Atherectomy Devices Market Outlook:

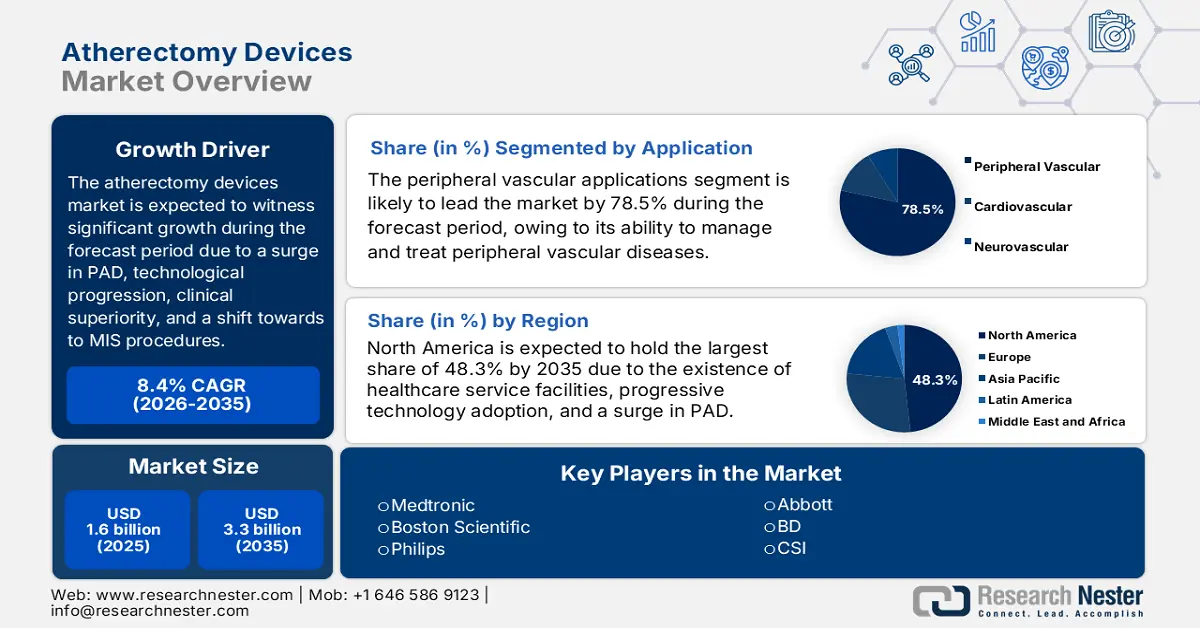

Atherectomy Devices Market size was USD 1.6 billion in 2025 and is anticipated to reach USD 3.3 billion by the end of 2035, increasing at a CAGR of 8.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of atherectomy devices is estimated at USD 1.7 billion.

The robust growth of the market is readily supported by the combination of economic, clinical, technological, and demographic factors. These include a surge in target disorders, technological innovation, clinical superiority, and a sudden shift towards minimally invasive procedures. According to an article published by the CDC in May 2024, peripheral arterial disease (PAD) is increasing, and 4 in 10 people experience no leg pain. Besides, an estimated 6.5 million people aged more than 40 years, particularly in the U.S., readily suffer from PAD, owing to which the market is gaining increased exposure.

Moreover, the presence of suitable reimbursement policies, development in healthcare infrastructure and expenditure, along with robust physician training, and clinical evidence are also driving the market internationally. As per an article published by NLM in June 2023, previously, 300 mm balloons and low-profile support catheters were utilized for aiding PAD. Besides, at present, there are 5,000 ASCs and 750 OBLs in the U.S., thereby denoting the growth of medical facilities for catering to the overall market’s upliftment. Meanwhile, the Decisions Resources Group utilizes a survey system, which tends to estimate that almost 25% of lower extremity arterial revascularization procedures and nearly 1/3rd of all endovascular procedures are conducted in the nonhospital setting.

