Automotive LiDAR Sensors Market Outlook:

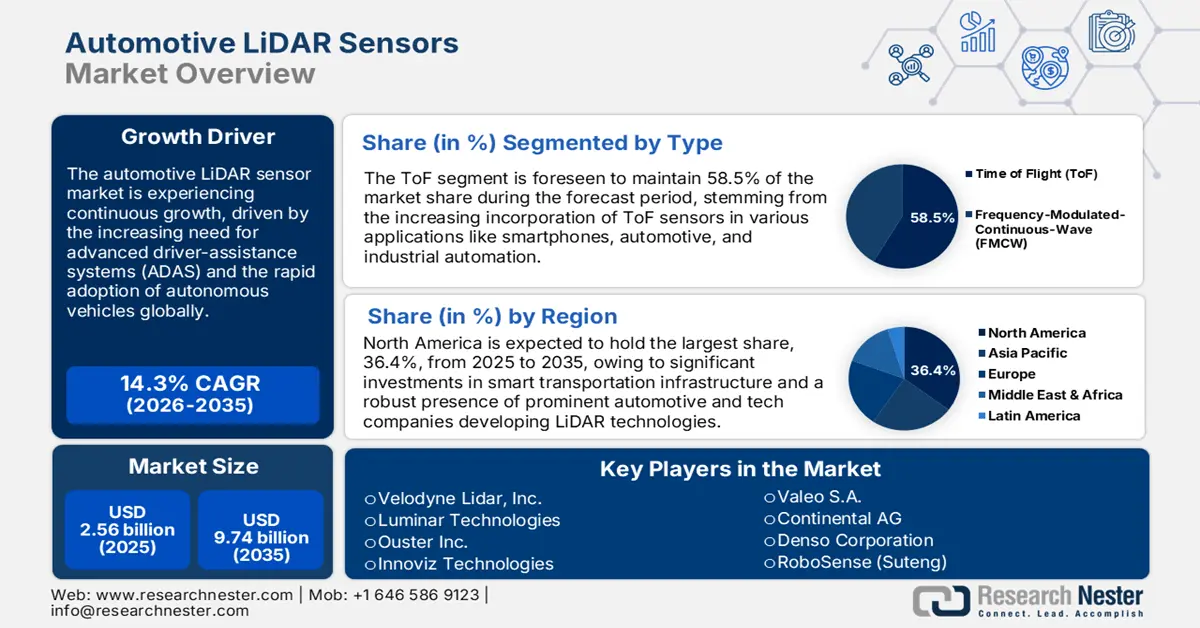

Automotive Lidar Sensors Market size was valued at approximately USD 2.56 billion in 2025 and is projected to reach around USD 9.74 billion by the end of 2035, rising at a CAGR of approximately 14.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive LiDAR sensors is estimated at USD 2.93 billion.

The rising research and development investments are exponentially bolstering the growth of the global automotive LiDAR sensors market. The investment is made in increasing sensor performance, lowering costs, and bolstering the inclusion in the autonomous and semi-autonomous vehicles. Companies are giving significant focus on technological advancements to make smaller and trust trustworthy LiDAR systems. For example, Mercedes-Benz has joined hands with Luminar Technologies to co-develop next-generation Halo LiDAR sensors, endeavoring a large-scale integration by 2026.

The automobile LiDAR sensor market is also characterized by intricate, international integrated supply chains. This situation leaves the U.S. market, driven by autonomous vehicle investment, needing to import in excess of domestic production, which opens supply chain vulnerabilities. Additionally, the dependence on specialized components such as semiconductors, optical lenses, and high-precision MEMS chips makes the supply chain highly sensitive to geopolitical tensions, trade restrictions, and raw material shortages. Lead times for crucial components can deter production and vehicle integration, impacting adoption timelines for LiDAR-equipped vehicles.

