Auto Dimming Mirror Market Outlook:

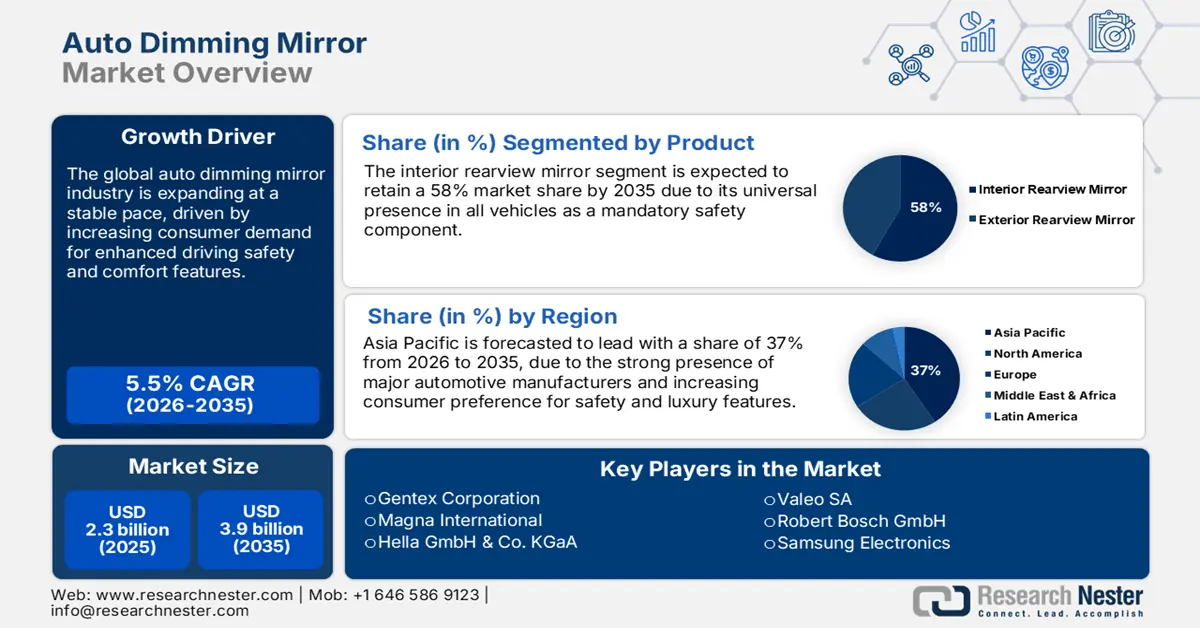

Auto Dimming Mirror Market size is valued at USD 2.3 billion in 2025 and is projected to reach a valuation of USD 3.9 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of auto dimming mirror is assessed at USD 2.4 billion.

The global auto-dimming mirror industry is expanding with increasing consumer interest in high-end safety features and driver assistance technologies for enhancing nighttime driving comfort and visibility. Government regulations and regulatory regimes are creating favorable frameworks for cutting-edge automotive safety technologies, such as advanced mirror technologies, which enhance overall car safety ratings and compliance levels. For example, in November 2024, the NHTSA finalized its decision to include four new ADAS technologies, including blind spot warning and intervention systems, in the New Car Assessment Program, adopting a 10-year master plan from 2024-2033 with implementation starting with the 2026 model year. This regulatory action creates integration of advanced safety technologies that augment mirror-based visibility systems, creating long-term demand for high-end auto-dimming solutions.

Market potential is driven by convergence in technology as traditional mirrors are evolving into sophisticated integrated systems that combine electrochromic dimming with digital display and driver monitoring capabilities. The trend is evident in reports like Gentex Corporation, which reached $579.0 million in core revenue in the second quarter of 2025, a 1% quarter-over-quarter growth, which highlights the growth potential and resilience of the specialized automotive product segment. Integration of smart glass technologies and real-time environment adaptation features highlights auto-dimming mirrors as focal components in modern vehicle safety architectures.

