Bismaleimide Monomer Market Outlook:

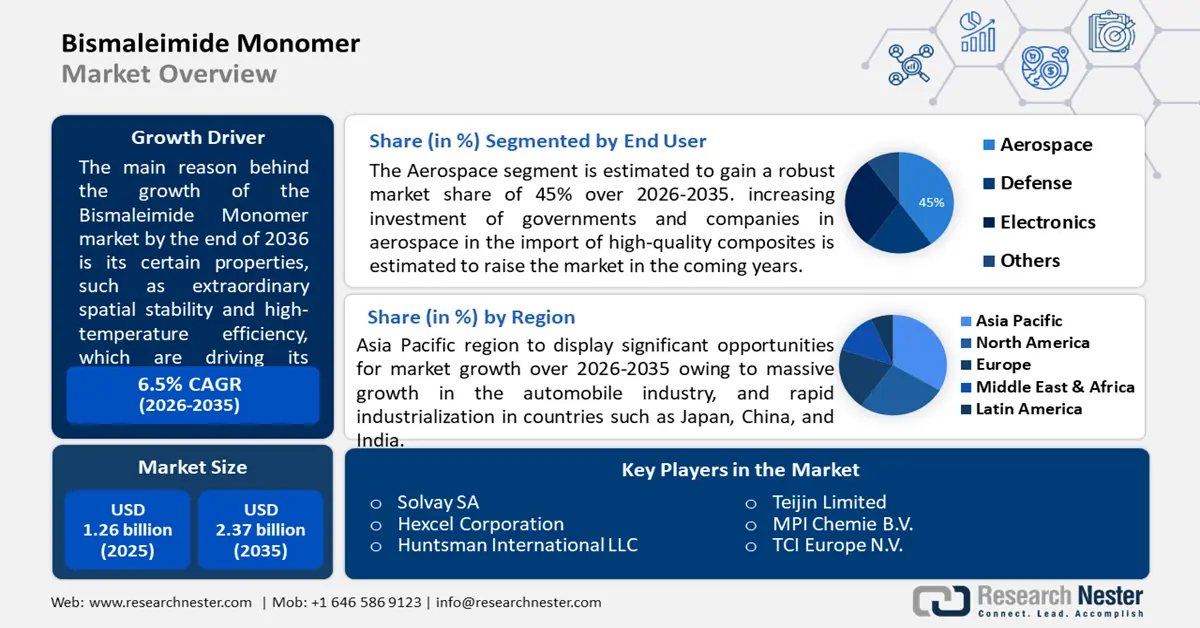

Bismaleimide Monomer Market size was over USD 1.26 Billion in 2025 and is projected to reach USD 2.37 Billion by 2035, growing at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bismaleimide monomer is evaluated at USD 1.33 Billion.

The growth of the market is primarily attributed to its certain properties, such as extraordinary spatial stability and high-temperature efficiency, which are driving its demand, particularly in the booming aerospace, automotive, and electrical & electronic industries. For instance, since mid-2020, the global electronics industry demonstrated positive growth. As part of this evolution, electronics exports in several major APAC electronics manufacturing hubs continued to grow strongly till the mid of 2022. South Korean ICT exports increased by 19% year on year to USD 124 billion in the first 6 months of 2022, making up 36% of total South Korean exports, whereas India's total electronics exports have boosted by 44% year over year to USD 12 billion since the previous financial year 2021–22.

Bismaleimides are addition-type polyimides that are employed in high-performance structural composites that need high temperature and toughness. Monomers are generally created by combining maleic anhydride and aromatic diamine, and the resulting bismaleamic acid is cyclo-dehydrated to form a bismaleimide resin. The maleimide double bond is highly reactive and can undertake a chain reaction. Bismaleimides have a higher service temperature than epoxies. Insulating materials have been becoming more popular in the growing aviation, computer, and construction industries. As per the World Bank, worldwide industrial growth (including the construction industry) reached up to 28.3% in 2021.

