Blockchain Finance Market Outlook:

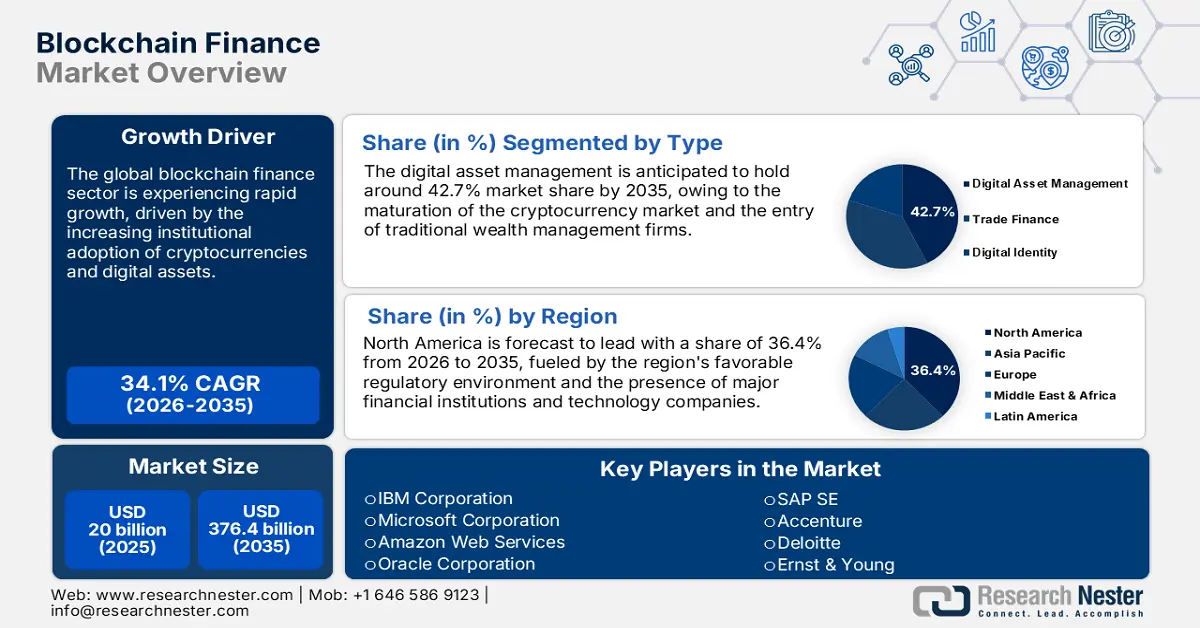

Blockchain Finance Market size is valued at USD 20 billion in 2025 and is projected to reach a valuation of USD 376.4 billion by the end of 2035, rising at a CAGR of 34.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of blockchain finance is evaluated at USD 26.8 billion.

The global blockchain finance sector is experiencing unprecedented growth, driven by the convergence of established financial institutions adopting distributed ledger technology and regulatory frameworks to keep pace with digital asset innovation. The prime growth opportunity lies in developing enterprise-grade blockchain solutions to address prime issues in cross-border payments, trade finance, and digital assets management while ensuring regulatory compliance and operational efficiency. This is evident with the successful implementation of innovative projects, such as the Bank for International Settlements' Project Agorá in October 2024, where it explored tokenization of wholesale central bank money and commercial bank deposits on a shared programmable platform and demonstrated blockchain's potential to accelerate payment and security while reducing costs involved in international financial transactions.

Policies of governments around the world are creating enabling regulatory environments that promote blockchain innovation while keeping the financial system stable through overarching policy frameworks and infrastructure development programs. The disruptive impact of government-supported blockchain projects is seen in the top economies, as emphasized by the U.S. Treasury's National Strategy for Financial Inclusion, published in August of 2023, which clearly acknowledged blockchain's ability to improve the efficiency, speed, and security of payment systems while identifying distributed ledger technology as a priority area for future financial system modernization efforts. This strategic acknowledgment of the importance of blockchain technologies illustrates their vital role in advancing overall financial inclusion and system modernization goals worldwide.

