Autonomous Finance Market Outlook:

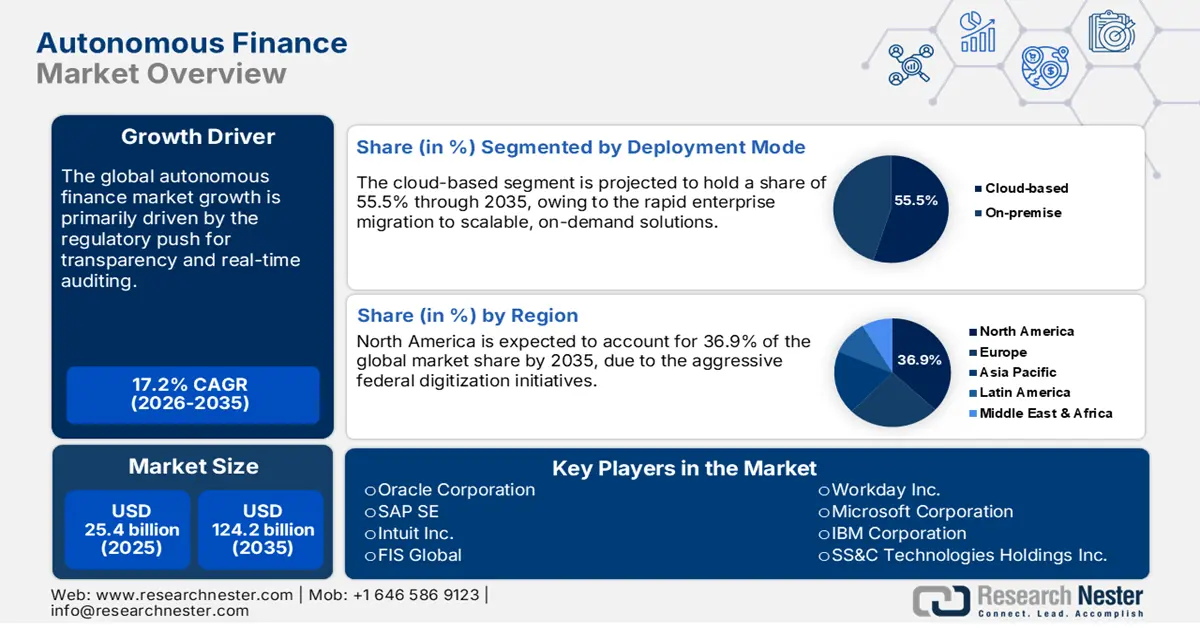

Autonomous Finance Market size was USD 25.4 billion in 2025 and is estimated to reach USD 124.2 billion by 2035, expanding at a CAGR of 17.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of autonomous finance is evaluated at USD 29.7 billion.

Autonomous finance depends heavily on AI and ML models to manage vast amounts of financial data in real-time. These technologies enable systems to assess transactions, detect anomalies, forecast cash flows, personalize customer insights, and automate decision-making. Instead of finance teams manually handling tasks such as reconciliation, loan underwriting, or fraud monitoring, AI-powered systems can work with speed, accuracy, and scalability. The result is a change from reactive finance management to proactive and predictive decision-making. For organizations, this leads to low operational costs, better risk management, and customer satisfaction. For consumers, it means personalized budgeting, instant credit scoring, and automated investment advice.

Moreover, public institutions and governments are using autonomous finance solutions for large-scale resources to projects that serve long-term strategic, social, and environmental goals. The following table provides insights into various initiatives by different countries.

|

Initiative / Program |

Country / Region |

Launch Year |

Primary Objective |

Details |

|

Belt and Road Initiative (BRI) |

China |

2013 |

Infrastructure development across Asia, Africa, and Europe |

Long-term geopolitical & trade connectivity vision, not tied to immediate income flows |

|

European Green Deal |

European Union |

2019 |

Climate neutrality by 2050 |

Large-scale public financing in renewable energy & green tech, independent of the current EU GDP |

|

Infrastructure Investment and Jobs Act (IIJA) |

U.S. |

2021 |

$1.2 trillion for transport, broadband, water systems |

Strategic nation-wide infrastructure overhaul, regardless of current demand |

|

National AI Strategy |

United Kingdom |

2021 |

Strengthen AI innovation ecosystem |

Public funding to build research capacity & national AI infrastructure |

Source: Mission Innovation, UK Government, White House, European Commission

Key Autonomous Finance Market Insights Summary:

