Audience Intelligence Platform Market Outlook:

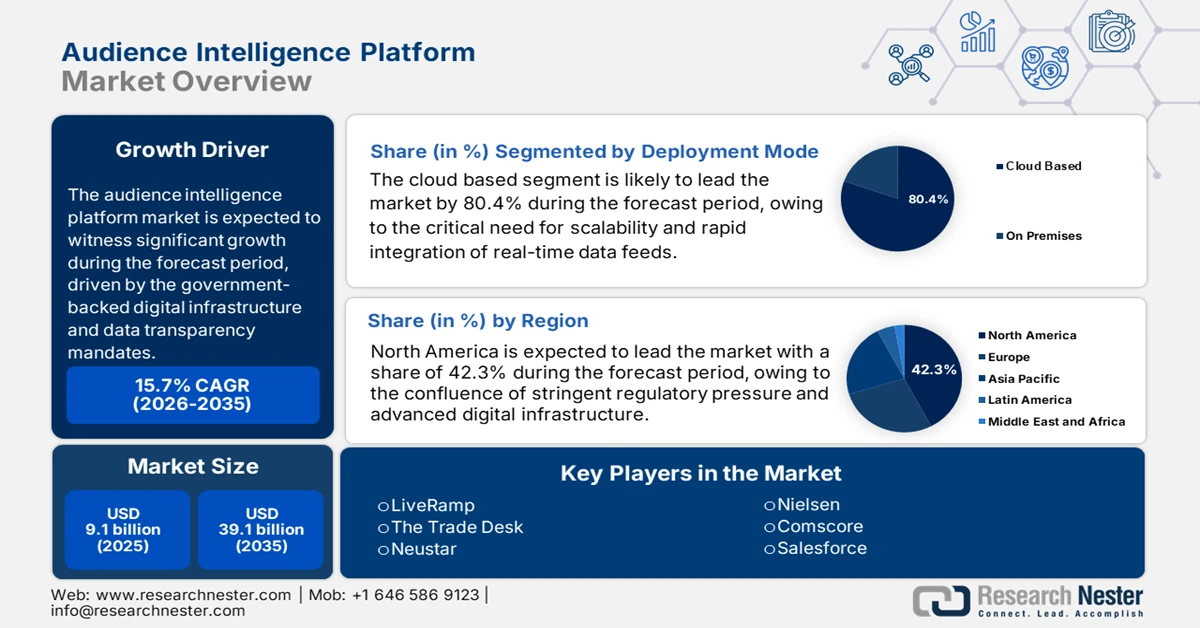

Audience Intelligence Platform Market size was valued at USD 9.1 billion in 2025 and is projected to reach USD 39.1 billion by the end of 2035, rising at a CAGR of 15.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of audience intelligence platform is evaluated at USD 10.5 billion.

The demand for the audience intelligence platform market is being shaped by the rapid expansion of government-backed digital infrastructure, data transparency mandates, and the scale of public sector data generation. According to the U.S. Census Bureau report in June 2024, 90% of U.S. households had internet access in 2021, creating a consistently expanding digital engagement base that enterprises must interpret and segment effectively for customer acquisition and retention strategies. At the same time, the AI adoption is stimulating investment in the USD 215 billion data center market, as per the IEEE Communications Society Technology report in September 2024, strengthening the infrastructure backbone for advanced analytics and AI-driven platforms. This expansion directly supports the scalability of audience intelligence systems that rely on high-performance computing to process large volumes of behavioral data.

As enterprises shift toward real-time personalization and predictive engagement, the demand for the low latency, secure data environments continue to rise. Together, these trends reinforce the structural link between data center growth and the expanding adoption of audience intelligence platforms. The public sector communication programs are further surging the enterprise adoption of the audience intelligence platforms market. The GAO report in December 2023 shows that in 2024, nearly 26 agencies in the U.S. have planned to spend nearly USD 95 billion on IT services, a part of USD 21 billion was allocated for new digital development and modernization services, including citizen engagement, analytics campaign measurement, and behavioral data integration. These investments are influencing the private sector benchmarks for audience measurement, mainly in regulated industries such as healthcare, utilities, and financial services that mirror government standards for data governance.

