Electrolyte Reagents Market Outlook:

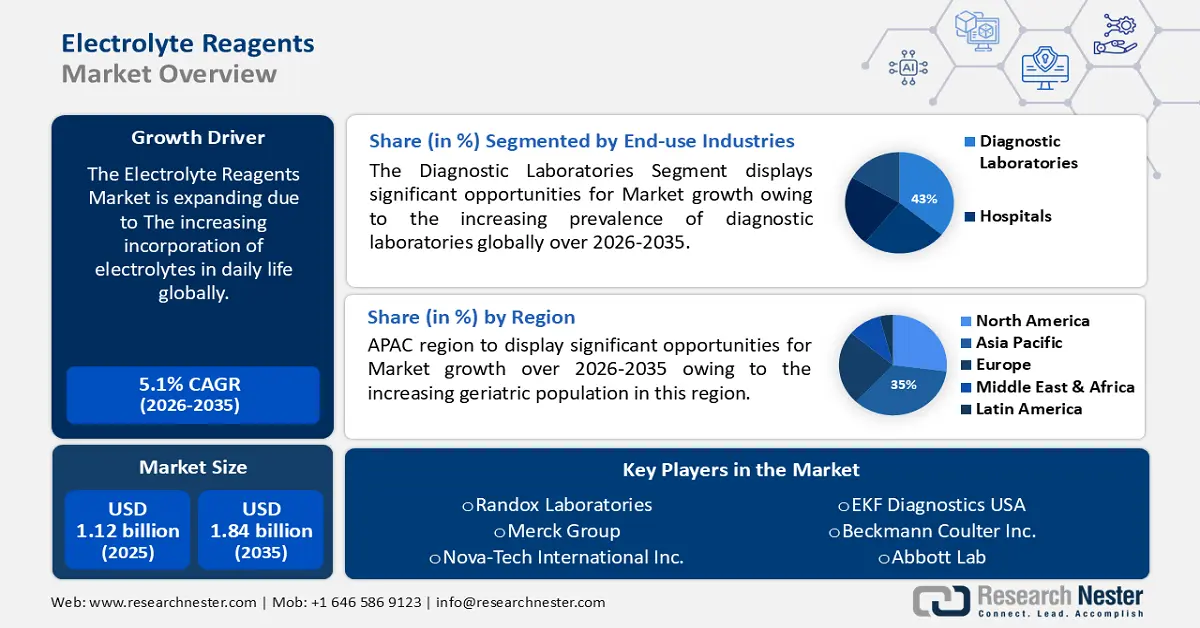

Electrolyte Reagents Market size was over USD 1.12 billion in 2025 and is anticipated to cross USD 1.84 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electrolyte reagents is assessed at USD 1.17 billion.

The increasing incorporation of electrolytes in daily life globally will exponentially help the market to grow in the expected CAGR. Since approximately 60% of an adult's body is made of water, electrolytes are present in almost all bodily fluids and cells. The electrolytes support the body's ability to manage chemical techniques, keep the fluid offset inside and outside of your cells, and much more.

Another reason to propel the electrolyte reagents market by the end of 2036 is the increasing use of electrolyte reagents in the resoluteness of sodium, potassium, and chloride concentration in human serum, plasma, and urine. Utilizing the special qualities of some membrane materials, an Ion-Selective Electrode (ISE) creates an electrical potential (electromotive force, or EMF) for measuring ions in solution. The ISE, a reference electrode, and electronic circuits to monitor and process the EMF to provide the test ion concentration make up the entire measuring system for a specific ion.

Key Electrolyte Reagents Market Insights Summary:

Regional Highlights:

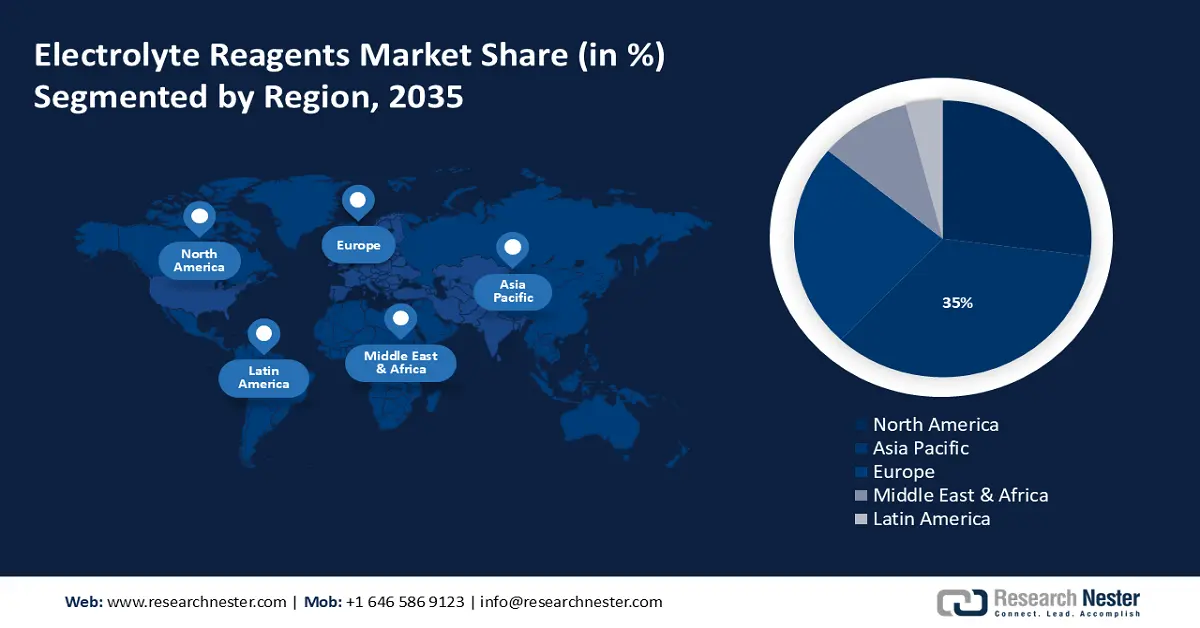

- By 2035, the Asia Pacific region is anticipated to secure a 35% revenue share in the electrolyte reagents market, attributed to the increasing geriatric population in this region.

- By 2035, the North America region is expected to hold the second-largest position, supported by the rapid advancement of technology in this region.

Segment Insights:

- By 2035, the bone diseases segment is projected to account for around 38% share of the electrolyte reagents market, propelled by the increasing cases of bone diseases globally.

- By 2035, the diagnostic laboratories segment is estimated to capture nearly a 43% share, sustained by the growing prevalence of diagnostic laboratory services.

Key Growth Trends:

- The Increasing Sedentary Lifestyle Across the World

- Increasing Cases of Hyperchloremia and Hypochloremia Worldwide

Major Challenges:

- Electrolytes Can Cause Different Types of Disorders

- Lack of Knowledge and Skill in People

Key Players: Convergent Technologies, Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsRandox Laboratories, Merck Group, Nova-Tech International Inc., EKF Diagnostics USA, Beckmann Coulter Inc., Abbott Lab, J S Medicina Electronica, URIT Medical Electronic, HANNA Instruments.

Global Electrolyte Reagents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.12 billion

- 2026 Market Size: USD 1.17 billion

- Projected Market Size: USD 1.84 billion by 2035

- Growth Forecasts: 5.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 1 December, 2025

Electrolyte Reagents Market - Growth Drivers and Challenges

Growth Drivers

-

The Increasing Sedentary Lifestyle Across the World - An estimated 3.2 million deaths worldwide are attributed to inadequate physical activity, which is practiced by about 31% of the world's population aged 15 and older. Data from 194 nations demonstrate that overall progress is sluggish and that nations must move more quickly to establish and put into place policies aimed at increasing physical activity levels, which will help to prevent disease and lighten the load on already overburdened healthcare systems. The Global Status Report on Physical Activity from WHO highlights a crucial finding: there are substantial gaps in global data that make it difficult to monitor the advancement of crucial policy initiatives like the creation of public open spaces, infrastructure for bicyclists and walkers, and the inclusion of physical education and sports in school curricula. The report also demands that certain data shortcomings be remedied.

-

Increasing Cases of Hyperchloremia and Hypochloremia Worldwide - The growing incidence of heart failure (HF) and the growing understanding of chloride as a prognostic indicator in HF have sparked interest in the etiology and relationships between anomalies in chloride and HF-related variables and therapies. One of the main electrolytes with a special function in fluid homeostasis is chloride, which is linked to the cardiorenal and neurohormonal systems. Thus, the importance of cardiac implants is also increasing globally. Nevertheless, hyperchloremia can appear when water losses surpass sodium and chloride losses when the capability to tackle high chloride is overpowered, or when the serum bicarbonate is low with a concomitant increase in chloride as appears with a normal anion gap metabolic acidosis or respiratory alkalosis.

- Rigorous Government Regulations to Increase Physical Activities - Even, though there have been more national initiatives in recent years to address physical inactivity and NCDs, 28% of these plans are reportedly unfunded or not being implemented. Although mass participation in physical activity events is thought to be a "best buy" for encouraging people to fight non-communicable diseases (NCDs), the survey revealed that in the past two years, just slightly more than 50% of countries had organized or conducted national communications campaigns. In addition to delaying these projects, the COVID-19 pandemic has impacted the execution of other policies, increasing disparities in many communities' access to and opportunities for physical exercise.

