NA

Alzheimers Disease Therapeutics Market Outlook:

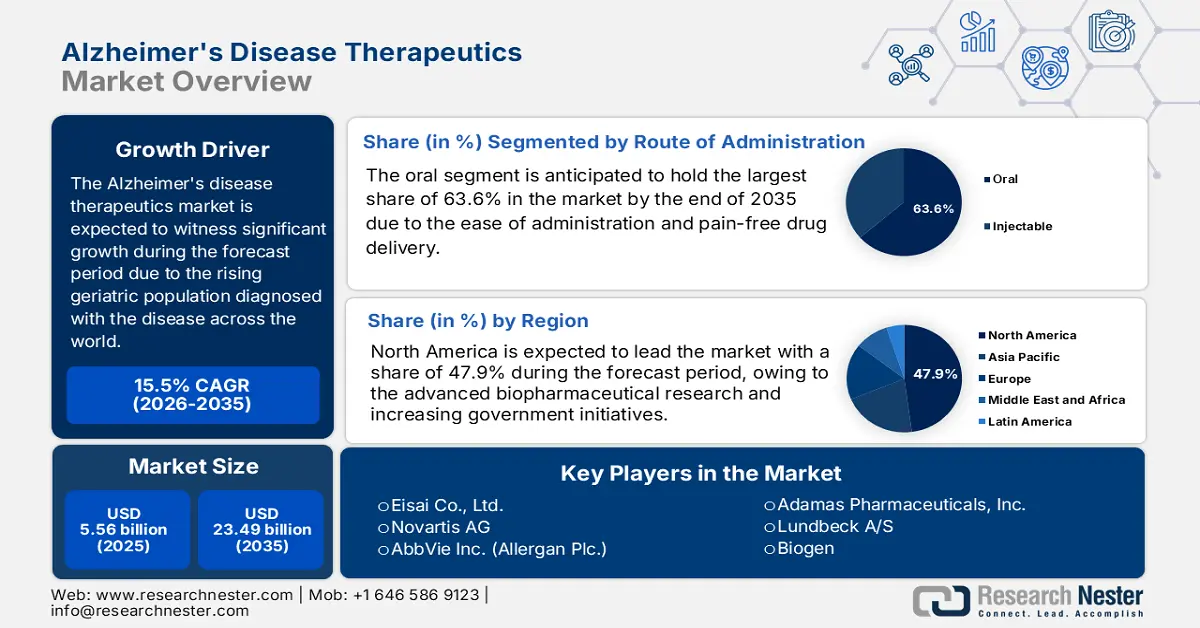

Alzheimers Disease Therapeutics Market size was valued at USD 5.56 billion in 2025 and is likely to cross USD 23.49 billion by 2035, registering more than 15.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alzheimers disease therapeutics is assessed at USD 6.34 billion.

The proven efficacy of therapeutics as an effective treatment solution is driving growth in the Alzheimers disease therapeutics market. The rising prevalence of Alzheimers disease and advancements in diagnostic technologies are encouraging global leaders to launch more of such effective therapeutics. According to a WHO report published in March 2025, 57 million people were residing with dementia in a year, with more than 60% of people living in developing countries, and approximately 10 million new cases were reported annually. It further stated that Alzheimers disease accounted for 60% to 70% of dementia cases, which is the seventh leading cause of death worldwide. These rising instances further inflate the demand for such therapeutics.

In addition, the rising awareness about the treatment procedures across the world led to an upsurge in demand for innovative therapies aimed at slowing the disease progression, further improving the quality of life. For instance, in March 2025, Alpha Cognition Inc. launched ZUNVEYL (Benzgalantamin), that is the first oral FDA approved treatment which is meant to be indicated for mild to moderate Alzheimers disease. These substantial launch activities by the industry are further inspiring pharmaceutical leaders to introduce more effective solutions, such as Alzheimers disease therapeutics, for solidifying their positions in the global landscape of this sector.