Key Audience Intelligence Platform Market Insights Summary:

Regional Highlights:

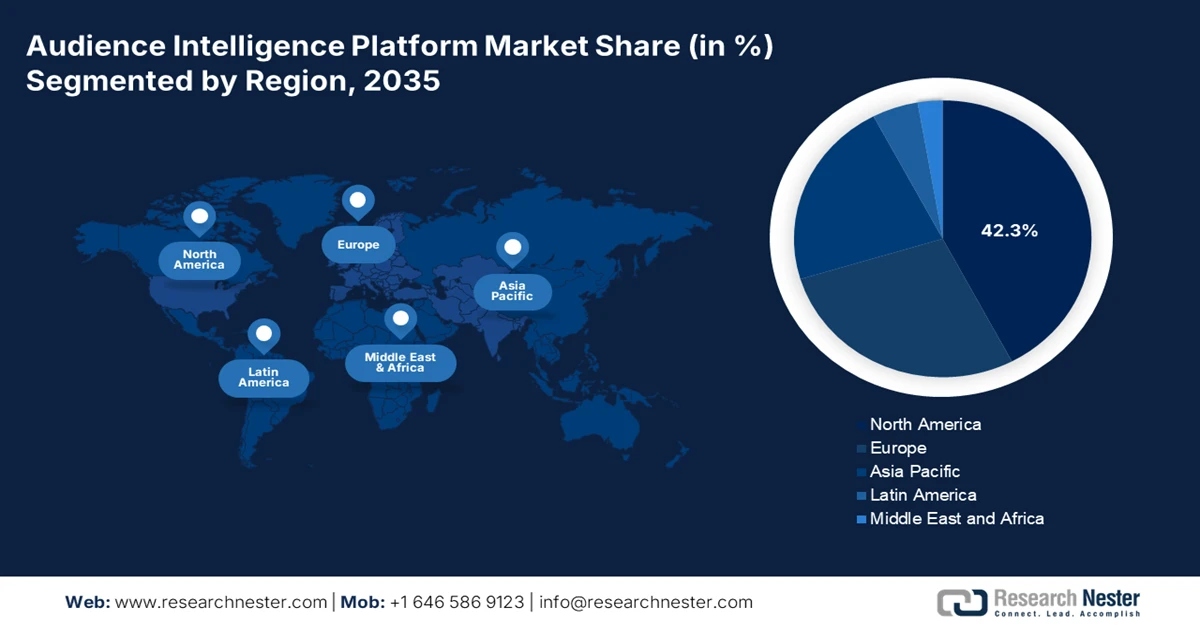

- North America is projected to hold 42.3% revenue share by 2035 in the audience intelligence platform market, driven by stringent data privacy regulations, advanced digital infrastructure, and substantial investment in AI and cloud technologies

- Asia Pacific is expected to register a CAGR of 13.8% during 2026–2035, reflecting rapid digital adoption, e-commerce expansion, and the growing need for cross-channel consumer insights in large-scale markets like India and China

Segment Insights:

- Cloud-Based Deployment Segment in the audience intelligence platform market is projected to hold 80.4% share by 2035, driven by the demand for scalable, cost-efficient, and rapidly integrable solutions, reinforced by government modernization initiatives and widespread enterprise cloud adoption

- Software/Solutions Component Segment is expected to command the largest revenue share, reflecting the critical role of AI-driven analytics, identity resolution, and audience segmentation in navigating complex data ecosystems under stringent privacy regulations

Key Growth Trends:

- Public sector digital transformation and data driven governance

- Rise of AI and ML accessibility

Major Challenges:

- High data acquisition and integration costs

- Technical complexity and AI/ML talent shortage

Key Players: LiveRamp (U.S.), The Trade Desk (U.S.), Neustar (U.S.), Nielsen (U.S.), Comscore (U.S.), Salesforce (U.S.), Oracle (U.S.), Adobe (U.S.), Lotame (U.S.), Audigent (U.S.), Quantcast (U.S.), IPONWEB (UK), Germinait (UK), AudienceProject (Denmark), Zeotap (Germany), Fujitsu (Japan), Near (India), Seoul Robotics (South Korea), Hypersonix (Australia), Antsomi (Malaysia)

Global Audience Intelligence Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.1 billion

- 2026 Market Size: USD 10.5 billion

- Projected Market Size: USD 39.1 billion by 2035

- Growth Forecasts: 15.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% revenue share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 20 January, 2026

