Automated Optical Inspection Market Outlook:

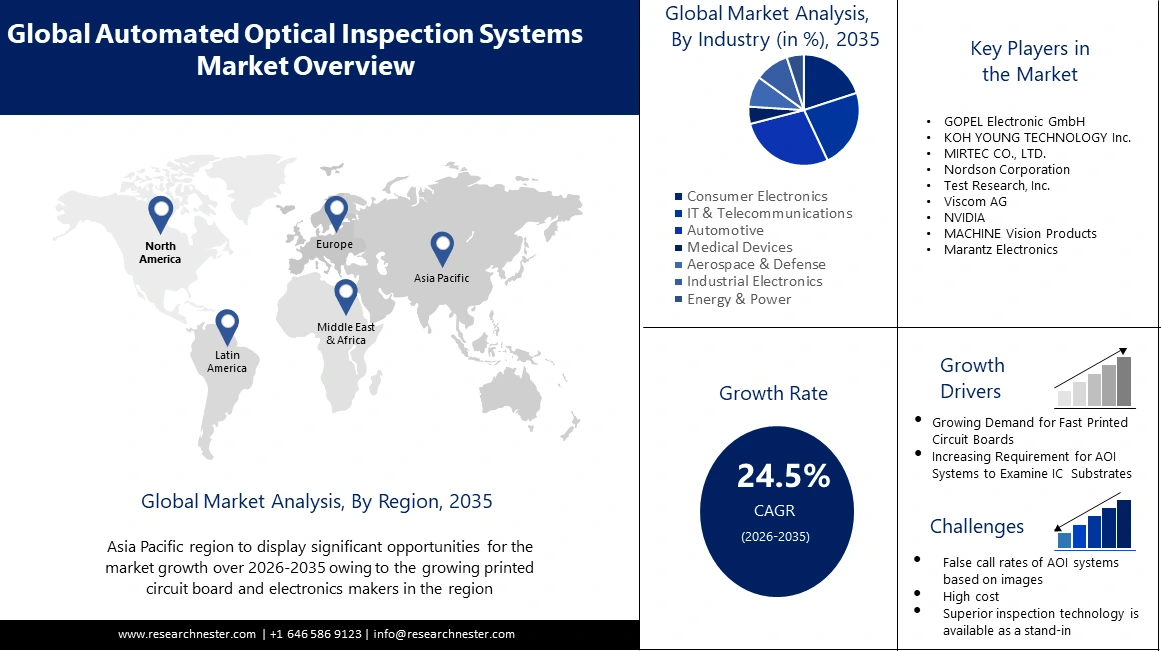

Automated Optical Inspection Market size was valued at USD 1.38 billion in 2025 and is likely to cross USD 12.35 billion by 2035, expanding at more than 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated optical inspection is assessed at USD 1.68 billion.

The growth of the market is due to industry 4.0 concepts being integrated, resulting in increased connectivity and data-driven insights in AOI. For instance, spending on the Internet of Things (IoT) in Europe surpassed USD 202 billion in 2021, according to the International Data Corporation's (IDC) Worldwide Semiannual Internet of Things Expenditure Guide. Through 2025, it is anticipated to rise at a double-digit rate. According to projections, the global annual generation of data is expected to surpass 180 trillion gigabytes by 2025. The industries that are enabled by IIoT will produce most of this.

In addition, AOI systems enable real-time error identification, guaranteeing the preservation of the product's quality. These systems can also give the operator feedback based on previous data and production statistics, which helps to streamline the manufacturing process and reduce expenses related to labor, supplies, and time. These factors should encourage market expansion and increase the use of AOI systems in the industrial sectors.

Key Automated Optical Inspection Market Insights Summary:

Regional Highlights:

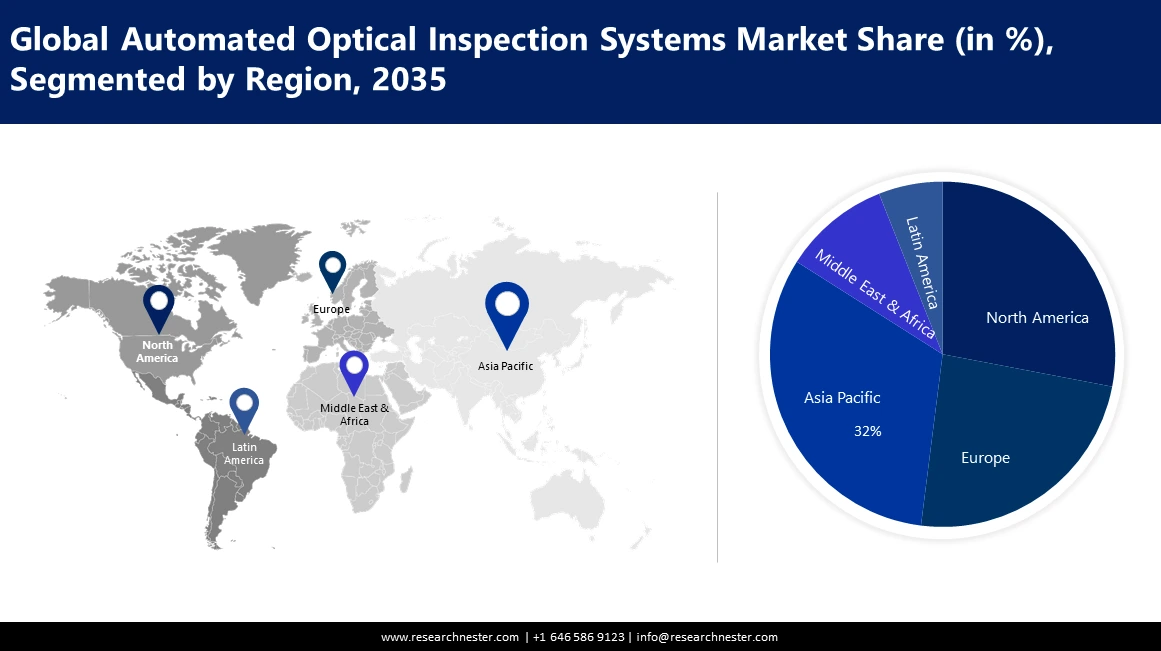

- Asia Pacific automated optical inspection market is expected to capture 32% share by 2035, driven by adoption of AOI systems and rising demand for cars and electronics.

- North America market will secure 28% share by 2035, driven by technical innovation and growing consumer demand for compact electronics.

Segment Insights:

- The inline aoi system segment in the automated optical inspection market is projected to achieve a 55% share by 2035, fueled by the efficiency of inline aoi systems in high-volume production of printed circuit boards.

- The automotive segment in the automated optical inspection market is anticipated to achieve a 28% share by 2035, driven by demand for advanced electronic components in vehicles, including ADAS and electric vehicle technologies.

Key Growth Trends:

- Growing Demand for Fast Printed Circuit Boards

- The Surging Process of Miniaturization of Printed Circuit Boards and Electrical Components

Major Challenges:

- Growing Demand for Fast Printed Circuit Boards

- The Surging Process of Miniaturization of Printed Circuit Boards and Electrical Components

Key Players: GOPEL Electronic GmbH, KOH YOUNG TECHNOLOGY Inc., MIRTEC CO., LTD., Nordson Corporation, Test Research, Inc., Viscom AG, NVIDIA, MACHINE Vision Products, Marantz Electronics.

Global Automated Optical Inspection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.38 billion

- 2026 Market Size: USD 1.68 billion

- Projected Market Size: USD 12.35 billion by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 16 September, 2025

Automated Optical Inspection Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Fast Printed Circuit Boards- The modern world demands that both people and technology move quickly because it moves so quickly. This anticipates things to become faster as time goes on, and electronics is no exception. The PCB technology will need to change for the gadgets to meet the increasing demand for speed in the form of flexible printed circuit board. Because they require more complexity during the design process, high-speed PCBs present a particular challenge for designers. On a high-speed PCB, the circuit layout has an impact on the signal integrity. Circuit boards (PCBs) are the fundamental components of almost everything electronic. Over 625 million square feet of printed circuit boards were produced in Taiwan in 2022. Taiwan was a significant manufacturer of electronic parts.

- The Surging Process of Miniaturization of Printed Circuit Boards and Electrical Components- Any product's manufacturing requires automated optical inspection equipment, but printed circuit boards and other small items require them even more. An automated optical inspection system uses image processing and artificial intelligence-based software to find defects in any manufactured good. Printed circuit boards with high-density interconnect (HDI), which are more detailed and densely packed with components, are gaining popularity. The usage of compact, portable structured devices has increased, which is the cause of this. Because it is challenging to perform human printed circuit board examinations, automated optical inspection are being employed more and more. The increasingly compact and intricate printed circuit boards are driving the development of automated optical inspection devices.

- Increasing Requirement for AOI Systems to Examine IC Substrates- The advent of nanotechnology has led to the reduction in size and application of high-density printed circuit boards in the electronics industry. However, a lot of issues are emerging as a result of these developments. Several PCB problems arise from the ball grid array (BGA) gap contracting in tandem with the PCB's diminishing size. Substrate corrosion, material mismatch, solder paste problems, and EMI interference susceptibility are a few of these flaws. A manual examination is not able to accurately identify these flaws. As a result, the need for using AOI devices to find IC substrate flaws is growing.