Key Blockchain Finance Market Insights Summary:

Regional Highlights:

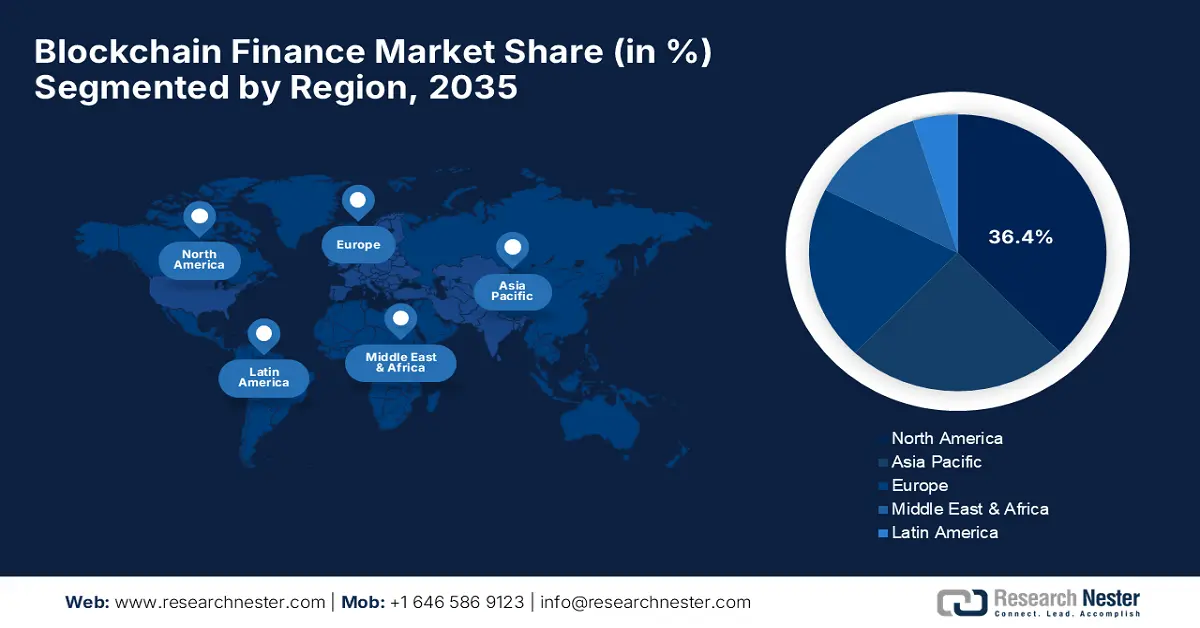

- North America is predicted to hold a 36.4% share by 2035, impelled by highly developed regulatory frameworks, advanced technology infrastructure, and robust institutional blockchain adoption across financial services.

- Asia Pacific is likely to register a 25% CAGR between 2026 and 2035, fueled by massive digital transformation initiatives, expanding fintech ecosystems, and strong government support for blockchain innovation.

Segment Insights:

- The Peer-to-Peer Transfers segment is projected to account for 59.4% share by 2035, propelled by the intrinsic usefulness of blockchain technology in facilitating direct, trustless transactions among individuals without traditional financial middlemen.

- The Bitcoin segment is expected to hold a dominant 66.3% share by 2035, owing to its leadership in financial applications, institutional trust, and regulatory acceptance, supported by the expansion of digital asset businesses.

