Automotive Camera Market Outlook:

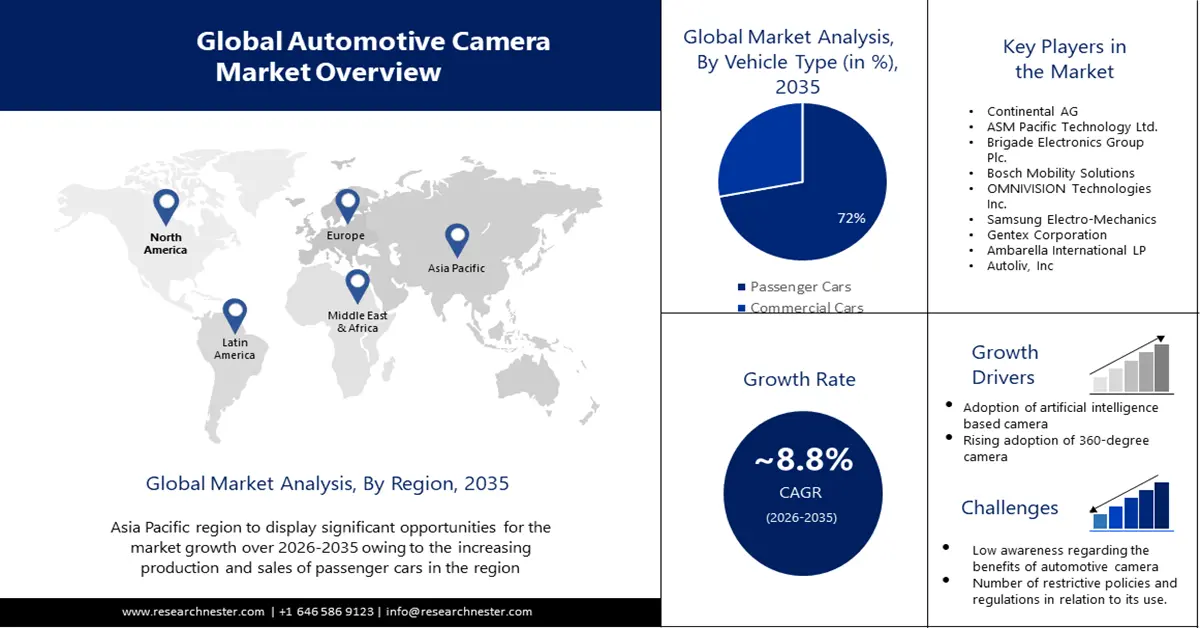

Automotive Camera Market size was over USD 10.17 billion in 2025 and is poised to exceed USD 23.64 billion by 2035, growing at over 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive camera is estimated at USD 10.98 billion.

The integration of advanced driver-assistance systems represents fundamental safety installations in modern vehicles. These technologies demand automotive cameras to monitor the vehicle environment in real-time and ensure accurate precision functions for security systems. The demand for ADAS camera is rapidly increasing as automaker and regulatory pressure is driving these components as critical building blocks for vehicle construction and market growth.

The ADAS camera sales are experiencing significant growth, accelerated by key industrial advancements. The companies leading camera-based safety innovations are maintaining their leadership by creating specialized products and following regulatory directions. For instance, in July 2023, Mobileye Global Inc. introduced the camera-based intelligent speed assist system to address new EU General Safety Regulation standards. The launch enables devices to detect speed limits automatically in new vehicle models without the need for third-party mapping services and GPS positioning information. The automotive cameras function as essential components for developing sophisticated ADAS features, driving the widespread adoption and ongoing development in the sector.

Key Automotive Camera Market Insights Summary:

Regional Highlights:

