Gastric Motility Disorder Drug Market Outlook:

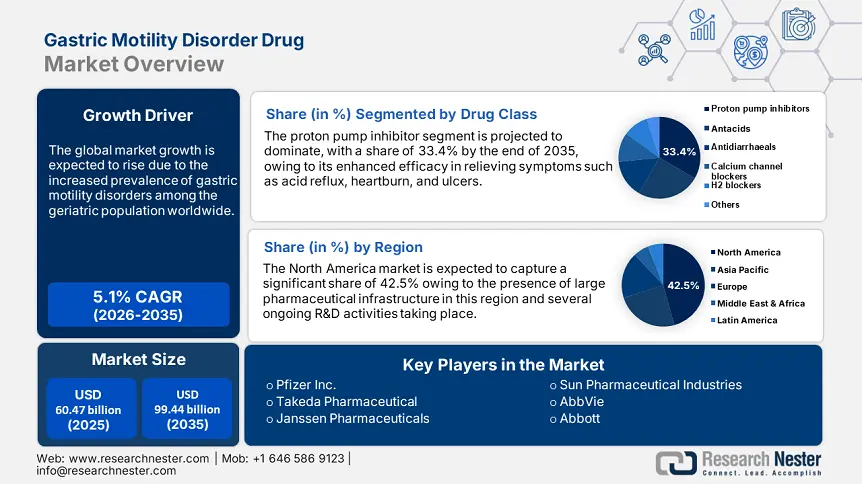

Gastric Motility Disorder Drug Market size was valued at USD 60.47 billion in 2025 and is likely to cross USD 99.44 billion by 2035, expanding at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gastric motility disorder drug is assessed at USD 63.25 billion.

The growth of the market is mainly driven by the increased burden of gastric motility disorders, such as gastroparesis, functional dyspepsia, and irritable bowel syndrome, among the aging population. There is a fast-rising prevalence of these diseases caused by a variety of factors such as unhealthy lifestyle choices, poor dietary habits, and sedentary lifestyles. Furthermore, the ongoing advancements in novel drug preparation and awareness of diagnostic procedures are anticipated to boost the market expansion in the forecast timeline. Pharmaceutical companies are investing in research and development of targeted therapeutics with improved safety and efficacy, contributing to market growth.

In September 2020, a report published by NLM stated that gastrointestinal problems are commonly encountered in intensive care units (ICUs) due to advancements in surgery and critical care. It further highlighted that GI motility disorders range from 50-80% in critically ill patients, significantly increasing mortality risk. Additionally, the disorders are associated with prolonged hospital stays and higher infection rates. Therefore, these challenges can be addressed through advanced gastric motility drugs by improving patient outcomes and enhancing overall healthcare efficiency toward betterment in the health status of the affected population.

Key Gastric Motility Disorder Drug Market Insights Summary:

Regional Highlights:

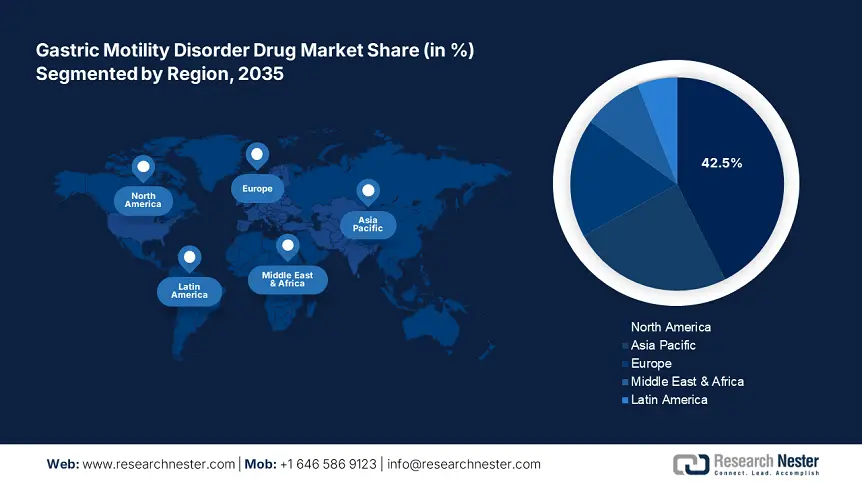

- North America commands a 42.5% share in the Gastric Motility Disorder Drug Market, fueled by a large pharmaceutical industry and stringent regulatory frameworks, driving robust growth by 2035.