Key Atherectomy Devices Market Insights Summary:

Regional Insights:

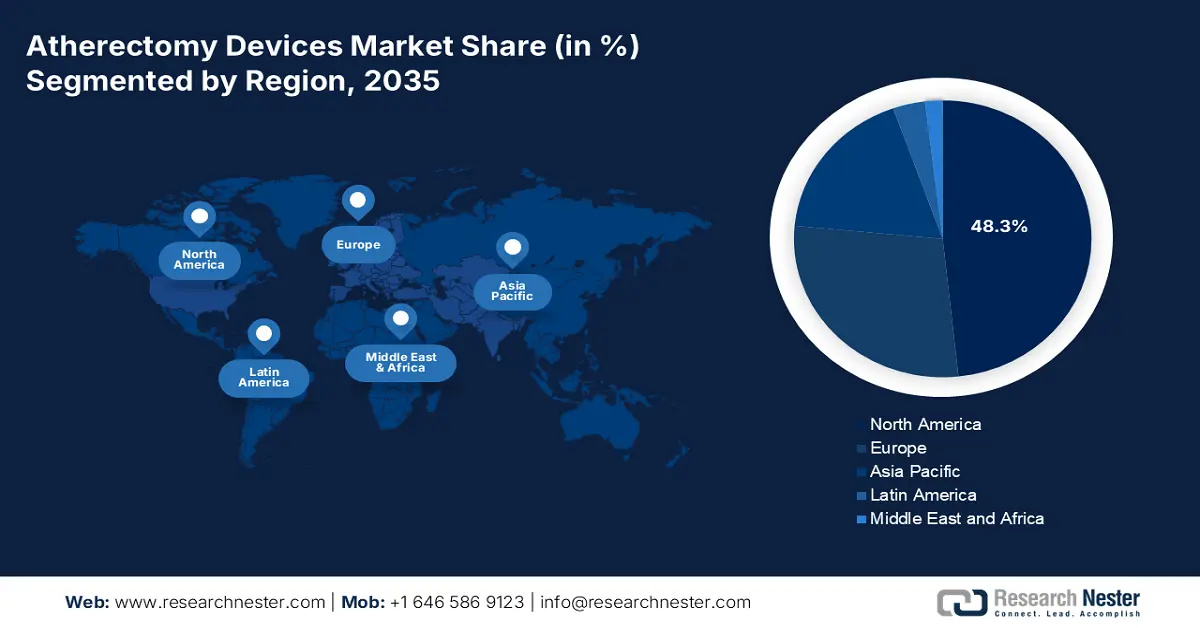

- North America is expected to capture 48.3% share by 2035, driven by rising PAD prevalence, advanced healthcare facilities, and effective Medicare reimbursement policies in the Atherectomy Devices Market.

- Asia Pacific is projected to be the fastest-growing region during 2026–2035, owing to aging populations, expanding healthcare infrastructure, and growth in medical tourism.

Segment Insights:

- Peripheral Vascular Applications segment is projected to account for 78.5% share by 2035, propelled by its critical role in managing and diagnosing peripheral vascular diseases (PVD).

- Hospitals segment is anticipated to hold the second-largest share by 2035, owing to comprehensive infrastructure and specialized medical expertise.

Key Growth Trends:

- Tactical focus on ambulatory surgical centers (ASCs)

- ata-generating capabilities in devices

Major Challenges:

- Strict health technology assessment and hurdles

- International and reference pricing benchmarking

Key Players: Medtronic plc (Ireland), Boston Scientific Corporation (U.S.), Philips (Netherlands), Abbott Laboratories (U.S.), BD (Becton, Dickinson and Company) (U.S.), Cardiovascular Systems, Inc. (CSI) (U.S.), iVascular (Spain), Rex Medical (U.S.), Avinger Inc. (U.S.), Spectranetics (U.S.), Biotronik (Germany), Cook Medical (U.S.), Cardinal Health (U.S.), AngioDynamics (U.S.), Lemaitre Vascular (U.S.), Straub Medical AG (Switzerland).

Global Atherectomy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.3 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 15 September, 2025

Atherectomy Devices Market - Growth Drivers and Challenges

Growth Drivers

- Tactical focus on ambulatory surgical centers (ASCs): These facilities provide personalized, convenient, and cost-effective care, particularly for surgical processes that are devoid of hospitalization, thereby uplifting the market globally. As per an article published by NLM in March 2023, surgical processes in the U.S. increasingly shifted to non-hospital locations, which resulted in 4% yearly expansion rate of the ASC market for more than 10 years. In addition, it was projected to witness a further increase to 144 million procedures in 2023, thus boosting the overall market’s exposure across different countries.

