Global Testing, Inspection and Certification (TIC) Market

- An Outline of the Global Testing, Inspection and Certification (TIC) Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation: How they would aid business?

- Recent Technological Advancements

- Root Cause Analysis (RCA) for discovering problems of the Testing, Inspection and Certification (TIC) Market

- Growth Outlook

- Risk Analysis

- Pricing Benchmarking

- SWOT

- Supply Chain

- Product Type Scenario

- Regional Demand

- Key End-User

- Patent Evaluation

- Key Developments

- Comparative Positioning

- Competitive Landscape: Key Players

- Competitive Model: A Detailed Inside View for Investors

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- Mistras Group Inc.

- SGS Societe Generale de Surveillance SA

- Bureau Veritas

- Dekra Certification B.V.

- Intertek Group plc

- Eurofins Scientific Group

- TUV SUD AG

- DNV GL

- UL LLC

- Applus+

- Global Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Region

- North America, Market Value (USD Million), and CAGR, 2024-2037F

- Europe, Market Value (USD Million), and CAGR, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), and CAGR, 2024-2037F

- Japan, Market Value (USD Million), and CAGR, 2024-2037F

- Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- Middle East and Africa, Market Value (USD Million), and CAGR, 2024-2037F

- By Service Type

- North America Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- North America Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- U.S., Market Value (USD Million), and CAGR, 2024-2037F

- Canada, Market Value (USD Million), and CAGR, 2024-2037F

- By Service Type

- Europe Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- UK, Market Value (USD Million), and CAGR, 2024-2037F

- Germany, Market Value (USD Million), and CAGR, 2024-2037F

- France, Market Value (USD Million), and CAGR, 2024-2037F

- Italy, Market Value (USD Million), and CAGR, 2024-2037F

- Spain, Market Value (USD Million), and CAGR, 2024-2037F

- Russia, Market Value (USD Million), and CAGR, 2024-2037F

- BENELUX, Market Value (USD Million), and CAGR, 2024-2037F

- Poland, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million), and CAGR, 2024-2037F

- By Service Type

- Asia Pacific Excluding Japan Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- China, Market Value (USD Million), and CAGR, 2024-2037F

- India, Market Value (USD Million), and CAGR, 2024-2037F

- South Korea, Market Value (USD Million), and CAGR, 2024-2037F

- Australia, Market Value (USD Million), and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million), and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million), and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million), and CAGR, 2024-2037F

- Thailand, Market Value (USD Million), and CAGR, 2024-2037F

- Singapore, Market Value (USD Million), and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of APEJ, Market Value (USD Million), and CAGR, 2024-2037F

- By Service Type

- Japan Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Service Type

- Latin America Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Latin America Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- Brazil, Market Value (USD Million), and CAGR, 2024-2037F

- Argentina, Market Value (USD Million), and CAGR, 2024-2037F

- Mexico, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- By Service Type

- Middle East & Africa Testing, Inspection and Certification (TIC) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Testing, Inspection and Certification (TIC) Market Segmentation Analysis (2024-2037)

- By Service Type

- Testing and Inspection, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Certification, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Source

- In-House, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Outsource, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By End user

- Consumer Goods & Retail, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Manufacturing, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Construction & Infrastructure, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Energy & Utilities, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Automotive, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Agriculture and Food, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Chemicals, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Oil & Gas, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Healthcare & Medical Sciences, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Israel, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Service Type

- Global Economic Outlook

- About Research Nester

Testing Inspection and Certification Market Outlook:

Testing Inspection and Certification Market size was valued at USD 36.09 billion in 2025 and is likely to cross USD 52.91 billion by 2035, expanding at more than 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of testing inspection and certification is assessed at USD 37.36 billion.

The testing, inspection, and certification (TIC) market is experiencing sustained expansion amid rising regulatory complexity, increased digitization, and growing demand for assurance in safety-critical sectors. TIC services are now becoming important enablers in infrastructure, consumer products, and energy systems as global industries focus on improved product reliability and system compliance. In October 2024, Element Materials Technology acquired ISS Inspection Services to strengthen its industrial testing portfolio across oil & gas and infrastructure sectors. By integrating ISS capabilities, companies aim to deliver deeper value across complex inspection projects. The shift is a sign of further concentration of TIC businesses on the international level and is indicative of the increasing trend towards greater focus on specialized services in the sector.

Digitalization and industry convergence are the two major trends that are revolutionizing the delivery of TIC services. Modern solutions and laboratory automation systems are essential to address compliance needs in newly emerging areas such as AI, renewable energy, and smart mobility. In June 2024, Element introduced RegNav, an artificial intelligence-based regulatory solution designed to help create safer and more effective medical devices. The tool optimizes compliance processes, enabling manufacturers to shorten the time it takes to bring their products to testing, inspection, and certification market. This is in line with the trends observed in the TIC industry where validation through AI, real-time analytics, and digital compliance are becoming the new normal.

