Automotive Chassis Market Outlook:

Automotive Chassis Market size was valued at USD 71.8 billion in 2025 and is projected to reach USD 174.7 billion by the end of 2035, rising at a CAGR of 9.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive chassis is estimated at USD 78.4 billion.

The automotive chassis market is closely aligned with the global vehicle production volumes, regulatory compliance costs, and long-term public investment in transportation efficiency and safety. The data from the OICA in 2025 indicates that the global motor vehicle production reached approximately 68,755,124 units in Q1 to Q2 2025, reflecting the recovery-driven capacity utilization across North America, Asia, and sustained output in Europe. The chassis demand scales directly with this production base, mainly as OEMs adjust platforms to meet the evolving load durability and lifecycle requirements. In the U.S., the BTS Transportation Statistics 2024 report shows that highway vehicle travel surged by 18.8% in 2024, reinforcing the OEM and fleet focus on structural longevity and fatigue resistance at the chassis level.

The integration of advanced driver assistance systems and automated driving features requires chassis components to interact with sensors and actuators, increasing the system complexity and validation requirements. According to the Auto Innovate 2024 data, the U.S. is the second largest exporter of motor vehicles and parts, and shipped more than USD 143 billion of goods. This data indicates the globalized and interdependent nature of the supply base. This complexity is compounded by the need for substantial capital investment in the new manufacturing processes for EV-specific components. The market’s growth is therefore intrinsically linked to the automotive industry’s broader capital expenditure cycle for electrification, with chassis suppliers facing pressure to co-develop systems alongside OEMs while managing costs related to lightweight materials and electronic integration.

States with the Largest Percentage of Exports from Motor Vehicle & Parts

|

STATE |

VALUE OF EXPORTED MOTOR VEHICLES & PARTS |

MOTOR VEHICLES & PARTS AS A % OF TOTAL STATE EXPORTS |

|

Alabama |

USD 12.2 billion |

45% |

|

Michigan |

USD 27.6 billion |

42% |

|

South Carolina |

USD 11.6 billion |

31% |

|

Oregon |

USD 6.2 billion |

22% |

|

West Virginia |

USD 1.2 billion |

21% |

Source: Auto Innovate 2024

Key Automotive Chassis Market Insights Summary:

Regional Highlights:

