Decentralized Finance Market Outlook:

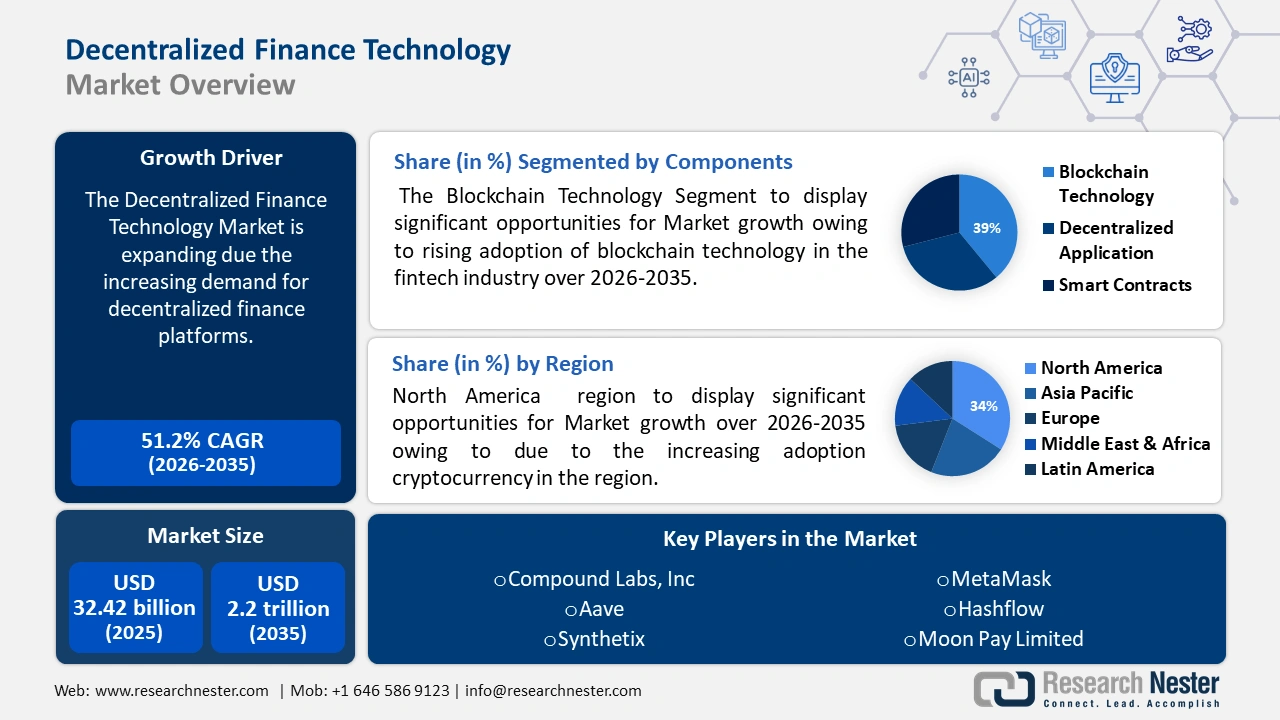

Decentralized Finance Market size was over USD 32.42 billion in 2025 and is projected to reach USD 2.02 trillion by 2035, growing at around 51.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of decentralized finance is evaluated at USD 47.36 billion.

The growth of the market is on account of the increasing demand for decentralized finance platforms. Decentralized Finance, allows anybody from anywhere in the world to utilize DeFi services if they have a Bitcoin wallet and an internet connection. For instance, according to research decentralized finance users reached a peak of estimated 8 million unique users in late 2021, whereas figures in 2023 are considerably lower. Users can transfer and exchange their assets without waiting for bank transfers or paying customary bank costs eliminating the need for a centralized financial framework.

In addition to that, decentralized finance provides a wide range of financial services which include yield farming, insurance, decentralized exchanges (DEXs), stablecoins, and lending and borrowing platforms. This wide range of financial services is also expected to grow demand for DeFi technology in the forecast period.