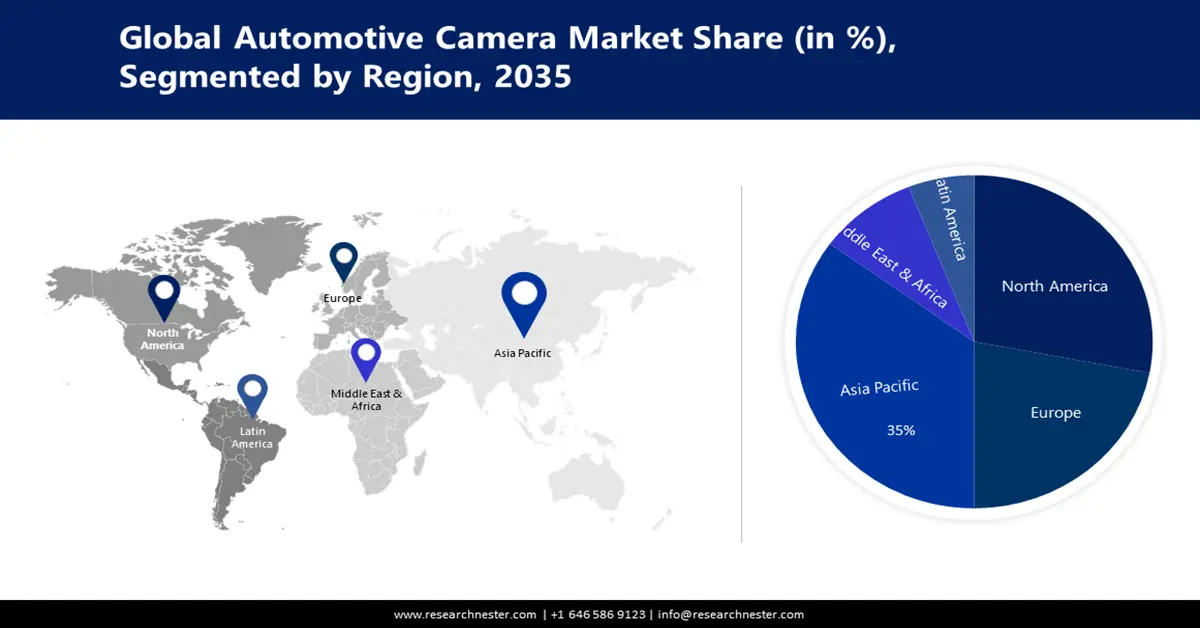

- Asia Pacific automotive camera market achieves a 35% share by 2035, attributed to rising demand for ADAS and regulatory mandates for road safety.

- North America market will secure 28% share by 2035, fueled by increasing regulatory standards and growing safety feature demand.

Segment Insights:

- The passenger cars segment in the automotive camera market is projected to hold a 72% share by 2035, fueled by government mandates for ADAS technologies in passenger vehicles.

- The stereo cameras segment in the automotive camera market is projected to achieve a 38% share by 2035, driven by integration of AI and ML for enhanced safety and recognition capabilities.

Key Growth Trends:

- Growth in electric and autonomous vehicles

- Demand for enhanced in-vehicle experiences

Major Challenges:

- Technical limitations

Key Players: Continental AG, ASM Pacific Technology Ltd., Brigade Electronics Group Plc., Bosch Mobility Solutions, OMNIVISION Technologies Inc., Samsung Electro-Mechanics, Gentex Corporation, Hyundai Mobis, Autoliv, Inc.

Global Automotive Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.17 billion

- 2026 Market Size: USD 10.98 billion

- Projected Market Size: USD 23.64 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Automotive Camera Market Growth Drivers and Challenges:

Growth Drivers

- Growth in electric and autonomous vehicles: The rising electric and autonomous vehicle output requires advanced camera-based vision systems to address market requirements. Autonomous driving systems need automotive cameras to function effectively by providing features such as 360-degree visibility and automatic lane keeping, and real-time obstacle detection systems. The required advancement of vehicle autonomy and electrification is making camera technology an essential base for this advancement.

Companies at the forefront of autonomous mobility systems are incorporating sophisticated vision solutions to address escalating needs for accurate performance and protective operations. For instance, in July 2023, Volkswagen launched an Austin, Texas-based test program using its all-electric ID model. This move demonstrates both future-oriented driverless capability implementation techniques and global smart mobility advancements through automotive cameras. Such partnerships are defining the upcoming generation of smart transportation systems. - Demand for enhanced in-vehicle experiences: Consumers are focusing on purchasing vehicles that possess modern features to improve their driving convenience, safety, and comfort. Automotive cameras are essential devices for the functionality of features such as parking assistance, blind-spot detection, and driver monitoring systems. These technologies align with the drivers’ requirement for their vehicles to function while providing enhanced safety assurance. The automotive sector is implementing modern camera-based systems in their designs as consumers are actively seeking in-vehicle convenience and safety awareness.

Companies are increasingly investing in camera technology innovations while forming strategic alliances to offer advanced vehicle features. Manufacturers are designing camera systems that give live feedback and help drivers while delivering their self-assurance and minimizing road dangers. For instance, in November 2023, Valeo manufactured a front camera system featuring Mobileye's EyeQ technology. Such modern production methods allow manufacturers to stay ahead in technology-based markets where user experiences define success while satisfying customer expectations.

Challenges

- Technical limitations: The automotive camera sales are facing hurdles due to technical problems. The functionality of cameras is reduced due to environmental elements, including fog, heavy rain, and snow, along with direct sunlight glare limits camera performance and visibility. The reliability of automotive camera systems suffers due to their limited functions in important situations, which affect autonomous driving systems that heavily depend on cameras. The challenges with camera visibility adversely affect their and autonomous vehicle technologies mass adoption, as users and regulatory bodies have difficulty trusting camera systems in diverse driving conditions.

Automotive Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 10.17 billion |

|

Forecast Year Market Size (2035) |

USD 23.64 billion |

|

Regional Scope |

|

Automotive Camera Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars segment is anticipated to hold 72% of the automotive camera market share during the forecast period. The implementation of passenger vehicle ADAS systems through government regulations is bolstering the segmental growth. Automotive cameras need implementation in vehicles to meet regulatory standards, including specific requirements from the European Union about Advanced Emergency Braking System (AEBS) and Lane Departure Warning (LDW) systems. Manufacturers are facing regulatory demands, which are pushing them to install improved camera technologies in their passenger vehicles. Automobile cameras are becoming more suitable for passenger vehicles as manufacturers are applying innovations in camera technologies.