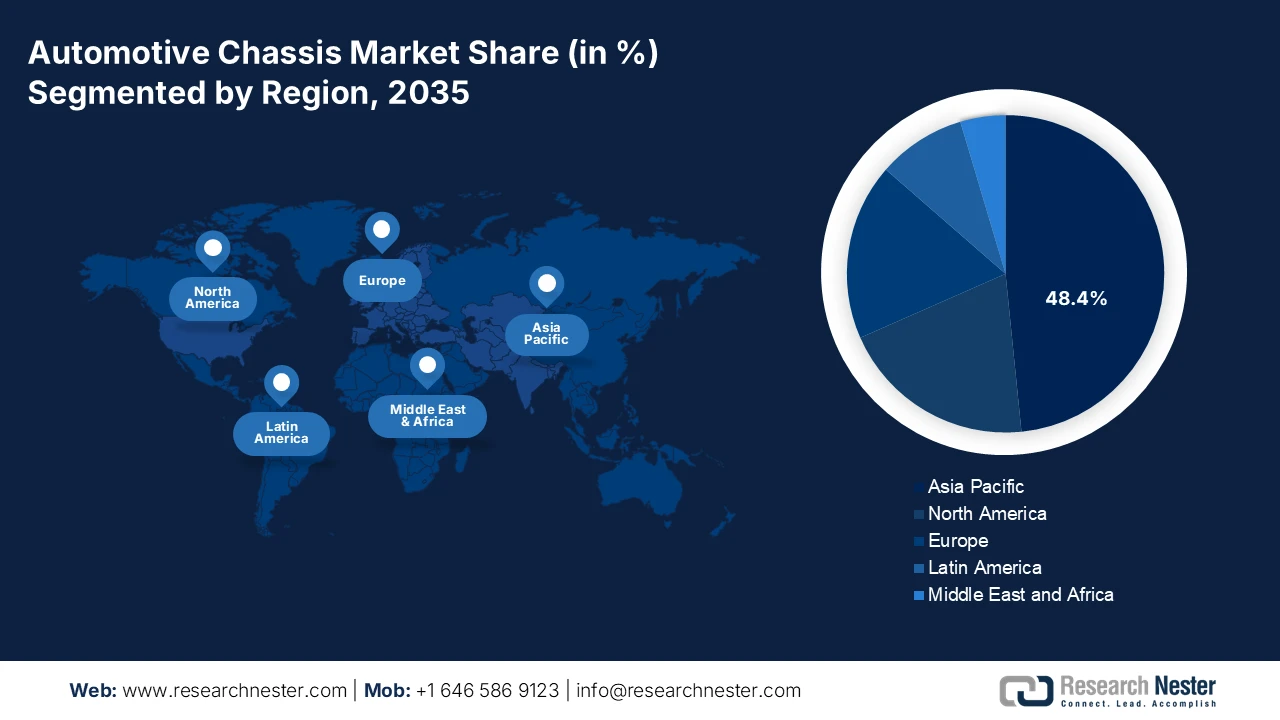

- In the automotive chassis market, Asia Pacific is projected to dominate with a 48.4% regional revenue share by 2035, underpinned by its position as the world’s largest vehicle manufacturing hub and accelerated electric vehicle adoption supported by stringent government mandates and subsidies.

- North America is anticipated to be the fastest-growing region, expanding at a CAGR of 8.5% during 2026-2035, stimulated by strong domestic manufacturing incentives under the U.S. Inflation Reduction Act encouraging investments in advanced EV platforms and localized chassis production.

Segment Insights:

- In the automotive chassis market, the OEM segment is projected to account for an 88.4% share by 2035, reflecting its dominance as the primary sales channel anchored in direct supply of fully integrated chassis systems to automakers for initial vehicle assembly.

- Under the vehicle type segment, passenger cars are expected to command the largest share by 2035, supported by sustained high-volume global production platforms and rapid adoption of advanced chassis technologies for electrification and driver assistance systems.

Key Growth Trends:

- Government road infrastructure expansion and fleet renewal

- Electrification policies reshaping chassis architecture

Major Challenges:

- Capital intensity and high R&D costs

- Rapid technological shift to electrification and software

Key Players: ZF Friedrichshafen AG, Continental AG, Magna International Inc., Robert Bosch GmbH, Benteler International AG, Aisin Seiki Co., Ltd., American Axle & Manufacturing Holdings, Inc., Hyundai Mobis Co., Ltd., Gestamp Automoción, S.A., Tower International, Multimatic Inc., Dana Incorporated, Hyundai WIA Corporation, Bharat Forge Limited, UNIPRES Corporation, Futaba Industrial Co., Ltd., KLT Automotive, Yorozu Corporation, Press Kogyo Co., Ltd., Scomi Group Bhd.

Global Automotive Chassis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 71.8 billion

- 2026 Market Size: USD 78.4 billion

- Projected Market Size: USD 174.7 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Thailand, Mexico, Brazil

Last updated on : 22 January, 2026

Automotive Chassis Market - Growth Drivers and Challenges

Growth Drivers

- Government road infrastructure expansion and fleet renewal: Public investment in road infrastructure directly accelerates the demand for new passenger and commercial vehicles, thereby sustaining the automotive chassis market procurement volumes. The NAPA 2026 report indicates that the Investment and Jobs Act allocates UAS 110 billion for roads and bridges by 2026, stimulating the vehicle replacement cycles for construction fleets, municipal services, and logistics operators. The 2021 Infrastructure Report Card data confirms that there are over 617,000 bridges across the U.S. that require modernization, increasing demand for structurally durable vehicle platforms. In parallel, the European Commission’s Connecting Europe Facility has earmarked funds for transport infrastructure supporting cross-border freight and public transport vehicle procurement. These programs create predictable, multi-year demand for chassis systems optimized for durability, payload efficiency, and regulatory compliance.

