Bromine Derivatives Market Outlook:

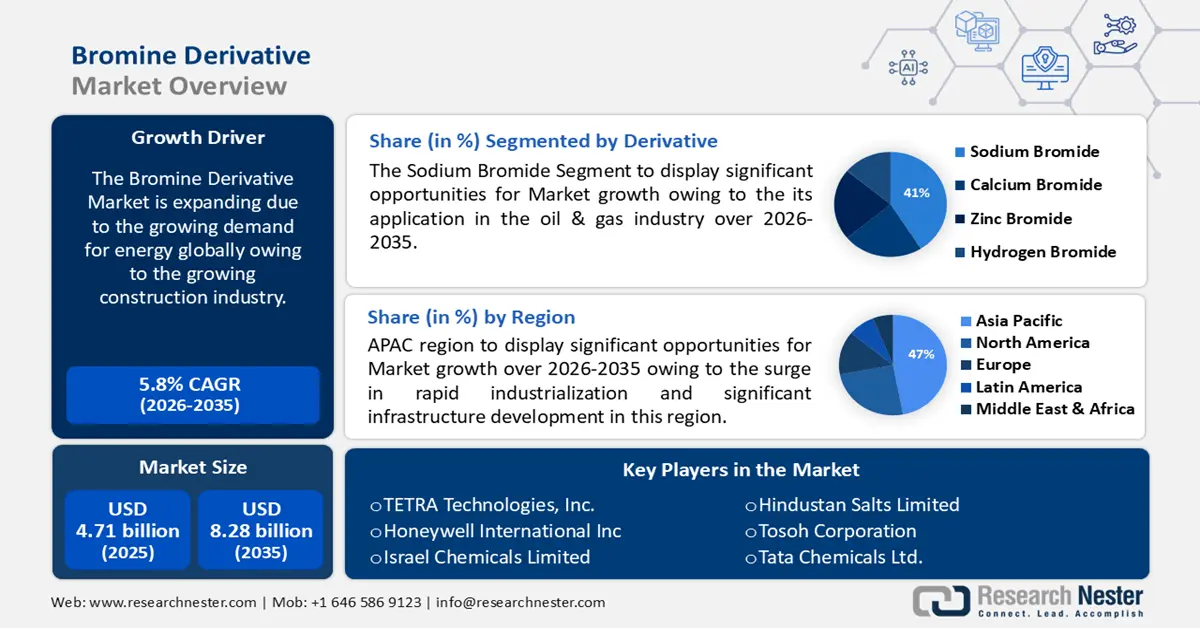

Bromine Derivatives Market size was valued at USD 4.71 billion in 2025 and is set to exceed USD 8.28 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bromine derivatives is estimated at USD 4.96 billion.

This boost is anticipated by the slated demand for flame retardants owing to the growing construction industry. According to a report, the construction industry is set to register a gain of about 1.4 trillion USD by 2025.

Moreover, flame retardants play a substantial role in influencing the fire resistance of various materials used in construction, such as insulation materials, and plastics, coupled with coatings. In addition, credited to the lucrative growth in construction activities worldwide and a significant emphasis on safety standards, the demand for bromine-based flame retardants has witnessed a substantial surge.

Additionally, the estimated advancements in urbanization along with population expansion, more buildings and structures are being observed, attributed to which there is significant awareness of the need for enhanced fire safety measures. Bromine derivatives are chemical compounds that contain bromine as part of their molecular structure, they itself is a halogen element and are widely used in various industries, including pharmaceuticals, flame retardants, oil & gas drilling, and water treatment.

Key Bromine Derivatives Market Insights Summary:

Regional Highlights:

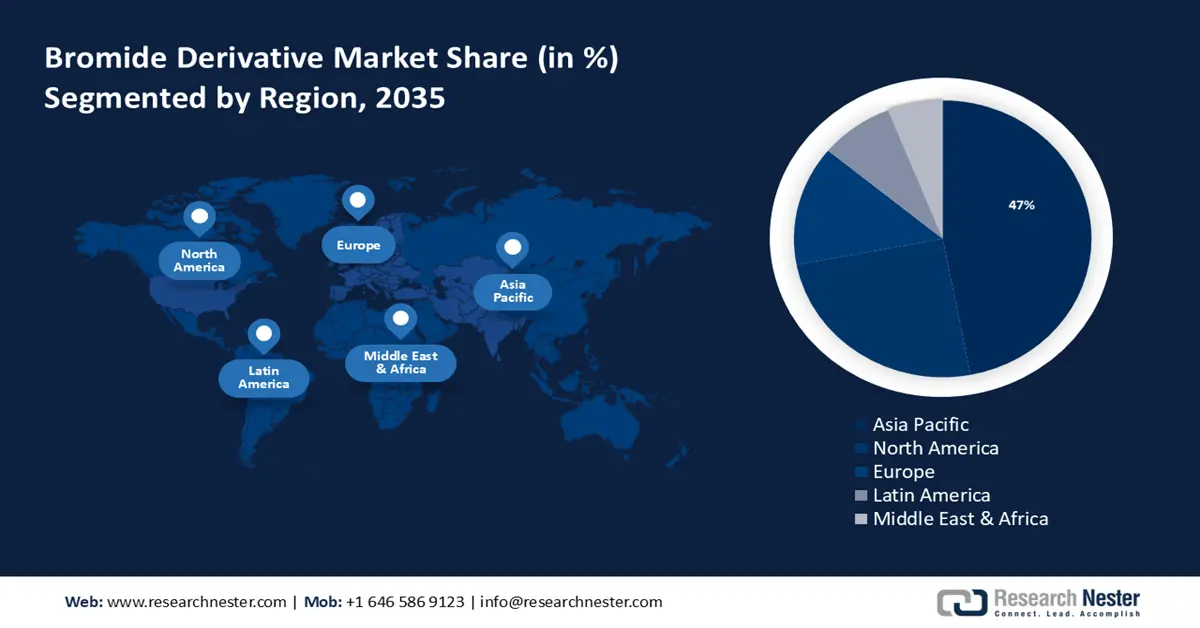

- Asia Pacific bromine derivatives market will dominate around 47% share, driven by rapid industrialization and infrastructure investment in the region, forecast period 2026–2035.

Segment Insights:

- The sodium bromide segment segment in the bromine derivatives market is expected to hold a 41% share by 2035, driven by its application in oil & gas industry, enhancing drilling operations by stabilizing wellbores.

Key Growth Trends:

- Rising automotive sector

- Increasing demand for electronics and consumer goods industry

Major Challenges:

- Rising automotive sector

- Increasing demand for electronics and consumer goods industry

Key Players: Jordon Bromine Company, Albemarle Corporation, LANXESS, Gulf Resources, TETRA Technologies, Inc., Honeywell International Inc, Israel Chemicals Limited, Hindustan Salts Limited, Tata Chemicals Ltd.

Global Bromine Derivatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.71 billion

- 2026 Market Size: USD 4.96 billion

- Projected Market Size: USD 8.28 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Bromine Derivatives Market Growth Drivers and Challenges:

Growth Drivers

-

Rising automotive sector - The automotive & transportation continuous expansion, coupled with strict safety regulations, will account for the increased adoption of bromine derivatives, as these derivatives are employed in manufacturing flame-retardant materials used in automotive interior materials, wiring, and other components.

Furthermore, as safety standards become more rigorous globally, the automotive sector has turned to bromine-based solutions to enhance fire safety in vehicles, contributing to the overall growth of the bromine derivatives market size expansion. According to a report, the aftermarket of domestic auto components is projected to cross about 14 billion USD by 2028. - Increasing demand for electronics and consumer goods industry - The electronics and consumer goods industry has witnessed a surge in the demand for bromine derivatives, mainly due to their application in flame-retardant materials which are used in electronic devices and several household appliances, with an increasing global reliance on electronic products, such as smartphones, laptops, and televisions, the need for fire-resistant components is increasing.

- Expansion in oil & gas drilling activities - The oil & gas industry extensively uses bromine derivatives, especially in drilling fluids, to enhance drilling efficiency and stability. With the exploration of new oil & gas reserves globally, the demand for bromine-based drilling fluids is at a surge, as their unique properties of bromine derivatives make them valuable in maintaining optimal conditions during drilling operations, thereby contributing to drive the bromine derivatives market. Bromine derivatives find applications in pharmaceutical manufacturing, where they are used as intermediates in the synthesis of various drugs.