Challenges

- False call rate of AOI systems based on images- The number of functioning components that are discovered to be defective is known as the false call rate (FCR), and the false call rate is measured in parts-per-million (ppm). The most important consideration for image-based AOI systems is false calls. Several images are used by the image-based AOI system to distinguish between good and defective components. Nevertheless, the operator who takes these pictures and enters them into the database is primarily responsible for this system. It is occasionally possible for incorrectly identified photographs to be added to the image database, rendering parameter optimization unfeasible.

- Superior inspection technology is available as a stand-in which may impede the automated optical inspection market growth.

- Growth of the market may be hampered by maintaining cost-effectiveness in fiercely competitive markets.

Automated Optical Inspection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 1.38 billion |

|

Forecast Year Market Size (2035) |

USD 12.35 billion |

|

Regional Scope |

|

Automated Optical Inspection Market Segmentation:

Industry Segment Analysis

The automotive segment is anticipated to hold 28% share of the global automated optical inspection market during the forecast period. The segment’s growth is being driven by an increase in demand for robust and high-performing electronic components that improve vehicle safety. Furthermore, the automotive industry now needs more high-end electronics components due to the introduction of technologies like advanced driver assistance systems (ADAS) and anti-lock braking systems (ABS), as well as autonomous and electric vehicle technology. Because there are several large automakers in Germany, France, and Japan, these three nations are the front-runners when it comes to the adoption of AOI systems in the automotive industry. Approximately 85 million automobiles were produced globally in 2022. This amounts to a rise of almost six percent when compared to the prior year. In 2022, the top three countries producing cars and commercial vehicles were China, Japan, and Germany.

Technology Segment Analysis

The inline AOI system segment in the automated optical inspection market is expected to hold the largest revenue share of about 55% during the forecast period. This is explained by the systems' rapid inspection of a large number of manufactured printed circuit boards. Every step of the production process can benefit from the use of an inline AOI system, which makes it easier to thoroughly verify printed circuit board components for flaws and specifications. The inline technology reduces the need for human interaction to flip the printed circuit boards by scanning both sides of the boards. Because inline AOI systems can scan a large number of printed circuit boards quickly, they are well suited for high-volume production industries like automotive and electronics. In order to expedite the inspection process, the majority of manufacturing organizations equip their production lines with several inline AOI devices.

Our in-depth analysis of the global automated optical inspection market includes the following segments:

|

Component |

|

|

Application |

|

|

Type |

|

|

Technology |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Optical Inspection Market Regional Analysis:

APAC Market Insights

The automated optical inspection market in the Asia Pacific region is expected to hold the largest share of about 32% during the forecast period. The adoption of AOI systems is growing in the region as a means of guaranteeing high-precision inspection and flaw identification, which enhances production procedures and product quality. The AOI system market is set to grow, providing both local and foreign producers with profitable prospects as China maintains its position as the world's manufacturing leader. Additionally, growing disposable income has led to a rise in the demand for cars and consumer electronics in nations like China and India, which has fueled the demand for high-quality electronic components and fueled the market's expansion. China's passenger automobile sector produced over 23.8 million vehicles in 2022.

North American Market Insights

North America automated optical inspection market is projected to hold 28% of the revenue share by 2035. The growth of the region is due to increased technical innovation and breakthroughs in all of the region's manufacturing industries. Growing consumer desire for smartphones and other smaller, faster, and more compact electronics is another factor propelling this market in this region. With more than 310 million smartphone users as of 2023, the US has one of the largest smartphone markets in the world.

Automated Optical Inspection Market Players:

- CyberOptics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GOPEL Electronic GmbH

- KOH YOUNG TECHNOLOGY Inc.

- MIRTEC CO., LTD.

- Nordson Corporation

- Test Research, Inc.

- Viscom AG

- NVIDIA

- MACHINE Vision Products

- Marantz Electronics

Recent Developments

- NVIDIA announced that Techman Robot has Selected NVIDIA Isaac Sim to optimize automated optical inspection. Taiwan cobot innovator accelerates robotics-based inspection by 20% to improve electronics manufacturing product quality with Omniverse. NVIDIA showcased how leading electronics manufacturer Quanta are using AI-enabled robots to inspect the quality of its products. NVIDIA also announced that leading Taiwanese manufacturers, including Foxconn Industrial Internet, Pegatron, Quanta, and Wistron, are adopting NVIDIA Metropolis for Factories to tap into industrial automation to handle automated optical inspections.

- Viscom developed a new Heavy Flex handling solution to meet the need for flexible handling of large and heavy objects. Heavy Flex handling options are available for Viscom's S3016 ultra system for optical inline 3D inspection.

- Report ID: 5527

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Optical Inspection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.