- Electrification policies reshaping chassis architecture: The government-led electrification policies are materially altering the automotive chassis market. The demand has surged, forcing the platform to redesign to accommodate battery systems and power electronics. The International Energy Agency 2024 data reports that the electric car vehicle sales exceeded 14 million units globally in 2023, supported by public subsidies and regulatory mandates. The European Commission October 2022 indicates that Europe will ensure all vehicles registered will be zero-emission by 2035. These policies require OEMs to deploy skateboard style or reinforced chassis platform capable of supporting battery loads while maintaining crash compliance. further the global EV-related public spending is directly stimulating the demand for the EV-specific chassis systems.

- Standardization of modular vehicle platforms: To manage the cost and complexity of the electrification, major OEMs are consolidating vehicle programs onto fewer scalable modular platforms. This trend creates massive consolidated demand for the automotive chassis market components designed for this specific architecture. Further, the suppliers who win the contracts for these global platforms secure high volume, long-term business, but must invest heavily in co-development and dedicated production lines, raising the stakes for market entry and favoring large system-capable tier 1 suppliers. Consequently, this paradigm shift raises significant barriers to entry and intensifies market concentration among established global suppliers.

Challenges

- Capital intensity and high R&D costs: Entering the automotive chassis market requires a huge amount of capital for prototyping, testing, and production tooling. Developing a new modular EV platform can cost billions. Startup companies face immense financial strain, spending heavily on their skateboard chassis before achieving volume production, highlighting the barrier that nearly led to cash depletion before the Amazon-backed ramp-up. Intense R&D is non-negotiable for compliance and competitiveness.

- Rapid technological shift to electrification and software: The core challenge is the pivot from mechanical to mechatronic systems. Expertise in traditional welding and forging is insufficient. The new entrants must master software-defined chassis controls, battery integration adn domain architecture. Top companies invest in R&D for these areas. Further, the global EV market is projected to grow, but its growth demands expertise; legacy players are racing to acquire often via M&A.

Automotive Chassis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 71.8 billion |

|

Forecast Year Market Size (2035) |

USD 174.7 billion |

|

Regional Scope |

|

Automotive Chassis Market Segmentation:

Sales Channel Segment Analysis

In the sales channel segment, the OEM is dominating the segment and is expected to hold the share value of 88.4% by 2035 in the automotive chassis market. This is because the chassis is a fundamental integrated vehicle system supplied directly to carmakers for initial assembly. The aftermarket segment is significant and largely confined to replacement parts such as the suspension components rather than the complete chassis. The demand is based on the new vehicle production volumes. The report from the FRED in January 2026 indicates that the Gross Domestic Product, which tracks the value of motor vehicles, bodies, trailers, and parts manufacturing in 2024, reached USD 185,854 million, underscoring the immense scale of the OEM-driven market that chassis suppliers serve directly.

U.S. Motor Vehicle Manufacturing Value

|

Year |

Value (Millions of Dollars) |

|

2022 |

166,562 |

|

2023 |

182,740 |

|

2024 |

185,854 |

Source: FRED January 2026

Vehicle Type Segment Analysis

Under the vehicle type segment, the passenger cars segment commands the largest share value in the automotive chassis market and is driven by the sheer global production volume and continuous technology advancement. The high-volume platform from the major automakers creates a massive, consistent demand for chassis components and systems. This segment is also at the forefront of adopting new chassis technologies for electrification, connectivity, and advanced driver assistance systems. According to the Transportation Statistics annual report in 2024, the total registered vehicles in the United States in 2022 were nearly 283,400,986, with light-duty short-wheelbase vehicles comprising the vast majority, highlighting the immense installed base and replacement market this segment represents. Of these, the passenger cars are the foundational and highest-volume category.