Key Growth Trends:

- Central bank digital currency development and implementation

- Enterprise blockchain platform integration and tokenization

Major Challenges:

- Regulatory complexity and compliance framework evolution

- Technical integration and interoperability issues of legacy systems

Key Players: IBM Corporation, Microsoft Corporation, Amazon Web Services, Oracle Corporation, SAP SE, Accenture, Deloitte, Ernst & Young, PwC, KPMG

Global Blockchain Finance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20 billion

- 2026 Market Size: USD 26.8 billion

- Projected Market Size: USD 376.4 billion by 2035

- Growth Forecasts: 34.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Singapore, South Korea, Canada, United Arab Emirates

Last updated on : 10 September, 2025

Blockchain Finance Market - Growth Drivers and Challenges

Growth Drivers

- Central bank digital currency development and implementation: National governments are spearheading blockchain finance innovation by investing in large-scale central bank digital currency projects that utilize distributed ledger technology to reshape payment systems and enhance financial sovereignty. Such expansive CBDC projects create foundational infrastructure for blockchain-based financial services while creating regulatory frameworks that facilitate broader market uptake and innovation. In June 2024, the European Central Bank published a series of progress reports on its digital euro project, detailing the completion of the investigation phase and the move to a preparation phase, which includes rulebook development and selection of technology providers. The project demonstrated the potential of blockchain technology to enhance the speed and trust of cross-border payments significantly.

- Enterprise blockchain platform integration and tokenization: The blockchain finance industry is experiencing paradigmatic growth through sophisticated enterprise platform integration that enables real-world asset tokenization, automation of compliance, and easy interoperability of legacy financial systems with decentralized technologies. For instance, Ernst & Young unveiled in February 2024 a revolutionary enterprise-grade NFT marketplace on the Polygon blockchain, specifically for the purpose of enabling financial institutions and corporate clients to venture into tokenizing real-world assets like real estate, art, and intellectual property. The revolutionary platform is equipped with end-to-end capabilities for building, administering, and trading digital assets in regulated environments, demonstrating how blockchain infrastructure bridges traditional finance and emerging digital asset economies.

- Cross-border payment and trade finance innovation: Banks are acquiring significant competitive advantages through blockchain-based solutions that revolutionize cross-border payments, trade finance, and supply chain finance by reducing settlement times, eliminating intermediaries, and enhancing transaction transparency and security. In March 2024, Swift announced the successful test of its Central Bank Digital Currency interlinking solution, demonstrating that existing financial infrastructure can seamlessly connect different CBDC networks and tokenized asset platforms. This critical development facilitates interoperability in future finance systems that may be made up of many blockchain-based digital currencies and assets, and still have Swift play the role of indispensable financial messaging infrastructure.

