Atorvastatin Calcium Market Outlook:

Atorvastatin Calcium Market size was over USD 296.21 million in 2025 and is projected to reach USD 545.67 million by 2035, witnessing around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atorvastatin calcium is evaluated at USD 313.01 million.

The proven efficacy of this element as an exclusive solution for heart concerns is driving growth in the atorvastatin calcium market. The rising prevalence of cardiovascular diseases and increasing awareness of cholesterol management across the world inflates the demand for atorvastatin calcium therapeutics. According to a WHO report published in June 2021, cardiovascular diseases are the leading cause of death globally, accounting for 17.9 million deaths in a year. It further stated that 85% of these deaths were associated with heart attack and stroke, with most occurrences in developing countries. Hence, these rising instances are pushing healthcare organizations to invest in availing effective treatments such as atorvastatin calcium.

In addition, advancements in pharmaceutical manufacturing and research initiatives from various organizations are contributing to broader market accessibility. In November 2022, researchers at Cleveland at University Hospitals and Case Western Reserve University discovered a new drug for lowering cholesterol. This drug targets PCSK9 levels and demonstrated a 70% reduction in cholesterol in animal models. The extensive research in this industry is further inspiring pharmaceutical leaders to introduce more effective solutions, such as atorvastatin calcium, for solidifying their positions in the global landscape of this sector.

Key Atorvastatin Calcium Market Insights Summary:

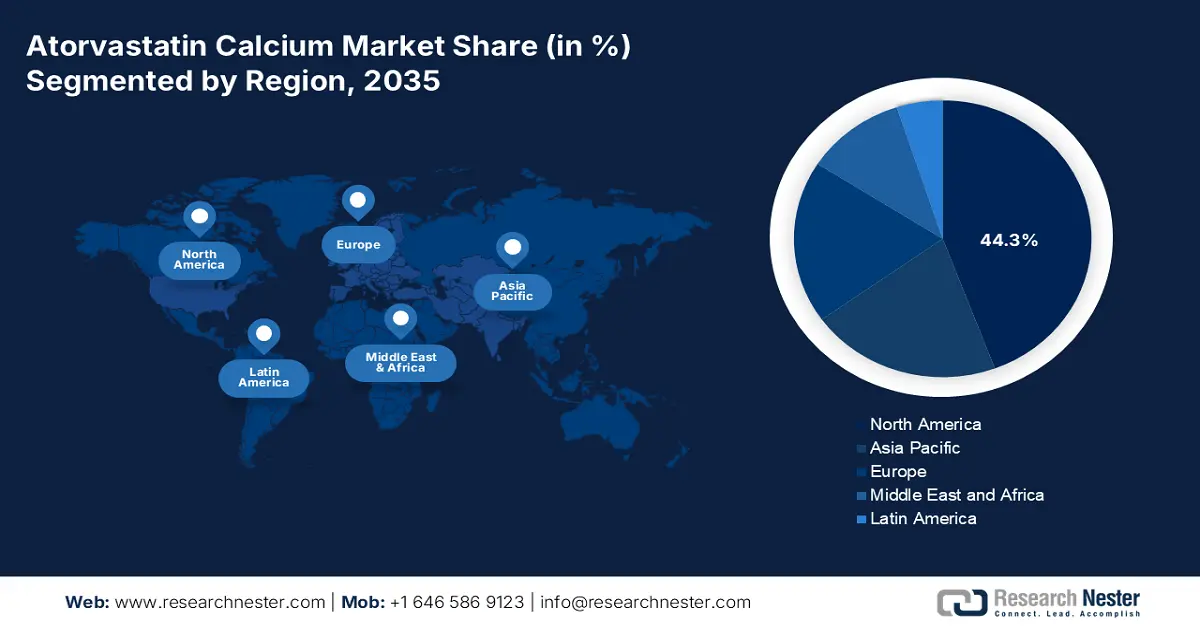

Regional Highlights:

- North America holds a commanding 44.3% share of the Atorvastatin Calcium Market, driven by advanced healthcare infrastructure, increased expenditure, and early adoption of technology, supporting sustained growth through 2026–2035.

- Asia Pacific's atorvastatin calcium market is poised for the fastest growth by 2035, fueled by government initiatives and heightened research activity in key countries.

Segment Insights:

- The biocatalysis segment is set for substantial growth from 2026-2035, due to its viable solutions.

- The capsule segment is projected to hold over 55.2% market share by 2035 due to the high effectiveness of atorvastatin calcium capsules in cardiovascular risk reduction.

