Small Molecule Drug Discovery Market Outlook:

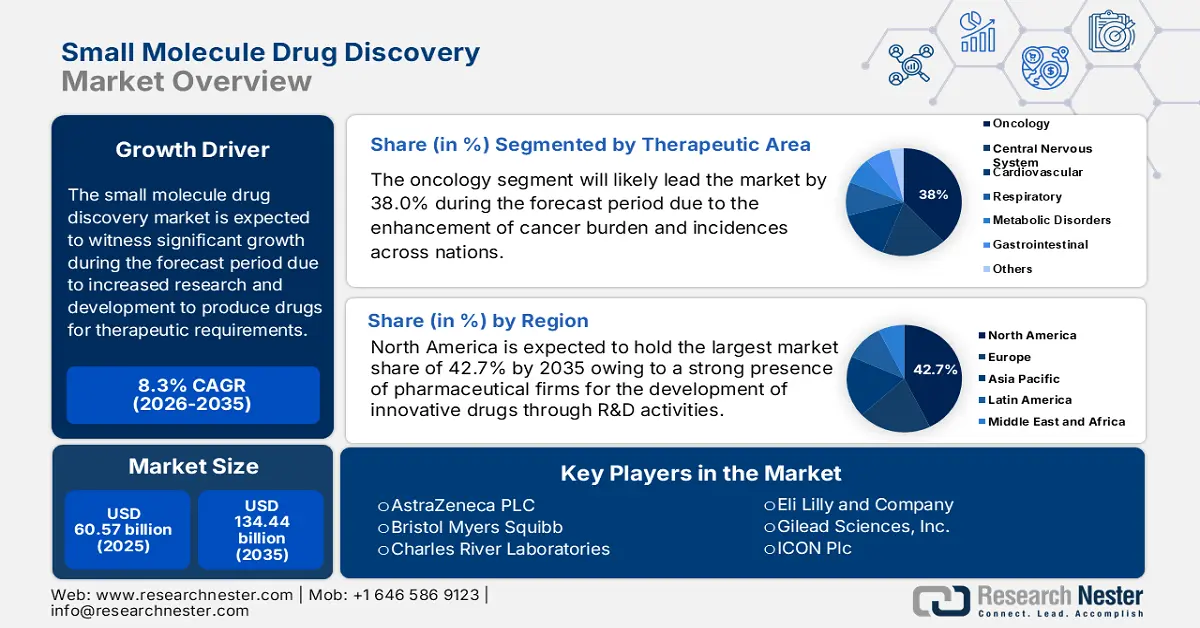

Small Molecule Drug Discovery Market size was valued at USD 60.57 billion in 2025 and is set to exceed USD 134.44 billion by 2035, registering over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small molecule drug discovery is estimated at USD 65.09 billion.

The small molecule drug discovery market is expanding rapidly as a result of the rising prevalence of chronic diseases and the increasing approval of targeted therapeutics. The surge in conditions such as rare genetic disorders, and cardiovascular concerns additionally encourages pharmaceutical firms to develop small-molecule drugs due to their efficacy, cost-effectiveness, and easy administration as compared to biologics. For instance, in 2023, the FDA approved 38 New Molecular Entities (NMEs), including small molecule drugs that aid in the treatment of diseases such as cardiovascular diseases, and rare disorders.

Additionally, the collaboration of pharmaceutical and biotech companies is increasing the competitive landscape in the market. In February 2023, Charles River Laboratories announced a multi-program collaboration with Pioneering Medicines to leverage AI-powered Logica to accelerate drug discovery. Similarly, in January 2024, Iktos partnered with Nerviano Medical Sciences to enhance small molecule discovery using AI. Therefore, the market is subjected to growth driven by the factors such as increased investments, and expanding regulatory approvals.

Key Small Molecule Drug Discovery Market Insights Summary:

Regional Highlights:

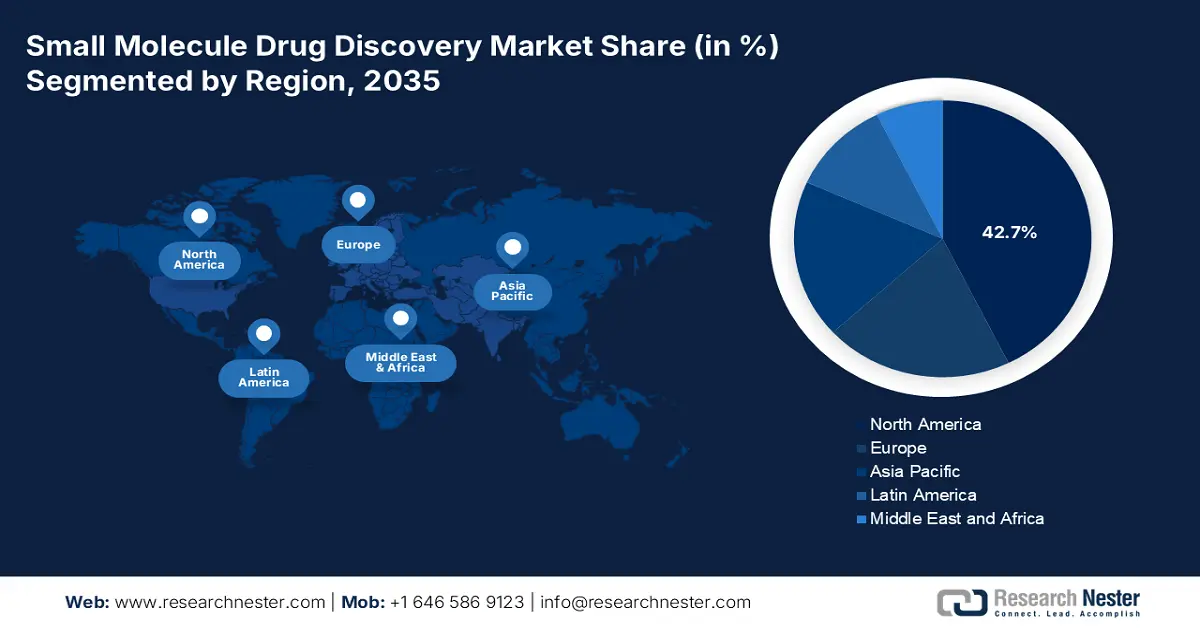

- North America dominates the Small Molecule Drug Discovery Market with a 42.7% share, fueled by rising prevalence of chronic diseases and FDA approvals, supporting robust growth through 2035.

- The small molecule drug discovery market in Asia Pacific is experiencing the fastest growth by 2035, driven by rising healthcare investments and a large patient base.

Segment Insights:

- Oncology segment is projected to hold a 38% share by 2035, driven by its role in treating various cancers including lung, breast, and prostate.

Key Growth Trends:

- Technological advancements

- Rising prevalence of chronic diseases

Major Challenges:

- High drug development costs

- Strict regulatory guidelines

- Key Players: Pfizer Inc., Johnson & Johnson, AstraZeneca PLC., Novartis AG, Merck & Co., Inc., GlaxoSmithKline plc, Bristol Myers Squibb Company.

Global Small Molecule Drug Discovery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.57 billion

- 2026 Market Size: USD 65.09 billion

- Projected Market Size: USD 134.44 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Small Molecule Drug Discovery Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements: The collaboration of artificial intelligence and machine learning is transforming the market by optimizing target identification along with lead selection, significantly reducing the time and cost associated with traditional drug development. According to AI in small molecule drug discovery by Elsevier in 2023, biotech companies using an AI-first approach have advanced over 150 small molecule drugs with more than 15 in clinical trials. In contrast, traditional drug development takes 10-15 years costing around USD 2.8 billion with an 80-90% failure rate.

- Rising prevalence of chronic diseases: A surge in the incidence of health disorders is also a major market-driving factor for these drugs. According to a report by WHO in December 2024, 43 million deaths were reported in 2021 due to chronic diseases with 80% of premature noncommunicable diseases (NCD) deaths linked to these disorders. Additionally, as stated by NIH, small molecule drugs are widely used in cancer treatment further driving market growth.

Challenges

- High drug development costs: For the small molecule drug discovery market to boost it requires huge development costs and lengthy timelines, which remains a major barrier. This aspect, as in high cost, makes organizations restrictive in the market penetration. The process of making this drug requires extensive preclinical research and clinical trials, which negatively act as a financial burden for investors.

- Strict regulatory guidelines: Rigid legal policies and compliance barriers act as a restraint for the drug discovery market. The regulatory authorities have uncompromising requirements for a drug to be approved with multiple phases of testing, such as randomized clinical trials, which can take up to 10-15 years to complete. Additionally, regulations on data transparency and safety monitoring can add increased complexity along with cost. Failure to meet these standards can cause delays, rejections, or supplementary testing, increasing the financial strain and negatively impacting both pharma and biotech firms as a challenge to grow in the market.

Small Molecule Drug Discovery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 60.57 billion |

|

Forecast Year Market Size (2035) |

USD 134.44 billion |

|

Regional Scope |

|

Small Molecule Drug Discovery Market Segmentation:

Therapeutic Area (Oncology, Central Nervous System, Cardiovascular, Respiratory, Metabolic Disorders, Gastrointestinal, and Others)

Oncology segment is expected to account for small molecule drug discovery market share of around 38% by 2035. This area is utilized to aid multiple cancer types such as breast, prostate, lung, and colorectal. Implementation of small molecule drugs in such cases assists in treating solid tumors along with hematological cancers efficiently. For instance, in 2024 Genentech's Alecensa received its approval from the FDA, which is the first adjuvant treatment for people diagnosed with ALK-positive early-stage lung cancer.