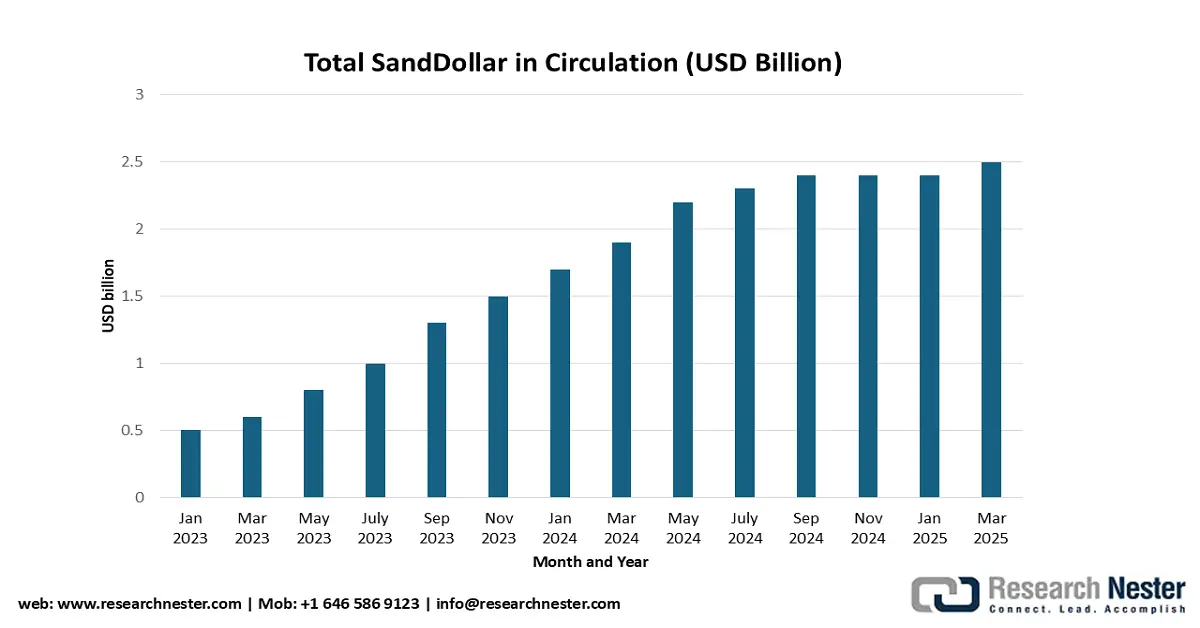

Adoption Metrics for a Retail CBDC: The SandDollar as a Blockchain Finance

Growing circulation suggests increasing public and merchant adoption, which is a positive signal for other countries developing similar projects and for the blockchain finance industry as a whole.

Source: Central Bank of Bahamas

Challenges

- Regulatory complexity and compliance framework evolution: The blockchain finance industry is constantly faced with very dynamic regulatory landscapes that introduce compliance complexity, operational uncertainty, and significant investment in the fulfillment of legal and technical infrastructure transformation across jurisdictions. Such regulatory overhead is compounded by varying national approaches to blockchain regulation, data privacy requirements, and financial services authorization that create a barrier to cross-border scalability and interoperability. Financial institutions need to build stronger digital defenses, conduct thorough testing, and report incidents more effectively, thereby ensuring stability and security in increasingly digital and interdependent financial systems.

- Technical integration and interoperability issues of legacy systems: Blockchain financial providers face significant technical challenges in integrating distributed ledger technology into legacy financial infrastructure, banking systems, and operational processes that are not blockchain-compatible. Such integration challenges are operationally risky, performance bottlenecking, and cost-burdensome heavy loads, and demand professional expertise and long development periods that delay market access and competitive positioning. The technical complexity of such challenges is evident, as seen in the UK's official adoption of its National Payments Vision in July 2025, which serves as an overall strategic framework governing payment system development, advancing innovation, and ensuring security. This model of government focuses on developing sustainable business models for Open Banking and transferring regulatory responsibility to entities like the FCA.

Blockchain Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

34.1% |

|

Base Year Market Size (2025) |

USD 20 billion |

|

Forecast Year Market Size (2035) |

USD 376.4 billion |

|

Regional Scope |

|

Blockchain Finance Market Segmentation:

Transaction Type Segment Analysis

The Peer-to-Peer Transfers segment should maintain a strong 59.4% market share by 2035, driven by the intrinsic usefulness of blockchain technology in the provision of direct, trustless transactions among individuals without traditional financial middlemen. The leadership of the segment is accentuated by the continued development of user experience and cross-border initiatives. In May 2025, Worldpay entered strategic partnerships with blockchain payment network BVNK to enable stablecoin payouts to its merchants, allowing businesses to execute faster and cheaper cross-border payments using blockchain efficiency. This tide of payment giants adopting blockchain technology marks mainstream adoption of digital assets in real-world finance.

Protocol Segment Analysis

The bitcoin segment is expected to command a dominant 66.3% market share by 2035, as the original and most established blockchain protocol maintains its leadership of financial applications, institutional onboarding, and regulator acceptance in global markets. This space is further bolstered by network effects, institutional trust, regulatory clarity in major jurisdictions, sophisticated infrastructure development, positioning bitcoin as digital gold and store of value for both individual and institutional investors. The protocol is fueled by the expansion of deepening digital asset businesses by major financial institutions. In May 2024, the Hong Kong Monetary Authority launched Project Ensemble with participation from Microsoft and global financial institutions in developing a wholesale Central Bank Digital Currency sandbox that explores tokenized deposits and assets in interbank settlement, demonstrating institutional confidence in blockchain-driven financial infrastructure.