- Asia Pacific's Gastric Motility Disorder Drug Market is set for significant growth by 2035, attributed to accelerating urbanization and increasing prevalence of gastric motility disorders.

Segment Insights:

- The Upper Digestive Tract segment is projected to dominate by 2035, driven by rising cases of conditions like achalasia and dyspepsia due to lifestyle and dietary habits.

- The Proton Pump Inhibitor segment of the Gastric Motility Disorder Drug Market is projected to hold over 33.4% share by 2035, driven by their effectiveness in managing acid-related disorders like GERD and peptic ulcers.

Key Growth Trends:

- Rising prevalence of gastric disorders

- Drug development advancements

Major Challenges:

- Safety concerns

- Cost and accessibility limitation

- Key Players: Janssen Pharmaceuticals NV, Salix Pharmaceuticals, Bayer AG, AbbVie Inc., and more.

Global Gastric Motility Disorder Drug Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.47 billion

- 2026 Market Size: USD 63.25 billion

- Projected Market Size: USD 99.44 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Gastric Motility Disorder Drug Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of gastric disorders: The Increasing burden of conditions such as gastroparesis has fueled the requirement of effective treatment solutions. Globally, the prevalence of gastroparesis has been steadily rising over the past few years due to heightened stress and lifestyle choices in developing countries. For instance, in January 2022, according to a report from Gastrojournal, the incidence of gastroparesis in the U.S. was 26.7 per 100,000 adults, while definite gastroparesis affects 21.5 per 100,000 people. It further highlighted that the condition can lead to lung disease (46.4%), diabetes (37.3%), etc. Thus, the increase in the frequency of these disorders drives the necessity for gastric motility drugs.

- Drug development advancements: The principal driver for the market is the extensive research and innovation in the drug development process. This will allow treatment of GMD aside from traditional drugs, lessening the side effects associated. Furthermore, faster approvals from regulatory frameworks also play a crucial role in addressing unmet medical needs. According to a report by NLM in August 2021, metoclopramide is the only FDA-approved drug for gastroparesis in the U.S. use is limited to less than three months. Such niche approvals fuel the market growth through catering to the ever-increasing interest in the effective treatment of GMD.

Challenges

-

Safety concerns: The main bottleneck in the gastric motility disorder drug market is mainly safety concerns associated with the existing usage of long-term medications. Commonly used prokinetic agents have been linked to severe side effects, including neurological disorders such as tardive dyskinesia and cardiac risks, I.e., QT prolongation resulting in a substantial number of individuals remaining unhealthy. The inability to ensure efficiency, leading to poor health outcomes, is tied to failing treatment. Safety concerns create hesitation among healthcare providers and patients, diminishing market growth and awareness worldwide.

- Cost and accessibility limitation: The major limiting factor in the market is accessibility in many regions. While new drugs with enhanced efficacy and low side effects are being introduced, their affordability remains a major concern in developing countries. Additionally, patent protections and high research and development costs can impact a large section of the population, making it expensive. Thus, this widens the disparities in the healthcare sector, restricting access to effective treatments.

Gastric Motility Disorder Drug Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 60.47 billion |

|

Forecast Year Market Size (2035) |

USD 99.44 billion |

|

Regional Scope |

|

Gastric Motility Disorder Drug Market Segmentation:

Drug Class (Proton Pump Inhibitors, Antacids, Antidiarrheals, Calcium-channel Blockers, H2 Blockers)

Based on the drug class, the proton pump inhibitor segment is anticipated to dominate over 33.4% gastric motility disorder drug market share by 2035. The dominance is majorly due to their widespread ability to manage acid-related disorders, such as heartburn and peptic ulcers, that impact gastric motility. According to a study published in the NLM in April 2021, proton pump inhibitors have revolutionized the management of acid-related diseases, particularly GERD, due to their enhanced efficacy in reducing stomach acid production. Therefore, the ongoing dominance of PPI, coupled with growing awareness, further supports the market expansion globally.

