Global Acrylate Monomer Market TOC

- Market Definition

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Analysis of Market Dynamics

- Market Drivers

- Market Trends

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Government Regulation

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation

- Manufacturing Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Demand risk analysis

- Supply risk analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Acrylate Monomer Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of recession Over Global Economy

- Porter’s Five Forces Analysis

- PESTEL Analysis

- SWOT Analysis of Global Acrylate Monomer Market

- Recent Trends/Development Across Global Acrylate Monomer Market

- Industry Growth Outlook w.r.t. Functionality Type

- Industry Pricing Analysis

- Competitive Positioning: Strategies to Differentiate a Company From its Competitor

- Value Chain Analysis

- EXIM Analysis of Acrylate Monomer

- Regional Analysis

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2022)

- Competitive Benchmarking

- Arkema

- Detailed Overview

- Assessment of key offerings

- Analysis of growth strategies

- Exhaustive analysis on key financial indicators

- Recent developments and strategies

- BASF

- DOW

- Evonik

- Merck KGaA

- Synthomer plc

- Mitsubishi Chemical Group Corporation

- Nippon Shokubai

- Guang Dong Huiquan Lianjum

- Alfa Chemistry

- Sinocure Chemical Group Co., Limited

- Miwon Specialty Chemical

- LG Chem

- Other Major Players

- Arkema

- Global Acrylate Monomer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Global Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Cross Analysis of Functionality Type w.r.t. Application (USD Million), 2022

- Global Acrylate Monomer Market, By Region

- North America, 2023-2036F (USD Million & Thousand Tons)

- Europe, 2023-2036F (USD Million & Thousand Tons)

- Asia Pacific, 2023-2036F (USD Million & Thousand Tons)

- Latin America, 2023-2036F (USD Million & Thousand Tons)

- Middle East and Africa, 2023-2036F (USD Million & Thousand Tons)

- North America Acrylate Monomer Market Outlook

- Major Acrylate Monomer Manufacturers in the Region

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- North America Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- North America Acrylate Monomer Market, By Country

- US, 2023-2036F (USD Million & Thousand Tons)

- Canada, 2023-2036F (USD Million & Thousand Tons)

- Europe Acrylate Monomer Market Outlook

- Major Acrylate Monomer Manufacturers in the Region

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Europe Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Europe Acrylate Monomer Market, By Country

- UK, 2023-2036F (USD Million & Thousand Tons)

- Germany, 2023-2036F (USD Million & Thousand Tons)

- France, 2023-2036F (USD Million & Thousand Tons)

- Italy, 2023-2036F (USD Million & Thousand Tons)

- Spain, 2023-2036F (USD Million & Thousand Tons)

- Russia, 2023-2036F (USD Million & Thousand Tons)

- NORDIC, 2023-2036F (USD Million & Thousand Tons)

- Rest of Europe, 2023-2036F (USD Million & Thousand Tons)

- Asia Pacific Acrylate Monomer Market Outlook

- Major Acrylate Monomer Manufacturers in the Region

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Asia Pacific Acrylate Monomer Market, By Country

- China, 2023-2036F (USD Million & Thousand Tons)

- India, 2023-2036F (USD Million & Thousand Tons)

- Japan, 2023-2036F (USD Million & Thousand Tons)

- Indonesia, 2023-2036F (USD Million & Thousand Tons)

- Malaysia, 2023-2036F (USD Million & Thousand Tons)

- Australia, 2023-2036F (USD Million & Thousand Tons)

- Vietnam, 2023-2036F (USD Million & Thousand Tons)

- South Korea, 2023-2036F (USD Million & Thousand Tons)

- Thailand, 2023-2036F (USD Million & Thousand Tons)

- Rest of Asia Pacific, 2023-2036F (USD Million & Thousand Tons)

- Latin America Acrylate Monomer Market Outlook

- Major Acrylate Monomer Manufacturers in the Region

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Latin America Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Latin America Acrylate Monomer Market, By Country

- Brazil, 2023-2036F (USD Million & Thousand Tons)