Key Auto Dimming Mirror Market Insights Summary:

Regional Highlights:

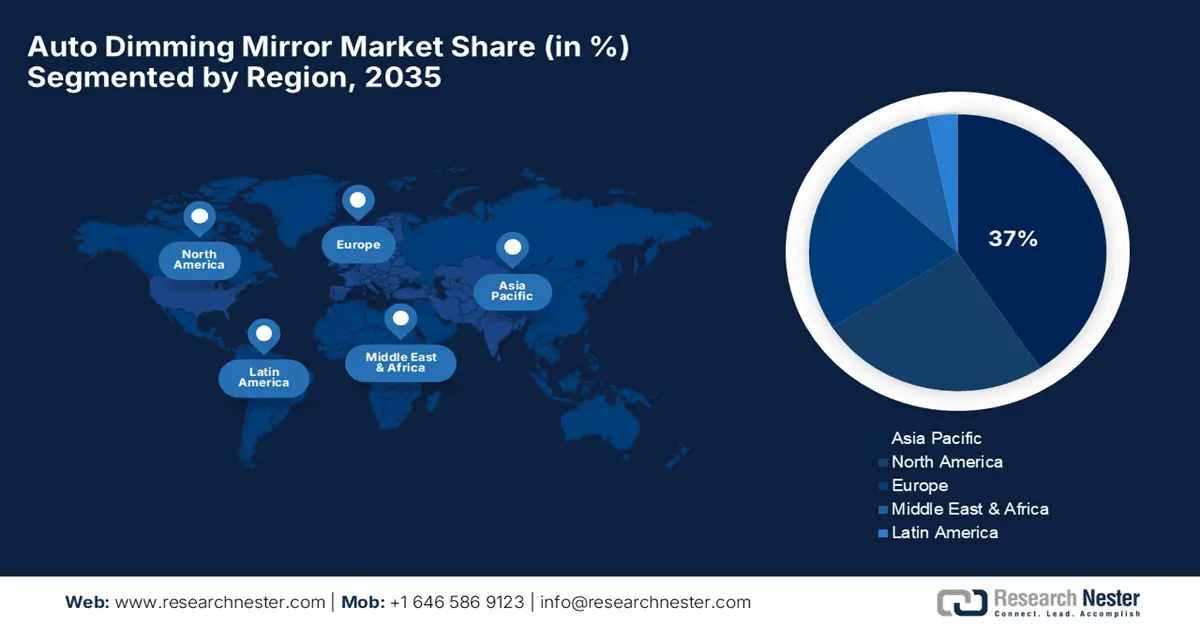

- Asia Pacific is set to command a 44.6% share by 2035 in the auto dimming mirror market, supported by expanding vehicle production and rising adoption of in-cabin safety technologies.

- North America is anticipated to record an 8% CAGR from 2026–2035, sustained by strong demand for premium automotive features and stringent regional safety regulations.

Segment Insights:

- Interior rearview mirror segment is projected to retain a 58% share by 2035, bolstered by its essential contribution to driver safety and increasing integration of advanced cabin technologies.

- OEM segment is expected to secure an 85% share by 2035, underpinned by the automotive industry's inclination toward factory-installed advanced systems requiring specialized integration.

Key Growth Trends:

- Growing integration of sophisticated driver monitoring systems

- Facilitating rapid adoption of digital vision technologies

Major Challenges:

- Requirements for integration with upcoming display technologies

- Regulatory complexity of compliance in international markets

Key Players: Magna International, Ficosa International, Hella GmbH & Co. KGaA, Valeo SA, Robert Bosch GmbH, Samsung Electronics, Tata AutoComp Systems, Proton Holdings, Britax PMG.

Global Auto Dimming Mirror Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 5 September, 2025

Auto Dimming Mirror Market - Growth Drivers and Challenges

Growth Drivers

- Growing integration of sophisticated driver monitoring systems: The automotive sector is experiencing unprecedented integration of driver monitoring systems into auto dimming mirrors, converting passive visibility components into active safety monitoring platforms with the ability to detect and counteract driver distraction and driver fatigue. This technology integration is adding tremendous value by merging conventional mirror functionality with sophisticated biometric monitoring capability through embedded cameras and infrared sensors.

|

Supplier / Company |

Integration & Capabilities |

|

Gentex Corporation |

Showcased mirror-integrated DMS and in-cabin monitoring systems at CES 2025 and IAA Mobility 2023. Tracks driver head pose, eye gaze, distraction, drowsiness, sickness, and readiness for manual control. Scalable to 2D/3D cabin monitoring and object detection. |

|

Magna International |

Developed a mirror-integrated driver and occupant monitoring system using ADAS cameras in the interior mirror. Detects distraction, predicts driver behavior; scalable to features like child presence detection, seat belt detection, video conferencing, and facial recognition. |

|

Seeing Machines / Partners |

Collaborated with Magna to integrate its DMS into rearview mirrors. Their advanced algorithms enable deeper HMI functionality, including gaze detection, augmented reality overlays, and smart interactions. |