Key Growth Trends:

- Rising awareness of cholesterol management

- Increasing research activities

Major Challenges:

- Safety concerns

- Strict regulatory requirements

- Key Players: Pfizer Inc., DSM, Cadila Healthcare Limited, Apotex Inc, Dr Reddy’s Laboratories Limited.

Global Atorvastatin Calcium Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 296.21 million

- 2026 Market Size: USD 313.01 million

- Projected Market Size: USD 545.67 million by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Atorvastatin Calcium Market Growth Drivers and Challenges:

Growth Drivers

- Rising awareness of cholesterol management: The proven effectiveness of the products from the atorvastatin calcium market makes them preferable for wider healthcare applications. This encourages pharma companies to undergo various clinical trials, deepening the exploration of its potential. In October 2024, as per the CDC report, in total of 10% of adults aged 20 years or above had total cholesterol levels above 240 mg/dL, and 54.5% of the population in the U.S. are taking medicine to manage their cholesterol levels. Therefore, these instances help diversify the product pipeline, attracting more pharmaceutical firms to invest in product development, thus boosting the market demand.

- Increasing research activities: With the advancements in healthcare infrastructure, the frequency of innovation in the atorvastatin calcium market increases. The proactive research initiatives aim to mitigate issues with administration routes and develop new, more effective formulations. For instance, in December 2021, Novartis AG announced that it received FDA approval for Leqvio (inclisiran), the first-in-class siRNA that helps to lower LDL with two doses a year. Therefore, such exclusive approvals inspire healthcare professionals to prescribe more for atorvastatin calcium therapies.

Challenges

- Safety concerns: One of the major challenges in the atorvastatin calcium market is the concern for side effects. The products of atorvastatin calcium can cause muscle pain and liver dysfunction, which can create a barrier among elderly patients to adopt them, limiting the expansion of this sector. In addition, these side effects can lead to poor patient outcomes, making it difficult for healthcare providers to prescribe them. Moreover, public awareness of drug safety may surpass the limited therapies of resource-constrained hospitals, thereby restricting product exposure across the healthcare industry.

- Strict regulatory requirements: The atorvastatin calcium market experiences significant challenges from the complex regulatory process, hindering market expansion. The delays in approvals, manufacturing audits, and non-compliance penalties can limit market penetration. This may further create a hurdle for this sector to captivate the optimum consumer base in the therapeutic industry. Moreover, this highly fragmented field can bring uncertainty in profit-making and consistent growth.

Atorvastatin Calcium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 296.21 million |

|

Forecast Year Market Size (2035) |

USD 545.67 million |

|

Regional Scope |

|

Atorvastatin Calcium Market Segmentation:

Application (Capsule, Tablet)

Based on the application, the capsule segment is poised to capture atorvastatin calcium market share of around 55.2% by the end of 2035. Capsules with specific formulations work as an excellent indicator for lowering LDL levels in the body with reduced side effects. As per an NLM report published in September 2020, it is highlighted that atorvastatin calcium effectively lowers LDL-C levels by 50% at high-intensity doses. It is further highlighted that it reduces myocardial infarction and stroke in high-risk patients. This proven efficacy is driving demand for this segment, and inspiring pharma companies to introduce more of these formulations.

Type (Biocatalysis, Chemical Synthesis)

In terms of type, the biocatalysis segment is projected to garner a significant share of the atorvastatin calcium market during the forecast period, due to its viable solutions. As per a June 2024 EPA article, Codexis, Inc.'s biocatalytic process for atorvastatin’s key chiral building block significantly enhances yield while minimizing waste. The enzymatic process developed using directed evolution boosts volumetric productivity up 4,000-fold under mild green conditions. It further stated that this eco-friendly innovation is used by Lonza Group AG for Pfizer Inc.'s atorvastatin calcium production, thus improving efficiency. The evidence of higher positive results makes biocatalysis preferable, inspiring companies to develop more effective solutions.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atorvastatin Calcium Market Regional Analysis:

North America Market Analysis

North America atorvastatin calcium market is set to hold revenue share of over 44.3% by the end of 2035. Advanced healthcare infrastructure, increased expenditure, the presence of key market players, and early adoption of cutting-edge technologies are major growth factors in the landscape. For instance, in January 2025, Calcium announced the launch of the FREE Medication Manager application. This allows users to schedule, track, and monitor their medications with ease. This highlights the growing adoption of advanced solutions to mitigate issues such as inappropriate medicine timings, which contribute to long-term health complications.

