Observability Tools and Platforms Market Outlook:

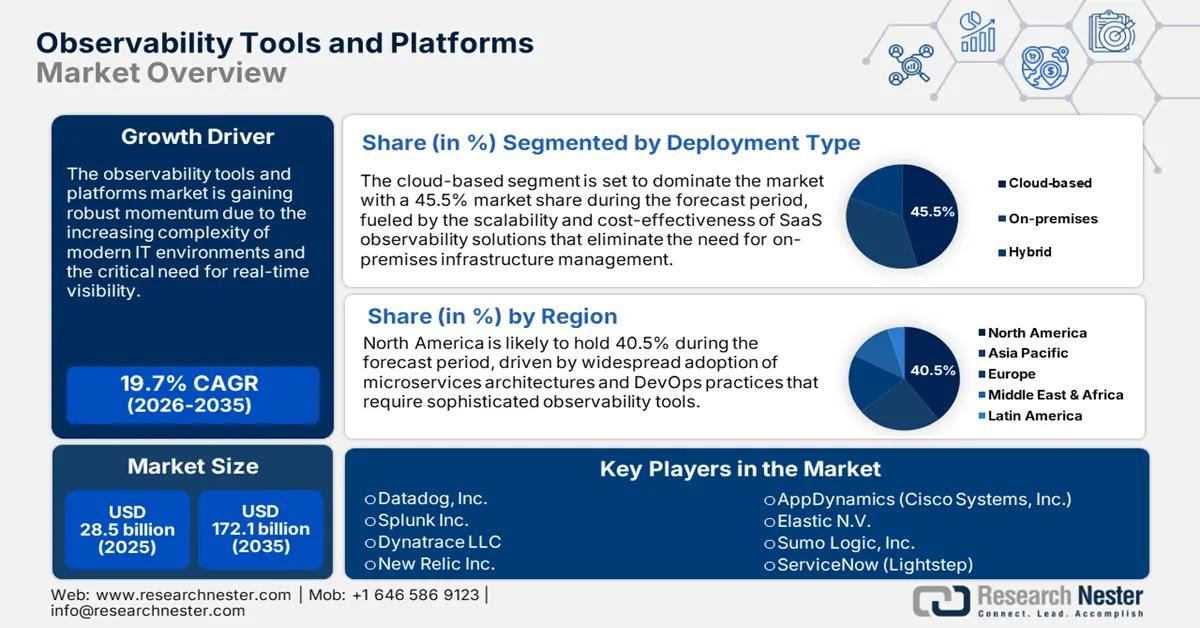

Observability Tools and Platforms Market size is valued at USD 28.5 billion in 2025 and is projected to reach a valuation of USD 172.1 billion by the end of 2035, rising at a CAGR of 19.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of observability tools and platforms is estimated at USD 34.1 billion.

The observability tools and platforms market is gaining robust momentum as enterprises struggle with increasingly complex distributed systems and cloud-native environments. Organizations are making comprehensive visibility throughout their entire technology stack a top priority in an effort to optimize performance and reliability. For example, Datadog announced in May 2025 that its platform can store over 100 petabytes of data per month, demonstrating the sheer volume of data generated that fuels this market. Digital transformation initiatives continue to fuel demand because companies require real-time visibility into system activity and performance metrics. Companies are investing heavily in integrated observability platforms, bringing together metrics, logs, and traces to deliver end-to-end system views.

The market expansion is underpinned by significant government spending on cybersecurity and infrastructure modernization in a number of regions. The U.S. Department of Homeland Security improved cybersecurity resilience in August 2025 by reinforcing infrastructure protection programs with emphasis on critical system monitoring capabilities. Deep analytics capabilities based on artificial intelligence and machine learning enhance anomaly detection and predictive maintenance functionalities in observability platforms. The adoption of AI-based automation integrates to enables organizations to rapidly discover and correct issues before they impact business operations.