Source: Gentex Corporation, Magna

- Facilitating rapid adoption of digital vision technologies: The market is going through a rapid transformation with the use of digital vision systems that replace traditional mirrors with camera-monitor pairs, offering enhanced visibility, aerodynamic benefit, and vehicle information system compatibility. The new systems remove inherent limitations of traditional mirrors while allowing extended functionality through digital processing and display technologies. For instance, Continental Automotive launched its ProViu Mirror system as an off-the-shelf commercial vehicle solution in September 2024, which features the industry's first one-camera system to be ASIL B functional safety certified. The modular system offers class II and IV wing mirror equivalent visual range while eliminating traditional shortcomings such as restricted view, blind spots, and poor aerodynamics.

- Premium vehicle segment growth and feature multiplication: The growing premium car segment is opening doors for mass adoption of auto-dimming mirrors as a standard feature, with manufacturers increasingly marketing these systems as comfort and safety features and not as optional luxury features. This growth is due to consumers' willingness to pay a premium for improved driving experiences and safety technology. In August 2023, Mahindra XUV400 EV launched eight new safety and convenience features on its flagship EL variant, including an auto-dimming internal rearview mirror and other advanced technologies. The addition made the XUV.400 EV is an improved product compared to the competition, marking an increasing adoption of auto-dimming technology in electric vehicles. The price has been increased by Rs 20,000 to reflect these premium features.

Challenges

- Requirements for integration with upcoming display technologies: The auto-dimming mirror industry faces legitimate technical issues in integrating electrochromic technologies with advanced OLED and flexible display technologies, which require sophisticated engineering solutions for the preservation of optical functionality. Such integration issues include extended development time and expenses, as well as the need for specialized technology expertise in multiple areas of technology. In January 2025, Samsung Display introduced new innovative automotive OLED display technologies at CES 2025, offering solutions that can be easily integrated into mirror systems, such as Under Panel Camera technology and bendable displays. Samsung shipped 1.64 million automotive OLED displays in 2024, a 273% increase from 600,000 units shipped in 2023, showing the explosive growth that requires complex integration solutions.

- Regulatory complexity of compliance in international markets: Auto dimming mirror producers face increasingly sophisticated regulatory landscapes with varying safety standards, testing, and certification procedures in each geographic market, leading to high compliance costs and market entry barriers. These regulatory issues are further exacerbated by changing standards to which new technologies must be re-engineered to retain safety effectiveness. In 2024, India's Ministry of Heavy Industries released the National Automotive Policy draft, proposing ambitious plans such as the Bharat New Vehicle Safety Assessment Program that demands higher safety standards for mirror systems. The policy addresses the Voluntary Vehicle Modernization Program to replace older cars with cleaner, technology-based substitutes with advanced safety features, which mirror the sophisticated regulatory landscape producers must contend with.

Auto Dimming Mirror Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

Auto Dimming Mirror Market Segmentation:

Product Segment Analysis

The interior rearview mirror segment is expected to retain a 58% market share throughout the forecast period on account of its pivotal role in the safety of drivers and growing incorporation of advanced technology within the cabin space. The segment is supported by regulatory needs and consumer requirements for better nighttime visibility, and interior auto-dimming mirrors consequently become a priority upgrade for OEMs and aftermarket buyers alike.

The segment growth is supported by technological developments that go beyond the fundamental dimming function. In October 2024, Ambilight Inc. showcased its black-gray electrochromic dimming product line at glasstec 2024, including solid-state EC auto-dimming rearview mirror systems featuring industry-leading light blocking. This revolutionary innovation provides smart light management and temperature control while greatly improving driving comfort through real-time environmental adaptation.

Distribution Channel Segment Analysis

The OEM segment is projected to hold 85% auto dimming mirror market share by 2035, indicating the trend of the automotive sector toward bundled safety systems and manufacturers' inclination toward factory installation of advanced technologies with warranty benefits and assurance of optimum performance. OEM dominance is a result of the technical complexity of auto-dimming mirror installation and calibration, which necessitates specialized knowledge and integration into automotive electrical systems. The trend is indicated through common technology alliances facilitating hassle-free integration of advanced mirror systems into vehicle production processes.