- Argentina, 2023-2036F (USD Million & Thousand Tons)

- Mexico, 2023-2036F (USD Million & Thousand Tons)

- Rest of Latin America, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

- Middle East & Africa Acrylate Monomer Market Outlook

- Major Acrylate Monomer Manufacturers in the Region

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Acrylate Monomer Market Segmentation Analysis (2023-2036)

- By Functionality Type

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Butyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Methyl Acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Bifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Tricyclodecanedimethanol diacrylate, 2023-2036F (USD Million & Thousand Tons)

- 2-Ethylhexyl acrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Trifunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- Trimethylolpropane ethoxide triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Trioxytrimethylolpropane triacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Multifunctional acrylate monomer, 2023-2036F (USD Million & Thousand Tons)

- Dipentaerythritol hexaacrylate, 2023-2036F (USD Million & Thousand Tons)

- Pentaerythritol tetraacrylate, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Monofunctional Acrylate Monomer, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Paints & Coatings, 2023-2036F (USD Million & Thousand Tons)

- Plastics, 2023-2036F (USD Million & Thousand Tons)

- Adhesive & Sealants, 2023-2036F (USD Million & Thousand Tons)

- Fabrics, 2023-2036F (USD Million & Thousand Tons)

- By End User Industry

- Building & Construction, 2023-2036F (USD Million & Thousand Tons)

- Packaging, 2023-2036F (USD Million & Thousand Tons)

- Consumer Goods, 2023-2036F (USD Million & Thousand Tons)

- Automotive, 2023-2036F (USD Million & Thousand Tons)

- Biomedical, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- Middle East & Africa Acrylate Monomer Market, By Country

- GCC, 2023-2036F (USD Million & Thousand Tons)

- Israel, 2023-2036F (USD Million & Thousand Tons)

- South Africa, 2023-2036F (USD Million & Thousand Tons)

- Rest of Middle East & Africa, 2023-2036F (USD Million & Thousand Tons)

- By Functionality Type

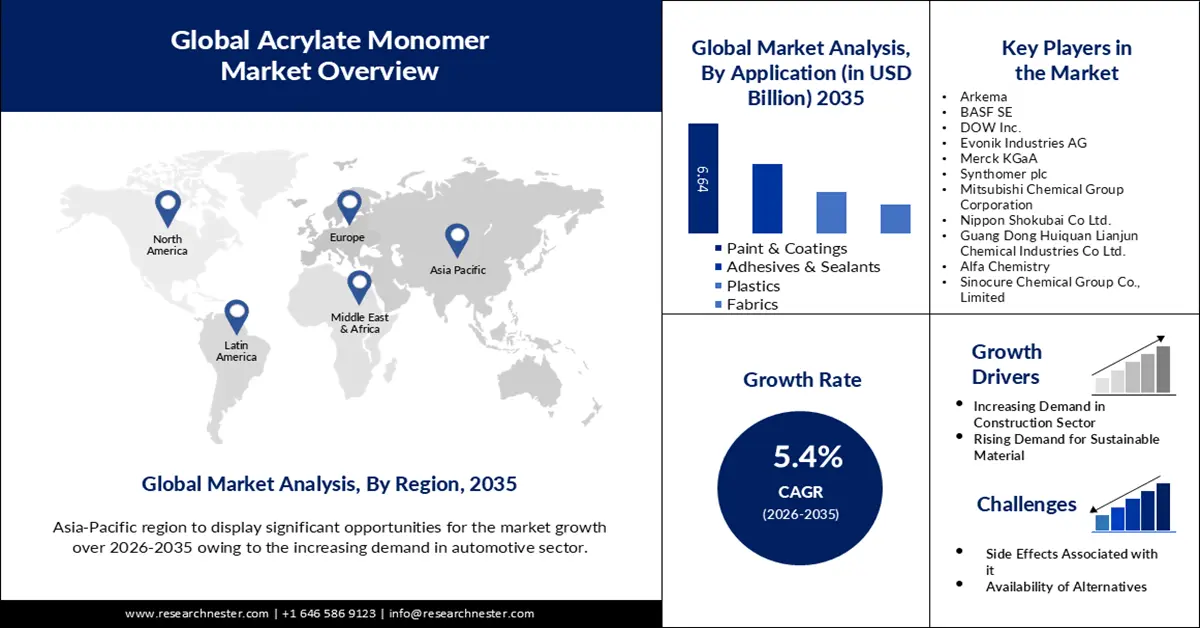

Acrylate Monomers Market Outlook:

Acrylate Monomers Market size was valued at USD 7.3 billion in 2025 and is set to exceed USD 12.35 billion by 2035, expanding at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acrylate monomers is estimated at USD 7.65 billion.

The use of acrylate monomers in construction materials, including insulation and concrete repair, is due to their high strength and ability to provide superior adhesion to a variety of surfaces. In addition, they are highly resistant to water and UV rays, making them suitable for outdoor applications. Additionally, growth in the construction sector due to rapid urbanization in developing countries is expected to boost the demand for paints and coatings, which will ultimately boost the demand for monomers acrylate. Such as, according to the World Bank, the total urban population is 4.4 billion people in 2021, up 2.3% from 2020. By 2050, nearly 7 in 10 people in the world will live in cities urban population and urban population growth will double.

Acrylic monomers are indispensable in the construction, automotive, packaging and electronics industries. Acrylic monomers have a unique advantage in that they easily combine with a variety of chemicals to form high-performance coatings, adhesives, and resins. Their popularity is due to their superior physical and chemical properties, including excellent toughness, transparency, and excellent resistance to weathering and aging.

Key Acrylate Monomers Market Insights Summary:

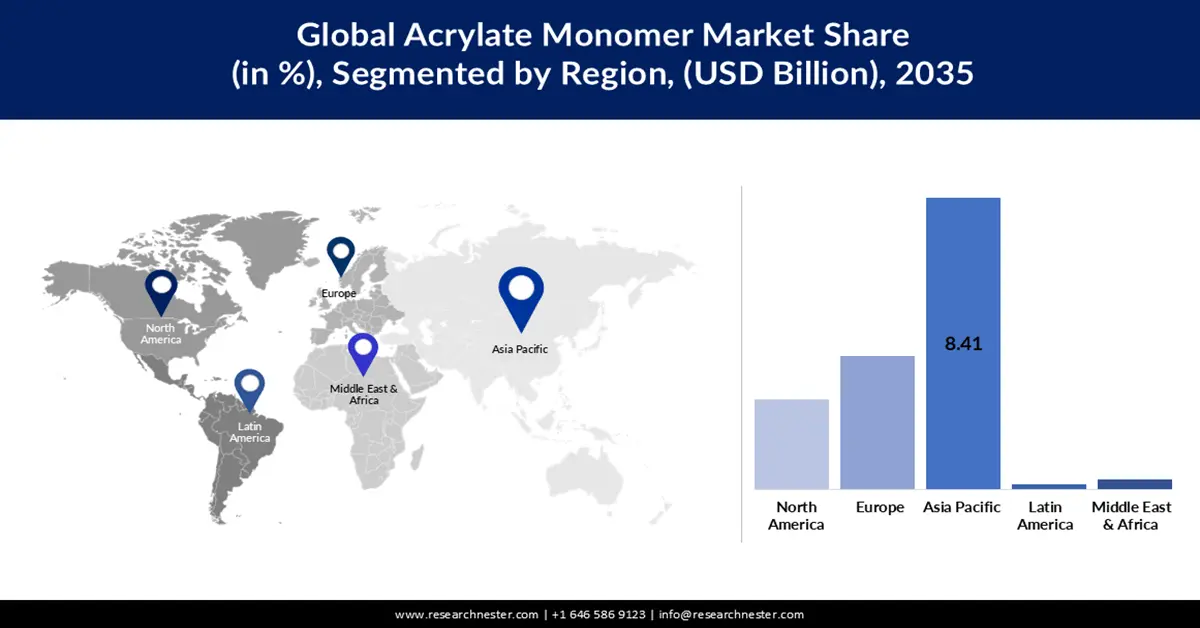

Regional Highlights:

- Asia Pacific acrylate monomers market dominates with a 55% share by 2035, driven by demand from automotive, packaging, and coatings industries.

