Personal Finance Apps Market Outlook:

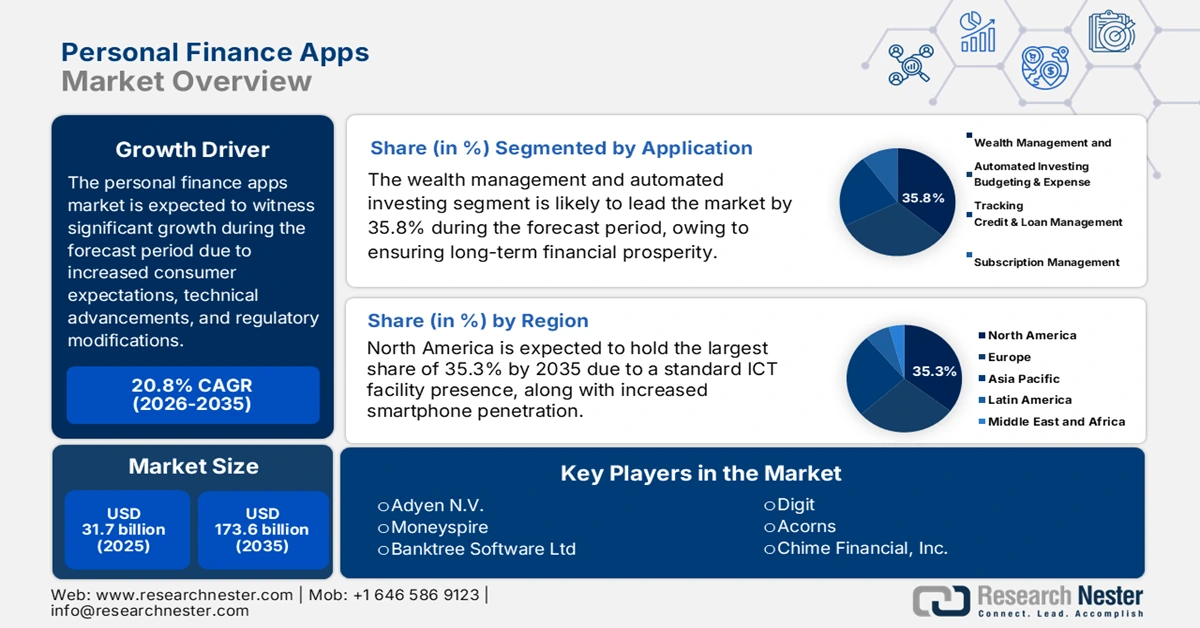

Personal Finance Apps Market size was over USD 31.7 billion in 2025 and is estimated to reach USD 173.6 billion by the end of 2035, expanding at a CAGR of 20.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of personal finance apps is evaluated at USD 38.2 billion.

The international personal finance apps market is currently undergoing an increased transformation, emerging from basic budgeting tools into artificial intelligence (AI)-driven and sophisticated financial operating systems. This worldwide transition is readily driven by a mix of modified customer expectations, regulatory changes, and technological advancement, which has positioned the personal finance apps market for significant and sustained growth in the upcoming decade. According to an article published by the U.S. Department of the Treasury in December 2024, the Treasury’s Office of Payment Integrity in the Bureau of the Fiscal Service declared its newest efforts in bolstering fraud detection processes, which have resulted in USD 1 billion recovery for improper and fraudulent payments. Besides, 78% of financial firms have implemented generative AI, and 86% are expecting a significant surge in model inventory, owing to this adoption.

Furthermore, the aspect of platformification into financial-based super applications, hyper-personalization through machine learning, sustainability and ESG integration, advanced security as the ultimate feature, and expansion into open finance and pen banking are also driving the personal finance apps market globally. Besides, as per an article published by the World Bank Group in January 2025, there has been an expansion in digital financial services, which has assisted in decreasing the adult number without account accessibility from 2.5 billion to 1.4 billion. Based on this, 76% of the worldwide adult population owns a financial account, which denotes a positive impact on the overall personal finance apps market. In addition, 80% of the population across Thailand, India, Kenya, and China holds accounts, and is gradually shifting from accessibility to active utilization of a wide range of financial services.