Regional Highlights:

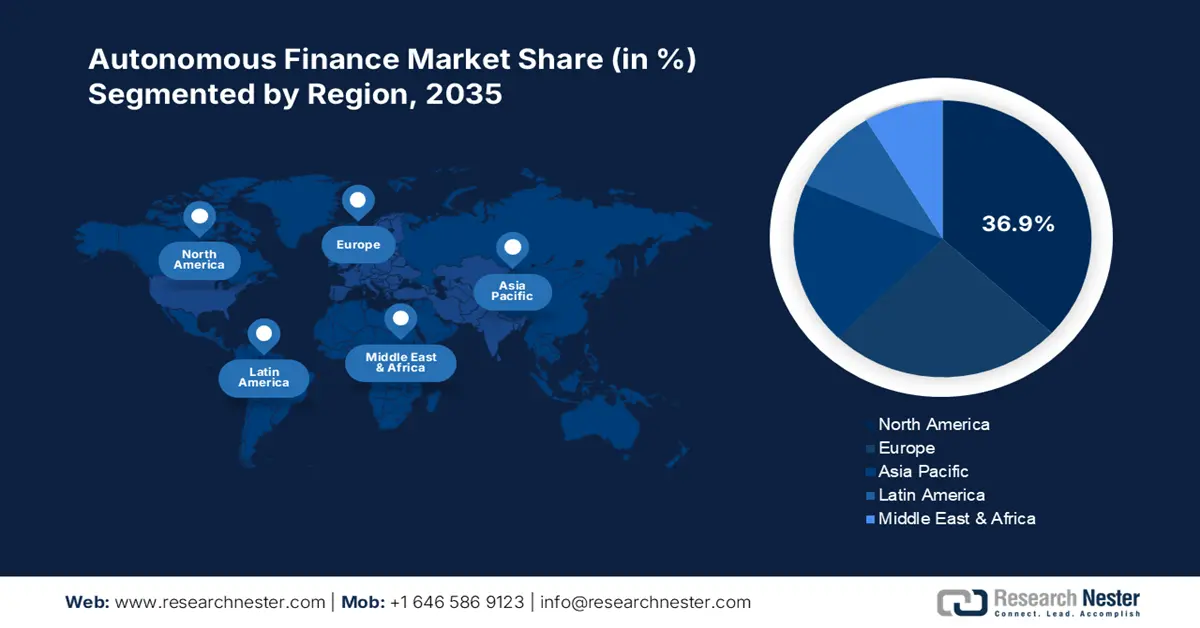

- The North America autonomous finance market is projected to hold a 36.9% share by 2035, owing to aggressive federal digitization programs and widespread private sector AI adoption.

- Europe is anticipated to secure a 25.5% share by 2035, impelled by cross-border financial collaborations and EU-backed initiatives such as the Digital Europe Programme.

Segment Insights:

- The cloud-based segment of the autonomous finance market is anticipated to account for 55.5% share by 2035, propelled by the rapid enterprise shift toward scalable, AI-driven, on-demand solutions.

- The risk & compliance management segment is estimated to capture 28.1% share by 2035, driven by heightened regulatory scrutiny and the rising use of AI-enabled compliance automation tools.

Key Growth Trends:

- Regulatory push for transparency and real-time auditing

- Surge in open banking and embedded finance integration

Major Challenges:

- Infrastructure gaps in emerging markets

- High cybersecurity and compliance costs

Key Players: Oracle Corporation, SAP SE, Intuit Inc., FIS Global, Workday Inc., Microsoft Corporation, IBM Corporation, SS&C Technologies Holdings Inc., Xero Limited, UiPath Inc., Infosys Ltd., Tata Consultancy Services (TCS), Kakao Enterprise, Silverlake Axis Ltd., Tech Mahindra Ltd.

