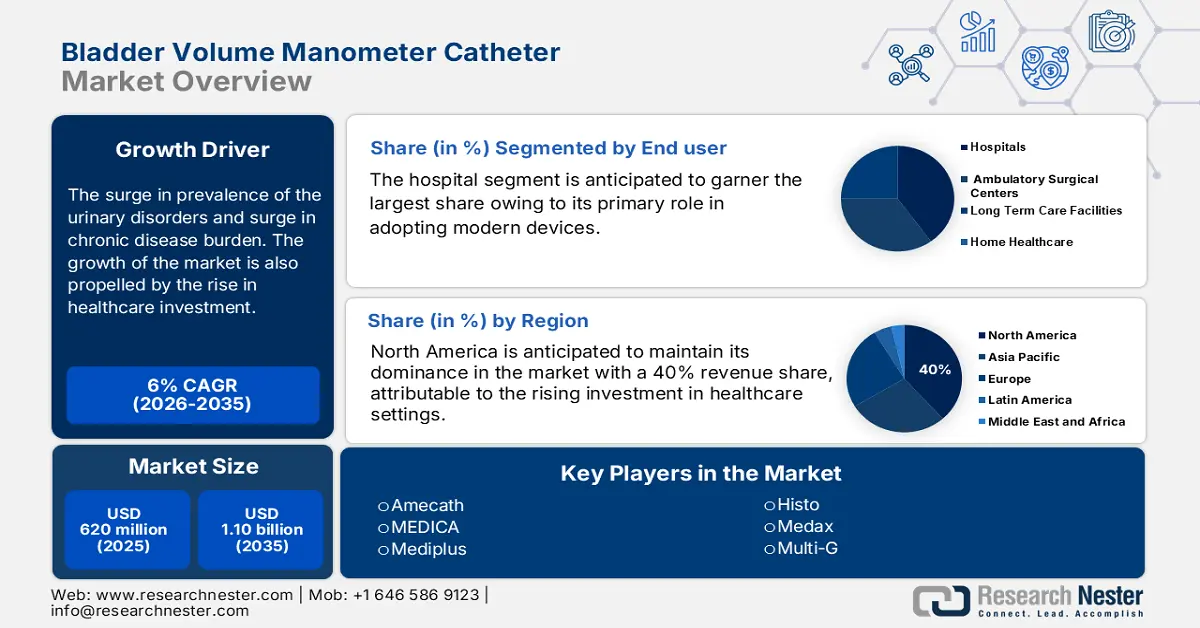

Bladder Volume Manometer Catheter Market size was over USD 620 million in 2025 and is projected to reach USD 1.10 billion by 2035, witnessing a CAGR of 6% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of bladder volume manometer catheter is evaluated at USD 650 million.

The rising prevalence of urinary retention, neurogenic bladder, and post-operative voiding dysfunction is fueling the market. Indwelling catheters are widely used for acute and chronic urinary retention. The growing demand for precise bladder pressure monitoring across both inpatient and outpatient settings is also creating a surge in this sector. Additionally, urological disorders are evidently observed among older citizens. Hence, the worldwide aging population is steadily enlarging the patient pool requiring these specialized surgical solutions.

The market faces moderate inflationary pressures, which are reflected in the changes in key economic indicators. For instance, the substantial rise in the producer price index (PPI) for medical devices highlights upstream manufacturing costs. Subsequently, a continuous increase in the consumer price index (CPI) for medical goods, including catheters, underscores reimbursement dynamics and payer negotiations. These parameters instill a need for a balanced business model, combining necessary assets of cost-optimized production and insurer coverage expansion, ensuring consistent access to these critical urological devices.