Key Personal Finance Apps Market Insights Summary:

Regional Highlights:

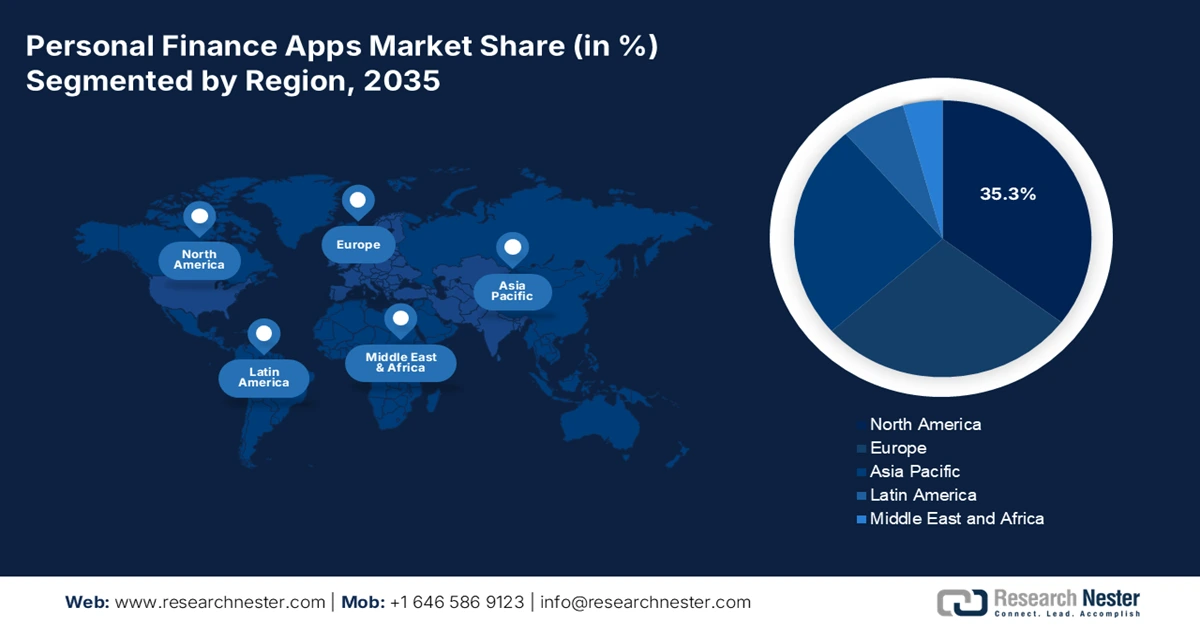

- North America personal finance apps market is projected to hold a 35.3% share by 2035, driven by mature ICT infrastructure, high smartphone penetration, and early Open Banking adoption through APIs.

- Asia Pacific is expected to emerge as the fastest-growing region during 2026–2035, fueled by increasing smartphone adoption, supportive digitalization agendas, and a large underbanked population.

Segment Insights:

- The wealth management and automated investing segment is projected to account for 35.8% share by 2035 in the personal finance apps market, owing to its personalized and holistic strategy for long-lasting financial prosperity.

- The subscription (SaaS) segment is expected to hold the second-largest share during 2026-2035, propelled by recurring and predictable revenue streams.