Key Decentralized Finance Technology Market Insights Summary:

Regional Highlights:

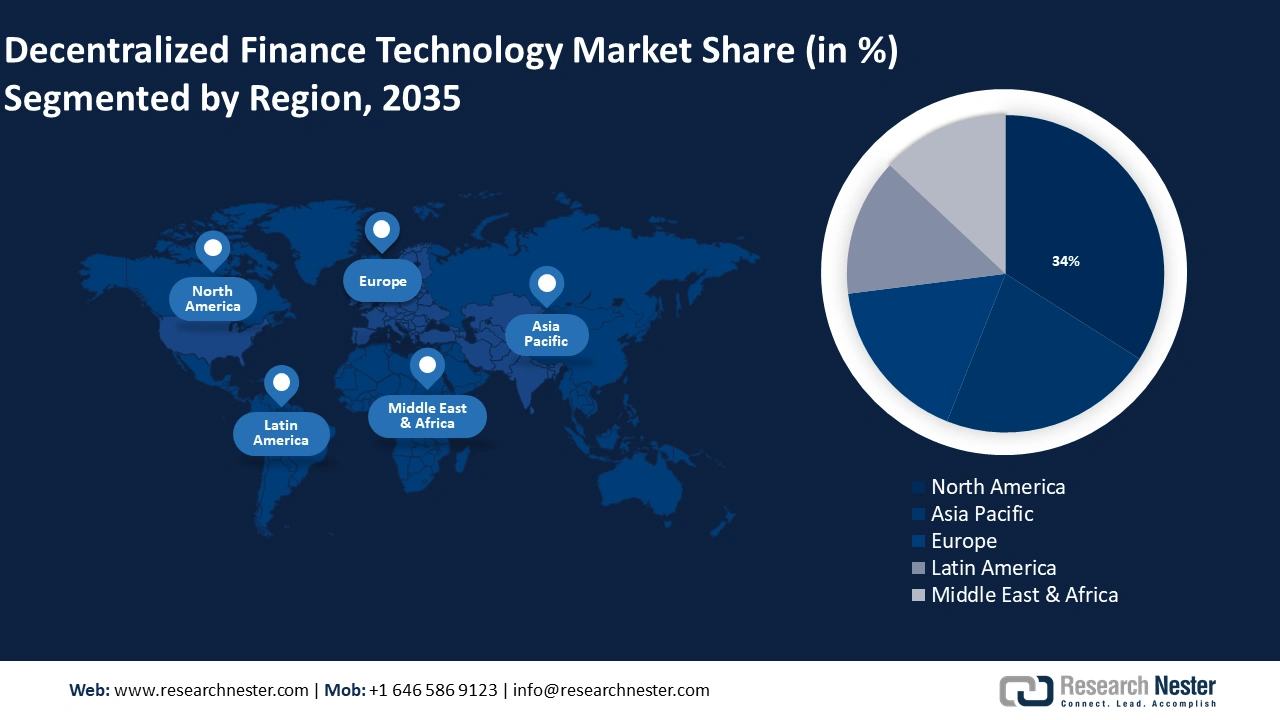

- North America decentralized finance (defi) market will dominate around 34% share by 2035, attributed to rising demand for DeFi applications, high cryptocurrency adoption, supportive government initiatives, and a tech-savvy population.

- Asia Pacific market will achieve a 22% share by 2035, fueled by strong fintech hubs, high blockchain adoption, supportive regulatory frameworks, and vibrant startup ecosystems.

Segment Insights:

- The blockchain technology segment in the decentralized finance market is projected to hold a 39% share by 2035, fueled by increased adoption in fintech and its benefits in transparency, lower costs, and decentralized platforms.

- The bfsi segment in the decentralized finance market is expected to hold a 29% share by 2035, fueled by DeFi’s ability to increase financial inclusion and reduce the need for intermediaries.