The U.S. has become the hub for global leaders in the atorvastatin calcium market due to its wide consumer base and excellent distribution channels. The country presents a golden opportunity for them to expand their business, making a crucial step in globalization. In October 2024, CalciMedica, Inc., which is focused on calcium release-activated calcium channel therapies, announced public offerings of 2.7 million shares at USD 3.7 per share, which is expected to raise around USD 10.2 million. Hence, it boosts investment confidence and research funding in calcium-associated treatments, supporting greater innovations.

Canada is steadily consolidating its position in the atorvastatin calcium market with proactive government approvals and rising health awareness. The concerning growth in cardiovascular cases is pushing the domestic players to promote their product portfolio. For instance, in December 2024, Esperion Therapeutics announced its new drug submission to Health Canada for NEXLETOL (bempedoic acid) and NEXLIZET (bempedoic acid and ezetimibe) to reduce low-density lipoprotein and cardiovascular diseases. This is further inflating demand in this sector due to the proven efficacy of atorvastatin calcium therapeutics in treating LDL-associated concerns.

APAC Market Statistics

Asia Pacific is expected to demonstrate the fastest growth in the atorvastatin calcium market with its strong captivity in government initiatives and heightened research activity. The region is augmenting substantial growth with the developmental tendency of countries such as China, India, Japan, and Australia. The governing bodies in these regions are further encouraging the domestic players to enhance their production and supply across the globe to expand in this sector. Hence, the growth in the region is further carried forward with the efforts of regional key players who are researching to bring innovations in this field.

India is propagating the regional atorvastatin calcium market with its strong pharmaceutical development and expansion. The country is accumulating resources to leverage the accessibility of therapeutic drugs with thorough approvals due to the rising burden of heart diseases. For instance, in September 2020, Lupin Limited announced the approval from the U.S. FDA and launch of Atorvastatin Calcium Tablets USP, 10 mg, 20 mg, 40 mg, and 80 mg, which is to be manufactured in Nagpur. The tablets are to be indicated to lower cholesterol in adults and children over 10 years of age. Hence, with such exclusive innovations, the market is expanding rapidly in the country, encouraging a competitive landscape among the domestic leaders.

China is one of the biggest suppliers of the atorvastatin calcium market, which is emerging as a great distribution source of this region. The country is also aiming to introduce more effective solutions through mass production, offering a favorable business environment for both domestic and international leaders. In June 2020, Shionogi China Co., Ltd. announced that it had received marketing approval for Aoding Pitavastatin calcium tablets to treat hypercholesterolemia and familial hypercholesterolemia. Thus, such milestones strengthen the product portfolio with better patient outcomes and great production values.

Key Atorvastatin Calcium Market Players:

- Teva Pharmaceuticals Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- DSM

- Cadila Healthcare Limited

- Apotex Inc

- Dr Reddy’s Laboratories Limited

- CMP Pharma, Inc.

- Sandoz Inc.

- Camber Pharmaceuticals Inc.

- Lupin Pharmaceuticals, Inc.

- Lannett Company, Inc.

The competitive demographic of the atorvastatin calcium market is inspiring global leaders to enforce their resources in innovating more effective solutions. They are continuously putting efforts to promote approvals to push their territory forward for globalization. As of May 2024, the Government of Australia, through the Therapeutic Goods Administration, regulates ATORVASTATIN-WGR, the medicine indicated to lower LDL levels and reduce heart attack risk, containing calcium trihydrate from GM Pharma International Pty Ltd. This is further dragging the focus of other competitor pharma companies to participate, enlarging the boundaries of this sector.

Furthermore, the global atorvastatin calcium market is expected to benefit from expansion of organizations for drug development due to a great demand for cardiovascular therapeutics. For instance, in September 2024, Rising Pharma Holdings Inc. announced the launch of its new facility in Decatur, Illinois, spanning about 230,000 sq. ft. This facility will be producing sterile products such as injectables and ophthalmic drugs in response to U.S. drug shortages. Such moves will strengthen the global supply chain efficiency by supporting the broader availability of drugs such as atorvastatin calcium.

Below are a few key players in the market:

Recent Developments

- In June 2024, Camber Pharmaceuticals Inc. launched two count sizes to Generic Lipitor, that is, Atorvastatin Calcium Tablets, USP, adding to its product line.

- In June 2023, CMP Pharma, Inc. announced that its Atorvaliq (atorvastatin calcium) Oral Suspension, 20 mg/5 mL received FDA approval. It is the first and only oral liquid of atorvastatin, which is now available for patients 10 years and above with high cholesterol levels.

- Report ID: 7545

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atorvastatin Calcium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.