Key Testing Inspection and Certification Market Insights Summary:

Regional Highlights:

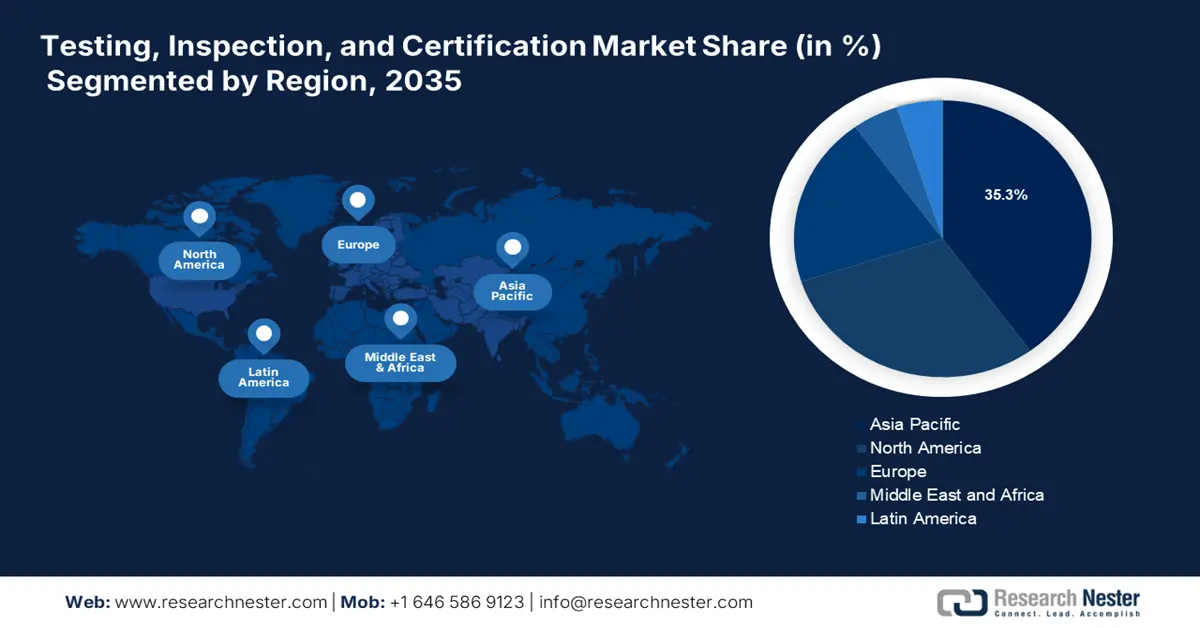

- Europe is projected to command over 35.3% share of the Testing, Inspection, and Certification Market by 2035, owing to rising compliance intensity and sustainability-focused regulatory alignment.

- Asia Pacific is anticipated to expand significantly through 2035, supported by accelerating manufacturing output and heightened export-control requirements.

Segment Insights:

- The Testing and Inspection segment is expected to secure around 73.9% share of the Testing, Inspection, and Certification Market by 2035, fueled by increasing safety assurance mandates and infrastructure quality needs.

- The In-house TIC Services segment is set to capture over 65.1% share by 2035, attributed to heightened internal quality assurance requirements in large-scale manufacturing environments.

Key Growth Trends:

- Global energy transition and infrastructure upgrades

- Digitization of assurance services and AI integration

Major Challenges:

- Fragmented standards and cross-border compliance complexity

- Talent shortage and specialized skills gap

Key Players: Mistras Group Inc., SGS Societe Generale de Surveillance SA, Bureau Veritas, Dekra Certification B.V., Intertek Group plc, Eurofins Scientific Group, TUV SUD AG, DNV GL, UL LLC, Applus+.

Global Testing Inspection and Certification Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.09 billion

- 2026 Market Size: USD 37.36 billion

- Projected Market Size: USD 52.91 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Testing Inspection and Certification Market Growth Drivers and Challenges:

Growth Drivers

-

Global energy transition and infrastructure upgrades: TIC services are gradually becoming popular as the world economy turns to green energy systems and enhanced infrastructures. Today, more and more governments and private sectors require TIC providers to ensure structural integrity, energy performance, and compliance with environmental standards. In January 2025, Kiwa PVEL and Kiwa PI Berlin published a white paper that aimed at outlining the standards of PV module quality to enhance the bankability of solar projects. The paper outlines rigorous testing benchmarks critical for performance assurance in renewable energy systems. Such development demonstrates how the TIC industry is aligning itself with global sustainability goals by offering testing frameworks that directly impact investment viability.