Key Observability Tools And Platforms Market Insights Summary:

Regional Highlights:

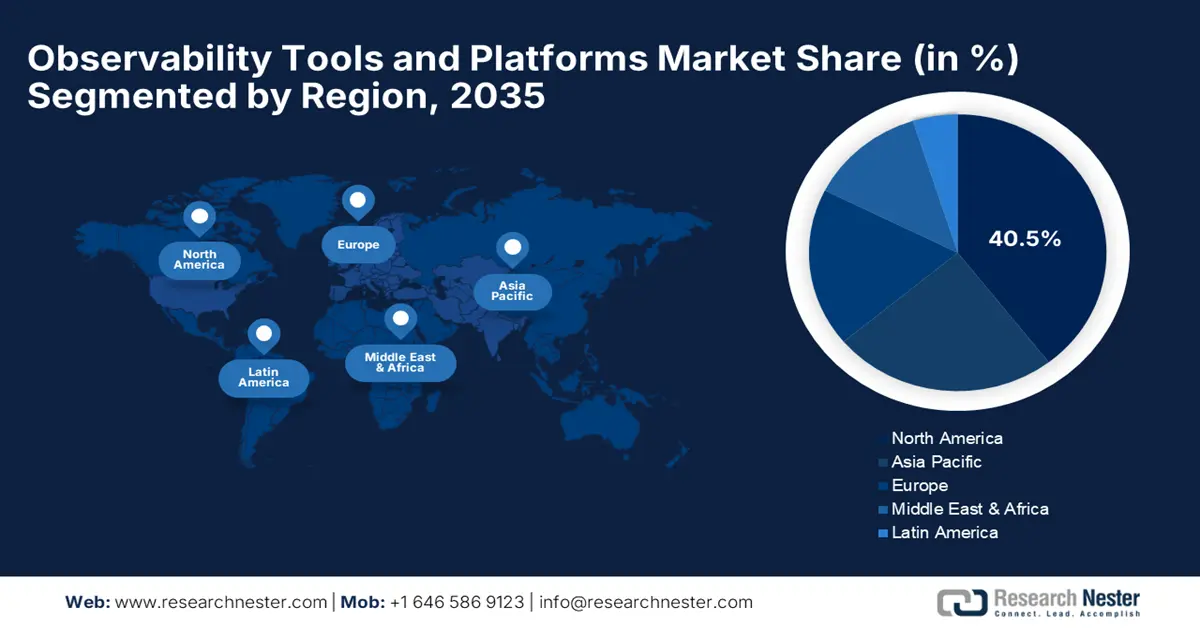

- North America is expected to lead the observability tools and platforms market with a 40.5% share by 2035, sustained by early technological adoption and substantial investments in digital infrastructure modernization.

- Asia Pacific market is set to expand at nearly 15.0% CAGR through 2035, spurred by rapid digital transformation efforts and large-scale investments in cloud infrastructure across emerging economies.

Segment Insights:

- The cloud-based segment of the observability tools and platforms market is projected to command a 45.5% share by 2035, propelled by organizations' strategic adoption of scalable and cost-efficient observability solutions.

- The log management segment is estimated to secure a 37.0% share by 2035, driven by the growing recognition of logs as essential sources of operational intelligence and debugging insights.

Key Growth Trends:

- Integration of AI-powered intelligence and automation

- Adoption of cloud-native architecture

Major Challenges:

- Data privacy and security concerns

- Tool integration and standardization complexity

Key Players: Datadog, Inc., Splunk Inc., Dynatrace LLC, New Relic Inc., AppDynamics (Cisco Systems, Inc.), Elastic N.V., Sumo Logic, Inc., ServiceNow (Lightstep), Grafana Labs, SolarWinds Corporation.

Global Observability Tools And Platforms Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.5 billion

- 2026 Market Size: USD 34.1 billion

- Projected Market Size: USD 172.1 billion by 2035

- Growth Forecasts: 19.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: India, China, Singapore, Brazil, South Korea

Last updated on : 30 September, 2025

Observability Tools and Platforms Market - Growth Drivers and Challenges

Growth Drivers

- Integration of AI-powered intelligence and automation: Artificial intelligence and machine learning technology are revolutionizing observability platforms to deliver smart anomaly detection and automated incident response capabilities. Organizations leverage AI-driven insights to predict system crashes before they occur, reducing downtime and operating costs by a significant amount. For instance, Splunk Inc. released advanced AI capabilities in both Enterprise Security 8.0 and Observability Cloud in June 2024 at the .conf24 conference. Machine learning models improve their accuracy by learning from history and system behavior in different environments. The adoption of AI assistants brings natural language querying capabilities, making data more observable for stakeholders who are not technical.