Key Automotive LiDAR Sensors Market Insights Summary:

Regional Highlights:

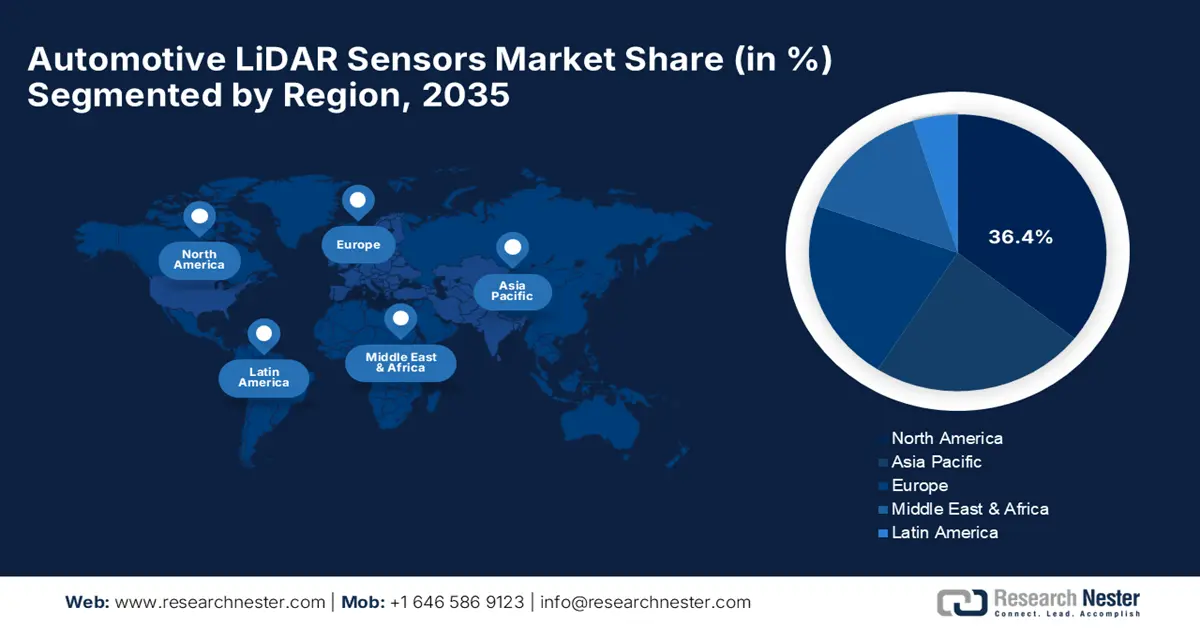

- North America automotive LiDAR sensors market is projected to command a 36.4% revenue share by 2035, underpinned by regulatory pilot programs, growing investments, and rising demand for ADAS-equipped vehicles.

- Europe is expected to witness steady expansion through 2026-2035, owing to stringent safety norms, collaborative R&D initiatives, and strong consumer preference for premium vehicle safety features.

Segment Insights:

- The ToF segment is anticipated to account for 58.5% of the automotive LiDAR sensors market share during 2026-2035, fueled by its superior accuracy in distance measurement for ADAS and autonomous driving applications.

- The solid-state LiDAR segment is projected to secure a 76% revenue share by 2035, propelled by reduced production costs, compact design, and enhanced durability.

Key Growth Trends:

- Increasing consumer demand for vehicle safety

- Integration with AI and ML

Major Challenges:

- Standards and regulatory fragmentation

- Supply chain and production bottlenecks

Key Players: Velodyne Lidar, Inc., Luminar Technologies, Ouster Inc., Innoviz Technologies, Valeo S.A., Continental AG, Denso Corporation, RoboSense (Suteng), Hesai Technology, Huawei, LeddarTech, Phantom Intelligence, Hyundai Mobis, ZF Friedrichshafen, AEye Inc..

Global Automotive LiDAR Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.56 billion

- 2026 Market Size: USD 2.93 billion

- Projected Market Size: USD 9.74 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 7 October, 2025

Automotive LiDAR Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Increasing consumer demand for vehicle safety: The surge in consumer awareness of road safety and efforts for the prevention of accidents has become a prominent driver for the adoption of LiDAR technology in the automotive sector. According to the World Health Organization in 2023, 1.19 million people die annually from road traffic crashes. LiDAR sensors render the bedrock of the ADAS by enabling vehicles to observe their environment in 3D with supremely high precision. LiDAR can generate real time point cloud that can map pedestrians, etc. This consumer-oriented paradigm is compelling automakers to integrate LiDAR sensors not only in luxury and premium vehicles but also in mid-range and mass-market models, expanding the potential automotive LiDAR sensors market base.