Application Segment Analysis

The digital asset management is likely to hold a strong 42.7% market share by 2035 with increasing sophistication of blockchain-based investment platforms, portfolio management tools, and institutional-grade custody solutions, which tackle increasing demand for consolidated digital asset services. This segment consists of cryptocurrency trading, DeFi protocols, NFT marketplaces, and tokenized asset management platforms, creating new sources of revenue for financial service providers while serving evolving customer expectations for digital investment. The uptick in the segment is borne out by leading technology companies increasing their blockchain service offerings. In December 2024, Amazon Web Services focused more on investment in its Amazon Managed Blockchain service during the re:Invent conference, enabling users to create and manage blockchain networks with ease and giving serverless access to public and private blockchains to finance, supply chain, and other industries.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Transaction Type |

|

|

Protocol |

|

|

Application |

|

|

Asset Class |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blockchain Finance Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest 36.4% market share through the forecast period, supported by highly developed regulatory frameworks, state-of-the-art technology infrastructure, and high-quality institutional blockchain technology usage across different financial services applications. Leadership is supported by intentional government policies and regulatory openness that create favorable environments to develop blockchain while maintaining consumer protection and system integrity.

The U.S. economy exemplifies exemplary growth through extensive regulatory modernization, infrastructure investment, and blockchain financial service industry-leading innovation, serving as examples of global best practices and regulatory approaches. The U.S. Federal Reserve launched in July 2023 the revolutionary FedNow Service, a landmark government initiative providing instant payment infrastructure for financial institutions, small and large, that enables real-time, 24/7 fund transfer. This foundational platform enables fintechs and banks to develop innovative blockchain payment solutions, transforming the U.S. payment system into a digital one and making it more efficient for consumers and businesses nationwide.

Canada blockchain finance market is supported by strategic government initiatives, sound regulatory systems, and strong financial institution innovation that fosters competitive strengths in digital service provisioning and blockchain integration possibilities. Canada market emphasizes security, interoperability, and customer-centric design and adapts to new technologies and shifting regulatory needs. In November 2023, the Government of Canada's Department of Finance concluded its consultations on a consumer-driven banking framework, signaling its intent to move forward with open banking legislation that gives consumers and small businesses the right to share their financial data with accredited third-party providers securely. This demonstrates how technology companies are actively shaping future financial market infrastructure development.

Europe Market Insights

Europe is set to observe sustained expansion from 2026 through 2035, driven by extensive regulatory harmonization, innovative digital infrastructure, and strong institutional adoption of blockchain technologies across a broad spectrum of national markets and financial service applications. The continent is endowed with world-class regulatory frameworks like the Digital Operational Resilience Act, high-quality data protection mandates, and new mandates for blockchain governance that promote homogenous, secure environments for distributed finance innovation.

The UK market demonstrates exemplary innovation through large-scale blockchain regulatory work, successful industry cooperation, and continuous investment in distributed ledger infrastructure that enhances financial service provider competitiveness and higher value propositions for consumers. The UK government is implementing strategic frameworks that facilitate the adoption of blockchain, ensuring system stability and consumer protection. In April 2025, the UK Government published draft legislation on cryptoassets through the Financial Services and Markets Act 2000 Order 2025, establishing a broad-ranging regulatory regime that brings cryptoasset activities within the regulatory perimeter. This historic step has regulated issuing qualifying stablecoin activities and custody of qualifying cryptoassets, demonstrating the UK's commitment to creating clear, enforceable rules.

Germany blockchain finance market is characterized by technological leadership, end-to-end regulatory compliance, and strategic industry development that positions German financial institutions at the forefront of distributed ledger innovation and enterprise-class blockchain service delivery. German institutions are pioneering the adoption of end-to-end blockchain security standards and operational resilience requirements. Germany, in December 2024, is entirely implementing the Digital Operational Resilience Act (DORA), which provides whole-of-institution standards for cybersecurity and ICT risk management. This has far-reaching impacts on blockchain-based financial services, requiring upgraded digital defenses, rigorous testing, and improved incident reporting to support financial system stability and security.

