Automotive Smart Display Market Outlook:

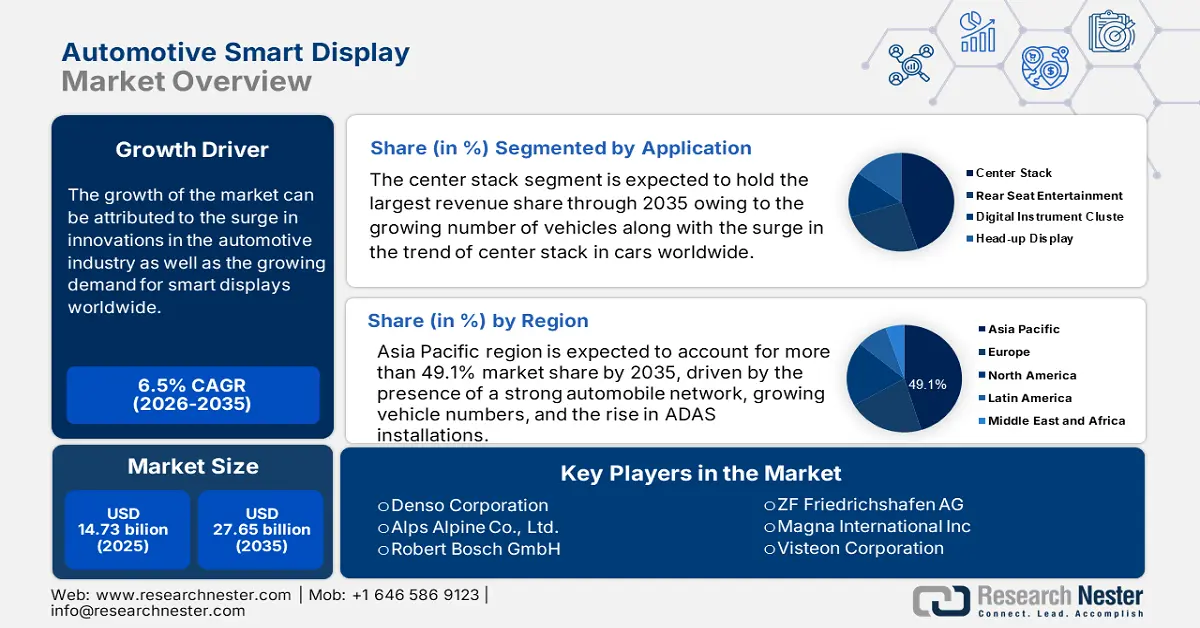

Automotive Smart Display Market size was valued at USD 14.73 billion in 2025 and is expected to reach USD 27.65 billion by 2035, expanding at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive smart display is evaluated at USD 15.59 billion.

The growth of the market can be attributed to the surge in innovations in the automotive industry as well as the growing demand for smart displays worldwide. For instance, it was found that over 15 million smart displays were sold worldwide in 2020. The increasing use of automotive cars owing to the increasing disposable income of people across the world. The rising preferences of people for entertainment and increasing safety concerns are the reason for the growth of smart display installation in automobiles. The display is used as a small-screen video player and a front and back camera visualizer that prevents accidental bumps into walls or obstacles.

Available on a single-touchscreen platform automotive smart display market play an essential role in the application of important driver assistance functions. Innovative and advanced displays are being incorporated by the original equipment manufacturers (OEMs) to deliver unique user experiences which can differentiate their brand image. With the recent advancements in automotive electronic modules as well as electronic control units, the demand for smart displays is on the rise amongst car users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive smart display market during the forecast period. It is expected that by 2030, electronics are expected make up 50% of a cost of a new car.