Global Autonomous Finance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.4 billion

- 2026 Market Size: USD 29.7 billion

- Projected Market Size: USD 124.2 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Canada

Last updated on : 24 September, 2025

Autonomous Finance Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory push for transparency and real-time auditing: The strict regulations aimed at transparency and real-time auditing are expected to drive the sales of advanced finance technologies during the projected period. Governments are moving toward continuous auditing and compliance systems, especially in the EU and Australia, which is opening high-earning doors for autonomous finance technology producers. This trend is also pushing financial software vendors to embed explainable AI (XAI) and audit-ready logs into their solutions. Thus, the regulatory shifts are likely to drive innovations in the market.

- Surge in open banking and embedded finance integration: The open banking APIs and embedded finance platforms are expected to fuel the demand for autonomous systems that can interpret external financial signals and trigger actions. Some of the companies are offering third-party data integration that allows automation of personal finance decisions, such as bill payments and savings transfers, based on real-time balances.

For instance, in November 2022, ANEXT Bank Singapore launched API-based embedded finance for SMEs, automating invoice financing and cash flow management services. FinTech firm IN Financial Technologies and Business Process Management provider Bizmann were among the early participants in the program, together supporting about 15,000 SMEs. Companies in Asia, especially in Singapore and Japan, are increasingly investing in autonomous budgeting and credit solutions for SMEs via open banking rails.

- Regional digital infrastructure and cloud readiness: Autonomous finance necessitates massive computing power for real-time data processing, analytics, and safe storage. The boost in cloud adoption helps fintech companies and banks to deploy flexible autonomous finance solutions globally. The increasing investments in scalable digital infrastructure are likely to accelerate the sales of autonomous finance solutions. For instance, AWS investments in India are broadening cloud capacity to host advanced fintech workloads.

In January 2025, Amazon Web Services (AWS) announced an $8.3 billion investment in cloud infrastructure for its Asia Pacific Mumbai Region in Maharashtra, aimed at extending cloud computing capacity in India. By 2030, this initiative is anticipated to increase $15.3 billion to India’s GDP and create over 81,300 full-time jobs yearly within the local data center supply chain. The investment is a set of AWS’s larger $12.7 billion commitment to strengthen cloud infrastructure in India by 2030, fueled by rising demand for cloud services nationwide. Thus, rising spending, both public and private, is predicted to double the sales of key players in the years ahead.

Challenges

- Infrastructure gaps in emerging markets: The infrastructure gaps in the underdeveloped regions limit the adoption of automated technologies. The low broadband access and poor cloud infrastructure hinder the sales of real-time data processing technologies essential to autonomous finance. In Sub-Saharan Africa and some parts of Southeast Asia, the 5G penetration and edge computing facilities are very less, which directly hinders the deployment of autonomous finance solutions.

- High cybersecurity and compliance costs: The rising cases of cybersecurity and online threats are necessitating the demand for advanced fintech solutions. But the price of next-gen solutions is quite high and not affordable to all users. Apart from this, the need to align with the strict regulations increases the compliance costs, hindering their adoption rates in the price-sensitive markets. Thus, the low-tech budgets often limit the investments in fintech automation in developing countries.

Autonomous Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 25.4 billion |

|

Forecast Year Market Size (2035) |

USD 124.2 billion |

|

Regional Scope |

|

Autonomous Finance Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is projected to account for 55.5% of the global autonomous finance market share by 2035. The cloud-based autonomous finance platforms are most sought after, owing to the rapid enterprise migration to scalable, on-demand solutions. The U.S. National Institute of Standards and Technology (NIST) states that cloud-native finance applications enable modular AI models, allowing banks and insurers to optimize operations and reduce downtime. For example, in June 2025, Elisa Oyj, a major telecommunications operator in Finland, expanded its partnership with Google Cloud to adopt AI-powered autonomous network operations. Through Google Cloud’s Autonomous Network Operations framework, leveraging advanced data and AI tools, Elisa aims to move beyond predictive analytics toward prescriptive insights and proactive AI-driven network management, boosting efficiency, resilience, and overall customer experience. Such innovations are directly opening lucrative doors for cloud-based autonomous finance solution producers.