Propulsion Segment Analysis

The electric vehicle segment, encompassing battery electric vehicles and plug-in hybrid electric vehicles, is projected to become the leading propulsion sub-segment in the automotive chassis market. This is due to the high-value purpose-built chassis architecture required, such as integrated skateboard platforms that house the battery pack. These designs necessitate new materials, components, and engineering commanding a premium. Supporting this shift, data from the U.S. Department of Energy in 2024, the Alternative Fuels Data Center shows that the number of EV charging ports in the Station Locator grew by 6.3%, or 12,485 EV charging ports in Q22024, reflecting the rapid infrastructure expansion enabling EV adoption and the corresponding demand for specialized chassis systems.

Our in-depth analysis of the global automotive chassis market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Material |

|

|

Vehicle Type |

|

|

Chassis Type |

|

|

Propulsion |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Chassis Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive chassis market is dominating and is poised to hold the regional revenue share of 48.4% by 2035. The market is driven by its status as the largest vehicle producer and the most aggressive adopter of electric vehicles. China is the central engine of this growth, with its domestic market and ambitious policies shaping the global supply chains. The primary driver is the potent mix of stringent government mandates for EV adoption, substantial state-backed subsidies for both manufacturers and consumers, and massive private investment in battery technology. A key trend is the rapid vertical integration seen in companies that control everything from battery cells to semiconductors and chassis components, allowing for highly cost-competitive dedicated EV platforms.

China automotive chassis market is defined by the scale, speed, and strategic autonomy. According to the IEA April 2024 data, the government’s New Energy Vehicle mandate targeting a 50% of NEV sales by 2035 creates an unparalleled demand. This is supported by the direct consumer subsidies and a vast state-coordinated charging infrastructure. The market is evolving from adapting internal combustion engine platforms to developing pure EV native architectures. A prime example is BYD’s e-platform 3.0 data in April 2024, a dedicated battery-integrated chassis that sets industry standards for efficiency and space utilization. Government support extends beyond subsidies. The Made in China 2025 initiative prioritizes advanced manufacturing, including lightweight materials such as aluminum alloys for chassis, reducing the dependence on foreign technology.

Government-led manufacturing incentives and accelerated adoption of advanced vehicle technologies are driving the India automotive chassis market. The data from the Ministry of Heavy Industries in January 2026 states that the production-linked incentive auto scheme was launched in 2021 with a budget of ₹25,938 crore for FY2022 to 2023 to FY2026 to 2027. This scheme incentivizes domestic manufacturing of advanced automotive technology products, including the electric and safety-critical vehicle platforms that require redesigned and reinforced chassis systems. By encouraging localization of EVs, advanced powertrains, and component manufacturing, the PLI auto scheme directly increases the OEM investment in modular and lightweight chassis architectures. In parallel, India’s expanding vehicle production base and alignment with global safety norms amplify structural compliance requirements. These policy measures collectively create sustained government-backed demand for the automotive chassis systems across passenger, commercial, and electric vehicle segments.

North America Market Insights

The North America automotive chassis market is the fastest-growing and is expected to grow at a CAGR of 8.5% during the forecast period 2026 to 2035. The U.S. Inflation Reduction Act is the primary catalyst creating strong domestic manufacturing incentives for electric vehicles and their components, including battery-integrated skateboard chassis. This drives massive investment in new EV platforms from Detroit automakers and Tesla, increasing the demand for lightweight aluminum and high-strength steel components to optimize the range. The shift towards advanced driver assistance systems and automated driving necessitates more advanced software-controlled chassis systems for precise vehicle dynamics. A parallel trend is supply chain nearshoring as IRA content requirements and USMCA rules compel suppliers to establish local production for chassis parts, moving away from Asia imports.