In July 2025, Gentex Corporation finalized the acquisition of VOXX International Corporation, expanding from traditional auto-dimming mirrors to consumer electronics while registering $78.8 million in Q2 2025 revenue and delivering a substantial gross margin improvement of 240 basis points to 35.3%. The OEM segment's market leadership is complemented by automotive manufacturers' growing emphasis on comprehensive safety packages and premium feature integration that makes auto-dimming mirrors a necessity rather than an optional feature.

Vehicle Segment Analysis

The passenger cars segment is expected to lead the market with a robust 68% auto dimming mirror market share until 2035, driven by the massive global production volume and increasing consumers' demand for premium safety and comfort features across all vehicle price segments. The segment is fueled by technological trickle-down effects where features initially associated with luxury vehicles become standard on mass-market passenger cars. The growth of the segment is supported by efforts by automobile manufacturers to differentiate their products with innovative safety solutions. In January 2023, Magna International launched production of its Clearview vision technology on Ram 2500 and 3500 Heavy Duty trucks. This technology fuses camera and mirror technology to reduce blind spot accidents by enabling flexible mirror movement with a zoom function and variable brightness for varying driving conditions.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Technology |

|

|

Vehicle |

|

|

Propulsion |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Auto Dimming Mirror Market - Regional Analysis

APAC Market Insights

Asia Pacific region is set to dominate around 44.6% market share by 2035, driven by increasing vehicle production and safety feature demand. The region has huge automotive production volumes, growing premium vehicle segments, and strong domestic manufacturing capacity supporting both local consumption and global export potential. APAC is the largest automotive market globally, with huge growth potential driven by urbanization and increasing safety awareness among consumers.

China auto dimming mirror market is being transformed by broad-based government initiatives encouraging autonomous vehicle development and advanced automotive safety technologies through massive infrastructure investment and regulatory support. China's government policy framework for automotive technology development offers huge opportunities for advanced mirror systems. In 2024, the government selected 20 cities for inclusion in a broad-based pilot program building roadside infrastructure and cloud-based control platforms for intelligent connected vehicles, thus accelerating nationwide autonomous vehicle development programs by huge margins.

India auto dimming mirror market is a fast-expanding opportunity fueled by rising automotive production, surging consumer demand for the luxury safety feature, and extensive government policies supporting the growth and production of advanced automotive technology. Domestic policy support for Indian manufacturing and technology development is robust in India’s auto industry. The Ministry of Heavy Industries continued to implement the Production Linked Incentive Scheme for Automobile and Auto Components with a budget of USD 2.59 billion in 2023 to promote Zero Emission Vehicles and Advanced Automotive Technology products. It enables the deep localization of AAT products, including advanced mirror systems with the capability to build domestic and international automotive supply chains, enabling India's shift toward sustainable mobility.

North America Market Insights

North America auto dimming mirror market is expected to register a robust CAGR of 8% during the forecast period, driven by demand for premium automotive technologies, stringent safety norms, and automotive leadership and manufacturing excellence at the regional level. The market is sustained by mature automotive supply chains, premium R&D capabilities, and customer willingness to pay a premium for comfort and safety technologies to enhance the driving experience. The automobile companies in the region are increasingly installing auto-dimming mirrors as standard equipment for cars, rather than optional equipment, driving mass market penetration for a broad set of vehicle classes.

The U.S. market offers several potential opportunities, with innovative automotive safety regulations and consumer demands for advanced driver assistance technologies that interface synergistically with conventional mirror systems. The regulatory environment encourages integration of holistic safety systems that improve overall vehicle safety ratings. In November 2024, NHTSA completed its decision to include four new ADAS technologies, such as blind spot warning and intervention systems, in the New Car Assessment Program, outlining a full 10-year plan from 2024-2033 and implementation starting with the 2026 model year. This regulation encourages integration of advanced safety technologies that interface synergistically with mirror-based visibility systems.