Application Segment Analysis

The risk & compliance management segment is anticipated to capture 28.1% of the global market share throughout the forecast period. The growing regulatory scrutiny across financial ecosystems is boosting the adoption of autonomous finance tools with built-in compliance workflows. The European Union Agency for Cybersecurity (ENISA) reveals in its 2024 report that real-time audit trails and AI-driven risk flags are a priority for EU-regulated entities under DORA and GDPR frameworks. Autonomous tools that integrate with regulatory databases to flag anomalies preemptively are exhibiting widespread adoption.

End user Segment Analysis

The banking & financial services segment is expected to expand at a rapid rate during the forecast period, fueled by the need to optimize operations, reduce costs, and meet rising regulatory demands for transparency. Banks are increasingly deploying advanced AI-powered tools for fraud detection, loan underwriting, cash-flow forecasting, and personalized user engagement, which significantly lowers manual workloads while granting accuracy and compliance. The growth is also based on open banking and embedded finance adoption, enabling effortless automation across payments and credit services. In 2024, JPMorgan Chase expanded its AI-driven COIN platform that processes contracts and legal documents in various departments, in order to save the bank millions of hours in manual reviews. As financial institutions face high competition from fintech, autonomous finance is becoming vital for efficiency, risk management, and customer retention.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Finance Market - Regional Analysis

North America Market Insights

The North America autonomous finance market is estimated to hold 36.9% of the global revenue share through 2035, owing to the aggressive federal digitization initiatives. The high private sector AI adoption is creating a lucrative environment for autonomous finance technology producers. In the U.S., the Federal Communications Commission (FCC) and NTIA support the ICT investments through programs, including the Broadband Equity, Access, and Deployment (BEAD) initiative, which also boosts high-speed internet infrastructure and indirectly increases the sales of autonomous finance solutions. The robust digital trend is also contributing to the high demand for advanced fintech solutions in Canada.

The sales of autonomous finance technologies in the U.S. are expected to be driven by the combination of aggressive federal investments in digital infrastructure and increasing enterprise-level automation in the financial services sector. The USD 42.5 billion BEAD program supporting the rollout of high-speed internet in underserved areas is indirectly propelling the penetration of AI-driven financial tools.

The Canada autonomous finance market is projected to increase at the fastest pace from 2026 to 2035. The strong federal backing for digital transformation in finance and telecommunications is contributing to the high sales of autonomous finance systems. The Innovation, Science and Economic Development (ISED) agency's commitment of CAD 3.225 billion under the Universal Broadband Fund to ensure universal internet access is facilitating the use of AI-based financial services in rural and remote areas.

Europe Market Insights

The Europe market is anticipated to account for 25.5% of the global revenue share throughout the study period. The digitization strategies and enhanced cross-border financial collaborations are accelerating the demand for autonomous finance solutions. The EU-level support through programs, including the Digital Europe Programme, is contributing to the rising adoption of automated transaction solutions. For example, the EU’s €7.6 billion Digital Europe initiative funding advanced data infrastructure, AI, and cybersecurity is opening high-earning opportunities for autonomous finance companies.

The sales of autonomous finance solutions in Germany are estimated to be driven by the extensive state and private investments in industrial automation. The integration of fintech in the country’s robust manufacturing economy is also contributing to the high demand for automated finance technologies. The government support through funding, subsidies, and policies is encouraging companies to expand their operations in the country.

The market for autonomous finance in France is expected to increase at a high CAGR from 2026 to 2035. The government’s France Numérique digital roadmap and AI strategies are significantly boosting investment in autonomous systems for the finance sector. France’s digital roadmap outlines the country’s commitment to advancing the EU’s Digital Decade objectives, with defined targets for 12 of the 14 key performance indicators (KPIs), most of which align with the EU’s 2030 ambitions. To drive this transformation, France has earmarked an estimated EUR 10.2 billion, equivalent to 0.4% of its GDP excluding private sector investments. This indicates that both the public and private enterprises are set to drive the sales of autonomous finance solutions in the years ahead.

APAC Market Insights

The Asia Pacific autonomous finance market is expected to increase at a CAGR of 17.9% between 2026 and 2035. The robust digitalization and hefty ICT spending are likely to accelerate the adoption of autonomous finance solutions. The countries in the region are leading the sales of autonomous finance solutions owing to the strong presence of early adopters. China, India, Japan, and South Korea are major revenue contributors for APAC. The AI-powered financial automation trend in banking, insurance, and the government e-payments field is set to drive the overall market growth in the coming years.