Process (Target ID/Validation, Hit Generation and Selection, Lead Identification, Lead Optimization)

Based on process, the target identification/validation segment is expected to dominate the market by 2035. The increased focus on the early identification of biomolecular structures and validation of the drug effect are the factors boosting the growth of this segment. However, to overcome the inability of certain drugs, these steps are critical to identify the biological targets. For instance, in December 2024, Encorafenib with Cetuximab was approved by the FDA for treating metastatic colorectal cancer, which highlights the increased priority for this leading to effective and safe treatments.

Our in-depth analysis of the global small molecule drug discovery market includes the following segments:

|

Therapeutic Area |

|

|

Process |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Molecule Drug Discovery Market Regional Analysis:

North America Market Analysis

By the end of 2035, North America small molecule drug discovery market is set to hold over 42.7% revenue share. The region is subjected to an increased prevalence of chronic diseases that is expanding the utilization of these therapeutics. For instance, in 2023 the U.S. FDA approved 50 small-molecule drugs that target conditions such as oncology and cardiovascular diseases, a few of the examples being lapatinib for NSCLC and imatinib for chronic myelogenous leukemia.

The stimulated urge in the U.S. for the small molecule drug discovery market is due to the occurrence of cancer in a majority of the population. According to a report by the National Cancer Institute (NCI), in 2024, 2,001,140 cases were diagnosed in the U.S. and 611,720 were estimated to death. Furthermore, as per the report by NLM, these therapeutics are improving prognosis by reducing side effects when compared with chemotherapy, denoting an increased requirement for these drugs.

Canada drug market is expanding steadily due to the rising demand for targeted therapeutics, according to a report published in NLM migraine is affected by 24.9% of females and 7.8% of males in total around 3.4 million adults encompassing around 2.6 million women and 0.8 million men in Canada. Among them, only 46% have been diagnosed under the supervision of a healthcare provider which underscores the health disparities. Subsequently, due to the advancements in the industry, the small molecule CGRP receptor antagonists such as Rimegepant, and Ubrogepant have revolutionized migraine treatment which was approved by Health Canada in a span from 2018 to 2024.

APAC Market Statistics

The APAC market is anticipated to be the fastest-growing, registering a significant share in 2035. Due to the large patient base and rising healthcare investments, the region houses a large population with a substantial number of people suffering from diseases that can be treated potentially through small-molecule drugs. This grants a considerable market prospect for establishments providing healthcare investments in the region, further driving market growth. These factors along with the benefits from high throughput screening (HTS) technologies and the increasing presence of Contract Research Organizations (CROs) can significantly boost the region’s market.

India is subjected to huge demand for these drugs due to the focus on oncology and small molecule drugs. For instance, in July 2022 Aurigene Discovery Technologies Limited announced a partnership with EQRx to encourage the development of drugs in the areas of oncology and immune-inflammatory diseases and improve global access to innovative medicines. Additionally, government initiatives and increased investments in pharmaceutical research and development are further driving market expansion in the country.

The small molecule drug market in China is gaining more traction due to the raised demand for targeted drugs and companies’ commitment to support and develop the drug. In May 2022, LaNova Medicines and Turning Point Therapeutics entered into a licensing agreement for the development and commercialization of LM- 302 an anti-body drug conjugate targeting claudin 18.2. Therefore, the country’s market is expected to experience substantial growth during the forecast period.

Key Small Molecule Drug Discovery Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- AstraZeneca PLC.

- Novartis AG

- Merck & Co., Inc

- GlaxoSmithKline plc

- Bristol Myers Squibb Company

The global small molecule drug discovery market is anticipated to witness a significant expansion due to factors such as research advancements, drug development strategies, etc. Major firms are strengthening their market positions via investments, collaborations, and acquisitions as well. For instance, in January 2024, the pharmaceutical industry saw a significant merger and acquisition. Bristol-Myers Squibb acquired Mirati Therapeutics for USD 5.8 billion to strengthen its oncology pipeline. Additionally, in January 2024 Roche acquired Carmot Therapeutics aiming to develop therapeutics for people living with metabolic diseases including obesity and diabetes. Here is the list of some prominent players across the globe:

Recent Developments

- In October 2024, Terra Therapeutics raised 120 million USD in an oversubscribed series B round for the advancement of its AI-powered small-molecule drug discovery platform, tNova.

- In February 2022, Remix Therapeutics announced its integration with Janssen to promote small molecule therapeutics, making the use of REMaster Drug Discovery Platform to Modulate RNA Processing.

- In January 2022, Amgen and Arrakis Therapeutics collaborated on RNA degrader therapeutics to target disease-causing proteins, which is a novel approach in small molecule drug development.

- Report ID: 7364

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.