Audience Intelligence Platform Market - Growth Drivers and Challenges

Growth Drivers

- Public sector digital transformation and data driven governance: The government spending on the digital infrastructure directly fuels the adjacent private sector technology demand. Significant investment in the national and AI strategies creates an advanced ecosystem. A key example is the report from the EU4Digital in February 2024, indicating that the European Commission’s Digital Europe Programme, with a budget of 7.5 billion euros for 2021 to 2027 focusing on building data spaces and advancing AI. This public investment in data interoperability and trust elevates the overall audience intelligence platform market’s technical standards and demonstrates the economic value of the data intelligence, encouraging the private sector adoption of similar platforms for competitiveness. This establishes a de facto proof of concept for large-scale secure data intelligence projects, de-risking the investment and validating the core architectures upon which commercial audience intelligence platforms are built.

- Rise of AI and ML accessibility: The commoditization of advanced AI/ML via cloud services allows the vendors in the audience intelligence platform market, including the new entrants, to embed powerful predictive analytics, natural language processing, and automated segmentation into their platforms without building everything from scratch. The public investment in AI R&D lowers this barrier. The U.S. Congress.gov report in December 2024 shows that nearly USD 1.6 billion is invested in AI-related activities in 2025, boosting the modeling and insight generation. This widespread access transforms the advanced analytics from a proprietary moat for tech giants into a standard table stakes feature, intensifying market competition on data quality and vertical specific application.

- Competitive intelligence and market agility: In the audience intelligence platform market, businesses use these platforms not only to understand their own customers but also to monitor competitors' digital footprints, campaign strategies, and audience sentiment in real time. This driver is about strategic agility and risk mitigation. The public agencies model this behavior, the U.S. International Trade Administration provides a detailed industry and country analyses helping businesses to understand the competitive landscapes, a function AIPs automate and scale for the digital domain, enabling faster strategic response to market shifts. This capability is vital in fast-moving sectors, allowing firms to preemptively adjust messaging, identifying white space opportunities or counter competitive threats before they impact the market share.

Challenges

- High data acquisition and integration costs: Building a viable audience intelligence platform market requires vast, diverse, and high-quality data sets, which involve expensive licensing fees and complex data engineering. New companies struggle to match the scale of incumbents who have established long-term data partnerships. The top players use its scale to integrate data from the hundreds of premium sources, creating a massive data marketplace that is cost-prohibitive for a new player to replicate.

- Technical complexity and AI/ML talent shortage: Developing the proprietary AI/ML algorithms needed for accurate identity resolution, predictive analytics, and segmentation is intensely complex. There is a fierce war for specialized data scientists and engineers. Top companies have invested millions annually in R&D to advance their measurement science, a level of sustained investment in talent and technology that is a formidable barrier.

Audience Intelligence Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.7% |

|

Base Year Market Size (2025) |

USD 9.1 billion |

|

Forecast Year Market Size (2035) |

USD 39.1 billion |

|

Regional Scope |

|

Audience Intelligence Platform Market Segmentation:

Deployment Mode Segment Analysis

Under the deployment mode, the cloud based are leading the segment and is poised to hold the share value of 80.4% by 2035 in the audience intelligence platform market. The segment is driven by the critical need for scalability, rapid integration of real-time data feeds, and lower total cost of ownership. The widespread shift to cloud infrastructure is reinforced by federal initiatives such as the U.S. Cloud Smart strategy, which mandates agencies to prioritize cloud solutions for modernization. A key statistical indicator of this surge is indicated in the Center for Statistics & International Studies report in July 2023, showing that the IT spending by the U.S. government reached USD 100 billion in 2022, of which USD 12 billion was allocated to cloud-related services. This data underscores the wholesale migration to scalable, secure cloud services across both the public and private sectors.

Component Segment Analysis

Within the component segment, the software/solutions sub-segment commands the largest revenue share in the audience intelligence platform market. This is because the core value of an AIP lies in its proprietary algorithms for identity resolution, AI-driven analytics, and audience segmentation. The demand for advanced integrated software platforms is amplified by the need to navigate a fragmented data landscape under strict privacy regulations. The government data highlights the intense investment in the underlying technologies. The data from the FRED in January 2026 depicts that in Q3 2025, the investment in information processing equipment and software reached USD 1,394.960 billion. This capital expenditure underscores the foundational role of software investments in powering the modern data economy, directly fueling innovation and capability within the AIP sector.