Key Automotive Smart Display Market Insights Summary:

Regional Highlights:

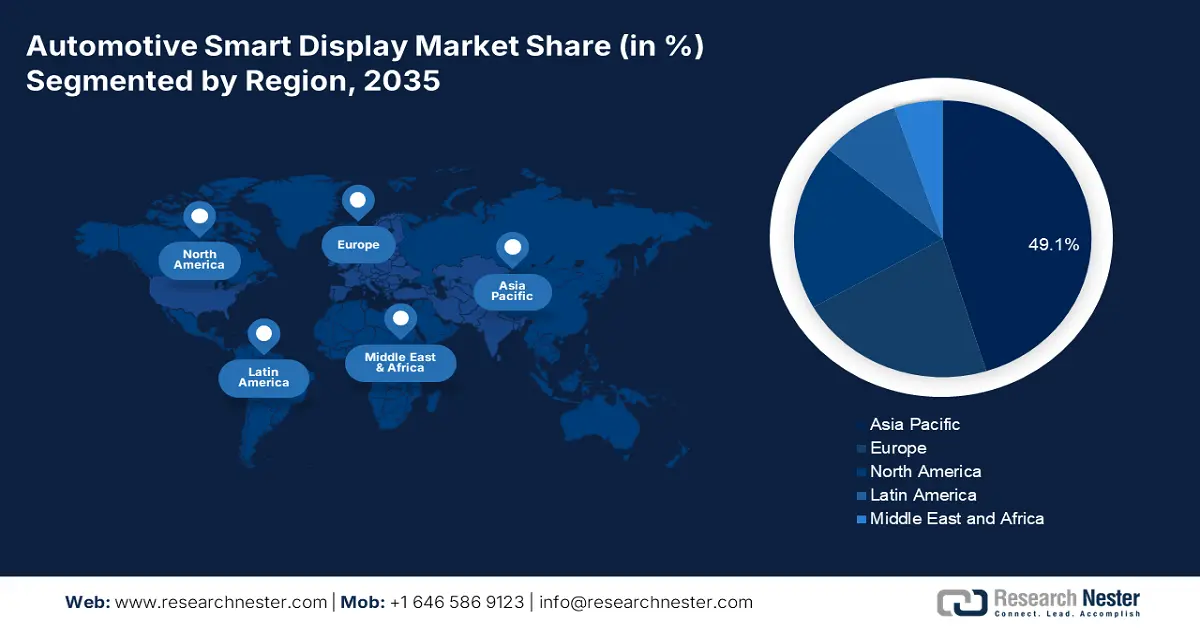

- Asia Pacific automotive smart display market will dominate more than 49.1% share by 2035, driven by the presence of a strong automobile network, growing vehicle numbers, and the rise in ADAS installations.

- Europe market will hold the second largest share by 2035, driven by the increasing production of automobiles and the use of advanced electronics in manufacturing.

Segment Insights:

- The center stack segment in the automotive smart display market is expected to hold the largest share by 2035, driven by increasing adoption of infotainment and smart display systems in vehicles.

- The semi-autonomous segment in the automotive smart display market is expected to achieve a significant share by 2035, influenced by growing in-vehicle smart display use and rising popularity of semi-autonomous vehicles.

Key Growth Trends:

- Growing Sales of Vehicles with Rising Spending Capacity of People

- Rising Trend of Electric Vehicles with Increasing Fuel Cost

Major Challenges:

- Increased Overall Cost of Vehicle

- Integration of Complex Functions

Key Players: Continental AG, Nippon Seiki Co., Ltd., Infineon Technologies AG, Denso Corporation, Alps Alpine Co., Ltd., Robert Bosch GmbH, Visteon Corporation, Aptiv Global Operations Limited, ZF Friedrichshafen AG, Magna International Inc.

Global Automotive Smart Display Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.73 billion

- 2026 Market Size: USD 15.59 billion

- Projected Market Size: USD 27.65 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Automotive Smart Display Market Growth Drivers and Challenges:

Growth Drivers

- Growing Sales of Vehicles with Rising Spending Capacity of People – in which smart displays are used to provide comfort and convenience with access to the latest technology. An automotive head-up display is any transparent display that presents data to the vehicle user without requiring users to look away from their usual viewpoints. The rising demand for vehicles is expected to boost the automotive smart display market in the forecasted period. It was found that the global sales of vehicles in 2021 reached 82 million.

- Rising Trend of Electric Vehicles with Increasing Fuel Cost – for instance, in the European Union, the share of new passenger car registrations with all-electric propulsion reached just below 9% in 2021.

- Upsurge in the Consumer Demand for Smart Cars Across the World – for instance, all smart vehicles sold globally with different levels of automation in Europe reached over 25% in 2022.

