Butyric Acid Derivatives Market Outlook:

Butyric Acid Derivatives Market size was valued at USD 1.05 Billion in 2025 and is set to exceed USD 1.92 Billion by 2035, expanding at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of butyric acid derivatives is estimated at USD 1.11 Billion.

The growth of the market can be attributed to the rising consumption of meat and poultry around the world. It was observed that over the past 30 years, the production of meat has doubled. Global meat consumption is expected to reach about 450 million to 580 million tons by 2050. The rising economic standards of people, as well as the growing concern about gaining weight, and the fact that meat is a source of good protein that reduces fat, are expected to drive market growth. Moreover, fish is one of the best meats to reduce cholesterol and the risk of heart disease in obese people.

Butyric acid is an alkyl carboxylic acid with a straight chain. There is extensive use of butyric acid derivatives in animal feed as additives and are used to reduce animal-derived products' strong meat odors. These ingredients help meet the health requirements of animals. It helps in improving health, provides a proper diet, and supports gut health and animal productivity. In addition, the increasing demand for meat-based products and understanding of the benefits of protein found in animal meat are expected to enlarge the global butyric acid derivatives market size during the forecast period. For instance, it has been 50 years since world meat consumption tripled, and meat production has grown more than threefold

Key Butyric Acid Derivatives Market Insights Summary:

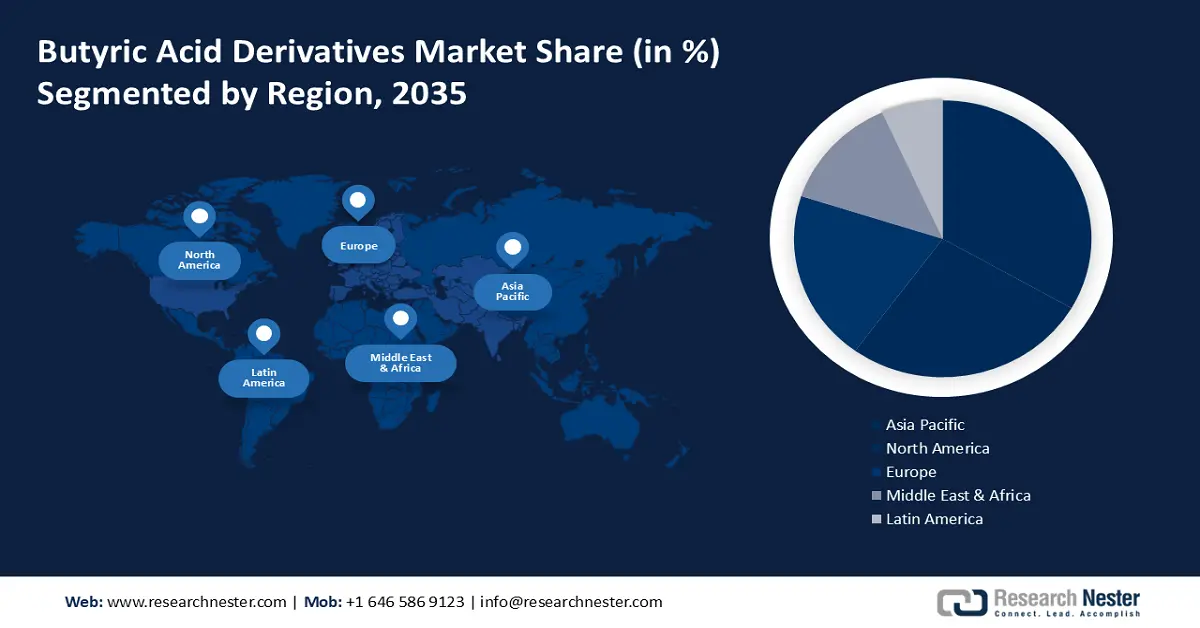

Regional Highlights:

- Asia Pacific’s butyric acid derivatives market holds the largest share by 2035, driven by livestock production increase and growing demand for poultry and animal health.

Segment Insights:

- The swine segment in the butyric acid derivatives market is projected to hold a 53% share by 2035, driven by increasing pork consumption and global demand for pig feed and breeding.

- The sodium butyrate segment in the butyric acid derivatives market is anticipated to secure a significant share by 2035, attributed to rising demand for less smelly meat and increasing global meat consumption preferences.

Key Growth Trends:

- Increasing Awareness of the Importance of Living a Healthy Lifestyle

- Increasing Prevalence of Different Diseases in Animals

Major Challenges:

- Increasing Awareness of the Importance of Living a Healthy Lifestyle

- Increasing Prevalence of Different Diseases in Animals

Key Players: Nutreco N.V., The Eastman Chemical Company, Koninklijke DSM N.V., Kemin Industries Inc., Metabolic Explorer S.A., Bioscreen Technologies S.r.l., Innovad Ad NV/SA, Palital BV, Alfa Aesar (China) Co. Ltd., OQ Chemicals GmbH, KUNSHAN ODOWELL CO. LTD.

