Automotive Power Liftgate Market Outlook:

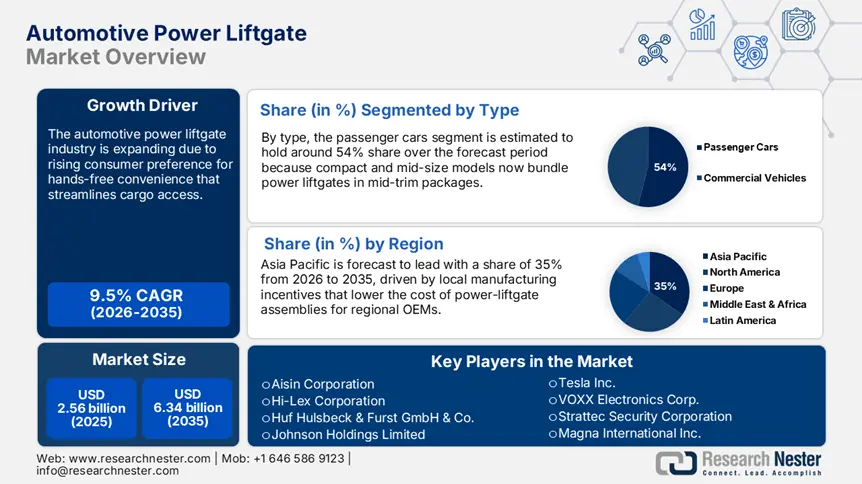

Automotive Power Liftgate Market size was over USD 2.56 billion in 2025 and is anticipated to cross USD 6.34 billion by 2035, witnessing more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive power liftgate is assessed at USD 2.78 billion.

The automotive power liftgate market is anticipated to record stable expansion owing to the increased attention of car manufacturers on the convenience and premium features in vehicles. In March 2024, Nissan offered a glimpse of the 2025 Murano with a fresh look, a power liftgate for the convenience of families. Car manufacturers are using smart, hands-free liftgates in mid-range and premium segments more and more often. There are many social engineering features that are now commonplace, including foot-activated sensors and smart locking. The increased use of SUVs and crossover vehicles around the world also increases the use of liftgates significantly. Manufacturers and suppliers are synchronizing product portfolios with emerging lifestyle patterns and safety protocols.

Electrification and weight reduction are two trends that have started to redefine the concept of power liftgate solutions. In March 2024, Volkswagen launched the ID. Buzz with a three-row configuration and an electric power liftgate to support EV market growth. Industry regulations directing improvements in energy efficiency are placing pressure on OEMs to create lighter and more intelligent liftgates. Original equipment manufacturers are using new composite materials and advanced electronics integration for the best performance. Auto makers are increasing their focus on fuel economy and emission standards set by governments, which in turn is driving lightweight vehicle components. Also, the growth of smart city projects is driving the connectivity of automotive technologies. Electrification, regulations, and the evolution of urban mobility are putting pressure on liftgate manufacturers to deliver new solutions.

Key Automotive Power Liftgate Market Insights Summary:

Regional Highlights:

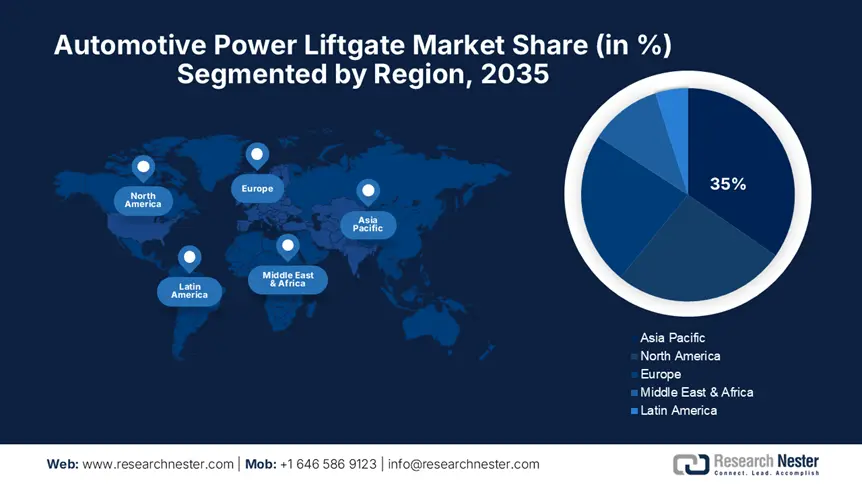

- Asia Pacific holds a 35.00% share in the Automotive Power Liftgate Market, with increasing SUV sales and smart convenience feature integration driving its leadership and growth by 2035.