- Adoption of cloud-native architecture: The mass adoption of cloud-native technologies, such as microservices, containers, and serverless computing, creates an unprecedented need for end-to-end observability products. Greater visibility into distributed systems where traditional methods of monitoring fall short when handling complex interdependencies is required by businesses. For instance, New Relic Inc. announced Digital Experience Monitoring powered by AI capabilities and enhanced Kubernetes monitoring through operator automation in July 2024. Multi-cloud and hybrid cloud installations increase the degree of monitoring complexity, necessitating a common observability platform across diverse infrastructure environments. The migration from monolithic to distributed systems requires observability solutions that can monitor requests across multiple services and infrastructure components in a frictionless manner.

- Regulatory compliance and security requirements: Strong regulatory requirements across most industries necessitate comprehensive monitoring and audit functionality that drives observability platform adoption significantly. Organizations must demonstrate continued compliance with data protection regulations through end-to-end logging and system process monitoring. Financial organizations require built-in real-time fraud detection and risk scoring capabilities in their observability platforms. In June 2025, the White House released an Executive Order continuing cybersecurity regulations requiring agencies to fund next-generation TLS protocols by January 2030. Healthcare organizations need observability products to ensure HIPAA compliance alongside monitoring patient data access and system vulnerability. Moreover, government agencies across nations are implementing compulsory cybersecurity frameworks that require complete system monitoring and incident response capabilities.

Economic Impact of Cyber Incidents & Role of Observability Tools

|

Aspect |

Key Finding / Metric |

Implication for Observability Tools & Platforms |

|

Indirect vs. Direct Costs |

Indirect costs (e.g., remediation, legal fees) reached $1.2B for 75 firms, but shareholder wealth loss was $104B following breaches (Kamiya et al., 2021). |

Observability platforms are critical for rapid investigation and remediation, directly targeting the largest component of indirect costs and mitigating long-term reputational damage |

|

Ransomware Trends |

Average ransomware breach cost was $4.54M in 2022, while occurrence increased from 7.8% to 11% year-over-year. |

The growing frequency underscores the need for real-time observability to detect intrusions early and minimize dwell time, directly reducing potential ransom payouts and downtime |

|

Macro-Economic Risk |

Cyberattacks may cause $5.2T in lost value creation opportunities by 2024. |

This represents a massive addressable market for observability solutions that protect digital revenue streams and ensure business continuity in key sectors like finance and healthcare |

|

Systemic Vulnerabilities |

Growing reliance on digital systems exposes essential services to disruptions, straining response resources. |

Observability tools provide a force multiplier for security teams, offering deep visibility across complex, interconnected systems to enable effective threat response and maintain essential services |