Private Fixed Investment in Information Processing Equipment and Software

|

Quarter 2025 |

Value (USD billion) |

|

Q1 |

1,352.203 |

|

Q2 |

1,352.452 |

|

Q3 |

1,394.960 |

Source: FRED January 2026

Organization Size Segment Analysis

Large enterprises are the primary adopters and the leading sub-segment by organization size in the audience intelligence platform market. Their dominance stems from the substantial budgets, complex data ecosystems spanning multiple departments, and a strategic imperative to use the audience intelligence for the competitive advantage and customer retention. A key supporting statistic is the evident digital investment gap. Data from the U.S. Small Business Administration shows that while the adoption is growing, this structural advantage allows them to operationalize audience insights at a scale and sophistication that remains out of reach for most smaller organizations. Further, their scale and advancement create a demand to entry point for smaller players, perpetuating their audience intelligence platform market leadership.

Our in-depth analysis of the audience intelligence platform market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Data Source |

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Audience Intelligence Platform Market - Regional Analysis

North America Market Insights

The North America audience intelligence platform market is the global revenue leader and is poised to hold the revenue share of 42.3% by 2035. The market is driven by the confluence of stringent regulatory pressure, advanced digital infrastructure, and substantial investment in foundational AI research. The region’s dominance stems from the enforcement of state-level privacy laws such as the CCPA/ CPRA and active Federal Trade Commission oversight, which compel enterprises to adopt advanced, compliant first-party data strategies. This is amplified by the significant federal spending on cloud computing and AI R&D, such as the National Science Foundation’s allocation, which sets high technical standards and reduces risks in innovation. High digital ad spend and the rapid growth of channels such as Connected TV further fuel the demand for the platforms that can deliver precise omnichannel measurement and attribution, cementing North America’s role as both the largest and most mature market for audience intelligence solutions.

The U.S. audience intelligence platform market is being shaped by the growing demand for unified measurement and AI-enabled audience analytics, as reflected in the recent platform launches and enterprise adoption. The LoopMe’s June 2024 introduction of its audience and measurement platform demonstrates how vendors are consolidating audience activation and performance measurement into single operating systems, addressing enterprise demand for closed-loop insight across media investments. This trend is reinforced by the Comscore’s January 2026 agreement with ESPN to deploy cross-platform content measurement, enabling a unified view of audience engagement across the linear TV, streaming, digital, and social channels. Together, these developments highlight a structural shift in the U.S. market from fragmented analytics tools towards integrated platforms that support total audience visibility, attribution accuracy, and ROI accountability.

The trends in privacy regulations and national AI capacity building, with a distinct emphasis on ethical data governance, are actively shaping the Canada audience intelligence platform market. Enforcement of the Personal Information Protection and Electronic Documents Act creates a compliance imperative similar to the U.S., driving the demand for audience intelligence platforms with robust consent management. The Government of Canada data in June 2025 indicates that the government has allocated USD 2 billion from the 2024 budget to meet the innovative needs of AI. Further, the government’s Digital Charter initiative promotes consumer control over data and responsible innovation, hence boosting a market preference for platforms that emphasize transparency and data sovereignty. These factors converge to drive the adoption in the key verticals like financial services and telecom, where trusted customer data utilization is critical for competitiveness.

Canada’s AI Compute Funding Framework

|

Funding Amount |

Program / Use Case |

Purpose & Impact |

|

Up to USD 300 million |

AI Compute Access Fund SME Support |

Supports Canadian SMEs in purchasing AI compute resources to meet near-term business needs while encouraging private-sector investment in domestic compute capacity. |

|

Up to USD 700 million |

AI Data Centre Development |

Funds industry, academic, and private-sector projects to build Canadian AI data centers, prioritizing proposals with strong public ROI, sustainability, and long-term impact. |

|

Up to USD 705 million |

AI Sovereign Compute Infrastructure Program |

Establishes a Canadian-owned supercomputing system to expand national compute capacity for research and industry; includes a secure system led by Shared Services Canada and NRC for government, industry R&D, and national security use cases. |

|

Up to USD 200 million |

Public Compute Infrastructure (Short-term boost) |

Enhances existing public compute infrastructure to address immediate capacity gaps and support near-term AI and data-intensive workloads. |