- North America's Automotive Power Liftgate Market is projected to grow substantially by 2035, driven by high light truck ownership, luxury expectations, and EV adoption.

Segment Insights:

- The Passenger Cars segment is projected to see robust growth by 2035, fueled by the growing trend of families, urbanization, and the popularity of hatchbacks and SUVs with hands-free power liftgates.

- The gasoline segment is projected to hold a 51% revenue share by 2035, driven by sustained demand for gasoline-powered SUVs and crossovers incorporating power liftgate technology.

Key Growth Trends:

- Increase in demand for SUV and crossover vehicles

- Technological innovation and lightweighting trends

Major Challenges:

- Complexity of integration and repair costs

- Regulatory and safety compliance pressures

- Key Players: Huf Hulsbeck & Furst GmbH & Co., Johnson Holdings Limited, Magna International Inc., Stabilus GmbH, Tesla Inc., VOXX Electronics Corp., Strattec Security Corporation, Aisin Corporation, Autoease Technology, Brose Fahrzeugteile SE & Co. KG, Continental AG, Hi-Lex Corporation.

Global Automotive Power Liftgate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.56 billion

- 2026 Market Size: USD 2.78 billion

- Projected Market Size: USD 6.34 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Automotive Power Liftgate Market Growth Drivers and Challenges:

Growth Drivers

- Increase in demand for SUV and crossover vehicles: The global market for SUV and crossover vehicles is considerably increasing the demand for automotive power liftgates. In May 2023, Toyota unveiled the 2024 Grand Highlander with a power liftgate to cater to the utility needs of families. These vehicles are now widely used in urban areas because of the space, comfort, and versatility that comes with them. Power liftgates are useful to increase convenience for loading heavy luggage or shopping in areas with restricted space in urban areas. Auto makers are making sure that most of the novelties that appear in liftgates are filtered down to mid-price segment cars. Increased competition in compact SUV segments in developing countries pushes up the homogenization of features. With the increasing trend in the use of SUVs, integrated liftgate technology is also becoming more popular among car manufacturers.

- Technological innovation and lightweighting trends: The development of new materials and smart systems is a key factor that is propelling the automotive power liftgate market in the automotive industry. In April 2024, Magna unveiled thermoplastic liftgate solutions that are 20-30% lighter than conventional steel components. The lightweighting process is consistent with the emission control norms and electric vehicle range maximization objectives. Currently, there are various types of liftgates, such as sensor-based liftgates, foot-operated liftgates, and remote-controlled liftgates. This allows integration with vehicle body control modules to allow for proper functioning. Some of the advanced technologies that are being incorporated include technologies that enable the user to customize the lift height in accordance with his or her convenience, such as the adjustable lift height memory. The trend to create smarter, lighter, and more intuitive systems remains an ongoing force in product development throughout the automobile categories.

- Increasing electrification across vehicle segments: The increasing electrification of automotive applications and automotive power liftgate market is driving the need for power-efficient liftgates. In March 2024, Rivian revealed the R2 SUV, which has an electric power liftgate as part of its adventure-focused electric vehicle architecture. Electric cars focus on parts that serve the purpose of improving the function without any energy consumption. The latest models of liftgates with regenerative braking and energy-efficient motors are consistent with the EV efficiency objectives. Increasing global rates of electric vehicle adoption increase the demand for lightweight, electronically optimized systems. Automakers concentrate on flexible modular liftgate designs that can be used for electric, hybrid, and traditional gas models. Liftgate feature opportunities are being driven by electrification and sustainable engineering worldwide.

Challenges

- Complexity of integration and repair costs: Liftgates have become more complex due to advancements in electronic systems, making installation, calibration, and repair a sensitive process. While liftgates are a complex part of the vehicle, integrating them with other systems, such as ADAS and body control modules, requires fine-tuning. While systems become more complex, the risk of malfunction also rises, and hence, the costs of maintaining the systems also rise. This also makes aftermarket repairs more expensive, and with that, insurance premiums are affected. Businesses must concentrate on the creation of long-term solutions that have the ability to diagnose themselves when it comes to ownership costs. The challenge of achieving reliability at reasonable costs will remain critical for the long-term adoption across all vehicle classes.