- Integration with AI and ML: LiDAR sensors are amalgamated with the AI and ML algorithms that can process and analyse the complex data efficiently. This inclusion of AI and ML upgrades the performance of vehicles and autonomous systems, allowing for better detection of objects and decision-making in varied driving conditions. Moreover, AI and ML models can learn from extended datasets gathered during real-world driving and simulations. This is further significantly improving the predictive decision-making ability of LiDAR-enabled systems. For instance, vehicles equipped with LiDAR and AI can anticipate unpredictable scenarios. Such as when a pedestrian suddenly crosses the road or an object appears in blind spots, thus it can increase collision avoidance and increase adaptive driving responses.

- Surge in integration of LiDAR in electric vehicles: As the adoption of electric vehicles is mushrooming, manufacturers are more inclined to incorporate advanced sensors to meet customer expectations. According to the International Energy Agency in 2023, more than 14 million electric vehicles were sold. Manufacturers are including premium ADAS features to attract tech-savvy buyers. Consumers purchasing EVs are expecting state-of-the-art technology with enhanced connectivity in their ownership experience. These factors make electric vehicles an impeccable launch pad for the integration of LiDAR, having characteristics such as collision avoidance, adaptive cruise control, etc.

Challenges

- Standards and regulatory fragmentation: One of the hurdles in the market is the absence of international standardization, which means expensive compliance for OEMs bringing products to markets. Compliance with different requirements incurs additional expense and time, and the main issue is the harmonization of performance and safety standards.

- Supply chain and production bottlenecks: The initiative to mass-produce LiDAR has revealed supply chain tension, particularly on component availability and manufacturing automation. Nevertheless, there remains a challenge since expansion of multi-LiDAR setups demands solid-state units, custom optics, and premium chip supply reliability—challenging even top suppliers o scale up and uprate routinely.

Automotive LiDAR Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 2.56 billion |

|

Forecast Year Market Size (2035) |

USD 9.74 billion |

|

Regional Scope |

|

Automotive LiDAR Sensors Market Segmentation:

Type Segment Analysis

The ToF segment is predicted to maintain 58.5% of the automotive LiDAR sensors market share during the forecast period based on its accuracy in distance measurement for ADAS and autonomous platforms. The high accuracy and flexibility further solidify ToF at the core of today's vehicle safety and navigation stacks. ToF LiDAR is being increasingly applied in autonomous transport tests and ADAS, which further reinforces the superiority of ToF LiDAR, especially as regulatory bodies seek to reduce accidents on city thoroughfares and highways. These factors are augmenting the segment growth in the coming period.

Technology Segment Analysis

The solid-state LiDAR market is projected to hold a 76% revenue share by 2035. The growth of the market is propelled by lowered production costs, hardiness, and diminution. The automotive LiDAR has solid-state designs that have a very small number of moving parts, which is useful in increasing reliability as well as durability and further lowering the need for maintenance. Additionally, the small form of solid-state LiDAR enables seamless integration, aligning with automakers' requirements for aerodynamics. The scalability of the technology is further propelled by the adoption of the system architecture with multiple LiDARs.

Image Type Segment Analysis

The 3D LiDAR segment is forecast to retain a 54.5% market share through 2035. The growth of the market is driven by burgeoning demand for high-resolution, real-time environmental mapping for ADAS and full autonomy. Additionally, the utilization of the 3D LiDAR aids in including advanced features such as the detection of cyclists or pedestrians and the avoidance of collisions, which are mandated by the safety regulations. Other than this, the inclusion of technological advancements is also lowering the costs and enhancing reliability. The amalgamation of various factors, such as consumer demand for safety, regulatory pressures, ensures that 3D LiDAR will remain dominant in the automotive market for the foreseeable future.