Key Growth Trends:

- The Rising Demand in E-Sports and Gaming

- Increasing Investment in Blockchain Technology

Major Challenges:

- Vulnerabilities in Smart Contracts

- Considering how new DeFi is, uncertainties in law and regulation present a significant obstacle to the market growth

Key Players: Compound Labs, Inc., Dapper Labs, Inc., Moon Pay Limited, Hashflow, Bancor Network, MetaMask, Uniswap, Aave, Synthetix, Balancer.

Global Decentralized Finance Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.42 billion

- 2026 Market Size: USD 47.36 billion

- Projected Market Size: USD 2.02 trillion by 2035

- Growth Forecasts: 51.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Singapore, United Kingdom, Japan, China

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 16 September, 2025

Decentralized Finance Market Growth Drivers and Challenges:

Growth Drivers

- The Rising Demand in E-Sports and Gaming: According to various surveys, in 2022 there were 250 million occasional e-sports viewers and 242 million eSports enthusiasts making a combined eSports audience of 492.0 million, furthermore it is estimated around 69% of esports viewers on Twitch are likely to bet on esports. This exponential rise in e-sports betting has created a high demand for a safe and easy-to-use betting platform. Decentralized Finance that utilizes Blockchain technology to create a sports betting solution that equips a decentralized finance system to ease direct payment anonymously without risking their own money and without the need for any institute & brokerage. Hence, attributing to the growth of the decentralized finance (defi) market

- Increasing Investment in Blockchain Technology: The simultaneous rise in spending and adoption of blockchain technology is responsible for the decentralized finance technologies market's rapid expansion. Increased investment in blockchain technology leads to the development of more stable and expandable platforms like Solana, Cardano, Polkadot, Polygon, and Avalanche, which in turn promotes the growth of Decentralized Finance applications. The effectiveness of DeFi technology is increased by blockchain's ability to guarantee trustless transactions and automate procedures, attracting both individuals and organizations seeking simple, accessible financial solutions.

- Increasing Adoption of Cryptocurrency: Studies have shown that there are an estimated 295 million cryptocurrency users worldwide with 33 new cryptocurrencies created every week. This quick expansion of the adoption of cryptocurrency results in increasing demand for Decentralized Finance applications like Uniswap and Sushiswap in the crypto market. As cryptocurrency market uses decentralized technology which operates on a blockchain network to provide easy and cheaper access to capital by eliminating the need for a mediator. Thus, propelling the decentralized finance market in the forecast period.

Challenges

- Vulnerabilities in Smart Contracts: Smart contracts have become a crucial component of the DeFi ecosystem, and are generally considered secure. However different countries have different legal systems and regulatory difficulties, which can be difficult. Traditional contracts' protections against harsh clauses and poorly drafted contracts are eliminated by smart contracts causing hindrances in the decentralized finance market growth.

- Considering how new DeFi is, uncertainties in law and regulation present a significant obstacle to the market growth

- Increased probability of cyberattacks in DeFi technologies can also hamper the market growth in the forecast period.

Decentralized Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

51.2% |

|

Base Year Market Size (2025) |

USD 32.42 billion |

|

Forecast Year Market Size (2035) |

USD 2.02 trillion |

|

Regional Scope |

|

Decentralized Finance Market Segmentation:

Components Segment Analysis

The blockchain technology segment is predicted to account for 39% share of the decentralized finance market during the forecast period. The segment growth is due to the rising adoption of blockchain technology in the fintech industry. The Fintech industry's strongest assets at the moment are Money Transfer Applications facilitated by Blockchain. According to studies digital money transfers around the world in 2018 amounted to USD 64,173 million. Additionally, by promoting distributed trust, lowering transaction costs, and strengthening decentralized platforms, blockchain technology has the potential to replace the current underpinnings of decentralized business models, thus expected to spur the decentralized finance market growth in the blockchain technology segment.