Source: World Bank

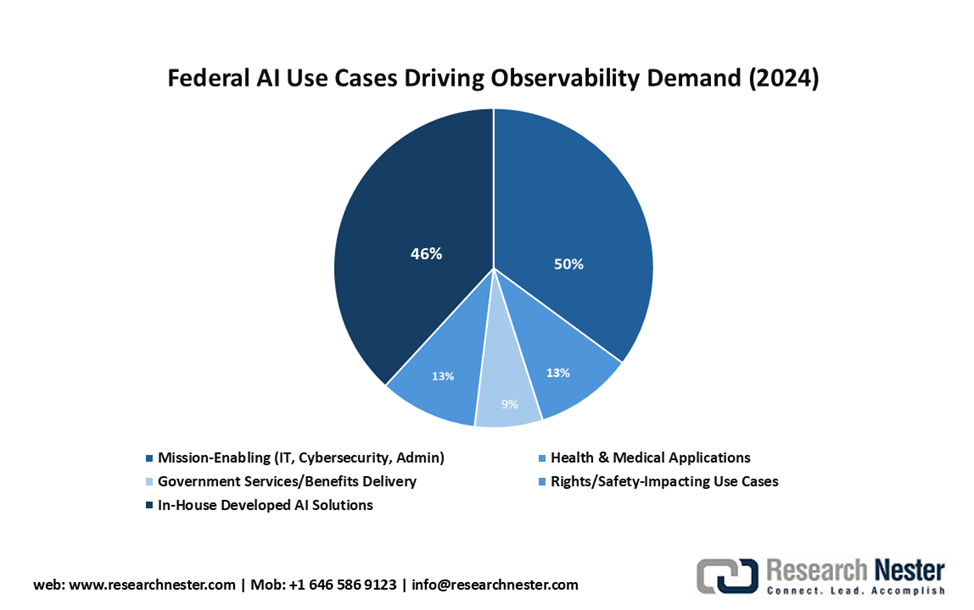

Federal AI Use Cases Driving Observability Demand (2024)

Source: Federal CIO

Challenges

- Data privacy and security concerns: Organizations face the challenge of deploying observability solutions with high data privacy and security demands in regulated environments. Observability platforms consume and process large volumes of sensitive telemetry information that, if left unsecured, could expose confidential business data or personal information. Financial institutions are faced with reconciling full monitoring needs with data isolation mandates in strict data-regulated environments. Government agencies require observability solutions that support high-level security clearance without compromising monitoring capabilities.

- Tool integration and standardization complexity: Agencies face the paramount challenge of integrating a large number of observability tools via diverse technology stacks while possessing standardized data formats and analysis capabilities. Legacy environments do not come with the latest instrumentation capabilities, and there are holes in end-to-end observability coverage across hybrid setups. Multiple observability vendors maintain proprietary data formats and APIs that integrate poorly and create high operational complexity. There is no standardization for telemetry data collection and analysis across sectors, which leads to vendor lock-in scenarios that deprive organizations of flexibility. Organizations struggle to achieve unified observability perspectives when dealing with heterogeneous infrastructure components and application spaces.

Observability Tools and Platforms Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.7% |

|

Base Year Market Size (2025) |

USD 28.5 billion |

|

Forecast Year Market Size (2035) |

USD 172.1 billion |

|

Regional Scope |

|

Observability Tools and Platforms Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment is anticipated to dominate the market with a 45.5% market share during the forecast period, fueled by organizations' strategic adoption of scalable and affordable observability solutions. Cloud-native architectures necessitate observability platforms that can scale dynamically with infrastructure requirements while delivering consistent monitoring capabilities throughout distributed environments. The global reach of cloud-based solutions enables distributed teams and remote working without sacrificing consistent monitoring experiences. In May 2025, Elastic N.V. acquired Keep, an AIOps company with alert management and automated incident response expertise. Cloud deployment models allow for rapid scaling during peak demand without the necessity for pre-planning capacity or hardware procurement processes. Integration with cloud-native security services provides advanced threat detection and compliance monitoring across observability implementations.

Component Segment Analysis

The log management segment is predicted to account for a 37.0% market share by 2035 as organizations increasingly appreciate the worth of logs as fundamental sources of operation knowledge and debugging data. Modern-day applications generate large volumes of structured and unstructured log data that require sophisticated parsing, indexing, and analysis features to be properly used. Advanced search and filtering capabilities enable operations teams to quickly locate relevant data within huge log data sets during critical incident response scenarios. In June 2024, Datadog Inc. extended log management capacity with additional long-term retention and search capabilities on the strength of Flex Logs' success. Natural language processing technologies enhance log analysis by providing significant findings from unstructured text data generated by applications and systems. The interweave of log management, metrics, and traces addresses end-to-end observability to facilitate effective system optimization and performance tuning.

Industry Vertical Segment Analysis

The IT and Telecommunications segment is expected to maintain a robust 36.5% market share through 2035, spurred by the reliance of these industries on system performance and reliability for service provision. Telecommunications services require monitoring network operations in real time to ensure service quality and minimize downtime in complex infrastructure environments. IT service providers leverage observability platforms for the purpose of delivering managed services with guaranteed service level agreements and proactive issue remediation. In July 2023, Splunk Inc. announced a strategic partnership with Microsoft to develop enterprise security and observability solutions on the Azure Marketplace. End-to-end observability is used by cloud providers to observe multi-tenant environments and preserve performance isolation and security across customer workloads. The convergence of telecom and IT infrastructure creates homogeneous monitoring requirements that drive observability platform use significantly.