The U.S. automotive chassis market is strongly supported by the federal transportation spending, vehicle safety regulation, and fleet renewal program. The U.S. Department of Transportation confirms that budget allocation for roads and bridges by IIJA is surging the demand for new commercial vehicles and municipal fleets that require structurally durable chassis platforms. In parallel, the National Highway Traffic Safety Administration continues to tighten crashworthiness and structural integrity standards, increasing OEM investment in reinforced and lightweight chassis architecture. From the production point, the U.S. Bureau of Economic Analysis in February 2024 reports that the motor vehicle and parts output contributed USD 179.0 billion, indicating the scale of domestic manufacturing tied to the chassis systems. These combined infrastructure safety and production dynamics position the U.S. as a structurally stable and regulation-driven chassis demand market.

Canada automotive chassis market is supported by the federal transit and mobility investments that translate into downstream vehicle procurement and fleet renewal. According to the Water Canada January 2026 report, the federal investment is delivered via multiple funding streams, including over USD 12.4 billion allocated for 413 projects under the Public Transit Stream. This funding supports the acquisition and modernization of buses, paratransit vehicles, and municipal fleets, all of which require heavy-duty and medium-duty chassis systems designed for high structural durability and extended service life. In addition, the Government of Canada report in August 2025 states that the Active Transportation Fund, which has committed USD 33 million across 62 projects, supports urban mobility infrastructure that indirectly increases the demand for service vehicles, electric shuttles, and maintenance fleets reliant on standardized chassis platforms.

Europe Market Insights

The Europe automotive chassis market is undergoing a transformative shift driven by the continent’s stringent transition to electric vehicles and digitalization. The primary driver is the EU’s de facto ban on new internal combustion engine car sales by 2035, which pushes the massive investment in dedicated EV platforms. This has stimulated the development of an integrated skateboard chassis architecture that houses batteries and electric drivetrains. A key trend is the heavy investment in giga factories for battery cells, which dictates the design and sourcing of surrounding structural chassis components. Concurrently, the push towards software-defined vehicles and advanced driver-assistance systems (ADAS) is integrating more sensors and electronic control units directly into the chassis, elevating its role from a structural element to a central, intelligent vehicle system.

Germany automotive chassis market is increasingly influenced by the federal electrification policy, transport investment, and vehicle production activity. In response to a parliamentary inquiry, the federal government confirmed that the battery research funding increased from 111 million euros in 2021 to 145 million euros in 2024, highlighting the national support for advanced electric vehicle development. This funding stimulates battery innovation, directly increasing the structural integration requirements for the EV platforms and reinforcing the demand for redesigned load-bearing chassis systems. In parallel, the VDIK January 2025 data states that the new passenger car registration reached 242,728 vehicles, sustaining the baseline chassis demand across passenger and commercial vehicle segments. Germany’s alignment with the EU safety and emissions regulation further pushes the OEMs to invest in optimized chassis architecture capable of supporting heavier electrified powertrains while meeting crash and durability standards.

The government-backed transport funding vehicle safety oversight and the production-linked replacement demand are driving the UK automotive chassis market. According to the Government of the UK report in July 2025, the government committed investment for rail and road infrastructure supporting the logistics efficiency and public transport fleet modernization. This investment drives the procurement of bus service vehicles and freight fleets that require compliant and durable chassis systems. further the Government of the UK data in June 2024 states that nearly 1.9 million new cars were registered in 2023, sustaining baseline demand for chassis platforms across passenger and light commercial segments. The UK’s continued alignment with UNECE vehicle safety regulations ensures a consistent set of structural compliance requirements for the OEMs, reinforcing steady chassis demand tied to regulatory and infrastructure spending.

Key Automotive Chassis Market Players:

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- Magna International Inc. (Canada)

- Robert Bosch GmbH (Germany)

- Benteler International AG (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- American Axle & Manufacturing Holdings, Inc. (U.S.)