New technological advancements in automotive cameras are providing enhanced visual clarity through increasing strong resolution and faster data processing results. Automobile safety receives benefits from high-resolution camera technology which assists in accurate detection of objects pedestrians and road signs thereby encouraging ADAS feature adoption for passenger vehicles.

Technology Segment Analysis

The stereo cameras segment is expected to capture 38% share of the automotive camera market through 2035. The integration of ML and AI functions into stereo camera systems is enhancing their reliability and performance. Companies are collaborating to create cameras enabled with artificial intelligence as it strengthens recognition capabilities and improves safety functions, including adaptive cruise control and autonomous emergency braking systems. For instance, in September 2023, AMD partnered with Hitachi Astemo to develop a stereo-format forward-facing camera working with AI technology for improved object detection and adaptive cruise control, and autonomous emergency braking system safety features. Such partnerships demonstrate how the industry uses AI to enhance stereo camera technologies and contribute to their sales growth.

Our in-depth analysis of the global automotive camera market includes the following segments:

|

Camera Type |

|

|

Vehicle Type

|

|

|

Technology |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Camera Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific automotive camera market is estimated to account for a share of over 35% by 2035. This growth is attributed to the accelerated adoption of advanced driver-assistance systems. China, and South Korea along with Japan are creating a rising demand for automotive cameras to improve their vehicle safety regulations. Auto manufacturers are integrating ADAS technologies through camera systems as these cameras enable lane-keeping assist and parking assistance along with collision avoidance features.

The market is experiencing increasing EV output, including intensive production in China, where it is considered to be the largest EV market globally. The expansion of electric and autonomous vehicles is creating a stronger requirement for upgraded camera systems as part of navigation solutions and driver assistance, and safety systems. The rising demand for commercial and EV vehicles is driving automotive manufacturers toward implementing more cameras for vehicles to address consumer expectations and regulatory standards.

Government-imposed stringent road safety regulations are augmenting the growth of the automotive camera market in China. The vehicle manufacturers are introducing ADAS with cameras as these systems enable collision detection, perform lane-keeping assist, and automatic emergency braking. Such regulations are compelling car manufacturers to use additional cameras as they allow them to meet compliance, thus creating new market opportunities. The automotive cameras are exhibiting high demand owing to rising public-private investments. The local manufacturers and tech companies are significantly investing in autonomous driving technologies to establish safe sensing and perception systems for vehicle operation.

North America Market Insights

The North America automotive camera market is set to hold 28% of the global revenue share between 2025 to 2035, due to the surging demand for enhanced safety features in vehicles. Automakers are increasingly embedding camera systems as consumers are emphasizing safety features, which enables them to implement advanced driver-assistance systems such as automatic emergency braking, along with lane departure warning and parking assist. The increasing public focus on road safety is transforming automotive cameras into essential safety components for new car sales and aftermarket solutions. The automotive cameras are gaining traction, with the requirement of additional safety features through mandates in the National Highway Traffic Safety Administration (NHTSA). Manufacturers are adopting camera systems to meet existing regulatory standards, which is positively influencing the overall market growth.

The demand for automotive cameras in the U.S. is projected to increase at a healthy pace during the forecast period, due to the rising demand for advanced systems. Safe driving demands and strict regulations are necessitating consumers to install advanced camera-based systems in vehicles. Automobile cameras are exhibiting wide applications due to their features, such as adaptive cruise control, automatic emergency braking, and lane departure warnings.

The rise in registrations of electric and autonomous vehicles is also accelerating the demand for automotive cameras. The essential safety functions, such as obstacle detection and environmental sensing, and 360-degree visibility, are fueling their applications in EVs and autonomous vehicles.

Automotive Camera Market Players:

- Magna International, Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- ASM Pacific Technology Ltd.

- Brigade Electronics Group Plc.

- Bosch Mobility Solutions

- OMNIVISION Technologies Inc.

- Samsung Electro-Mechanics

- Gentex Corporation

- Ambarella International LP

- Autoliv, Inc

The global automotive camera market is highly competitive, owing to the strong presence of leading companies. These players are focusing on technological innovations, such as stereo cameras, 360-degree vision systems, and AI-powered cameras, to enhance vehicle safety and autonomous driving capabilities. Strategic collaborations and partnerships are common, as seen with Mobileye's collaboration with Volkswagen for autonomous driving technology. The increasing adoption of ADAS features, government regulations on safety standards, and the growth of electric and autonomous vehicles are driving competition, pushing companies to invest heavily in research and development to stay ahead.

Here are some key players operating in the global market:

Recent Developments

- In September 2023, Mobileye and Valeo launched a partnership to deliver software-defined, best-in-class imaging radars for next-generation driver assist and automated driving features. Through this collaborative move, the companies are anticipated to boost their positions in the global landscape.

- In January 2023, ZF announced it had produced over 50 million automotive cameras. The company is the first supplier to manufacture more than 10 million cameras in a single year.

- Report ID: 3507

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.