- Data-generating capabilities in devices: These capabilities in medical devices are essential due to their ability to offer effective and personalized patient care, latest treatment development and medical research, provide early disease detection, and support progression by offering real-world proof, thus suitable for the market. According to the April 2023 NLM article, the digital health market, also contributing towards medical devices, accounted for USD 211 billion as of 2022, and is further anticipated to surge to 18.6% by the end of 2030, thus creating opportunity for healthcare delivery.

- Rise in medical tourism: This is a crucial growth factor for the market, providing high-quality and affordable healthcare services to patients demanding treatments that are either unavailable or expensive in their respective countries. According to the April 2025 CDC report, it is recommended for medical tourists not to fly for at least 10 days after abdominal surgery to overcome risks related to modifications in atmospheric pressure. Besides, commercial aircraft cabin pressures are approximately equivalent to external air pressure at 6,000 to 8,000 feet above sea level to get rid of any medical disaster.

Needles, Catheters, Cannulae 2023 Export and Import Data

|

Components |

Export |

Import |

|

U.S. |

USD 6.9 billion |

USD 7.6 billion |

|

Ireland |

USD 4.4 billion |

- |

|

Mexico |

USD 4.3 billion |

- |

|

Netherlands |

- |

USD 4.9 billion |

|

Germany |

- |

USD 2.7 billion |

|

World Trade |

USD 35.8 billion |

|

|

World Trade Share |

0.1% |

|

|

Product Complexity |

1.1 |

|

|

Export Growth |

5.9% |

|

Source: OEC, August 2025

Historical Global Healthcare Expenditure Uplifting the Atherectomy Devices Market

|

Components |

2005 |

2010 |

2015 |

2019 |

2022 |

|

Health spending USD per capita |

25 |

46 |

60 |

74 |

81 |

|

Government domestic health spending % |

5.3 |

5.5 |

5.2 |

3.4 |

0.8 |

|

Out-of-pocket spending % |

79.0 |

79.0 |

78.4 |

76.8 |

77.9 |

|

Priority to health |

3.4% |

2.3% |

2.0% |

1.8% |

1.1% |

|

GDP USD per capita |

252 |

542 |

593 |

499 |

349 |

Source: WHO

Challenges

- Strict health technology assessment and hurdles: Beyond efficiency and basic safety, payers in the market are in need of strong and superior economic value evidence. Agencies, such as IQWiG in Germany and NICE in the UK, demand additional data to display higher expenses, which is readily justified by effective long-lasting outcomes, including lower care expenses, fewer amputations, and diminished repeat procedures. Besides, new entrants, particularly those with advanced technology, struggle to achieve real-world evidence, thus causing a hindrance in the overall market’s growth.

- International and reference pricing benchmarking: This practice associates the reimbursement price of the newest device in a country and compares it with prices that are already established in other nations. For manufacturers, this develops a tactical dilemma, which negatively impacts the market across different nations. Besides, this system drastically diminishes the overall return on investment as well as critically constrains the pricing flexibility across Europe. As a result, market accessibility initiatives become complicated for countries to unveil and maintain pricing strategies, thus lowering the market’s growth.

Atherectomy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.3 billion |

|

Regional Scope |

|

Atherectomy Devices Market Segmentation:

Application Segment Analysis

Based on the application, the peripheral vascular applications segment is anticipated to garner the largest market share of 78.5% by the end of 2035. The segment’s growth is highly attributed to its essentiality for managing, aiding, and diagnosing peripheral vascular diseases (PVD), which tends to result in critical complications, including organ damage and limb loss. As per an article published by NLM in June 2023, this disease affects almost 200 million people, including 40 to 45 million patients from America, thereby creating a huge growth opportunity and increased demand for the market internationally.

End user Segment Analysis

Based on the end user, the hospitals segment is expected to cater to the second-largest share during the projected timeline. The segment’s upliftment is highly subject to the presence of wide-ranging infrastructure, which comprises on-site intensive care units, hybrid operating rooms, and innovative catheterization laboratories. Besides, hospitals also focus on the specialized talent for radiologists, vascular surgeons, and interventional cardiologists, as well as readily possess the financial ability for increased capital investment expense. Meanwhile, suitable diagnosis-related group (DRG) reimbursement codes for inpatient procedures in markets such as Germany and the U.S. solidify this segment as the ultimate revenue center.