APAC Market Insights

Asia Pacific blockchain finance market is likely to record a 25% CAGR between 2026 and 2035, driven by massive digital transformation initiatives, rapidly expanding fintech ecosystems, and widespread government support for blockchain innovation in diverse economic environments and legislations. The region has cutting-edge technology infrastructure, strong governmental backing for fintech innovation, and evolving consumer attitudes towards blockchain financial services that provide unprecedented opportunities for market expansion and technological leadership. Market expansion is enabled by strategic alliances among traditional banking institutions, technology companies, and blockchain professionals that accelerate innovation and service delivery capabilities.

China blockchain finance market is among the leaders in innovation with sophisticated deployment of digital currency, comprehensive regulatory climates, and measured international expansion that positions China institutions and tech companies at the forefront of distributed ledger solutions globally. These institutions are leading new frontier applications of blockchain that optimize the efficiency and scale of financial systems. In January 2024, the People's Bank of China launched its e-CNY pilot program with pioneering offline payment capabilities, allowing users to make transactions even when devices have no battery or internet coverage, representing stupendous advancements in China's dominance in digital currency and mobile payment infrastructure development.

India blockchain finance market presents excellent growth prospects driven by strong government digital infrastructure plans, rapidly expanding smartphone penetration, and strategic financial inclusion schemes that allow for innovative delivery of blockchain services and customer engagement. In October 2024, India government launched Vishvasya: National Blockchain Technology Stack, a flagship program aimed at facilitating blockchain adoption through Blockchain-as-a-Service. This initiative features geographically distributed infrastructure and encompasses a range of applications across health, agriculture, finance, and education, underscoring India's commitment to developing a robust national blockchain infrastructure.

Key Blockchain Finance Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Amazon Web Services

- Oracle Corporation

- SAP SE

- Accenture

- Deloitte

- Ernst & Young

- PwC

- KPMG

The competitive landscape for the blockchain finance market features intense competition among established technology industry powerhouses, specialized blockchain service businesses, and professional services firms leveraging their unique capabilities to capture market share and drive customer adoption across multiple industry segments and geographies. Market giants such as IBM Corporation, Microsoft Corporation, Amazon Web Services, and Oracle Corporation take the lead by providing end-to-end platform offerings, leading-edge technology expertise, and extensive enterprise connections while competing against professional services leaders such as Accenture, Deloitte, Ernst & Young, PwC, and KPMG that provide customized blockchain implementation and advisory services.

Companies are investing large amounts of capital in next-gen blockchain technology, regulatory platforms, and customer experience that differentiate their products in increasingly competitive markets. IBM Company in January 2025 launched the roll-out of a revolutionary blockchain trade finance platform that marries artificial intelligence and quantum-resistant cryptography to accelerate secure transactions while enhancing transparency, reducing fraud, and streamlining complex processes in cross-border payments as well as supply chain finance, demonstrating how veteran technology leaders are building enterprise-grade blockchain platforms to address essential pain points in global financial systems.

Here are some leading companies in the blockchain finance market:

Recent Developments

- In March 2025, PwC announced the launch of a new blockchain-enabled platform designed to help financial firms automate and streamline complex revenue recognition and compliance reporting processes. The solution provides a real-time, tamper-proof audit trail for multi-party contracts and transactions, which significantly reduces manual reconciliation efforts and the risk of errors.

- In February 2025, Oracle announced significant enhancements to its Oracle Blockchain Platform Cloud Service, tailored for the financial services industry. The release includes a new "Digital Assets Edition" with out-of-the-box support for central bank digital currencies, tokenized deposits, and other tokenized real-world assets.

- Report ID: 8082

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blockchain Finance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.