- Regulatory and safety compliance pressures: Stringent safety measures around the world require higher safety standards to be followed in the design and functioning of liftgates. As part of efforts to increase the safety of power liftgate systems, NHTSA issued new guidelines for power liftgate safety standards in 2024. The requirements for obstacle detection, force limitations, and the ability to bypass them manually are also increasing. Regulation increases the cost of R&D and manufacturing, especially for automobiles in the lower margin categories. Inability to achieve the set standards may result in product recalls and harm to the company’s reputation. Modern car manufacturers are incorporating backup sensor sets and fail-safe mechanisms. This trend still affects innovation cycles and creates strategic manufacturing changes across the regions and countries.

Automotive Power Liftgate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 2.56 billion |

|

Forecast Year Market Size (2035) |

USD 6.34 billion |

|

Regional Scope |

|

Automotive Power Liftgate Market Segmentation:

Type (Passenger Cars, Commercial Vehicles)

By 2035, passenger cars segment is estimated to capture over 54% automotive power liftgate market share. Alfa Romeo launched the Tonale PHEV in February 2023 with the power liftgate feature, which underlines the car’s practicality alongside luxury. The increasing level of urbanization and the growing trend of families as car users also push for hatchbacks and SUVs with liftgates. Mid-sized SUVs, compact crossovers, and even premium sedans are incorporating hands-free systems. Auto manufacturers are now keen on developing specific features in their cars that will appeal to the younger generation of car users. From the customer’s perspective, the primary concerns include convenience, aesthetics, and smart access. These preferences clearly establish passenger cars as the most suitable segment for liftgates.

Propulsion (Gasoline, Diesel, Electric)

In automotive power liftgate market, gasoline segment is expected to capture over 51% revenue share by 2035, retaining a strong position while consumers shift towards electric vehicles. In March 2024, Toyota introduced the Crown Signia, with an optional power liftgate for conventional internal combustion customers. This explains why gasoline-powered SUVs and crossovers are still common in developed countries such as the U.S. and emerging markets. Auto makers are working to make ICE and EV lineups similar in terms of offering standard equipment, including liftgates. The composite and smart-powered liftgate technologies are especially useful for lightweight gasoline models. The transition to blended ICE platforms continues the liftgate integration trend. Passenger cars, particularly those running on gasoline, remain the primary source of significant liftgate demand.

Our in-depth analysis of the global automotive power liftgate market includes the following segments:

|

Type |

|

|

Propulsion |

|

|

Material Type |

|

|

System Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Power Liftgate Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in automotive power liftgate market is predicted to hold more than 35% revenue share by 2035, mainly owing to increasing sales of SUVs. In October 2023, Tata Motors launched the Harrier Facelift in the Indian market with a new power liftgate and other improvements. The growth of urbanization, economic development, and an increase in disposable income lead to increased demand for SUVs in the region. The rise in demand for smart convenience features is in line with the escalating middle-class standards. Liftgate is not limited to premium vehicles anymore, as OEMs are introducing them in mid-segment SUVs also. Further, a strong expansion of electric vehicles in China and India also strengthens the need for smart access technology.

China remains one of the leading automotive power liftgate market in Asia Pacific, which is driven by the high demand for EVs and SUVs. In July 2023, Volkswagen teamed up with ORNL and the University of Tennessee to produce lightweight liftgate SMC materials for the Atlas SUV. Chinese Original Equipment Manufacturers (OEMs) increasingly incorporate the electric power liftgates in new EV and SUV models. Government policies such as energy efficiency and vehicle electrification help to advance innovation. Liftgate features have become standard on premium and mid-range models as they offer added convenience to consumers. Factors such as increasing urbanization and premiumization of vehicles also contribute to the growth of the liftgate market in the near future. China’s leadership in EVs and smart vehicle technologies cements its market dominance.

The demand for automotive power liftgate market in India is on the rise due to premiumization and smart feature integration. In March 2023, MG launched the Hector facelift in India with a new update that included a power liftgate as a new addition. To be more specific, increasing concerns about the quality of life among the middle-income group lead to an increase in demand for higher utility functions. The demand for SUVs remains high owing to the need for more space, flexibility, and exciting driving experiences. Domestic OEMs and global players are standardizing liftgate solutions to fit with price-conscious markets. Urban mobility challenges lead to designing compact vehicles with rich functionality. Liftgate integration is seen to gain further traction with increasing consumer sophistication in India.