Key Alzheimers Disease Therapeutics Market Insights Summary:

Regional Highlights:

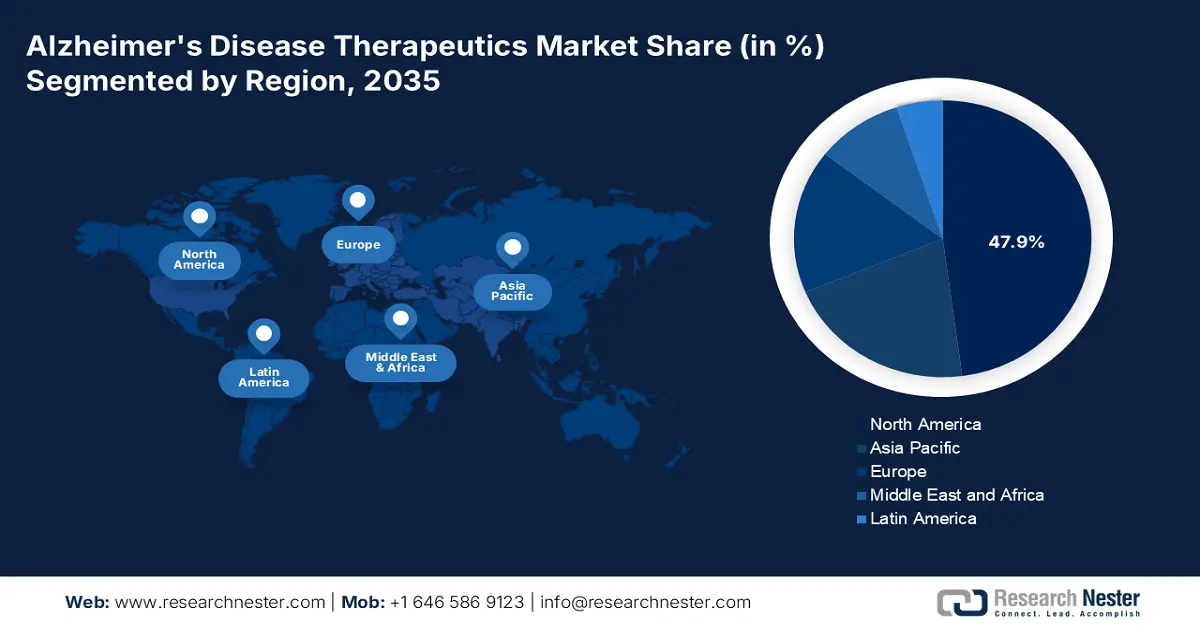

- North America commands a 47.9% share in the Alzheimers Disease Therapeutics Market, driven by increased R&D healthcare expenditure and government initiatives, fostering robust growth through 2035.

- Asia Pacific's Alzheimers disease therapeutics market is set for the fastest growth by 2035, fueled by rising aging population and innovation in AD therapeutics.

Segment Insights:

- Cholinesterase Inhibitors segment are expected to grow at a considerable rate by 2035, driven by their efficacy in relieving Alzheimer’s symptoms.

- Oral administration segment is expected to capture a 63.60% share by 2035, driven by its ease of administration and painless drug delivery method.

Key Growth Trends:

- Increasing investments in the sector

- Increasing research activities

Major Challenges:

- Limitations in affordability and availability

- Clinical trial failures

- Key Players: Eisai Co., Ltd., Novartis AG, AbbVie Inc. (Allergan Plc.), Adamas Pharmaceuticals, Inc., Lundbeck A/S, Biogen.

Global Alzheimers Disease Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.56 billion

- 2026 Market Size: USD 6.34 billion

- Projected Market Size: USD 23.49 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Alzheimers Disease Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Increasing investments in the sector: The proven effectiveness of these drugs encourages the biotechnology and pharmaceutical firms to invest significantly in the sector, allowing market progression. Due to the increased occurrence of neurodegenerative disorders, companies are actively pursuing development activities. For instance, in December 2020, Novo Nordisk announced that it entered phase 3 development in AD with 14 mg oral semaglutide, which is a once-daily oral formulation of the long-acting GLP-1 analogue semaglutide. It further reported to initiate the program with 3,700 individuals with the disease, thereby uplifting market demand.