Our in-depth analysis of the observability tools and platforms market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Component |

|

|

Industry Vertical |

|

|

Application |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Observability Tools and Platforms Market - Regional Analysis

North America Market Insights

North America takes the lead, predicted to hold a robust 40.5% market share during the forecast period, spearheaded by early adoption of technology and hefty investments in digital infrastructure upgradation. The region has an established technology ecosystem supported by leading observability vendors, cloud players, and enterprise customers, driving innovation and market growth. Organizations across different industries utilize end-to-end observability solutions to support hybrid and multi-cloud infrastructures and ensure regulatory compliance and security requirements. Cybersecurity and infrastructure monitoring capabilities are invested in by government agencies, creating a huge demand for enterprise-level observability platforms.

The U.S. is one of the significant market where organizations implement advanced monitoring solutions in cloud-native architectures and distributed systems environments. US-based tech companies drive innovation through heavy research and development investments in AI-driven observability capabilities and automation features. In January 2025, the Biden Administration's executive order on improving the nation's cybersecurity moved observability from optional to mandatory for federal agencies, requiring real-time network telemetry capabilities across all government systems, which has significantly accelerated demand for enterprise observability platforms. Federal government agencies need end-to-end monitoring and compliance features across government systems, leading to a significant demand for enterprise observability platforms.

Canada shows strong observability tools and platforms market growth driven by digitization initiatives by governments and increased use of cloud-native technologies in the government and private sectors. Canadian organizations implement end-to-end monitoring solutions to improve remote workspaces and distributed application architecture driven by pandemic-led changes. The banking sector adopts observability platforms to ensure compliance with regulations and drive digital banking initiatives and fintech innovation programs. In February 2025, the Canada Government launched a new National Cyber Security Strategy with inclusive stakeholder engagement and staff development programs. IoT monitoring and predictive maintenance capabilities enabled by strong observability platforms are embraced by manufacturing companies across their factory settings and supply chain management operations.

APAC Market Insights

Asia Pacific observability tools and platforms market is projected to witness around 15.0% CAGR through 2035, driven by swift digital transformation initiatives and massive investment in cloud infrastructure in emerging economies. The region is supported by the growing adoption of microservices architecture and container orchestration platforms, which require sophisticated monitoring and analysis functions. Organizations use observability solutions to facilitate e-commerce growth, digital payment processing, and mobile application development across diverse market sectors. Public investment in smart city growth and Industry 4.0 production fuels high demand for end-to-end monitoring platforms capable of catering to complex IoT scenarios.

China observability tools and platforms market experiences explosive growth, powered by high digital infrastructure investments and government schemes for technology R&D in manufacturing and services industries. The country's focus on integrating machine learning and artificial intelligence creates high demand for AI-based observability platforms that can meet complex data analysis requirements. China Government released a comprehensive AI security governance framework through the National Technical Committee 260 in September 2024, with a focus on safety management principles. Observability solutions are used by online payment services and e-commerce platforms to ensure system reliability and performance during heavy traffic hours and promotion periods.

India demonstrates robust observability tools and platforms, driven by market growth in the digital transformation projects of legacy industries and emerging technology sectors in the country. Indian organizations deploy cloud-native infrastructure requiring sophisticated monitoring and analysis capabilities to provide optimal performance and reliability in distributed environments. The banking and financial services sector uses extensive observability platforms to facilitate digital banking initiatives while assisting with regulatory compliance and security requirements. In July 2025, the Indian Government improved cybersecurity across major sectors by having CERT-In conduct 9,708 security scans and observe over 2.04 million cases of cybersecurity incidents. Information technology service providers use observability solutions to offer managed services with guaranteed service level agreements and proactive problem-solving capabilities.