- Hyundai Mobis Co., Ltd. (South Korea)

- Gestamp Automoción, S.A. (Spain)

- Tower International (U.S.)

- Multimatic Inc. (Canada)

- Dana Incorporated (U.S.)

- Hyundai WIA Corporation (South Korea)

- Bharat Forge Limited (India)

- UNIPRES Corporation (Japan)

- Futaba Industrial Co., Ltd. (Japan)

- KLT Automotive (South Korea)

- Yorozu Corporation (Japan)

- Press Kogyo Co., Ltd. (Japan)

- Scomi Group Bhd (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ZF Friedrichshafen AG is a defining player in the automotive chassis market, driving the evolution via its integrated chassis solution approach. The company strategically focuses on developing intelligent chassis systems that merge active damping steering and braking into a single software-controlled network. This initiative is vital for enhancing vehicle dynamics safety and, most importantly, providing the stable, predictable platform required for autonomous driving. According to the 2024 annual report, the company has made sales of €41,377 million.

- Continental AG uses its system integration expertise to strategically advance in the automotive chassis market. The company’s key initiative is the development of its full-stack chassis control, which seamlessly connects sensor data from tires, brakes, and suspension via high-performance computers. This holistic approach allows for predictive chassis responses, improving safety and comfort. The annual report 2025 indicates that in the third quarter 2025, the company made sales of €5.0 billion with the organic growth of 2.6%.

- Magna International Inc. adopts a unique and powerful strategy in the automotive chassis market via its complete vehicle engineering and manufacturing capabilities. Its strategic initiative revolves around the development of a complete rolling chassis, most notably its versatile FAST skateboard platform. This modular electric vehicle chassis is designed to be adapted by various OEMs for diverse vehicle bodies, reducing the development time and cost.

- Robert Bosch GmbH competes in the automotive chassis market by strategically focusing on the synergy between chassis control, electrification, and automation. Its key initiative is the development of integrated vehicle dynamics management systems that coordinate braking, steering, and powertrain. Bosch is pioneering technologies such as its eAxle for EVs and the IPB system, which are vital for electric vehicle chassis design.

- Benteler International AG holds a significant position in the automotive chassis market via its strategic specialization in high-value structural components and complete systems assembly. A core initiative is its aggressive push into electrification with the Benteler Electric Drive System, a scalable, modular rolling chassis designed specifically for battery electric vehicles.

The global automotive chassis market is highly competitive and consolidated, dominated by the major tier 1 suppliers from Europe, North America, and Japan. The key players are actively pursuing strategic initiatives such as the heavy R&D investment in lightweight materials and modular chassis platforms to support vehicle electrification and autonomous driving. Consolidation via mergers and acquisitions is common to gain technological expertise and global scale. For example, in June 2025, Qualcomm announced that it had acquired Autotalks to boost V2X Deployments, enhance road safety, and improve automated driving and traffic efficiency. Furthermore, partnerships with the EV startups and legacy OEMs are vital for securing long-term contracts and developing next-generation skateboard platforms for battery electric vehicles, defining the future architecture of the automotive industry.

Corporate Landscape of the Automotive Chassis Market:

Recent Developments

- In October 2025, Tata Motors Commercial Vehicles has unveiled its most advanced intercity platform the all-new Tata LPO 1822 bus chassis. Engineered to set new benchmarks in long-haul passenger transport, the LPO 1822 represents a bold leap forward in comfort, performance and operational efficiency, reaffirming Tata Motors’ leadership in shaping the future of mass mobility.

- In August 2025, Kongsberg Automotive has announced that it has, through its subsidiary Kongsberg Automotive AS, decided to exercise its call option to acquire the remaining 75% of the shares in Chassis Autonomy SBA AB (CA).

- In April 2024, Foxconn acquired 50% of the shares in ZF Chassis Modules GmbH. This strategic partnership strengthens cooperation, business growth, and expansion of the customer base.

- Report ID: 4479

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Chassis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.