- Increasing research activities: With ongoing research activities in the healthcare sector, the frequency of advancements in the Alzheimers disease therapeutics market increases. The research activities aim to mitigate the route of administration issues and develop more accurate detection strategies. As of April 2025, NIH reports that researchers analyzed cerebrospinal fluid samples from 3,400 individuals across the U.S., Sweden, and Finland and found that the YWHAG: NPTX2 protein ratio more accurately reflects cognitive decline in AD patients than existing biomarkers. This ratio is a promising tool to predict and track AD progression, thus driving demand for innovative solutions.

Challenges

- Limitations in affordability and availability: One of the major restraints for the market is the limitation in affordability and availability. These expenses can create an economic barrier among the people who belong to price-sensitive regions. These costs are further exacerbated by the high costs associated with PET scans, biomarker testing, and biologics, further limiting market expansion of this sector. In addition, the inadequate healthcare infrastructure and lack of skilled professionals hinder the effective management of the disease, restricting product exposure across the healthcare industry.

- Clinical trial failures: Despite having limited adverse reaction cases, growth in the market can be hindered due to the failure rate of clinical trials, particularly for disease-modifying therapies. Besides the substantial investments by the key players, many therapeutics fail to demonstrate efficacy in slowing or reversing cognitive decline, limiting market penetration. This may further create a hurdle for this sector to capture the optimum consumer base in the therapeutic industry. Hence, the higher failure rate of clinical trials limits the market expansion.

Alzheimers Disease Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 5.56 billion |

|

Forecast Year Market Size (2035) |

USD 23.49 billion |

|

Regional Scope |

|

Alzheimers Disease Therapeutics Market Segmentation:

Route of Administration (Oral, Injectable)

Based on route of administration, the oral segment is expected to garner the highest share of 63.6% in the alzheimers disease therapeutics market by the end of 2035. The ease of administration and the painless way of drug delivery are anticipated to augment the segment growth. Additionally, the patient can consume it regardless of the place, which is the key factor driving the segment's growth. In May 2023, the U.S FDA announced that it approved Rexulti (brexpiprazole) oral tablets that are meant to be indicated for treating agitation symptoms that are associated with dementia due to AD. Thus, this denotes a positive outlook for the segment’s growth, driving significant outcomes during the forecast timeline.

Drug Class (Cholinesterase inhibitors, NMDA Receptor Antagonist, Combination Drug, Pipeline Drugs)

Based on the drug class, the cholinesterase inhibitors segment is projected to grow at a considerable rate in the alzheimers disease therapeutics market during the forecast period. The growth is attributable to the drug’s enhanced efficacy in relieving symptoms and improving cognitive function. For instance, in April 2024, Essential Pharma finalized the acquisition of Reminyl (galantamine hydrobromide) cholinesterase inhibitor from Janssen Pharmaceutica NV, a Johnson & Johnson company, to treat dementia in AD patients. Hence, the market will witness lucrative growth activities with such improved acquisitions further inspiring companies to develop more effective treatment alternatives.

Our in-depth analysis of the global alzheimers disease therapeutics market includes the following segments:

|

Route of Administration |

|

|

Drug Class |

|

|

Disease Stage |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alzheimers Disease Therapeutics Market Regional Analysis:

North America Market Analysis

The North America alzheimers disease therapeutics market is poised to capture the largest share of 47.9% during the forecast period. The increased healthcare expenditure in terms of research and development by the global leaders and the rising government initiatives are the key drivers for growth in the region. In December 2021, Biogen Inc. and Eisai Co., Ltd. together announced that lecanemab, an anti-amyloid beta (Aβ) protofibril antibody for the treatment of early AD, was granted fast track designation by the U.S. FDA to address the unmet medical needs. This highlights the growing need for advanced drugs such as Alzheimers disease therapeutics in this region.