Our in-depth analysis of the automotive LiDAR sensors market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Image Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive LiDAR Sensors Market - Regional Analysis

North America Market Insights

North America automotive LiDAR sensors market is projected to dominate 36.4% revenue share during the forecast period. The growth of the market can be attributed to various factors such as the launch of various regulatory pilot programs, rising investment, and expanding demand for vehicles equipped with ADAS. OEMs are accelerating new vehicle introductions as DOT and DOE programs continue to support large-scale field validation of solid-state LiDAR sensors for mixed road and weather conditions. In October 2024, the U.S. DOT placed large-scale LiDAR-based safety pilots at the top of its Modal Research Plan, with supplemental funding and data collection for ADAS development.

Canada market growth is being driven by innovation and public-private piloting of secure, autonomous transportation. Automotive manufacturers are joining hands with technology companies are speed up the deployment and development of the latest LiDAR technologies. For instance, Luminar Technologies has joined hands with companies such as Volvo to amalgamate its LiDAR sensors into their vehicles, demonstrating industry confidence in the technology's potential.

Europe Market Insights

Europe automotive LiDAR sensors market is anticipated to garner sustained growth between 2026 and 2035. The growth of the market can be attributed to widespread safety regulations and inter-country research and development support. The region has an established automotive industry and a highly trained workforce also renders fertile ground for innovation and rapid deployment of such high-end systems. In Germany, burgeoning consumer demand for safety and autonomy features, mainly among buyers of premium vehicles, supports LiDAR uptake. In the country, the consumers are accustomed to superior quality and advanced safety; these advanced features become differentiators.

The market in the UK is anticipated to garner significant growth on the back of the significant investment from the government. According to data published by the government, USD 183 million of funding will be delivered by 2030 for connected and automated mobility. These investments are supporting research and development as well as the commercialization of the autonomous & sensor technologies, including LiDAR. The prospect of large economic returns helps drive investment in sensor R&D and adoption.

APAC Market Insights

The Asia Pacific market is undergoing robust growth, propelled by significant advancements in connected vehicle technologies across countries. Governments are aiding smart mobility with the help of AV testing licenses and the implementation of smart city programs. Also, the burgeoning sale of electric vehicles in the region is accelerating the adoption of LiDAR. In China, manufacturers are using chip-based LiDAR integrated with detection and scanning. Additionally, the country is developing test roads for autonomous vehicles, smart expressways, high-precision mapping, and V2X infrastructure.

The market in India is propelled by the swift expansion of the ADAS adoption and the mushrooming launch of electric vehicles. The government policies are aiding EV manufacturers in launching innovative and modern electric vehicle models that are further pushing the demand for sensors. Other than this, according to the Press Information Bureau, in the financial year 2023-24, the total inflow of FDI amounted to USD 70 billion, highlighting the rising appeal of India as a global investment destination. These global investments are acting as a prominent catalyst, propelling the OEM collaborations and scaling the production.

Key Automotive LiDAR Sensors Market Players:

- Velodyne Lidar, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Luminar Technologies

- Ouster Inc.

- Innoviz Technologies

- Valeo S.A.

- Continental AG

- Denso Corporation

- RoboSense (Suteng)

- Hesai Technology

- Huawei

- LeddarTech

- Phantom Intelligence

- Hyundai Mobis

- ZF Friedrichshafen

- AEye Inc.

The automotive LiDAR sensors market leaders are focusing on new sensor technology, price, and cross-industry applications. Market leaders include Velodyne Lidar, Luminar Technologies, Ouster Inc., Innoviz Technologies, Valeo S.A., Continental AG, Denso Corporation, RoboSense, Hesai Technology, Huawei, LeddarTech, Phantom Intelligence, Hyundai Mobis, ZF Friedrichshafen, and AEye Inc. Their strategies range from obtaining OEM partnerships to scaling solid-state and multi-LiDAR architectures, with penetration in public safety, infrastructure, and V2X applications also gaining momentum.

Here are some leading companies in the automotive LiDAR sensors market:

Recent Developments

- In May 2025, Luminar announced a strategic shift to a unified architecture, aiming to streamline its product offerings and enhance integration across various platforms. This move is part of their broader plan to improve operational efficiency and market competitiveness.

- In September 2025, Valeo, in collaboration with Ennostar, launched an advanced Mini LED high-definition automotive exterior display. This system aims to enhance vehicle-to-everything (V2X) communication and road safety.

- Report ID: 8173

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive LiDAR Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.