Key Growth Trends:

- Increased demand for financial wellness

- Proliferation in mobile and smartphone connectivity

Major Challenges:

- Battle for customer trust, privacy, and data security

- The monetization and paradox and fierce market saturation

Key Players: Intuit Inc. (U.S.), Block, Inc. (U.S.), PayPal Holdings, Inc. (U.S.), NerdWallet, Inc. (U.S.), Robinhood Markets, Inc. (U.S.), Revolut Ltd (U.K.), Monzo Bank Ltd (U.K.), NADRA (Pakistan), Credit Karma (Intuit) (U.S.), Yahoo! Inc. (U.S.), Empower (U.S.), MoneyLion (U.S.), Digit (U.S.), Acorns (U.S.), Chime Financial, Inc. (U.S.), YNAB (U.S.), Adyen N.V. (Netherlands), Moneyspire (U.S.), Banktree Software Ltd (U.K.), Monefy (Bulgaria).

Global Personal Finance Apps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.7 billion

- 2026 Market Size: USD 38.2 billion

- Projected Market Size: USD 173.6 billion by 2035

- Growth Forecasts: 20.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Indonesia, Brazil, Mexico, South Korea

Last updated on : 17 November, 2025

Personal Finance Apps Market - Growth Drivers and Challenges

Growth Drivers:

- Increased demand for financial wellness: The inflation and post-pandemic economic uncertainty aspect has readily heightened customer focus on long-lasting financial stability, savings, and debt management, which has enhanced dependency on digitalized tools for insight and control. According to the 2025 UNCTAD Organization data report, the international public debt has reached USD 102 trillion as of 2024. Besides, despite the public debt in developing nations accounting for less than 1/3rd of the USD 31 trillion, it has developed two times fast in developed countries. Therefore, debt management strategies such as prioritizing high-interest debts, budgeting, new debt avoidance, and seeking professional credit counseling are readily driving the market’s exposure across different nations.

Regional Debt Level Analysis (2010-2024)

|

Years |

Developed Nations (USD Trillion) |

Africa (USD Trillion) |

Asia and Oceania (USD Trillion) |

Latin America and the Caribbean (USD Trillion) |

|

2010 |

43 |

1 |

5 |

2 |

|

2011 |

48 |

1 |

6 |

3 |

|

2012 |

50 |

1 |

6 |

3 |

|

2013 |

49 |

1 |

7 |

3 |

|

2014 |

50 |

1 |

8 |

3 |

|

2015 |

47 |

1 |

8 |

3 |

|

2016 |

50 |

1 |

10 |

3 |

|

2017 |

51 |

1 |

11 |

3 |

|

2018 |

53 |

1 |

13 |

4 |

|

2019 |

54 |

1 |

14 |

4 |

|

2020 |

63 |

2 |

16 |

3 |

|

2021 |

67 |

2 |

19 |

4 |

|

2022 |

65 |

2 |

21 |

4 |

|

2023 |

68 |

2 |

22 |

5 |

|

2024 |

71 |

2 |

25 |

5 |

Source: UNCTAD Organization

- Proliferation in mobile and smartphone connectivity: An increase in cost-effective mobile data and international smartphone penetration provides the crucial infrastructure for the comprehensive adoption and regular finance apps utilization. For instance, as per a data report published by the PIB Government in June 2025, internet connections in India increased from 25.1 crore in 2014 to 96.9 crore in 2024, with 4.7 Lakh 5G towers installed that cover 99.6% of districts. This robust mobile network readily supports 116 crore users as of 2024, with an upsurge in internet users by 285% in overall 11 years. Based on this, there has been a sudden reduction in data expenses from ₹308 crore per GB to only ₹9.3 crore in 2022. This has successfully made the internet immensely cost-effective for the overall population in the country, which positively caters to the personal finance apps market.

- Advancement in actual ICT facility: The comprehensive availability of sophisticated data analytics, 5G networks, and cloud computing permits feature-rich, real-time, and scalability in applications, thereby fueling the personal finance apps market internationally. According to an article published by the Journal of Economy and Technology in November 2025, based on modern technology globalization and advancement, there has been an increase in digitalized communication, along with a 43% increase in texting. In addition, there has also been a 36% increase in voice calls, 35% in social media, and 30% in video calls. Meanwhile, as per the June 2025 World Economic Forum report, 80% of fintech organizations have implemented AI across different business domains. In addition, the widespread AI adoption has readily ensured optimization in 83% of consumer experience, 75% cost reduction, and 75% in profitability, thereby boosting the overall market growth.