-

Digitization of assurance services and AI integration: The integration of AI and digital technologies is enhancing TIC capabilities across diagnostics, testing, and predictive maintenance. TIC firms are developing AI-based solutions to improve real-time compliance and enhance systems. In July 2024, Bureau Veritas acquired Security Innovation Inc. to expand its cybersecurity and software testing capabilities. This is also in line with testing, inspection, and certification market trends where TIC players are being called upon to provide more bundled solutions in the validation of security. Such acquisitions are evidence of the growing trend towards tech-oriented assurance solutions that protect digital environments.

- Surging food and consumer product compliance demand: The growth of TIC services in food and consumer sectors is due to increasing global trade and quality standards and consumer safety concerns. Regulatory tightening across geographies fuels localized testing needs and traceability systems. In March 2025, Merieux NutriSciences completed the acquisition of Bureau Veritas’ food testing activities across Japan, Morocco, Southeast Asia, and South Africa. The acquisition enables more localized testing capacity with globally harmonized quality standards. It supports the emerging trend of TIC services in food safety and emphasizes the importance of TIC suppliers in the supply chain.

Challenges

-

Fragmented standards and cross-border compliance complexity: The globalization of TIC business brings a major problem of managing the inconsistent national regulation of the industry. These varying regional certification requirements create obstacles to establishing unified testing protocols, leading to increased compliance costs for multinational clients. This fragmentation of the standards not only complicates the TIC processes but also makes it challenging for business entities to have a smooth flow of operations across the borders, which in turn may affect the efficiency and market entry of businesses operating in the global testing, inspection, and certification market.

-

Talent shortage and specialized skills gap: The rapid advancement of TIC applications, particularly in emerging fields like AI testing, battery validation, and renewable infrastructure, has created a demand for specialized skillsets. However, there is a notable scarcity of talent in areas such as inspection engineering and quality systems testing. This talent shortage is a risk factor for the growth of TIC services as it may hinder the industry’s capacity to satisfy the expanding needs of sectors that require skilled and knowledgeable professionals. Closing these skills gaps is therefore imperative to sustain the TIC sector growth and its ability to adapt to new technology and compliance demands.

Testing Inspection and Certification Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 36.09 billion |

|

Forecast Year Market Size (2035) |

USD 52.91 billion |

|

Regional Scope |

|

Testing Inspection and Certification Market Segmentation:

Service Type Segment Analysis

Testing and inspection segment is expected to account for around 73.9% testing, inspection, and certification market share by 2035, fueled by rising safety assurance mandates and infrastructure quality needs. These services act as the first line of defense in product lifecycle validation and compliance across different sectors. In March 2024, Warringtonfire announced the opening of the UK’s largest testing facility dedicated to structural fire safety evaluations. This expansion strengthens testing capacity for façade systems and construction material certifications. Such developments highlight increased regulatory requirements in the built environment sector.

With increasing global standards, testing, inspection, and certification (TIC) firms are increasing capacity to cater to demands in non-destructive testing and evaluation, performance evaluation and material authentication. These functions are useful in high risk areas of operation such as in the aviation, energy and construction industries. Testing and inspection services provide early risk detection and compliance transparency, making them essential to maintaining operational and safety benchmarks in both legacy and new-age industries.

Source Segment Analysis

By 2035, In-house TIC services segment is set to capture over 65.1% testing, inspection, and certification market share, due to internal quality assurance requirements in large-scale manufacturing and process industries. Companies prefer to build internal capacity for mission-critical testing where proprietary systems require customized protocols. In August 2023, Element Materials Technology announced an USD 8 million expansion of its Cincinnati facility to increase testing capacity. Such investment caters for demand in materials validation and compliance within aerospace and manufacturing industries.

In-house services also offer real-time testing benefits and quicker feedback cycles, reducing downtime and boosting process efficiency. As digital twins and AI monitoring become more prominent, internal TIC frameworks offer adaptable and data-based quality systems to companies. This is quite evident in regulated industries such as pharmaceuticals, defense, as well as electronics, where real time assurance and security are critical.

Our in-depth analysis of the global market includes the following segments:

|

Service Type |

|

|

Source |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Testing Inspection and Certification Market Regional Analysis:

Europe Market Insights

Europe in testing, inspection, and certification market is estimated to hold over 35.3% revenue share by the end of 2035, owing to compliance, sustainability requirements, and a well-developed industrial base. In April 2024, Bureau Veritas launched a 0.8% share buyback as part of Wendel’s accelerated placement for improving the shareholder value and enhancing TIC capacities. The decision is indicative of the company’s confidence in the future performance and its position in the testing, inspection, and certification market environment. This maintains capital efficiency while keeping the growth of core TIC services on track. The buyback is a part of a value creation plan that is aligned with the development of the TIC market in Europe, which is driven by digitalization and regulation.