- Europe market will register substantial CAGR from 2026 to 2035, driven by demand in the dental and adhesive industries.

Segment Insights:

- The paints & coatings segment in the acrylate monomers market is anticipated to capture a 43% share by 2035, attributed to increasing demand for fast-drying, durable, and eco-friendly coating solutions.

- The monofunctional acrylate monomer segment in the acrylate monomers market is expected to secure a 35% share by 2035, driven by its favorable chemical properties for various industrial applications.

Key Growth Trends:

- Growing Demand for Water-based Adhesives in Textile Industry

- Accelerating Demand for Eco-friendly and Sustainable Products

Major Challenges:

- Growing Demand for Water-based Adhesives in Textile Industry

- Accelerating Demand for Eco-friendly and Sustainable Products

Key Players: Arkema, BASF SE, DOW Inc., Evonik Industries AG, Merck KGaA, Synthomer plc, Mitsubishi Chemical Group Corporation, Nippon Shokubai Co Ltd., Guang Dong Huiquan Lianjun Chemical Industries Co Ltd., Alfa Chemistry, Sinocure Chemical Group Co., Limited.

Global Acrylate Monomers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.3 billion

- 2026 Market Size: USD 7.65 billion

- Projected Market Size: USD 12.35 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Acrylate Monomers Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Water-based Adhesives in Textile Industry- n-Butyl acrylate (n-BA) and 2-ethylhexyl acrylate (2-EHA) are two of the most commonly used soft monomers for water-based acrylic PSAs. Water-based adhesives have a number of advantages that have led to their widespread use in the textile industry. The main advantage of water-based adhesives that makes them suitable for the textile industry is that they do not require heating (like hot melt adhesives), so they can be applied to more delicate fabrics such as lace and fabrics used in underwear. Additionally, they contain little or no solvent; therefore, they are often used in place of solvent-based adhesives where VOCs would be an issue. Depending on the formulation, water-based adhesives can have many beneficial properties that make them suitable for many applications. Hence, water-based adhesives, which have several uses, will contribute to the rise in the acrylate monomers market.

-

Accelerating Demand for Eco-friendly and Sustainable Products- The acrylic monomers market is expected to witness changes in the future due to the emergence of new technologies. These technologies, including green polymerization processes and the production of biocompatible monomers, are designed to improve the environmental sustainability of chemicals. The adoption and use of these technologies can help businesses align with sustainability goals and consumer preferences. Due to the pollution crisis the world is facing, regulations and technological solutions for plastic waste management need to be urgently developed. In this context, bioresource approaches involving microbial activity can be promising and environmentally friendly solutions. The importance of sustainability is felt by 78% of consumers globally, they prefer using products that are made of sustainable materials.

Challenges

-

Harmful Effects of Acrylate Monomer - Methyl methacrylate and tertiary amine are the two most important raw materials used in the production of acrylate monomers, both of which are hazardous to humans and the environment. When inhaled in significant amounts, isobutene has negative effects on the lungs. Some possible health risks are sensitizing effects that may occur after skin contact; Prolonged contact with skin may cause dermatitis. High concentrations of this product in the atmosphere may cause respiratory irritation. Isobutene is a highly flammable chemical and poses a serious fire hazard. These harmful effects are expected to hamper the acrylate monomers market expansion in the upcoming future.

-

Emergence of Substitutes – A number of alternative acrylate monomer are emerging such as ethylene, propylene, and styrene. These substitutes offer similar properties to acrylate monomer but at a lower cost. This putting pressure on the acrylate monomers market and could lead to a decline in demand in the future.

- Strict Regulations Put the Government are Set to Pose Limitation on the Acrylate Monomers Market Growth in the Future Times.