Global Butyric Acid Derivatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.05 Billion

- 2026 Market Size: USD 1.11 Billion

- Projected Market Size: USD 1.92 Billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Butyric Acid Derivatives Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Awareness of the Importance of Living a Healthy Lifestyle - According to a survey held in India, it was observed that more than 65% of people were more inclined than before to improve their health through dietary and lifestyle changes in 2021. Approximately 62% of respondents also report that they are relying more heavily on medical and nutritional experts to assist them in reaching a healthy lifestyle. Healthy lifestyles and healthy food products are becoming more popular around the world. There has been a significant increase in egg consumption, meat consumption, and dairy consumption as a result of the huge population base. In turn, this increases the demand for animal feed, which is expected to propel the demand for the global butyric acid derivatives market worldwide.

- Increasing Prevalence of Different Diseases in Animals - It was observed that worldwide there were more than 960 medical cases of cattle diagnosed by veterinarians between June 2017 to July 2018. Animals were mostly affected by endo-parasites 15%, FMD 27%, nonspecific diarrhea 7%, and post-partum anestrus 7%.

- Mergers and Acquisitions by Key Manufacturers and Increased Product Development - The Metabolic Explorer company started a partnership with Alinova in March 2020 for the sale of 100% bio-based butyric acid for the animal nutrition market. Alnova produced the first bio-based butyric acid for animal nutrition in France.

- A Rise in Spending on Research & Development Worldwide - Globally, in 2020, the R&D sector contributed 2.63% of GDP to the global economy, according to data released by the World Bank. As compared to 2018, this represents an increase from 2.2% of the total GDP.

- Rapid Growth in the Chemical Industry Worldwide with Increasing Demand - According to estimates, approximately USD 5 trillion in revenue was generated by the global chemical industry in 2021 as a result of growth in the chemistry sector, with a growth rate of 1.6% expected by 2025.

Challenges

-

Growing Acceptance of Vegan Foods - The increasing protest to decrease animal kills in slaughterhouses and use their milk products is estimated to reduce the market growth. Further, people are changing to be vegan with the increasing vegan products that look and taste very similar to meat despite being made from plant ingredients. Hence, these are the reasons expected to have a negative impact on the growth of the market in the coming years.

-

Increasing Market for Plant-Based Products

-

Regulations Regarding Butyric Acid Derivatives and Food Safety Initiatives

Butyric Acid Derivatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.05 Billion |

|

Forecast Year Market Size (2035) |

USD 1.92 Billion |

|

Regional Scope |

|

Butyric Acid Derivatives Market Segmentation:

Animal Feed Segment Analysis

The swine segment will hold the largest butyric acid derivatives market share of 53% by 2035. In recent years, pork and poultry consumption has greatly impacted the demand for pig feed and pig breeding. Worldwide shipments of butyric acid derivatives for swine feed are expected to augment the segment's growth during the forecast period. For instance, the consumption of pork in China is expected to rise at a rate of around 6.5 kg per capita by 2024 and to increase at a rate more than three times higher than that of poultry, 2.6 kg per capita. Moreover, there has been a rising number of meat eaters around the world owing to the rising preference of people for tasty food. Eating veggies every day makes people bored so meat or poultry is the best way to treat themselves. Also, it is reported that many people eat in restaurants, and street trucks, or place online orders for non-vegetarian food. All the diet charts of nonvegetarian eaters are filled with chicken, turkey, bacon, eggs, or lamb sticks. Therefore, all these factors are anticipated to increase the demand for the segment's growth in the market.

Product Segment Analysis

The sodium butyrate segment is expected to garner a significant share, owing to the increasing demand for odorless or less smelly meat. Moreover, the pungent smell of meat is disliked by most people, even though they love to eat meat. The rising preference for pig meat is further estimated to fuel the growth of the market during the forecast period. In addition, pork is very popular in many countries, as it is cheaper than poultry, lamb, and beef. Also, the increasing demand for protein foods among people across the world is further predicted to contribute to the segment's growth. About more than 85% of people consume meat in their diet across the world as of 2021 survey estimations.

Our in-depth analysis of the global market includes the following segments:

|

By Animal Feed |

|

|

By Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Butyric Acid Derivatives Market Regional Analysis:

Asia Pacific industry is likely to hold largest revenue share by 2035. The growth of the market can be attributed majorly to the increasing production of livestock in developing countries such as China, India, Japan, and Korea. It was observed that a significant increase in monogastric livestock, 63 to 75% of total livestock units (LUs), caused the number of livestock units (LUs) in China to triple within 30 years. Moreover, the rising per capita income, growing population, high consumption of poultry products, growing animal husbandry activities, and rising awareness towards the adoption of a healthy lifestyle are factors expected to drive the global butyric acid derivatives market in the region during the forecast period.

Butyric Acid Derivatives Market Players:

- Nutreco N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Eastman Chemical Company

- Koninklijke DSM N.V.

- Kemin Industries Inc.

- Metabolic Explorer S.A.

- Bioscreen Technologies S.r.l.

- Innovad Ad NV/SA

- Palital BV

- Alfa Aesar (China) Co. Ltd.

- OQ Chemicals GmbH

- KUNSHAN ODOWELL CO. LTD.

Recent Developments

-

OQ Chemicals GmbH to increase the price of Carboxylic Acids and esters. A number of substances are included in it, such as 2-Ethylhexanoic Acid, n-Butyric Acid, and isobutyric acid.

-

Nutreco N.V. has announced that its collaborative project with Mosa Meat called 'Feed for Meat' has been granted almost EUR 2M to advance cellular agriculture and bring cultivated beef to the EU market by the European REACT-EU* recovery assistance programme.

- Report ID: 4297

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Butyric Acid Derivatives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.