Challenges:

- Battle for customer trust, privacy, and data security: The single most significant roadblock for the personal finance apps market is the establishment of maintaining suitable customer trust and focus on financial data privacy and security. These particular applications demand accessibility to users’ most sensitive financial information, such as investment portfolios, transaction histories, and bank credentials. Besides, a single high-profile data breach can erode market-based confidence by crippling an organization. This challenge is considered to be multifaceted, with applications incorporating state-of-the-art encryption, strong data storage solutions, and secure API integrations. This is possible while carefully navigating the complicated global administrative landscape. Moreover, customers are becoming increasingly aware of data monetization, thus creating a gap in the market’s development.

- The monetization and paradox and fierce market saturation: The personal finance apps market is witnessing intensified saturation and fragmentation, especially at the basic service level, posing an effective challenge to profitability and sustainability. The gap to entry for a simple budgeting application is extremely low, resulting in competing offerings. This has created a monetization-based paradox, and customers have become accustomed to ad-supported and free models. Besides, the aspect of transferring users to a premium tier and paid subscription is exceptionally challenging in the existence of different free alternative options. This has pressured organizations to continuously progress and provide value to justify a fee, which in turn boosts their developmental and operational expenses.

Personal Finance Apps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.8% |

|

Base Year Market Size (2025) |

USD 31.7 billion |

|

Forecast Year Market Size (2035) |

USD 173.6 billion |

|

Regional Scope |

|

Personal Finance Apps Market Segmentation:

Application Segment Analysis

The wealth management and automated investing segment in the personal finance apps market is anticipated to garner the largest share of 35.8% by the end of 2035. The segment’s exposure is highly attributed to its provision of a personalized and holistic strategy for long-lasting financial prosperity. In addition, the low-cost, emotionless, and efficient execution of investment approaches is also uplifting the segment. The combination of these offers a strong hybrid approach that assists in balancing human expertise, along with technological efficacy. As per the January 2025 IBEF Organization article, there has been an upsurge in wealth management services in India from Rs. 95,23,800 crore (USD 1.1 trillion) as of 2024, and it is projected to reach Rs. 1,99,13,400 crore (USD 2.3 trillion) by the end of 2029. Meanwhile, as stated in the September 2024 Automate Organization article, startup funding in computer vision, automation, and robotics successfully recovered, with an overall USD 748.9 million secured by U.S.-specific organizations, thus suitable for the segment’s growth.

Business Model Segment Analysis

The subscription (SaaS) segment in the personal finance apps market is expected to cater to the second-largest share during the predicted period. The segment’s growth is highly driven by the recurring and predictable revenue stream, which is essential for funding ongoing research and development in data analytics, innovative security features, and AI features. Besides, for users, there has been a shift in the value proposition from a one-time purchase to continuous partnership and collaboration for financial wellness. This is significantly possible for providing accessibility premium features, such as ad-free experiences, tax optimization strategies, personalized investment portfolios, and advanced cash-flow forecasting. Therefore, the success of this particular model focuses on delivering demonstrable and consistent value that readily justifies the monthly or yearly fee in the market, with different fee alternatives.

End user Segment Analysis

The individual consumers (B2C) segment in the personal finance apps market is projected to account for the third-largest share by the end of the forecast timeline. The segment’s development is highly fueled by an international surge in the need for personal financial literacy and empowerment. This need is further driven by economic pressures, including a complicated investment landscape, a rise in living expenses, and inflation, which has pushed individuals to adopt digitalized tools for greater control over their own finances. Besides, the modernized B2C user tends to expect a mobile-first and seamless experience that constitutes all financial accounts, such as investments, credit card loans, savings, and checking, within an intuitive and single dashboard.