Source: Government of Canada June 2025

APAC Market Insights

The Asia Pacific audience intelligence platform market is the fastest-growing market and is expected to grow at a CAGR of 13.8% during the forecast period, 2026 to 2035. The market is driven by the explosive digital adoption, a booming e-commerce sector, and rapidly evolving data privacy landscapes. The primary growth catalyst is the sheer scale of digital consumers in countries such as India and China, coupled with businesses' urgent need to understand fragmented cross-channel consumer behavior. Unlike the regulatory-driven market of the West, the APAC growth is fueled by commercial agility and competition, mainly in retail fintech and media. A key regional trend is the development of sovereign digital ecosystems and local laws, which are pushing a shift from unconstrained data collection to more structured, compliant first-party data strategies.

The India audience intelligence platform market is driven by the rapid public infrastructure expansion and sustained government investment in data-led service delivery. The PIB data in July 2024 reports that India’s Digital Pubic Infrastructure ecosystem supported over 13 billion digital transactions in 2023, led by Aadhaar UPI and DigitLocker, creating a large-scale behavioral and demographic data environment that enterprises increasingly integrate into audience analytics workflow. In parallel, the report from the India AI in March 2024 shows that the government has allocated ₹10,372 crore to the India AI Mission in 2024, focused on AI compute datasets and industry adoption. These investments are stimulating the demand for platforms that enable compliant audience segmentation campaign measurement and personalization across retail financial services, telecom, and public communication.

China audience intelligence platform market is closely linked to the national digital economy and data governance priorities. The report from the People’s Republic of China in April 2023 indicates that China’s digital economy exceeded RMB 50.2 trillion in 2022, underscoring the scale at which enterprises must manage and interpret audience and consumer data. Further, the data from the People’s Republic of China in August 2024 shows that the country has invested more than 6.1 billion USD in major computing hubs, strengthening the national high-performance computing and data center ecosystem that underpins the advanced analytics and AI deployment. Audience intelligence platforms depend on this infrastructure to process large-scale behavioral data, run predictive models, and deliver real-time insights across media, retail, and digital services.

Europe Market Insights

Europe audience intelligence platform market is defined by robust data governance and sector specific application. Its growth is primarily driven by the region’s comprehensive enforcement of the General Data Protection Regulation, which compels the organization to adopt the advanced consent-based data strategies. Significant public investment in digital and health initiatives, such as the European Commission’s Digital Europe Programme and the EU4Health programme, creates a high compliance environment and boosts innovation in trusted data ecosystems. Leading trends include the rise of privacy-first identity resolution, the application of AIPs in highly regulated sectors, such as the pharmaceuticals, for stakeholders mapping and personalized engagement, and the integration of AI under strict ethical guidelines. These factors collectively shape the market that values transparency and compliance as key competitive advantages.

Germany audience intelligence platform market is defined by its stringent data governance, industrial B2B applications, and the national digital sovereignty initiatives. The demand is driven by the SME digitalization, the automotive sector’s shift to data-driven customer relationships, and compliance with the world’s strictest data localization and GDPR plus security. Government policy actively shapes the landscape. The OECD 2024 Artificial Intelligence report in Germany indicates that the funding for AI research in 2022 reached EUR 280.4 million to transfer research into practical application, including the intelligent data analysis that underpins the AIPs. This substantial, directed public investment de-risks the innovation for the private sector AIP vendors, enabling them to develop and deploy advanced, compliant analytics solutions that meet the specific needs of German industry.

AI Research Funding in Germany

|

Year |

EUR million |

|

2017 |

17.4 |

|

2018 |

20.5 |

|

2019 |

41.9 |

|

2020 |

85.7 |

|

2021 |

120.2 |

|

2022 |

280.4 |

|

2023 |

427.2 |

|

2024 |

483.3 |

Source: OECD 2024

The digital advertising and financial services sectors are driving the UK audience intelligence platform market. The UK is the world's leading life sciences industry and has a pro-innovation regulation approach post Brexit. The demand for the audience intelligence platform is mainly high for the pharmaceutical stakeholders, mapping, financial customer intelligence, and cross-channel media measurement. The UK government’s significant public investment in foundational AI research and infrastructure acts as a key market catalyst. A core component of this is the UK Research and Innovation body. The report from the UKRI in February 2024 shows that it has funded the launch of 9 new AI Research Hubs in 2024 with an investment of £80 million specifically aimed at harnessing AI for scientific discovery and practical business applications, directly enhancing the technological capabilities available to the audience intelligence platform sector.