Acrylate Monomers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 7.3 billion |

|

Forecast Year Market Size (2035) |

USD 12.35 billion |

|

Regional Scope |

|

Acrylate Monomers Market Segmentation:

Functionality Type Segment Analysis

The monofunctional acrylate monomers market share is predicted to surpass 35% by the end of 2035. This growth can be attributed to its favorable properties for various applications such as low viscosity, resistance to hydrolysis, high glass transition temperature, thinner for thermosetting resins, Low vulcanization shrinkage and high Tg. Once cured, the monofunctional acrylate monomer has low shrinkage and high glass transition temperature. The secondary ester bond is resistant to hydrolysis. Monofunctional acrylates are recommended for use as reactive thinners in UV- or peroxide-cured resins, coatings or adhesives. It can also be used to enhance high-temperature stereolithography processes.

Application Segment Analysis

In terms of application, the paints & coating segment share in the acrylate monomers market is estimated to cross 43% by the end of 2035. Paints are composed of a mixture of one or more methylacrylate derived products, that help the paint and coating to be applied effectively while being able to retain its durability and longevity. This prevents the surface from being exposed to sunlight, rainfall, and other factors that may lead to the the deformation of the layers. Many uses of methacrylate paints and coatings, such as markings on roads, are made use of their durability. Acrylic-based coatings and paints dry quickly, reducing construction downtime and increasing overall efficiency. Acrylate monomers can benefit the gloss and smoothness of the final coating, improve the appearance of the coated surface, and they can replace solvents in UV/EB curable formulations, providing has the unique advantage of being environmentally friendly, harmless, up to 100% solids, low VOC solutions. These are expected to boost the growth of this segment in the predicted period.

Our in-depth analysis of the global acrylate monomers market includes the following segments:

|

Functionality Type |

|

|

Application |

|

|

End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrylate Monomers Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific industry is estimated to dominate majority revenue share of 55% by 2035. This is mainly driven due to the growth of the printing ink, automobile, cosmetics and pharmaceutical industries. The increase in demand and production of packaging materials, electric vehicles, and paints and coatings has led to increased demand for POPs and POEs in the Asia Pacific region. This growth can also be attributed to the growing demand for automobiles and significant growth in the automobile industry in India and China. In the FY2023, the production volume of commercial vehicle was over USD 26 million units which a rise then the previous year.

Europe Market Insights

The European acrylate monomers market is estimated to grow substantially by the end of 2035. Acrylic monomers are low molecular weight compounds with vinyl groups participating in the polymerization process. Their composition makes them suitable for use in a variety of products such as solvents, inks, adhesives, thermoplastics, paints, ceramic nails and soft contact lenses. Further, in dentistry, these monomers are used to make dental prostheses and a variety of dental fillings and enamel materials. Dentists use them to prepare cement to attach prostheses to bone. Europe provides a huge market for acrylates for the dental industry. Therefore, dental industry in Europe is set to accelerate the growth of acrylate monomers market in the forecast period.

Acrylate Monomers Market Players:

- Arkema

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- DOW Inc.

- Evonik Industries AG

- Merck KGaA

- Synthomer plc

- Mitsubishi Chemical Group Corporation

- Nippon Shokubai Co Ltd.

- Guang Dong Huiquan Lianjun Chemical Industries Co Ltd.

- Alfa Chemistry

- Sinocure Chemical Group Co., Limited

Recent Developments

- In February 2022, Mitsubishi Chemicals Corporation announced its decision to transfer all shares of Lucite International Japan Co., Ltd., specializing in the production of acrylic composite materials, to Midorikawa Chemical Industry Co., Ltd. is part of portfolio reform based on Mitsubishi Chemical Corporation's management policy.

- In May 2023, Evonik announced that it has chosen a new distribution structure for its VISIOMER specialty methacrylates to meet the growing demand of the Indian market and has therefore developed a partnership strategic partnership with leading chemical distribution organizations Vimal Intertrade and Nordmann. With this agreement, Evonik aims to strengthen its position as a leading supplier of specialty methacrylate solutions and, together with its distribution partners, ensure personalized and efficient support. results for your customers.

- Report ID: 3790

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrylate Monomers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.