Canada auto dimming mirror industry is supported by rigorous automotive safety regulations and extensive regulatory supervision that ensures high-quality automotive products and allows the industry to upgrade to newer safety technologies and environmentally friendly mobility solutions. The government has ongoing oversight through regular manufacturer audits and safety conformity initiatives. Transport Canada in 2024 continued to implement stricter vehicle safety regulations through extensive inspection schemes and manufacturer audits to ensure automotive products meet rigorous safety standards. Moreover, the department has ongoing supervision through regular audits of manufacturers and importers to ensure safety recall compliance and effective implementation of mandatory testing procedures.

Europe Market Insights

Europe is projected to see significant growth from 2026 to 2035, driven by the high standards of automotive safety in the continent, premium car production excellence, and consumer demand for the embedding of advanced technologies that enhance safety and environmental performance. European automakers are leaders in the development of advanced mirror systems that combine traditional functions with digital technology to provide full vision solutions for future cars. The industry is underpinned by strong research and development capabilities, advanced manufacturing facilities, and regulatory frameworks that encourage innovation in a manner that underpins safety and quality standards.

The UK market is dominated by advanced automotive engineering skills and strong premium automotive technology demand for safety and performance enhancements in broad vehicle applications. British automotive part suppliers and vehicle manufacturers are designing innovative mirror systems that are part of broader vehicle intelligence platforms. A significant development emerged in August 2025, when Tata AutoComp Systems announced it was buying 100% of the Slovakian operations of IAC Group through its UK subsidiary, with a target of IAC Slovakia's Lozorno plant specializing in producing interior and exterior automotive components like mirror systems for leading automakers like Jaguar Land Rover and Volkswagen.

Germany auto dimming mirror market is underpinned by the country’s dominance in the automotive technology space and focus on creating end-to-end mobility solutions to meet safety as well as environmental sustainability needs. German automakers and suppliers are leading the way in combining innovative display technologies with conventional mirror systems. Germany introduced the Mobility Data Law that will aid multimodal travel by facilitating data exchange and networking across modes of transport, including automotive systems. The Federal Ministry of Digitalization and Transport introduced this bill to end current fragmentation in transport data systems while ensuring interoperability in Europe and lowering barriers to data usage by providing transparent rules for automotive firms and technology providers.

Key Auto Dimming Mirror Market Players:

- Gentex Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Magna International

- Ficosa International

- Hella GmbH & Co. KGaA

- Valeo SA

- Robert Bosch GmbH

- Samsung Electronics

- Tata AutoComp Systems

- Proton Holdings

- Britax PMG

The auto dimming mirror industry is competitive with several specialist auto parts suppliers, established auto parts manufacturers, and technology companies leveraging their expertise in optics, electronics, and advanced materials to create sophisticated mirror systems. Market leaders such as Gentex Corporation, Magna International, Ficosa International, and Valeo SA dominate the market with their exhaustive product ranges, strong OEM ties, and relentless research and development of electrochromic technologies and digital integration capability. They face competition from leading auto suppliers such as Robert Bosch GmbH, Samsung Electronics, and Tata AutoComp Systems in a highly dynamic market scenario that encourages technological innovation and market expansion.

The sector is experiencing massive consolidation and strategic growth as firms strive to increase their technological strengths and global market scope through partnerships and acquisitions. Strategic alliances allow firms to diversify product lines and geographic scope and utilize synergies in manufacturing and technology development. In July 2023, Tata AutoComp Systems inked a Memorandum of Understanding with Punch Powertrain to form a 50/50 joint venture dedicated to sustainable mobility solutions and future automotive technologies for the Indian market. The partnership builds on Tata AutoComp's strengths in automotive component manufacturing, like mirror systems, while adding depth in powertrain technologies and sustainable transport solutions, illustrating how strategic partnerships are enabling firms to build integrated automotive technology profiles.

Here are some leading companies in the auto dimming mirror market:

Recent Developments

- In April 2025, Valeo SA announced a strategic partnership with Appotronics to develop next-generation front lighting systems utilizing innovative laser video projection technology. While focused primarily on lighting, this collaboration enhances adaptive lighting (ADB) functionalities that complement auto-dimming mirror systems for improved road safety.

- In January 2025, Gentex Corporation reported record Full Display Mirror (FDM) unit shipments of 2.96 million for calendar year 2024, representing a 21% increase compared to 2023. The company achieved net sales of $2.31 billion, a new annual sales record, while maintaining its leadership position in auto-dimming mirror technology.

- Report ID: 4959

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Auto Dimming Mirror Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.