Key Bladder Volume Manometer Catheter Market Insights Summary:

Regional Highlights:

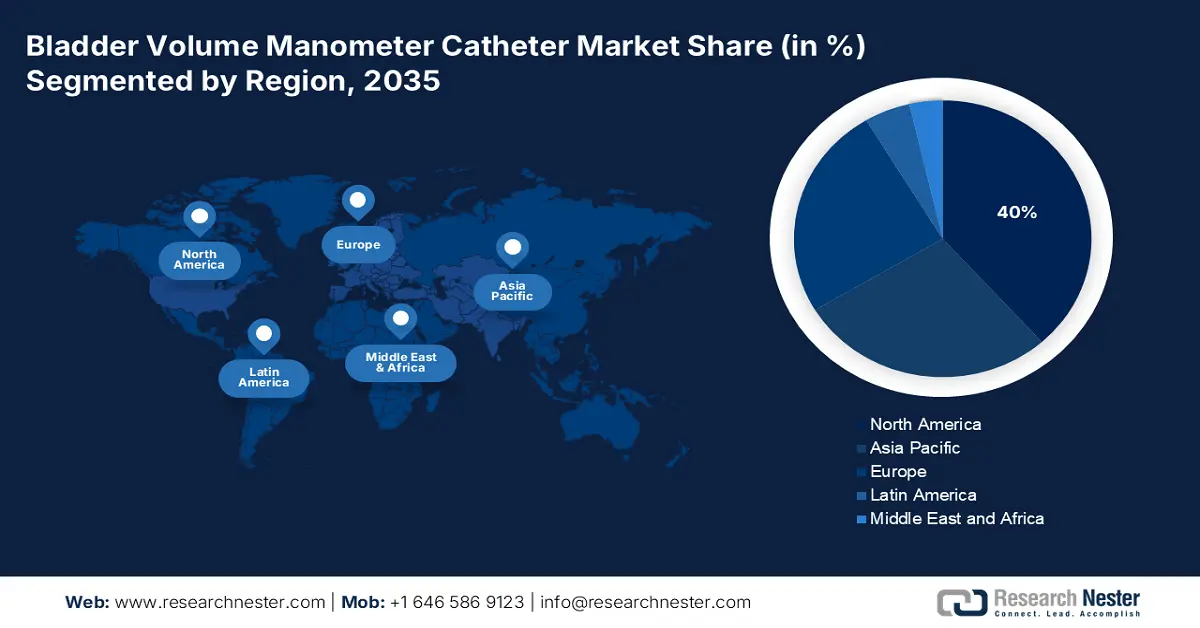

- North America in the bladder volume manometer catheter market is projected to secure a 40% share by 2035, sustained by an aging population, high urinary disorder prevalence, and expanding reimbursement support.

- Asia Pacific is anticipated to grow at the fastest rate by 2035, underpinned by healthcare modernization, rising disposable income, and stronger infection-control and telehealth integration.

Segment Insights:

- Hospitals segment in the bladder volume manometer catheter market is set to hold the largest share by 2035, strengthened by rising surgical volumes and expanding post-operative monitoring needs among aging patient populations.

- Disposable bladder volume manometer catheters segment is expected to capture a substantial share by 2035, supported by healthcare modernization that prioritizes infection-prevention compliance and technologically enhanced, low-maintenance device designs.

Key Growth Trends:

- Surge in prevalence of urinary disorders

- Increasing awareness about urinary health

Major Challenges:

- Government-imposed pricing constraints

- Fragmented procurement systems

Key Players: Amecath, MEDICA, UROMED, Mednova Medical Technology, Mediplus, Urotech, Hamilton Syringes & Needles, Hi-Tech Medicare Devices, Histo, Medax, Multi-G, Coloplast, Teleflex, Cook Medical, B. Braun Melsungen AG, Romsons, Bard (a BD company), Narang Medical Limited

Global Bladder Volume Manometer Catheter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 620 million

- 2026 Market Size: USD 650 million

- Projected Market Size: USD 1.10 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: USA, China, Germany, Japan, UK

- Emerging Countries: India, South Korea, Brazil, Italy, Australia

Last updated on : 6 November, 2025

Bladder Volume Manometer Catheter Market - Growth Drivers and Challenges

Growth Drivers

- Surge in prevalence of urinary disorders: The surge in prevalence of urinary disorders, such as benign prostatic hyperplasia and urinary incontinence, is a prominent growth driver for the market. Also, with validation gained from several certification authorities about the efficacy in cost saving and treatment, the market is gaining traction. The supportive studies demonstrate that these devices play a crucial role in reducing catheter-associated urinary tract infections (CAUTIs) by enabling early detection of urinary retention and preventing unnecessary catheterizations. Hospitals and specialized clinics are emphasizing proactive diagnosis and treatment, which fuels the adoption of advanced catheter systems, further propelling the market growth.