France remains the largest exporter of automotive and aerospace TIC services, benefiting from domestic R&D capabilities and export-oriented production. In July 2024, Bureau Veritas acquired Security Innovation Inc. to expand its cybersecurity and software testing capabilities. The decision is consistent with the increasing need for bundled TIC solutions in cybersecurity assurance. This acquisition highlights the fact that France is garnering stable growth of innovation-driven TIC services due to the use of digital technologies and compliance to international standards.

Germany continues to be one of the most significant testing, inspection, and certification markets attributed to its focus on precision manufacturing and industry-leading engineering. It encompasses mechanical, automotive, and electrical certification. In early 2025, Certania secured growth capital from Summit Partners to accelerate its expansion across testing, inspection, and certification markets. The investment will fuel growth in laboratory services, digital tools, and international markets. Such announcements underline the development of the Germany TIC ecosystem and the investors’ optimism for innovation-driven TIC solutions in industrial and digital sectors.

Asia Pacific Market Insights

Asia Pacific region is poised to witness substantial growth through 2035, due to increased manufacturing activity and increasing emphasis on export control in manufacturing economies. Localized testing capacity and digitized inspection systems are shaping TIC market competitiveness. In June 2023, Element acquired South Korea–based NCT to enhance its battery testing operations in Asia. The acquisition enhances Element’s position in the rapidly growing energy storage testing, inspection, and certification market and addresses increasing regional demand for electrification assurance. Such development also emphasizes how acquisitions are enabling firms to localize technical infrastructure and scale responsiveness to region-specific testing requirements.

China remains a key TIC market due to electronics exports, infrastructure development, and technological advancement in digital products. For example, Acuren Corporation joined the OTCQX market in January 2025 to increase the availability of capital and enhance capital recognition. The move also aligns with its growth strategy across high-performance inspection segments. The coountry’s domestic testing, inspection, and certification (TIC) sector is also growing as local manufacturers focus on internal compliance systems due to the increasing stringencies of domestic and international regulatory requirements.

The TIC market in India is rising at a fast pace with the increasing industrial reforms and digital governance. In April 2024, the government of India introduced a new plan to encourage innovation and sustainability of the electronics industry to create an environment-friendly component system. This program is focused on decreasing the effects of the electronics manufacturing on the environment and promoting the usage of green practices in the industry. This decision underlines the importance of testing, inspection, and certification (TIC) services in supporting companies in assessing environmental and safety performance of supply chains. As India's manufacturing competitiveness rises, TIC firms are gaining traction in local certification, compliance testing, and export quality assurance.

Testing Inspection and Certification Market Players:

- Mistras Group Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGS Societe Generale de Surveillance SA

- Bureau Veritas

- Dekra Certification B.V.

- Intertek Group plc

- Eurofins Scientific Group

- TUV SUD AG

- DNV GL

- UL LLC

- Applus+

The testing, inspection, and certification (TIC) market remains highly saturated and is characterized by the increase of inorganic growth strategies and digital integration among international participants. Some of the prominent players in this testing, inspection, and certification market include Mistras Group Inc., Intertek Group plc, Eurofins Scientific Group, SGS Societe Generale de Surveillance SA, Bureau Veritas, DEKRA Certification B.V., TUV SUD AG, DNV GL, UL LLC, and Applus+. These firms are at the forefront of offering diverse services, geographic coverage, and AI-based compliance services for various industries.

The competitive landscape is increasingly shaped by the integration of smart testing tools, specialized lab services, and industry-specific validation protocols. In October 2024, Applus+ formed a partnership with Four Hills Group, a provider of equipment and workforce hire services to Western Australia civil, mining, and construction sectors. The collaboration is designed to expand advanced testing and inspection services across Australia. It also aims to create employment opportunities, supporting both Indigenous and non-Indigenous individuals in building sustainable careers within the testing and inspection segment of the construction and mining industries.

Here are some leading companies in the testing, inspection, and certification market:

Recent Developments

- In January 2025, Astorg launched a EUR 1 billion+ continuation fund dedicated to TIC sector assets, reflecting investor confidence in long-term TIC value. The fund aims to support portfolio growth through acquisitions and digital transformation. It underscores rising institutional focus on compliance-oriented industries. TIC is increasingly viewed as a high-return, resilient sector.

- In January 2025, TUV SUD established an AI procurement qualification platform in Singapore to evaluate and certify artificial intelligence solutions. The platform sets testing protocols for AI functionality, transparency, and safety standards. It demonstrates the TIC sector’s proactive adaptation to AI-driven industry requirements. This initiative positions TUV SUD at the forefront of AI assurance.

- In April 2024, UL Solutions filed terms for a USD 770 million IPO to scale its product assessment and sustainability certification services. The capital raise will support technology upgrades, lab infrastructure, and ESG-driven testing solutions. It signals UL’s intent to strengthen leadership in the global TIC industry. The IPO highlights rising investor interest in compliance innovation.

- Report ID: 4738

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Testing Inspection and Certification Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.