Challenges

-

Electrolytes Can Cause Different Types of Disorders - The most common electrolyte abnormality is hyponatremia. When the serum sodium level is less than 135 mmol/L, hyponatremia is diagnosed. There are neurological signs of hyponatremia. Patients may exhibit delirium, headaches, nausea, and confusion. When serum sodium levels are higher than 145 mmol/L, hypernatremia is the result. Restlessness, tachypnea, and trouble sleeping are signs of hypernatremia. Osmotic demyelination syndrome (ODS) and cerebral edema are two serious side effects of rapid sodium adjustments. Malnutrition and chronic alcohol misuse disorders are two additional factors that contribute to the development of ODS. Arrhythmias of the heart may arise from abnormalities in potassium. When serum potassium levels are less than 4 mmol/L, hypokalemia is the result. Hypokalemia manifests as weakness, lethargy, and twitching of the muscles. Generalized bodily weakness caused by hypokalemic paralysis might be inherited or occur occasionally. When serum potassium levels are higher than 5 mmol/L, it is referred to as hyperkalemia and can cause arrhythmias.

-

Lack of Knowledge and Skill in People

- The Excessive Cost Related to Progressed Electrolyte Analyzers

Electrolyte Reagents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.12 billion |

|

Forecast Year Market Size (2035) |

USD 1.84 billion |

|

Regional Scope |

|

Electrolyte Reagents Market Segmentation:

Diagnostic Application Segment Analysis

The bone diseases segment is expected to hold around 38% share of the global electrolyte reagents market by 2035.because of the increasing cases of bone diseases globally. An osteoporotic fracture occurs every three seconds due to osteoporosis, which results in more than 8.9 million fractures worldwide each year. A projected 200 million women internationally are thought to be influenced by osteoporosis. This diagnosis impacts one-tenth of women in their 60s, one-fifth of women in their 70s, and two-fifths of women in their 80s. Two-thirds of women are in their 90s when they face muscle stiffness. Muscle and bone are hormonally delicate tissues. When women come to menopause, the results of estrogen withdrawal are far higher than in men of the same age. Osteoporotic fractures have a female-to-male ratio of roughly 1.6, meaning that women sustain 80% of forearm fractures, 75% of humerus fractures, 70% of hip fractures, and 58% of spine fractures.

End-user industries Segment Analysis

The diagnostic laboratories segment is expected to hold around 43% share of the global electrolyte reagents market by 2035.owing to the increasing prevalence of diagnostic laboratories globally. A crucial part of the healthcare system is played by clinical laboratories. Approximately 60–70% of clinical choices are supported by objective medical data from clinical laboratories; nevertheless, despite their undeniable influence on patient care and public health, the evidence for this claim is little documented, and laboratories continue to be poorly known. By offering and guaranteeing the caliber of medical laboratory tests to assist in clinical decision-making, clinical laboratories play a crucial part in the provision of patient care. Clinical laboratories give medical practitioners the unbiased information they need to deliver high-quality, secure, efficient, and suitable care for the prevention, diagnosis, treatment, and management of disease.

Our in-depth analysis of the global electrolyte reagents market includes the following segments:

|

Product Type |

|

|

Diagnostic Application |

|

|

End-User Industries |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrolyte Reagents Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 35% by 2035. This growth will be noticed owing to the increasing geriatric population in this region. In Asia and the Pacific, one in four individuals will be over 60 by 2050. Between 2010 and 2050, the number of senior people (those over 60) in the region will treble, approaching 1.3 billion. The region will face a wide range of social and economic ramifications from this demographic shift, including changes to the structure and layout of towns and cities, the provision and administration of social and health services, the nature of work and employment, social security, and supportive fiscal policies.

North American Market Insights

The electrolyte reagents market in the North America region will also encounter huge growth during the forecast period and will hold the second position owing to the advancement of technology in this region. North America's tech and AI scene in 2024 will be defined by quick developments, intense competition, and a rising focus on the moral and responsible application of AI. Major tech hubs across the continent, including Silicon Valley, Seattle, New York City, Toronto, and others, are still at the forefront of innovation and draw in top talent from across the globe. Artificial intelligence (AI) technologies are widely used in a wide range of industries, in the region including manufacturing, entertainment, healthcare, finance, and transportation.

Electrolyte Reagents Market Players:

- Convergent Technologies

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Randox Laboratories

- Merck Group

- Nova-Tech International Inc.

- EKF Diagnostics USA

- Beckmann Coulter Inc.

- Abbott Lab

- J S Medicina Electronica

- URIT Medical Electronic

- HANNA Instruments

Recent Developments

- Merck Group, a foremost science and technology company, has grown its M LabTM Collaboration Center in Shanghai, the organization’s newest in its international network of ten interrelated labs. The € 14 million (1 Million USD) spent adds a fresh biology application lab, a technique development training center, and an upstream application lab to the present M LabTM Collaboration Center in Shanghai.

- Merck Group, spent over € 300 million (32 Million USD) into the latest Bioprocessing Production Center in Daejeon, South Korea. The new site is the biggest investment by Merck's Life Science business sector in Asia-Pacific to date and shows the organization’s dedication to growing its capabilities in the fast-growing region. Merck projects the investment to develop roughly 300 additional jobs by the end of 2028.

- Report ID: 5976

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrolyte Reagents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.