Our in-depth analysis of the personal finance apps market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Business Model |

|

|

End user |

|

|

Technology Platform |

|

|

Operating System |

|

|

Security and Compliance |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Personal Finance Apps Market - Regional Analysis

North America Market Insights

North America is anticipated to account for the largest share of 35.3% in the personal finance apps market by the end of 2035. The market’s upliftment in the region is highly propelled by the presence of a mature ICT infrastructure, increased smartphone penetration, and early Open Banking principles adoption through application programming interfaces (APIs). According to an article published by the Pew Research Organization in November 2024, 98% of the population in the region currently owns a cellphone of a different kind. In addition, almost 9 in 10, which is 91% own a smartphone, denoting a 35% increase since 2011. Besides, 99% aged between 18 to 29 years have a cellphone, 98% have a smartphone, and 1% have a cellphone, which is not a smartphone. Likewise, 98% aged between 50 to 64 years own a cellphone, 91% smartphone, and 6% cellphone that is not a smartphone, thereby making it suitable for boosting the market’s exposure in the overall region.

Cellphone and Smartphone Ownership Comparison in North America (2015-2024)

|

Year |

Cellphone |

Smartphone |

|

2015 |

91% |

69% |

|

2016 |

95% |

77% |

|

2017 |

- |

- |

|

2018 |

95% |

77% |

|

2019 |

96% |

81% |

|

2020 |

- |

- |

|

2021 |

97% |

85% |

|

2022 |

- |

90% |

|

2023 |

97% |

91% |

|

2024 |

98% |

|

Source: Pew Research Organization

The personal finance apps market in the U.S. is growing significantly, owing to the shift from simple budgeting tools to integrated financial ecosystems. In addition, the open banking formulation through CFPB rulemaking has standardized data sharing through APIs, which has readily fueled the latest wave of personalized and data-driven services. This administrative push has escalated AI-based features adoption, such as automated investment and predictive cashflow analysis, thus compelling conventional banks to collaborate and acquire agile fintech for maintaining their competitiveness. As per an article published by the U.S. Government Accountability Office in 2024, federal agencies in the country reported 32,211 information-based security incidents as of 2023. This includes 38% of improper usage resulting from organizational violation, 19% caters to phishing email, 18% unknown cyberattack, 11% website or web-based application attack, 10% theft or equipment loss, and 4% attrition. Therefore, to combat these, advanced blockchain and cybersecurity-based authentication have emerged to be essential.

The personal finance apps market in Canada is also growing due to the federal government’s strategy to incorporate a regulated open banking framework to successfully unlock customer data and spur fintech progression. Additionally, the increased focus on financial resilience tools, with applications increasingly providing features for savings goals and debt management, which are deliberately aligned with the country’s Financial Consumer Agency national financial literacy strategy. Besides, as stated in the Global Trade Alert Organization article, in March 2022, the government of Canada declared an investment of CAD 4 billion (an estimated USD 3.2 billion) to readily stimulate the country’s digital transformation. This caters to small and medium-sized enterprises, which is possible through the Canada Digital Adoption Program. Meanwhile, as stated in the February 2025 Government of Canada report, 54% of citizens indicated utilizing websites as the ultimate contact method, 34% used telephone as the main communication channel, and 4% visited offices, kiosks, and service counters.

APAC Market Insights

Asia Pacific in the personal finance apps market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the overall region is highly fueled by a surge in smartphone adoption, supportive government-based digitalization agendas, and the presence of a massive underbanked and unbanked population demanding digital-first financial services. According to the May 2025 Ergomania article, WeChat, which is a China-based application, accounts for 1.3 billion active users, while Alipay comprises 1.3 billion users. Besides, 74% of the population in Indonesia, 57% in China, and 54% in India own smartphones, and the internet utilization has aggressively transitioned to these devices in recent years. Meanwhile, 70% of the population belongs to the unbanked category, with little or no accessibility to basic banking services, thereby creating a huge growth opportunity for the personal finance apps market in the region.