- Increasing awareness about urinary health: The European Association of Urology in 2025 commemorates Urology Week from 22-26 September for raising awareness of urinary tract infections among the general population. The occurrence of UTIs and other urinary disorders often results in complications such as bladder dysfunction or retention, increasing the need for precise bladder monitoring. With the rise in awareness, more patients are seeking early diagnosis, bolstering the demand for accurate and reliable monitoring tools. Moreover, a surge in focus on eradicating complications related to urinary disorders is encouraging healthcare providers to use modern bladder monitoring technologies, further supporting market expansion.

- Surge in chronic disease burden: The global surge in chronic diseases such as diabetes and multiple sclerosis is contributing to an increased prevalence of bladder dysfunctions. For instance, according to the International Diabetes Federation, 589 million people aged between 20-79 years are living with diabetes globally. Patients with these conditions need regular monitoring of the volume of the bladder to prevent any chance of renal damage or urinary retention. The rising necessity for continuous and non-invasive monitoring solutions is prompting healthcare providers to adopt these catheters, thereby augmenting the market growth during the forecasted period.

Challenges

- Government-imposed pricing constraints: Despite the gradual increase in accessibility, the price controls implemented by individual governing bodies often limit profitability from premium pricing products in the market. Strict pricing policy guidelines push several countries to enforce strict price caps on diagnostic devices.

- Fragmented procurement systems: In low- and middle-income countries (LMICs), sufficient availability still imposes a notable hurdle in the market. The lack of centralized procurement across these nations often complicates the pathway of participation in public tenders for suppliers. This restricts efficient distribution and hence creates operational challenges for manufacturers in such emerging economies.

Bladder Volume Manometer Catheter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 620 million |

|

Forecast Year Market Size (2035) |

USD 1.10 billion |

|

Regional Scope |

|

Bladder Volume Manometer Catheter Market Segmentation:

End-user Segment Analysis

The hospitals segment is projected to dominate the market, holding the largest share over the assessed period. Hospitals have the primary role in providing surgical procedures, and post-operative monitoring is the major driver behind the segment growth. Healthcare facilities across the globe are increasingly investing in urodynamic diagnostics to acknowledge the needs of the geriatric population. Furthermore, government investments for infrastructural upgrades and digital health integration also reinforce the segment's position as the primary adoption channel for these advanced urological solutions.

Type Segment Analysis

The disposable bladder volume manometer catheters segment is poised to represent a significant share. The rapid modernization of healthcare facilities across various regions is making disposable variants the gold standard for reimbursement criteria and compliance with evolving infection prevention standards. Additionally, using these modern devices is convenient with lowered maintenance in comparison with other catheters. Technological advancements, such as enhanced sensor accuracy and amalgamation with digital monitoring systems, are also upgrading the functionality of disposable catheters, further reinforcing their position in the market.

Application Segment Analysis

The post-operative urinary retention monitoring is anticipated to garner the largest share primarily due to the burgeoning number of surgical procedures, mainly in urology, as well as gynecology. This has resulted in the higher incidence of post-operative urinary retention, and for precise monitoring of bladder volume, catheters are essential in post-operative care. Additionally, reimbursement policies for the post-operative monitoring is further support dominance over other applications.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bladder Volume Manometer Catheter Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the largest share of 40% in the global bladder volume manometer catheter market during the forecasted period. This leadership is a result of the region's aging population, high urinary disorder prevalence, and favorable reimbursement policies. For instance, the notable expansion of reimbursement coverage for urological diagnostics by Medicare & Medicaid service providers escalated adoption and cash inflow in this category. Moreover, the region's robust diagnostic infrastructure and continuous R&D funding are streamlining the management of associated urological interventions. This is making the region the epicenter of an advanced and opportunistic healthcare ecosystem.