Disorder Type (Upper Digestive Tract, Lower Digestive Tract)

The upper digestive tract segment is anticipated to dominate the gastric motility disorder drug market by 2035, attributable to the requirement of proper enzymatic function in breaking down food & facilitating an empty stomach. This is an area of growth due to the burden of conditions such as achalasia and functional dyspepsia caused by the consumption of processed foods, lifestyle changes, and stress-associated digestive disorders. In November 2023, according to a population-based cohort study by the Korean National Health Insurance Service, achalasia affected 6.4 per 100,000 people, with a risk of esophageal cancer. Therefore, research into new drug formulations proves to be helpful in the use of therapeutic drugs in managing gastric motility disorders.

Our in-depth analysis of the global market includes the following segments:

|

Drug Class |

|

|

Disorder Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gastric Motility Disorder Drug Market Regional Analysis:

North America Market Statistics

North America gastric motility disorder drug market is set to account for revenue share of more than 42.5% by the end of 2035, driven by the presence of a large pharmaceutical industry and stringent regulatory frameworks. The advanced healthcare infrastructure, strong research and development initiatives further drive market expansion. This has heightened awareness among both healthcare providers and patients about the need to address gastric motility disorders as a critical health issue.

The U.S. market is unfolding remarkable growth opportunities attributable to the increased geriatric population with increasing instances of gastric motility disorders. Additionally, rising healthcare expenditure and the adoption of prescription-based treatments support market expansion. For instance, in August 2024, according to a clinical study by NLM, GERD is a highly prevalent disorder affecting over 40% population in the U.S., which drives the necessity for effective treatment with better patient outcomes.

The gastric motility disorder drug market in Canada is witnessing significant growth due to the growing focus on digestive health and instances of gastrointestinal disorders. In addition, the government supports to improvement of this health condition through its funding and approvals. In July 2022, Evoke Pharma, Inc. announced the expansion of its intellectual property portfolio with a patent for GIMOTI for treating diabetic gastroparesis aligning with U.S. FDA-listed patents. Such approvals position Canada as a global leader in the gastric motility drug market.

Asia Pacific Market Analysis

The gastric motility disorder drug market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline, i.e., 2026-2035. Health professionals are increasingly finding a place for gastric motility disorders within their practices, which has resulted in a context that encourages developing effective treatment to improve quality of life. Consequently, the need for proper health evaluation and intervention encompassing physiological aspects of health has become more prominent in this region.

The market in India is expecting substantial growth owing to the accelerating urbanization & sedentary lifestyle with distorted digestive health. To manage such conditions to become more intense, the country’s organizations are initiating steps by reforming the collaborations. In July 2024, Dr. Reddy’s Laboratories Ltd. announced a licensing agreement with Takeda Pharmaceutical Company Limited to commercialize Vonoprazan in India to treat reflux esophagitis & acid peptic disorders. Such agreements strengthen India’s position in the global market.

The market in China is gaining traction due to a large aging population and healthcare professionals and companies with a collective goal of improving health quality through their inventions. For instance, in August 2024, AstraZeneca and Daiichi Sankyo Company, Limited’s Enhertu received conditional approval in China for HER2-positive gastric or gastroesophageal junction adenocarcinoma in patients who have undergone at least two prior treatments. Thus strengthening China’s market in the global network with advanced treatments.

Key Gastric Motility Disorder Drug Market Players:

- Pfizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Janssen Pharmaceuticals NV

- Salix Pharmaceuticals

- Bayer AG

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Gilead Sciences, Inc.

- Biogen

- Organon Group of Companies

- Abbott

The landscape in the gastric motility disorder drug market is rapidly changing, mainly because of the growing awareness of gastrointestinal health, innovative treatment approaches to address the concerns. In December 2023, Vanda Pharmaceuticals Inc. announced that the FDA had accepted its new drug application (NDA) for tradipitant to treat gastroparesis symptoms. This action reinforces the gastric motility drug market focusing on effective therapies.

Here's the list of some key players:

Recent Developments

- In December 2024, Evoke Pharma, Inc. announced that GIMOTI remains the only FDA-approved alternative for gastroparesis treatment as the domperidone supply is expected to end in early 2025.

- In June 2024, Akums Drugs and Pharmaceuticals Ltd introduced Rabeprazole + Levosulpiride SR Capsules, approved by DCGI, to enhance relief for gastrointestinal tract disorders with its dual action.

- Report ID: 7451

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.