The personal finance apps market in China is gaining increased traction, owing to the existence of the People's Bank of China (PBOC), reporting the third-party mobile payments domination by applications. Besides, according to an article published by the People’s Republic of China in January 2025, there has been an increase in internet users by 1.1 billion as of 2024, denoting a surge from 16 million in the previous year. In addition, the China Internet Network Information Center (CNNIC) has revealed that the domestic internet penetration has effectively reached 78.6% in 2024, which has made the country emerge as the largest internet infrastructure globally. Meanwhile, online payment users also increased in the country by 1 billion, of which 974 million people were engaged in online shopping, denoting a 59.5 million increase from 2023, thereby creating a huge growth opportunity for the overall market.

The personal finance apps market in India is also developing due to the Government of India’s Digital India approach, especially for the Unified Payments Interface (UPI), which is significantly processing an increased transaction volume. This, in turn, has created a huge foundational infrastructure that overall personal financial applications can leverage in the country. As per a data report published by the PIB Government in September 2025, the UPI has successfully transformed the overall country’s payment landscape and has emerged as the largest real-time payment system by processing over 19 billion transactions every month. In addition, this particular system readily processed over 20 billion transactions, with a valuation of more than ₹24.8 Lakh Crore. In this regard, domestic users are successfully able to initiate merchant transactions of almost ₹10 Lakh per day for selected categories. Therefore, based on all these factors, the UPI system in the country accounts for 85% of overall digital transactions in the country, thus proliferating the personal finance apps market growth.

Europe Market Insights

Europe in the personal finance apps market is predicted to grow steadily by the end of the forecast timeline. The market’s upliftment in the region is highly fueled by the presence of a strong regulatory framework, which is proactively shaping growth. The Revised Payment Services Directive (PSD2) is considered the primary catalyst, which readily mandates open banking through APIs by pressuring conventional banks to share consumer data with licensed third-party service providers. This has successfully unlocked innovation, permitting applications to provide payment initiation services as well as aggregated financial views. Besides, as per an article published by NLM in August 2023, the Europe Union Agency for Cybersecurity (ENISA) has reported that the healthcare sector in the region has readily witnessed 76% of cybersecurity breaches, owing to system intrusions, miscellaneous errors, and basic web application attacks.

The personal finance apps market in the UK is gaining increased exposure, owing to the first-mover benefit in successfully incorporating a wide-ranging and government-mandated Open Banking regime. This has resulted in creating a standard ecosystem for application developers, with the Competition and Markets Authority (CMA) indicating that domestic customers as well as small and medium-sized enterprises are utilizing open banking-based products. According to an article published by the UK Government in October 2025, GoCardless’s Chancellor committed to ensuring financial service growth in Leeds, which is responsible for uplifting investment into the country, with more than £110 billion. This is possible to be achieved by an international financial services organization, with the global fintech leader, Revolut, unveiling its latest headquarters in Canary Wharf. This caters to part of the £3 billion investment for the upcoming 5 years, which will additionally create 1,000 employment opportunities, thus suitable for boosting the market.

The personal finance apps market in Germany is also growing due to the presence of a robust economy, along with an increased demand for customer financial therapy. In addition, the active Fintech Strategy by the Federal Ministry of Finance has aimed to digitize the financial sector as well as enhance customer accessibility. Besides, as per an article published by the ITA in August 2023, the country’s fintech market size and demand have reached a 64% adoption rate as of 2023. This is further projected to grow based on the 2022 GDP per capita of USD 48,432, along with per head consumption spending amounting to USD 21,704. Additionally, 97% of the country’s population has an account at financial institutions as of 2023, and over 75% are recognized as digital payment users in the same period. Further, the country’s mobile payment adoption presently stands at 43.8% in comparison to 19.5% in the UK, which is also positively impacting the market’s upliftment.

Key Personal Finance Apps Market Players:

- Intuit Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Block, Inc. (U.S.)

