Behcet's Disease Market Outlook:

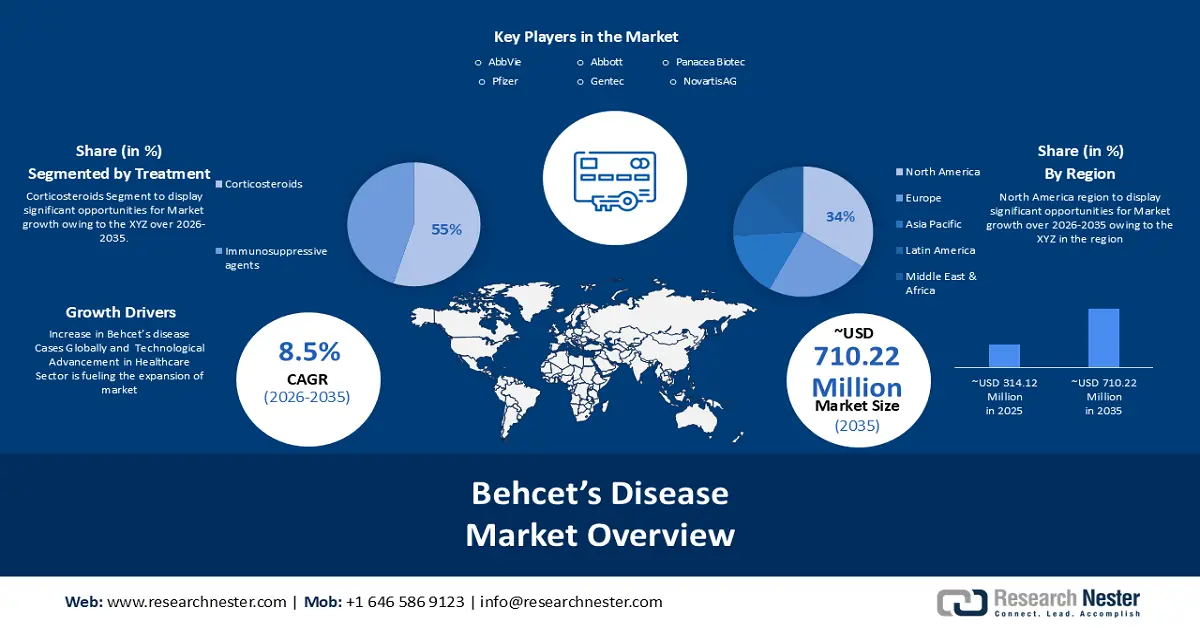

Behcet's Disease Market size was over USD 314.12 million in 2025 and is projected to reach USD 710.22 million by 2035, witnessing around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of behcet's disease is evaluated at USD 338.15 million.

The increase in Behcet’s disease cases globally is fueling the expansion of the market. For instance, according to a report published in 2022 states, the frequency of Behcet’s Disease in Japan, Korea, China, Iran, and Saudi Arabia ranges from 13.5 to 22 cases per 100,000 population. The prevalence in North America and Europe is 1 case per 15,000-500,000 population. The widespread of the disease globally is increasing due to rapid recognition of the disease and immigration from endemic areas. Fast recognition of the disease leads to a higher demand for available treatment & field research.

Major shifts are taking place in environmental factors related to genetics refers to exposure to toxic substances and acceptance of an unhealthy lifestyle that can increase an individual’s risk of disease are anticipated to boost the expansion of the market. Additionally, increased awareness of the disease in the healthcare sector disease can help with more precise diagnosis and treatment.

Key Behcet's Disease Market Insights Summary:

Regional Highlights:

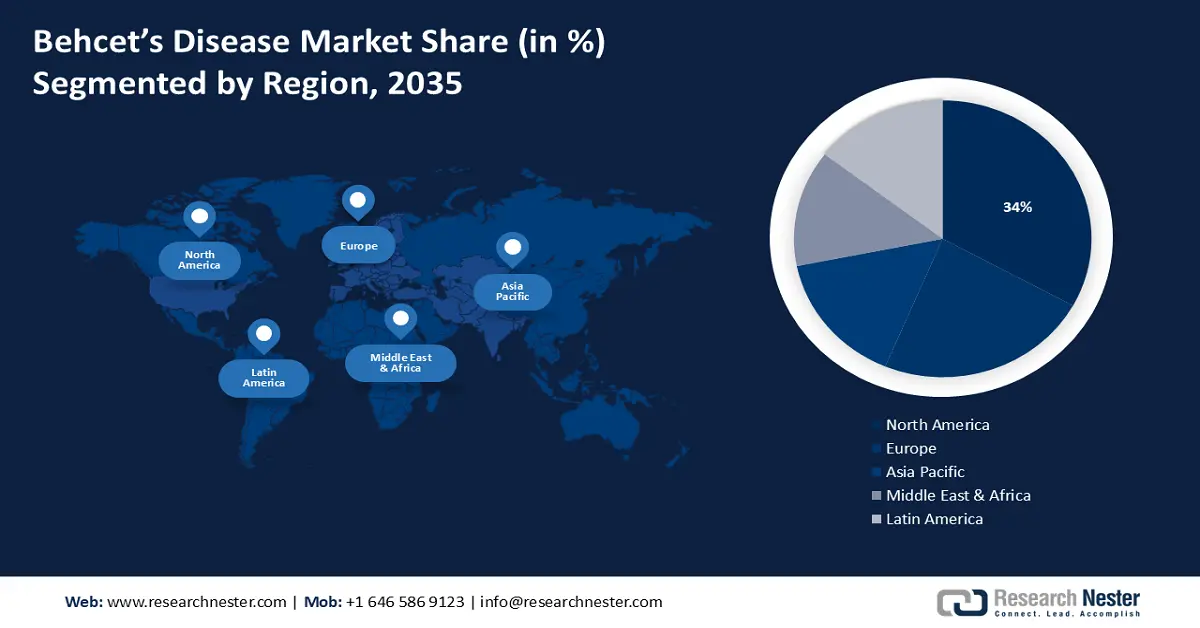

- North America is projected to secure a 34% share by 2035 in the behcet's disease market, underpinned by rising disease incidence and heightened regional healthcare expenditure.

- Europe is anticipated to capture a 24% share by 2035, strengthened by expanding patient prevalence and advancements in the regional healthcare ecosystem.

Segment Insights:

- The corticosteroids segment is expected to command a 55% share by 2035 in the behcet's disease market, propelled by their widespread use as potent anti-inflammatory treatments.

- The oral segment is set to attain roughly a 62% share by the end of 2035, supported by the predominance of orally administered medications in managing Behcet’s disease.

Key Growth Trends:

- Technological Development in the Healthcare Sector

- Increasing Expenditure on Healthcare Sector by the Government

Major Challenges:

- Difficulty in Diagnosis Hinders Market Expansion

Key Players: Pfizer Inc., Gyroscopic Therapeutics, Novartis AG, AbbVie, F. Hoffmann La Roche Ltd., Johnson and Johnson, Panacea Biotec, Gentech.

Global Behcet's Disease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 314.12 million

- 2026 Market Size: USD 338.15 million

- Projected Market Size: USD 710.22 million by 2035

- Growth Forecasts: 8.5%

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Turkey, Mexico

Last updated on : 28 November, 2025

Behcet's Disease Market - Growth Drivers and Challenges

Growth Drivers

- Technological Development in the Healthcare Sector: The treatment of Behcet’s disease is assisted by the specific symptoms that are clearly visible in each individual. The widespread increase in the disease has led to growth in demand for chronic disease management characterized by inflammation of various organs. For reducing the inflammation two specific therapies were used: supportive and symptomatic. Treatment choices are determined by the patient's age, sex, and disease severity. For instance, a study published in 2023 states that using the Egyptian College of Rheumatology (ECR)-BD cohort various machine learning models were developed for detection of vision-threatening behcet’s disease.

- Increasing Expenditure on Healthcare Sector by the Government: Government programs and funding for research work on rare disorders can have a big impact on the behcet's disease market. The development of drugs and patient access to treatment can be improved by with grants & funding. According to the American Behcet’s Disease Association, a person can claim social security disability benefits if the person is suffering from behcet’s disease.

- FDA Approval for Medications: With the increasing number of cases of Behcet’s disease, researchers have discovered various drugs have the potential to reduce inflammation. For instance, a report published by the American Behcet’s Disease Association in 2019 states that the US Food and Drug Administration (FDA) has approved the use of apremilast drug (Otezla, Celgene) 30 mg twice a day for the treatment of oral ulcers in adults associated with Behçet's disease. It’s an oral elective phosphodiesterase 4 (PDE4) inhibitor used for treating oral ulcers associated with Behcet's Disease. Apremilast was approved as a 30 mg twice-daily therapy which can be prescribed to an adult. Multiple systems can be affected by the presence of this disease, but it's often characterized by reoccurring of oral ulcers along with lesions in other organ systems.