The U.S. has become the hub for global leaders in the market due to its wide consumer base and excellent manufacturing facilities. The country fosters a favorable environment for organizations to expand their business with a huge population adapting to the developing therapeutics along with technologies. For instance, in March 2025, Eli Lilly and Company notified the expansion of its LillyDirect digital healthcare platform to improve AD care in the U.S., to connect individuals with in-person and telehealth providers to enhance diagnostic capacity by reducing delays. Thus, it inspires other domestic participants to establish their footprint in this country by promoting the need for early detection.

Canada is steadily consolidating its position in the Alzheimers disease therapeutics market with proactive government approvals and ongoing clinical trials. The concerning growth in Alzheimers disease cases is pushing the international players to promote available treatment options and develop new therapeutics. In January 2025, Toronto Memory Program became the first clinic in Canada to offer C2N Diagnostics PrecivityAD2 blood test. The test allows healthcare professionals to diagnose AD by detecting amyloid pathology using a simple, non-invasive process. This is further inflating demand in this sector due to the high requirement for early detection & Alzheimers disease therapeutics in the country.

APAC Market Statistics

Asia Pacific is expected to demonstrate the fastest growth in the alzheimers disease therapeutics market, with its strong capacity in biotechnology and ongoing research & development in AD therapeutics. The region hosts growth factors driven by the developmental trajectory of countries such as Australia, Japan, India, and China. The region’s aging population is experiencing a heavy incidence of the disease, which is increasing the awareness among the domestic players to develop new therapeutic drugs and elevate their production. Thus, the growth in this region is further carried forward with the high demand for cost-effective treatment procedures and the continuous efforts of organizations that are researching to bring innovations in this field.

India is propagating the regional market with its strong pharmaceutical development and government support. The country leverages a huge patient pool with rising instances of dementia, which necessitates the need for effective therapeutics. For instance, in October 2025, as published by the Government of India, the Ministry of Science & Technology reported that scientists from Agharkar Research Institute, Pune, developed novel, non-toxic molecules for treating AD using synthetic, computational, and in vitro techniques that demonstrated low toxicity, improving the efficacy. Thus, such innovations with enhanced patient safety measures are expected to augment the market expansion in the country.

China is one of the major hubs for the market, which is emerging as a great manufacturing source. The increasing demand for new therapies and great support from the government offer a favorable business environment, encouraging international leaders. In May 2024, AriBio Co., Ltd received IND approval from China’s NMPA to begin a phase 3 clinical trial for its investigational drug AR1001 targeting Alzheimers disease. It further stated that the Polaris-AD trial will be conducted at up to 20 clinical centers across the country. Hence, these ongoing trials are readily blistering the market with positive outcomes.

Key Alzheimers Disease Therapeutics Market Players:

- AbbVie Inc. (Allergan Plc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Adamas Pharmaceuticals, Inc.

- Lundbeck A/S

- Eli Lilly and Company

- Biogen Inc.

- AC Immune

- Hoffmann La Roche Ltd.

- AriBio Co., Ltd

- Daiichi Sankyo Company, Limited

- Johnson & Johnson Services, Inc.

- TauRx Pharmaceuticals Ltd.

The competitive demographic of the market is inspiring global leaders to increase their research and development investments to develop new, exclusive therapeutic formulations. In addition, the ongoing growth policies by each player are drawing the focus of other competitors to participate, encouraging a healthy competition. For instance, in January 2024, Biogen Inc. declared its plan to reprioritize its Alzheimers disease resources by discontinuing ADUHELM and focusing on advancing LEQEMBI (lecanemab-irmb). It further reported to accelerate the therapies, such as BIIB080 & BIIB113, aiming to build a new franchise. Thus, this ensures a positive outlook for the market upliftment with such effective strategies.

A few of the key players in the market include:

Recent Developments

- In January 2025, Eisai Co., Ltd. with Biogen Inc., declared the U.S FDA clearance of Supplemental Biologics License Application (sBLA) for LEQEMBI’s IV maintenance dosing for AD treatment.

- In July 2024, Eli Lilly and Company notified that its Kisunla (donanemab-azbt) 350 mg/20 mL received approval from the U.S. FDA for the treatment of early symptomatic Alzheimers disease in adults.

- Report ID: 7599

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.