The autonomous finance market in China is rising rapidly, fueled by a strong digital payments system, the adoption of AI, and supportive government policies promoting financial innovation. With tech companies such as Ant Group and Tencent leading mobile payment and digital lending platforms, autonomous finance solutions are becoming key to daily transactions. China’s regulatory force toward fintech standardization and data governance is also forcing banks to adopt AI-driven compliance and risk management systems. In 2024, Industrial and Commercial Bank of China (ICBC) declared its implementation of AI-powered smart finance platforms to automate credit risk assessments and fraud detection, highlighting the nation's commitment to AI-powered finance.

The India market is expected to register rapid growth owing to the widespread adoption of digitalization and UPI transactions, and government-led efforts to expand financial inclusion and reduce reliance on cash. in addition to this, the fintech sector in India is adopting advanced technologies to improve credit scoring, combat fraud, and optimize personal finance management. The Reserve Bank of India's framework for digital lending is also supporting in building of trust and promoting the safe adoption of these tools. In 2023, HDFC Bank partnered with Google Cloud to create advanced services that simplify risk analysis and improve customer experiences. With cloud infrastructure expanding and a young, tech-savvy population driving demand, autonomous finance market in India is set for continued growth. The government and several public sectors are also adopting autonomous finance to achieve long-term social, strategic, and infrastructural goals. This is expected to boost the sales of autonomous finance services and solutions in the coming years.

|

Initiative |

Launch / Approval Year |

Primary Objective |

Details |

|

Smart Cities Mission |

2015 |

Urban infrastructure modernization |

Strategic city development, independent of present income levels |

|

IndiaAI Mission |

2024 |

Build national AI infrastructure |

₹10,300 crore for GPUs & AI innovation - done to future-proof India’s tech landscape |

|

Research Development & Innovation (RDI) Scheme |

2025 |

Deep-tech R&D & strategic technologies |

Public funding to support sunrise sectors and national R&D, independent of short-term returns |

|

NLC India Renewable Energy Push |

2025 |

Invest ₹7,000 crore in 10 GW renewable projects |

Long-term energy security & green transition, not tied to immediate demand |

source: PMGSY, DDWS, PIB

Key Autonomous Finance Market Players:

- Oracle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- Intuit Inc.

- FIS Global

- Workday Inc.

- Microsoft Corporation

- IBM Corporation

- SS&C Technologies Holdings Inc.

- Xero Limited

- UiPath Inc.

- Infosys Ltd.

- Tata Consultancy Services (TCS)

- Kakao Enterprise

- Silverlake Axis Ltd.

- Tech Mahindra Ltd.

The autonomous finance market is characterized by the presence of gigantic companies and the increasing emergence of start-ups. The key companies are investing heavily in research and development activities to introduce next-gen solutions. The leading players are also collaborating with other players to boost the market reach and product offerings. Some of the industry giants are expanding their operations in developing regions to earn hefty gains from untapped opportunities. Both the organic and inorganic marketing strategies are poised to double the profits of key players in the years ahead.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Ramp secured $500 million in fresh funding at a $22.5 billion valuation, coming just 45 days after its previous $200 million raise. The new capital will fuel the company’s rapid expansion in the U.S. business market and accelerate the rollout of its AI-powered finance automation solutions.

- In January 2025, OpenEnvoy, a leading player in Autonomous Finance, entered into a strategic partnership with global food company Schreiber Foods. As part of the collaboration, Schreiber’s venture arm has made a strategic investment, while Schreiber will integrate OpenEnvoy’s Autonomous Finance platform across its financial operations. The initiative marks a major step in digitally transforming Schreiber’s finance processes, with a focus on automating Accounts Payable (AP) and Accounts Receivable (AR) through OpenEnvoy’s AI-driven platform.

- In May 2024, Fujitsu Limited announced the launch of an AI-based autonomous expense and invoice reconciliation tool under its Finplex brand. This product is designed for SMEs and accounting firms.

- In March 2024, NTT DATA introduced its Autonomous Treasury Management Suite (ATMS). This solution is focused on targeting large financial institutions in Japan and Southeast Asia.

- Report ID: 8119

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Finance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.