Challenges

- Difficulty in Diagnosis Hinders Market Expansion: There’s no specific diagnostic technique for Behcet’s disease. A physician's experience is the only consideration in diagnosing the condition. Multiple studies show that Behcet's disease patients find it difficult to lead normal lives due to the degenerative nature of the disease. The inability to precisely diagnose the indication is anticipated to seriously hinder the growth of the worldwide Behcet’s syndrome treatment market during the forecast year.

- Lack of knowledge among the population, medical practitioners and specialists lead to a delayed or inaccurate diagnosis.

- People not responding well to specific medications & therapies available for reducing inflammation.

Behcet's Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 314.12 million |

|

Forecast Year Market Size (2035) |

USD 710.22 million |

|

Regional Scope |

|

Behcet's Disease Market Segmentation:

Treatment Segment Analysis

The corticosteroids segment in the behcet's disease market is estimated to gain the largest revenue share of about 55% in the year 2035. Corticosteroids are potent anti-inflammatory drugs that help in reducing the inflammation associated with Behçet's disease. They are available as topical steroids and oral steroids depending on the symptom to be treated. For instance, A report published in 2021 states that a survey was conducted which resulted in the frequently used medications in Behcet’s Disease are glucocorticoids (67.6%) and colchicine (55.0%). Middle Eastern countries commonly use corticosteroids to reduce inflammation caused by Behcet’s disease.

Route of Administration Segment Analysis

The oral segment in the behcet's disease market is estimated to gain a significant share of about ~62% by end of 2035. Minimizing the inflammation caused by the disease is the main goal of the treatment and the medications used come in the form of tablets, capsules, or injections. Azathioprine, Ciclosporin, and Tacrolimus are immunosuppressants taken orally to reduce pain & infection. As most of medications for Behcet's disease are consumed orally, this is anticipated to fuel the growth of this segment and drive overall market growth throughout the course of the forecast year.

Our in-depth analysis of the market includes the following segments:

|

Treatment |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Behcet's Disease Market - Regional Analysis

North America Market Insights

North America industry is set to account for largest revenue share of 34% by 2035, due to a rise in behcet's disease cases globally and an increase in healthcare expenditure by government in the region, amongst the market in all the other regions. The large-scale research and development efforts in the region to learn and find more efficient treatments for Behcet’s syndrome are expected to contribute to regional market expansion. North America is the home of various leading corporations in the healthcare sector like Pfizer Inc., and because of the existence of such big companies the demand for treatment is significantly impacted. For instance, a study was conducted in 2022 by the U.S. National Library of Medicine to check the effectiveness and safety of Amgen's apremilast (CC-10004) in treating Behcet’s syndrome. Apremilast is used to treat mouth ulcers associated with Behcet’s syndrome. It is also estimated that the growing rate of the Behcet’s syndrome treatment market in the region is driven by factors like an increase in clinical trial studies for checking the efficacy of the medications during the forecast period.

European Market Insights

The Europe behcet's disease market is estimated to be the second largest, share of about 24% by the end of 2035. Patients suffering from Behcet’s disease in rapidly increasing in this region. Additionally, the Growth of Europe’s economy is leading to an increase in consumer income resulting in the development of the healthcare sector which is a key factor fueling the regional growth. Healthcare systems are organized and financed by European Government to provide treatment of rare diseases at an affordable cost to both individuals and society. The region is progressing in accepting new technological development because of the major firms in countries like Germany and France. The most noticeable feature is the geographic variation in Behcet's disease prevalence. The country with the highest risk of Behcet’s Disease is Turkey. Within Europe, it is most frequent in Southern Europe, whereas very rare in Northern Europe. For instance, a report published in 2023 states that skin lesions were the first symptom observed in 70% of patients, and the most common symptom observed was oral ulcers in patients with Behcet’s disease was reported in Turkey to be 100%, in Iran 96.8% The attempts to improvise the healthcare sector & growing awareness of Behcet’s disease in Europe are helping in regional growth.

Behcet's Disease Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gyroscopic Therapeutics

- Novartis AG

- AbbVie

- F. Hoffmann La Roche Ltd.

- Johnson and Johnson

- Panacea Biotec

- Gentech

- Abbott

- Coherus Biosciences Inc,

- R pharm

Recent Developments

- Pfizer, announced completion its acquisition of Global blood therapeutics. It’s a biopharmaceutical company dedicated to development, discovery and delivering lifesaving treatments that offer hope to patients with non-curable diseases, like sickle cell anemia & Behcet’s disease.

- Gyroscope Therapeutics, announced that Novartis has finalized a deal to purchase all of the outstanding shares of the company. This therapy has the potential to be the first therapy with sustained efficacy for geographic atrophy patient population.

- Report ID: 5795

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Behcet's Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.