Key Bismaleimide Monomer Market Insights Summary:

Regional Highlights:

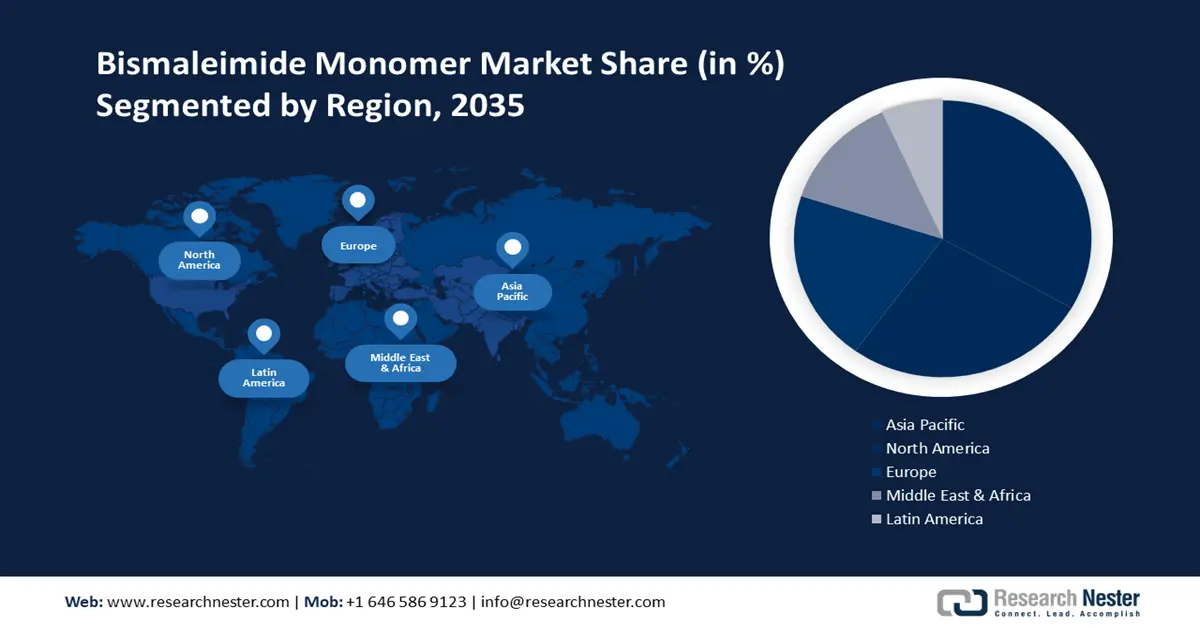

- Asia Pacific’s bismaleimide monomer market will hold around 36% share by 2035, driven by massive growth in the automobile industry and rapid industrialization in key countries.

- North America market will achieve substantial CAGR during 2026-2035, attributed to rising production capacity, adoption of diverse growth strategies, and the aerospace sector’s demand for lightweight, cost-efficient materials.

Segment Insights:

- The aerospace segment in the bismaleimide monomer market is anticipated to hold a 45% share by 2035, driven by rising investments in aerospace and imports of high-quality composites.

Key Growth Trends:

- Growth in the Aerospace and Defense Industry

- Upsurge in Computer Manufacturing

Major Challenges:

- Stringent Governmental Guidelines

- Restrictions Such as High Melting Points

Key Players: Evonik Industries AG, Solvay SA, Hexcel Corporation, Huntsman International LLC, Teijin Limited, MPI Chemie B.V., TCI Europe N.V., Willing New Materials Technology Co., Ltd., Honghu Shuangma Advanced Materials Tech Co., Ltd., ABR Organics Limited.

Global Bismaleimide Monomer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.26 Billion

- 2026 Market Size: USD 1.33 Billion

- Projected Market Size: USD 2.37 Billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Bismaleimide Monomer Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in the Aerospace and Defense Industry – Post-pandemic, the conditions of air traveling have been improving notably. The global availability of COVID vaccines is paving the way for the liberalization of air travel. On the other hand, to stimulate growth, defense companies are trying to concentrate their efforts on enhancing their fighter jet, space resilience, shipbuilding, and cybersecurity capabilities. Such growth in the aerospace and defense industry is increasing the demand for bismaleimide monomers. For instance, revenue for the global aerospace and defense sector was reported around USD 715 billion in 2021, an increase of 6% from 2020.

-

Striving Boost in Automotive Industry - By the end of 2030, the global automotive industry is predicted to have a potential revenue of nearly USD 1.8 trillion, growing by 31% in the same year.