- Increasing the Number of Connected Vehicles to Support Passenger Transport – which for instance is expected to exceed 300 million in 2035 in the United States, making it the biggest market for connected vehicles.

Challenges

- Increased Overall Cost of Vehicle - Autonomous cars are usually very costly owing to the self-driven technology which includes the use of many advanced sensors, AI, and machine learning technology. This high price of all these technological components increases the price of vehicles. Along with this, the installation of smart displays rises the price of vehicles which is not affordable for everyone.

- Integration of Complex Functions

- High Cost of Research & Development

Automotive Smart Display Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 14.73 billion |

|

Forecast Year Market Size (2035) |

USD 27.65 billion |

|

Regional Scope |

|

Automotive Smart Display Market Segmentation:

Application Segment Analysis

The global automotive smart display market is segmented and analyzed for demand and supply by application into rear seat entertainment, digital instrument cluster, center stack, and head-up display. Amongst these segments, the center stack segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing number of vehicles along with the surge in the trend of center stack in cars worldwide. For instance, the number of cars with center stack displays rose from 25% to nearly 50% within the year 2012 to 2020 globally. The technological advancements to offer information and assistance to the driver are increasing the demand for center stack segment growth. The presence of infotainment systems, the use of electronics, multiple screens, and telematics are promoting the use of center stacks in automotive vehicles.

Autonomy Segment Analysis

The global automotive smart display market is also segmented and analyzed for demand and supply by autonomy into semi-autonomous and autonomous segments. Amongst these two segments, the semi-autonomous segment is expected to garner a significant share. Semi-autonomous vehicles are increasing their popularity around the world owing to the increasing number of in-vehicle automotive smart display applications. The growing development in the automobile industry to enhance the safest of the driver and passengers on the roads is estimated to boost the market growth. Additionally, the increasing preference of people for advanced driver assistance are together boosting the growth of the market. Increasing purchase of sports and luxury cars with rising spending capacity of people as well as living standards. The government regulations to reduce carbon emissions from fuel vehicles are increasing the demand for electric vehicles.

Our in-depth analysis of the global market includes the following segments:

|

By Size |

|

|

By Technology |

|

|

By Autonomy |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Smart Display Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 49.1% market share by 2035, driven by the presence of a strong automobile network, growing vehicle numbers, and the rise in ADAS installations. For instance, by 2025, passenger vehicles pre-installed with an ADAS is predicted account for nearly 70% of total vehicles sold in China. The increasing population with the growing urbanization of the region is anticipated to lead the market growth. The increasing number of industries leads to more job opportunities. This is assumed to eventually rise the count of people traveling for the job which increases public transport. The increasing fuel efficiency and traffic promotes the use of electric vehicles and metro stations. Altogether rise the use of smart displays in these automobile vehicles is estimated to boost the market growth during the forecast period as per the market analysis.

Europe Market Insights

Further, Europe is the second largest market region for the smart display market. The presence of prominent key players and the increasing production of automobiles in the region are expected to drive market growth in the coming years. The use of advanced electronics in the manufacturing of automotive vehicles is also estimated to rise the market growth. Also, the market growth is attributed to the increasing adoption of vehicles with safe and secure methods. As per the estimations, about 10 million passenger cars are produced in the year 2021 in Europe.

Automotive Smart Display Market Players:

- Continental AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nippon Seiki Co., Ltd.

- Infineon Technologies AG

- Denso Corporation

- Alps Alpine Co., Ltd.

- Robert Bosch GmbH

- Visteon Corporation

- Aptiv Global Operations Limited

- ZF Friedrichshafen AG

- Magna International Inc.

Recent Developments

-

Continental AG announced that it has developed a head-up display (HUD) for trams, a technology which was initially designed by the company for cars. Developed by its in-house development team, Continental Engineering Services (CES), the new HUD helps prevent collisions in road traffic.

-

Infineon Technologies AG launched a new MEMS scanner solution comprising a MEMS mirror and MEMS driver. Its miniature size and low power consumption are the basis for making augmented reality (AR) solutions more widely available for automotive head-up displays and for consumer applications such as wearables.

- Report ID: 4639

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Smart Display Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.