Challenges

-

Environmental concerns and regulations - The increasing strictness and regulations about the environmental impact of the bromine compounds have been associated with environmental and health concerns, leading to regulatory restrictions. Along with high environmental standards significant investments in research and development to create more sustainable and eco-friendly bromine derivatives. The industry faces the challenge of potential substitution by alternative materials, as environmental awareness grows, industries may seek alternatives to bromine derivatives that are seen as more environmentally friendly.

- Fluctuations in raw material prices

- Global economic uncertainties.

Bromine Derivatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 4.71 billion |

|

Forecast Year Market Size (2035) |

USD 8.28 billion |

|

Regional Scope |

|

Bromine Derivatives Market Segmentation:

Derivatives Segment Analysis

The sodium bromide segment is estimated to gain the largest market demand of about 41% in 2035. The reason behind this growth is its application in the oil & gas industry, as sodium bromide is a major key component in the formulation of drilling fluids, where it enhances the performance of drilling operations by stabilizing wellbores while controlling pressure.

According to a report, there would be a rise of about 6% in global oil demand between 2022 and 2028, and this would cross about 105.7 million barrels per day, such expansion of oil & gas drilling activities acts as a major growth driver for sodium bromide.

Additionally, sodium bromide finds application in the pharmaceutical industry, particularly in the production of sedatives and anticonvulsant medications. The pharmaceutical sector's continuous growth, driven by an aging global population and increased healthcare needs, contributes to the rising demand for sodium bromide. Its role as an active pharmaceutical ingredient (API) in certain medications positions it as a growth driver in this segment.

End User Segment Analysis

The chemical segment is set to garner a notable share shortly and is likely to remain the second largest segment in the end-user of the bromine derivatives market expansion impelled by the growth in the healthcare and pharmaceutical sector. Chemicals serve as essential raw materials in the production of pharmaceuticals, including active pharmaceutical ingredients (APIs) and intermediates, coupled with the continuous advancements in medical treatments and the global demand for healthcare solutions, the chemical industry has experienced growth as a key supplier to the pharmaceutical landscape.

Additionally, companies that follow these standards not only avoid legal issues but also gain trust and credibility in the market revenue. The growth of the chemical segment is propelled by the increasing demand for specialty chemicals. Specialty chemicals cater to specific applications and industries, offering unique properties and functions.

Our in-depth analysis of the market includes the following segments:

|

Derivatives |

|

|

End-user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bromine Derivatives Market Regional Analysis:

APAC Market Insights

The bromine derivatives market in the APAC region is expected to hold the largest share with a revenue share of about 47% by the end of 2035. The landscape growth in the region is expected on account of the surge in rapid industrialization and significant infrastructure development, as countries in the region continue to invest in construction projects, the demand for bromine derivatives, especially flame retardants for building materials, increases.

According to a report, APAC is estimated to gain a growth of about USD 2.5 trillion in the construction landscape, in the coming years. The Asia Pacific region is a hub for electronics manufacturing, with several countries being major contributors to global electronic production. Bromine derivatives, particularly in flame retardants and other electronic applications, are in high demand in the electronics industry, and due to the continuous growth of electronic manufacturing in the region, they serve as a significant driver for the market.

North America Market Insights

The North American region will also encounter a huge influence on the bromine derivatives market expansion during the forecast period and will account for the second position attributed to the demand for electronic devices continues to rise, led by technological advancements, the need for bromine derivatives in the electronics landscape contributes to the overall growth of the industry. Water treatment applications represent a growth driver for the market in North America.

Bromine Derivatives Market Players:

- Jordon Bromine Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albemarle Corporation

- LANXESS

- Gulf Resources

- TETRA Technologies, Inc.

- Honeywell International Inc

- Israel Chemicals Limited

- Hindustan Salts Limited

- Tata Chemicals Ltd.

Recent Developments

- Environmental Protection Agency- announced its new guideline highlighting the usage of methyl bromide as a pre-shipment fumigant and quarantine for logs storage in the ship’s hold.

- Lanxess- announced their expansion plans across North America, along with the investment of about 60 million USD in the bromine reservoir site.

- Report ID: 5769

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bromine Derivatives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.