The U.S. is experiencing dominance over the regional market on account of robust payer support and clinical demand for precision urological diagnostics. The country has a renowned network of hospitals and dedicated urology clinics, which are increasingly adopting modern catheter-based monitoring solutions to manage severe conditions such as neurogenic bladder and urinary retention. Furthermore, favorable reimbursement policies and growing adoption of minimally invasive procedures are reinforcing the use of bladder volume manometer catheters.

The market in Canada is garnering significant growth owing to the rising prevalence of urinary disorders. The country is focusing on enhancing patient outcomes and lowering hospital stays, which has fostered long-term facilities and hospitals to implement modern bladder monitoring solutions. Also, the ongoing investment from the prominent manufacturers in intensive research and development to launch a minimally invasive catheter system to further propel the adoption of these devices in modern settings.

Asia Pacific Market Insights

The Asia Pacific bladder volume manometer catheter market is anticipated to grow at the fastest pace by the end of 2035. Rapid aging and government-led healthcare modernization initiatives are the primary growth engines of this region. Key landscapes, including Japan, China, and India, are propelling adoption in this sector through continuous funding and strategic procurement. Besides, the regulatory reforms and increasing disposable income are collectively influencing this merchandise to expand its territory across these emerging economies. Furthermore, the combination of infection control needs and telehealth expansion is positioning APAC as the global growth hotspot.

China is augmenting the bladder volume manometer catheter market with a predominant captivity over the regional output. The surge in medical tourism in the country is also increasing the demand for advanced post-operative bladder monitoring solutions. Moreover, joint ventures and local manufacturing capabilities are enhancing the cost-effectiveness, making it accessible for the larger patient pool. Cumulatively, these factors are augmenting the market growth in the country during the forecasted period.

The market in India is witnessing unprecedented growth on the back widening healthcare infrastructure, mainly in tier 1 and tier 2 cities. The market is also getting benefits from the humongous investments by multinational as well as local manufacturers to launch technologically advanced solutions. Furthermore, a surge in the home healthcare sector and outpatient care services is fostering the use of bladder volume manometer catheters beyond traditional hospital settings, contributing to steady market expansion.

Europe Market Insights

The Europe bladder volume manometer catheter market is expected to capture astounding growth owing to the rising geriatric population. Moreover, there is a surge in awareness among the patients and clinicians for early detection and management of urinary difficulties is augmenting the market growth. The market in the UK has an advanced healthcare infrastructure with specialized urology centers supporting the adoption of technologically advanced catheter systems. Also, the government is supporting the market growth with the favorable reimbursement policies and various initiatives promoting patient safety.

In Germany, the market is witnessing significant growth owing to the country’s well-established hospitals and outpatient clinics facilitate the adoption of technologically advanced catheter systems. These facilities are investing in devices that render real-time monitoring to improve patient outcomes and reduce complications. The decentralized healthcare system in the nation also facilitates rapid adoption across public and private hospitals. Besides, the MDR compliance positions it as a gateway for global manufacturers, which is further coupled with favorable reimbursement policies and government subsidies.

Key Bladder Volume Manometer Catheter Market Players:

- Amecath

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MEDICA

- UROMED

- Mednova Medical Technology

- Mediplus

- Urotech

- Hamilton Syringes & Needles

- Hi-Tech Medicare Devices

- Histo

- Medax

- Multi-G

- Coloplast

- Teleflex

- Cook Medical

- B. Braun Melsungen AG

- Romsons

- Bard (a BD company)

- Narang Medical Limited

The bladder volume manometer catheter market features moderate fragmentation, with multinational players like MEDICA, Coloplast, and Teleflex competing against cost-efficient solutions. Manufacturers in Asia are establishing their distinguished position through wireless and sensor-enabled innovations. They are also solidifying their commercial operations with accelerated regulatory compliance and strategic localization. Moreover, cost-optimized production and public-private partnerships are creating sustainable dynamics for this sector.

Some of the key players in the global market are:

Recent Developments

- In March 2024, Becton Dickinson (BD) launched its BD SensaTrak Bluetooth-Enabled Catheter, a next-generation bladder volume monitoring device designed for real-time patient management. The catheter features integrated Bluetooth technology, enabling seamless transmission of bladder volume data to electronic health record (EHR) systems, thereby enhancing clinical workflow and patient safety.

- Report ID: 7868

- Published Date: Nov 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.