- PayPal Holdings, Inc. (U.S.)

- NerdWallet, Inc. (U.S.)

- Robinhood Markets, Inc. (U.S.)

- Revolut Ltd (U.K.)

- Monzo Bank Ltd (U.K.)

- NADRA (Pakistan)

- Credit Karma (Intuit) (U.S.)

- Yahoo! Inc. (U.S.)

- Empower (U.S.)

- MoneyLion (U.S.)

- Digit (U.S.)

- Acorns (U.S.)

- Chime Financial, Inc. (U.S.)

- YNAB (U.S.)

- Adyen N.V. (Netherlands)

- Moneyspire (U.S.)

- Banktree Software Ltd (U.K.)

- Monefy (Bulgaria)

- Intuit Inc. is considered a foundational player, which has been possible through acquiring Credit Karma and the long-lasting Mint platform, in democratizing automated budgeting and free credit scoring for millions. It focuses on developing an interconnected financial ecosystem that guides customers from filing taxes to tracking expenditure, as well as managing financial health. As per its 2025 annual report, the company has declared USD 4.1 per share cash dividends, along with USD 1.2 billion in common stock, and USD 1,012,518 in total shares purchased.

- Block, Inc. has successfully revolutionized peer-to-peer payments and also expanded into cryptocurrency trading and mainstream investing to create an accessible and simple financial platform for the young population. Its contribution focuses on merging social payment features with investment services, thus fueling the embedded finance trend.

- PayPal Holdings, Inc. has been instrumental in normalizing online transactions and digital wallets by establishing one of the first-ever comprehensively trusted brands for digital payments. The organization is continuing to shape the overall market by incorporating cryptocurrency, savings, and shopping features into its payment-based platforms directly. According to its 2024 annual report, the organization has been successful in generating USD 14.7 billion in transaction margin, USD 5.8 billion in non-GAAP operating income, along with USD 4.6 for non-GAAP EPS and USD 3.9 for GAAP EPS.

- NerdWallet, Inc. has significantly carved an outstanding niche by readily focusing on comparison tools and financial literacy, which has empowered users to undertake informed decisions on loans, bank accounts, and credit cards. Its generous contributions are a lead-generation and content-driven model that associates customers with tailored financial products.

- Robinhood Markets, Inc. has effectively disrupted the brokerage sector by popularizing a mobile-first and commission-free trading interface, thus making crypto and stock markets easily accessible to the latest generation of retail investors. Besides, its introduction of a simplified UX and fractional shares has pressured the entire industry to improve digital offerings and lower fees.

Here is a list of key players operating in the global personal finance apps market:

The international personal finance apps market is intensely fragmented and competitive, highly characterized by a mixture of personalized fintech startup firms, technological conglomerates, and established financial service giants. The dominant and tactical approach is ecosystem building and platformification, which is positively impacting the market’s growth. Besides, notable players are strongly extending their core services, ranging from budgeting to investing and payments, along with becoming wide-ranging financial super apps. This can successfully be achieved through strong investment in AI for customized insights, leveraging open banking APIs, and tactical mergers and acquisitions to robustly gain the newest user bases and technologies to provide aggregated financial aspects. Besides, in September 2025, Mobilization Funding declared the introduction of Maximus, which is a loan management platform, designed to accelerate and simplify the overall lending process, thus positively impacting the personal finance apps market.

Corporate Landscape of the Personal Finance Apps Market:

Recent Developments

- In November 2025, United Fintech has successfully acquired Trade Ledger, with the intention of gaining a robust consumer base that comprises Bank of Queensland and Barclays, as well as standard expertise in data-based lending and commercial banking automation.

- In March 2024, Brain Capital Tech Opportunities notified to ensure the majority of investment in Finova, and also to acquire the U.K. Mortgage Sales and Originations software business of Iress to provide products and services to potential consumers.

- Report ID: 8243

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Personal Finance Apps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.