North America Market Analysis

North America automotive power liftgate market is projected to register significant growth over the forecast period. Toyota in February 2023 focused on the increased U.S. production of the Grand Highlander with an optional power liftgate to meet the growing automotive power liftgate market needs. High light truck ownership, luxury vehicle expectations, and electric vehicle adoption provide strong demand for liftgate integration. Automakers have recognized that smart access systems are important factors that can be used to set them apart from each other in increasingly competitive segments. The pressure exerted by the regulatory authorities for energy efficiency has made it easier for lightweighting to be adopted. Growth in the premium segments and increasing mobility within the urban areas also contribute to the increased demand for smart liftgates.

The U.S leads North America in automotive power liftgate adoption owing to consumers’ need for convenience and added utility. In March 2024, Ford adjusted the 2025 Escape models, eliminating standard liftgates to better define option groups. Flexibility in feature selection is a reflection of customer segmentation approaches. Larger vehicle sizes are more suitable for the powered rear access to facilitate the loading and offloading processes. An increase in the usage of EVs boosts smart body electronics integration. The stringency of the CAFE standards forces auto manufacturers to use lightweight liftgate materials. Regional automakers are increasingly targeting personalization, productivity, and voice and gesture control. The demand for automotive liftgates in the U.S. is driven by a combination of lifestyle and regulation factors.

The automotive power liftgate market in Canada is also steadily growing, attributed to the increase in urbanization, sales of SUVs, and the usefulness of the feature in cold climates. In April 2024, Buick launched the 2025 Enclave, which included hands-free power liftgates for the upper trim levels to appeal to customers in Canada. Seasonal factors that influence consumer perception of remote-access tailgate functions are also important to consider. Increase in premium vehicle sales drives liftgate integration in each segment. It is evident that safety, comfort, and fuel economy are the primary concerns of Canadians when purchasing a vehicle. The government incentives for hybrid and EV purchases drive the need for smart access systems. As SUVs become more popular, the long-term growth prospects for power liftgates in Canada are promising.

Key Automotive Power Liftgate Market Players:

- Aisin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hi-Lex Corporation

- Huf Hulsbeck & Furst GmbH & Co.

- Johnson Holdings Limited

- Tesla Inc.

- VOXX Electronics Corp.

- Strattec Security Corporation

- Magna International Inc.

- Stabilus GmbH

- Autoease Technology

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

The global automotive power liftgate market is highly competitive, with new technologies, materials, and cost management strategies being the key drivers. Some of the major market players are Huf Hulsbeck & Furst GmbH & Co., Johnson Holdings Limited, Magna International Inc., Stabilus GmbH, Tesla Inc., VOXX Electronics Corp., Strattec Security Corporation, Aisin Corporation, Autoease Technology, Brose Fahrzeugteile SE & Co. KG, Continental AG, and Hi-Lex Corporation. These companies focus on modularity, automation, and energy-efficient parts. OEM relationships and aftermarket growth are crucial for a company to gain dominance in the automotive power liftgate market. This makes competition intensity increase across regions.

In April 2024, Magna introduced its next-gen thermoplastic liftgate solutions, which are 20–30% lighter and are important for EV efficiency. This development is an attempt by Tier-1 suppliers to quickly adapt to changes in EV architectures through the provision of scalable liftgate modules. Collaboration between OEM and suppliers aims at improving durability, sustainability, and the overall user experience. Liftgate systems are also receiving attention as companies are investing in predictive diagnostics through the use of AI. The competitive forces will shift toward greater efficiency, lighter vehicles, and more integration of vehicles into systems.

Here are some leading players in the automotive power liftgate market:

Recent Developments

- In July 2024, Kia revealed the 2025 Seltos in the U.S., featuring refreshed styling, advanced technology, and available power liftgate options. The update enhances practicality and consumer appeal in the competitive compact SUV segment. Kia continues positioning Seltos as a versatile urban crossover with the latest refresh.

- In April 2024, Toyota announced pricing for the all-new 2025 4Runner, introducing improved off-road capability and upgraded features including a power liftgate. The model continues Toyota's legacy of rugged utility with modernized comfort, appealing to both off-road enthusiasts and daily drivers.

- Report ID: 7568

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Power Liftgate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.