Key Audience Intelligence Platform Market Players:

- LiveRamp (U.S.)

- The Trade Desk (U.S.)

- Neustar (U.S.)

- Nielsen (U.S.)

- Comscore (U.S.)

- Salesforce (U.S.)

- Oracle (U.S.)

- Adobe (U.S.)

- Lotame (U.S.)

- Audigent (U.S.)

- Quantcast (U.S.)

- IPONWEB (UK)

- Germinait (UK)

- AudienceProject (Denmark)

- Zeotap (Germany)

- Fujitsu (Japan)

- Near (India)

- Seoul Robotics (South Korea)

- Hypersonix (Australia)

- Antsomi (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LiveRamp is a foundational player in the audience intelligence platform market, specializing in data connectivity and identity resolution. Its strategic initiative focuses on building a neutral privacy-centric infrastructure that allows markets to securely activate the first-party data across the open web, walled gardens, and emerging channels like connected TV without relying on third-party cookies. In 2024, the company earned the revenue of USD 659,661K.

- The Trade Desk leverages the audience intelligence platform market as the core engine of its demand-side platform. Its key strategy involves aggregating vast premium data from multiple partners to empower advertisers with advanced cross-channel audience targeting and optimization, championing the open internet in competition with walled gardens. The company has made a revenue of USD 2,445 million in 2024.

- Neustar, now part of TransUnion, is a pivotal entity in the audience intelligence platform market via its core competency in real-time identity resolution. Its strategic initiative centers on linking online and offline customer interactions with deterministic accuracy, providing a single customer view that drives personalized marketing and precise measurement for Fortune 500 companies.

- Nielsen integrates its deep legacy in audience measurement into the audience intelligence platform market, mainly for media planning and valuation. Its strategic focus is on unifying its TV and digital ratings with the advanced audience segmentation, enabling advertisers to plan and optimize campaigns based on the consistent cross-platform demographic and behavioral insights.

- Comscore is a major force in the audience intelligence platform market, mainly for media and content owners. Its strategy emphasizes currency-grade audience measurement for TV, digital, and streaming combined with the detailed audience segmentation tools to help publishers demonstrate the value and composition of their audience to advertisers.

Here is a list of key players operating in the global audience intelligence platform market:

The audience intelligence platform market is a dynamic and consolidated space dominated by the major U.S. ad tech and data giants, with innovative specialists emerging globally. The competition involves data scale, AI-driven analytics, and platform integration. The key strategic initiatives include a significant investment in artificial intelligence and machine learning to expand predictive insights, as well as first-party data solutions in response to privacy regulations. Additionally, strategic acquisitions are being made to broaden data sets and functional capabilities. For example, in March 2025, Buxton announced the acquisition of Audiense to accelerate innovation in consumer intelligence and engagement. Partnerships with the media owners and CRM platforms are also important for ecosystem integration as players strive to offer omnichannel audience understanding from awareness to conversion.

Corporate Landscape of the Audience Intelligence Platform Market:

Recent Developments

- In January 2026, The Nova Method, an audience-first marketing and public relations firm has announced the launch of NovaSight, which is an AI visibility and optimization platform for marketing and communications leaders.

- In May 2025, Quartile has announced the launch of Quartile Pro Suite, a comprehensive upgrade designed to provide brands with an unrivaled competitive advantage in Amazon advertising. This next-gen platform integrates advanced and scalable audience targeting powered by Amazon Marketing Cloud (AMC), real-time market intelligence, and a conversational AI assistant to empower brands with unparalleled precision and performance.

- In March 2025, OnAudience has introduced the latest technological innovation for the AdTech market that delivers advanced audience intelligence: AI-Powered Audiences. This cutting-edge solution enhances agency productivity by streamlining the process of audience creation.

- Report ID: 8356

- Published Date: Jan 20, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.