-

Upsurge in Computer Manufacturing – Bismaleimide monomers are extensively used in various composite formulations for multi-layer printed circuit boards in high-performance computers. Therefore, the increased growth in the production of large-scale computers is another significant factor that is fueling up the demand for bismaleimide monomers. As of 2021, approximately 344 million PCs were shipped worldwide.

-

Huge Development in Chemical Industry - In 2021, the chemical industry's estimated worldwide revenue reached its highest level in the previous 16 years, bringing the total to approximately USD 5 trillion.

-

Rise in Research and Development Expenditure – As per the World Bank, global research and development spending increased to 2.63% of total GDP in 2020.

Challenges

-

Stringent Governmental Guidelines – The first challenge that arises in front of this market, is the stringent rule and regulation regarding bismaleimide monomers put forward by the government.

-

Restrictions Such as High Melting Points

- Low Electrical Conductivity

Bismaleimide Monomer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.26 Billion |

|

Forecast Year Market Size (2035) |

USD 2.37 Billion |

|

Regional Scope |

|

Bismaleimide Monomer Market Segmentation:

Type

The global bismaleimide monomer market is segmented and analyzed for demand and supply by type into 4,4' bismaleimidodiphenyl methane, M-phenylene bismaleimide, phenylmethane maleimide, 4-methyl-1,3-phenylene bismaleimide, BANI-M, and others. Out of which 4,4' bismaleimidodiphenyl methane segment is estimated to significantly grow over the forecast period. On the back of its significant use in the production of insulated wires. The export of insulated wires has rapidly been growing which is estimated to lead to the growth of this segment. For instance, China's exports of insulated wire or cable increased to USD 2,451,212 in July 2022, up from USD 2,375,592 in June 2022.

End User

Additionally, the market is segmented and analyzed to demand and supply by end-user into aerospace, defense, electronics, and others. Out of which, the aerospace segment is anticipated to hold the largest market share at 45%, defense at 25%, electronics at 20%, and others at 10%. The increasing investment of governments and companies in aerospace in the import of high-quality composites is estimated to raise the market in the coming years. The import value of the government of Spain fueled from USD 3,811 in 2016 to USD 4,478 in 2019. The availability of raw materials doubled with cheap labor and low costs are driving the growth of this segment.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bismaleimide Monomer Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 36% by 2035. Backed by the massive growth in the automobile industry, and rapid industrialization in countries such as Japan, China, and India. For instance, China's automotive sector produced around 22 million passenger cars in 2021, whereas Japan secured second place for the same by manufacturing nearly 7 million passenger cars in the same year. Asia Pacific is a region that is considered to be the biggest industrial hub in the world, they include sectors like automotive, aerospace, and electronics & electrical industry. Low cost double with cheap labor and easy availability of raw materials is the key factor that is available in the Asia Pacific region that drives the growth of this market.

North American Market Insights

Further, the North American region accounted for substantial market share. The increase in production capacity and adoption of various organic and inorganic growth strategies are estimated to expand the business and product portfolio. This factor is anticipated to drive bismaleimide monomer market growth in the region during the forecast period. Also, the rise of the aerospace industry in this region is expected to drive the growth of bismaleimide monomer market in the forecast period. Bismaleimide monomers help in reducing the weight of aircraft along with reducing the fabrication cost at the same time making it more demanding in the aerospace sector.

Bismaleimide Monomer Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay SA

- Hexcel Corporation

- Huntsman International LLC

- Teijin Limited

- MPI Chemie B.V.

- TCI Europe N.V.

- Willing New Materials Technology Co., Ltd.

- Honghu Shuangma Advanced Materials Tech Co., Ltd.

- ABR Organics Limited

Recent Developments

-

Huntsman Corporation and KPX Chemical launched a joint venture named KPX HUNTSMAN POLYURETHANES AUTOMOTIVE CO., LTD. (KHPUA) to provide Korean automobile manufacturers the innovative polyurethane systems.

-

Hexcel Corporation has joined the U.K.-based project ASCEND (Aerospace and Automotive Supply Chain Enabled Development) which aims to develop high-speed manufacturing and processing technologies for the development of new, lightweight advanced composite materials.

- Report ID: 4313

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bismaleimide Monomer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.