Europe Market Insights

Europe observability platforms and tools market forecasts constant growth between 2026 and 2035, driven by robust regulatory requirements and significant investments in digital infrastructure upgrades across a broad spectrum of industry sectors. Given their concern with data security and privacy regulations compliance, European companies depend on observability platforms to provide complete monitoring under the most stringent regulatory compliance requirements. The banking sector is using end-to-end monitoring solutions for digital banking initiatives across geographies and regulatory systems, to ensure compliance with GDPR. Manufacturing firms utilize Industry 4.0 technologies that require sophisticated monitoring capabilities to optimize production productivity and implement predictive maintenance programs at their sites.

Germany market for observability tools and platforms is fueled by state-of-the-art manufacturing capabilities and heavy investments in Industry 4.0 technologies in the automotive and industrial sectors. German businesses implement end-to-end monitoring solutions to enable digital twin installations and maintenance programs that predict and optimize equipment performance, reducing operational costs. In 2024, the German Federal Ministry of Economic Affairs and Climate Action (BMWK) provided €150 million in funding to the Manufacturing-X program to enhance the competitiveness, resilience, and sustainability of the manufacturing industry through digitalization, with projects running from early 2024 to 2026, in support of the deployment of high-end observability and monitoring systems in smart factories. Country leadership in renewable energy creates a need for observability platforms that will monitor smart grid systems and energy storage technology.

The UK depicts strong observability tools and platforms market growth driven by financing services innovation, as well as high investment in cybersecurity infrastructure following Brexit-induced regulatory changes. In June 2025, the UK Government announced a comprehensive Cyber Security and Resilience Bill with £16 million investment to grow the £13.2 billion cyber sector. The banking sector utilizes observability platforms to facilitate open banking initiatives and fintech innovation, while ensuring compliance with the Financial Conduct Authority's requirements and maintaining security. Technology firms incorporate advanced observability capabilities to facilitate software development and deployment pipelines in cloud-native architectures and microservices applications.

Key Observability Tools and Platforms Market Players:

- Datadog, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Splunk Inc.

- Dynatrace LLC

- New Relic Inc.

- AppDynamics (Cisco Systems, Inc.)

- Elastic N.V.

- Sumo Logic, Inc.

- ServiceNow (Lightstep)

- Grafana Labs

- SolarWinds Corporation

The observability tools and platforms market is highly competitive, with conventional technology giants and new-generation innovative startups developing next-generation monitoring and analytics capabilities. Dominant players such as Datadog Inc., Splunk Inc., Dynatrace LLC, New Relic Inc., and AppDynamics compete based on leading AI capabilities, breadth of integration, and scalability to support enterprise customers across various industry verticals and regions. Elastic N.V., Sumo Logic Inc., and ServiceNow utilize open-source roots and domain-specific analytics capabilities to gain market share among price-sensitive organizations. The competitive landscape continues to evolve with strategic acquisitions, partnership agreements, and significant investments in automation and artificial intelligence technologies.

Leaders in the market demonstrate continuous innovation through deep platform enhancements and strategic acquisitions that expand the observability capabilities across diverse technology environments and applications. Firms significantly invest in artificial intelligence and machine learning technologies to offer predictive analytics, automated incident response, and intelligent anomaly detection capabilities. For example, Datadog Inc. unveiled impressive new features in May 2025 at DASH 2025, including Bits AI agents for SRE and APM Investigator with AI-enabled features. Strategic partnerships with cloud vendors deliver one-click integration and end-to-end monitoring capabilities within multi-cloud and hybrid infrastructure environments.

Here are some leading companies in the observability tools and platforms market:

Recent Developments

- In April 2025, Datadog acquired Metaplane, an AI-powered data observability startup, to accelerate its expansion into unified data and application observability, supporting organizations as they build and monitor increasingly complex cloud-native and AI-driven systems.

- In March 2025, ServiceNow (Lightstep) announced definitive agreement to acquire Moveworks for $2.85 billion, combining ServiceNow's agentic AI and automation strengths with Moveworks' front-end AI assistant and enterprise search technology. The acquisition unlocks new experiences for every employee across the business while accelerating enterprise adoption and innovation across key growth areas including CRM.

- Report ID: 8139

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.