End-user Segment Analysis

The BFSI segment is predicted to account for 29% share of the decentralized finance market during the forecast period. The segment growth can be attributed to the ability of decentralized finance technologies to improve financial inclusion by giving underbanked and unbanked people worldwide access to financial services. According to data published by The World Bank around 1.7 billion people remain unbanked globally. By using public blockchains, the DeFi technology reduces the need for middlemen and promotes transparency attracting more individuals toward the BFSI sector. Moreover, a vast array of financial services, such as yield farming, insurance, stablecoins, decentralized exchanges (DEXs), lending, and borrowing platforms, are made possible by Decentralized Finance which is expected to contribute to the growth in the BFSI segment.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Decentralized Finance Market Regional Analysis:

North American Market Insights

The North America region is predicted to account for 34% share of the decentralized finance market by the end of 2035. The market growth in the region is also expected on account of the rising demand for DeFi applications in the region. As Decentralized Finance eliminates the requirement for a centralized finance paradigm and everyone anywhere can access financial services. Moreover, due to the increasing adoption, cryptocurrency has also increased the need for DeFi applications in the region. Studies show that approximately 46 million Americans (roughly 22% of the adult population) own a share of Bitcoin. Furthermore, the presence of key market players such as Blockchain App Factory, SDLCCorp, ScienceSoft, Uniswap and rising number of strategic initiatives such as Canadian Blockchain Research Institute and government support for blockchain projects are also expected to fuel the market revenue growth of this region during the forecast period. Additionally, the region benefits from a tech-savvy population, high internet penetration, and a strong culture of entrepreneurship, which further accelerates the adoption of decentralized financial solutions. Overall, these factors drive the expansion of the DeFi market across North America.

APAC Market Insights

The Asia Pacific decentralized finance market is estimated to be the second largest, registering a share of about 22% by the end of 2035. The market’s expansion of Decentralized Finance in the region can be attributed majorly to the leading fintech hubs in the region like South Korea, India, China, Japan, Singapore, and the Philippines. According to research, South Korea's fintech acceptance rate has reached 67% of the country's digitally active adults. In addition to that, India solidified its place as a prominent player on the global stage, placing third internationally in 2023 for fintech startup investment. Furthermore, progressive regulatory frameworks like the Monetary Authority of Singapore's (MAS) fintech regulatory sandbox and the establishment of the Singapore Fintech Association contribute to the flourishing DeFi ecosystem in the region. Additionally, the region benefits from the high adoption of blockchain technology. For instance, the number of registered blockchain-related enterprises in China is expected to reach 33,700 by 2022. The vibrant startup ecosystems, strategic geographic positions, and growing investor interest in Decentralized Finance projects serve as key drivers of DeFi market growth in the Asia-Pacific region.

Decentralized Finance Market Players:

- Compound Labs, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dapper Labs, Inc.

- Moon Pay Limited

- Hashflow

- Bancor Network

- MetaMask

- Uniswap

- Aave

- Synthetix

- Balancer

Recent Developments

- Compound Finance has announced the launch of its next generation of the popular scaling tool Arbitrum. Compound's deployment on Arbitrum is confined to a few cryptocurrencies, including Ethereum (ETH), Arbitrum, Wrapped Bitcoin (WBTC), and GMX (the token that powers the eponymous decentralized exchange). This is because the project's most recent iteration, known as V3, is designed to manage risk by limiting the number of long-tail crypto assets that can be leased and borrowed.

- Decentralized finance (DeFi) platform Aave has deployed its money market protocol on the BNB Chain network as the blockchain expands its DeFi ecosystem. The BNB Chain team announced to Cointelegraph that Aave will join the increasing number of DeFi protocols on BNB Chain. The lending protocol joins Uniswap and PancakeSwap in boosting the DeFi ecosystem on the blockchain network.

- Report ID: 5975

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.