Product Segment Analysis

Based on the product, the orbital atherectomy (OA) systems segment is projected to constitute the third-largest share during the forecast period. The segment’s development is effectively driven by its ability to effectively and safely aid critical and calcified arterial plaque, which is a challenging condition that can combat adequate balloon as well as stent extension during percutaneous coronary intervention (PCI). As per the July 2025 NLM article, the procedural success of the treatment was 94% based on the ORBIT I trial. In addition, it was also demonstrated that after one year of effectively following OA, 87.3% of patients did not face any cerebrovascular incidences, thus suitable for the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Product |

|

|

Type |

|

|

Material |

|

|

Disease Pathology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atherectomy Devices Market - Regional Analysis

North America Market Insights

North America in the atherectomy devices market is projected to garner the largest share of 48.3% by the end of 2035. The market’s growth in the region is highly attributed to an increase in the PAD prevalence, suitable health and medical facilities, innovative technology implementation, strong physician preference, and effective Medicare reimbursement policies. In this regard, the April 2022 PNAS article indicated that cardiology is one of the highest-paying physician specialties in the U.S., with a yearly income of USD 430,000 over the past 5 years, thereby suitable for the market’s upliftment in the overall region.

The atherectomy devices market in the U.S. is growing significantly, owing to the existence of suitable CMS reimbursement, expansion in ASC, the presence of a tort and litigation environment, and direct-to-physician marketing. According to the November 2023 NLM article, in Part A Medicare, enrollment commences at 65 years of age, and inpatient services are subject to out-of-pocket expenses are available in the form of hospital deductibles, amounting to USD 1,600 per benefit period as of 2023. In addition, copays cater to more than 61 days of inpatient care and over 21 days for skilled nursing facility care.

The atherectomy devices market in Canada is also growing due to government-based procurement, universality of care, data-based implementation, along with the existence of wait-time strategies. Besides, the November 2023 ITA report depicted that the overall healthcare spending in the country amounted to CAD 331 billion, which denotes a huge opportunity for the market to experience growth. For instance, in Alberta and British Columbia, the spending per person was CAD 8,545, denoting a 3.5% from 2021 and CAD 8,790, further denoting a rise by 2.4% as of 2022.

2022 Health Expenditure in North America

|

Countries |

Health Spending (USD) |

|

U.S. |

12,434 |

|

Mexico |

650.9 |

|

Canada |

6,112.0 |

|

Guatemala |

396.0 |

|

Haiti |

52.3 |

|

Cuba |

1,199.3 |

Source: World Bank Group 2025

APAC Market Insights

Asia Pacific in the atherectomy devices market is considered to be the fastest-growing region during the forecast period. The market’s development in the region is subject to the aspect of rapid aging populations, economic development, expansion in healthcare infrastructure, and medical tourism. As per the February 2023 NLM article, an estimated 4% to 7% of the overall gross domestic product (GDP) has been readily invested in the region’s healthcare industry, which is more than 12% in the U.S. and Europe. Besides, people in the region are increasingly aware of health, which in turn leads to a surge in the health requirement, directly and indirectly pressurizing governments in the region to initiate investments in the industry.

The atherectomy devices market in China is gaining increased traction, owing to the Made in China 2025 policy, escalated approval pathway, volume-specific procurement, and the presence of a tiered healthcare system. As stated in an article published by NLM in March 2025, the medical device market of the country has been positioned in the third place, with a valuation of USD 42.5 billion over the past 4 years, and is further projected to be USD 63.6 billion by the end of 2025 at a 10.6% growth rate. Therefore, with such development in the sector, the market is expected to surge in the upcoming years.

The atherectomy devices market in India is also growing due to the presence of a volume-based market, innovation in expenses, public health insurance availability, and medical value travel. According to the October 2024 National Portal of India article, the Union Cabinet accepted to expand the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) for senior citizens more than 70 years of age and benefit over 4.5 crore (45 million) families, which included 6 crore elder citizens. The ultimate aim is to provide free health insurance coverage of almost ₹5 Lakh (USD 5,676) per family, therefore indicating a huge opportunity for the market to expand.

Europe Market Insights

Europe in the atherectomy devices market is expected to account for a considerable share by the end of 2035. The market’s upliftment in the region is highly fueled by the presence of a harmonized regulatory pathway, an increase in the disease burden, suitable clinical guidelines, and regional research funding. According to the January 2023 Europe Journal of Vascular and Endovascular Surgery article, there has been changes in the regional health guideline, including symptomatic patient management with an ipsilateral 50% to 99% for atrial fibrillation and carotid stenosis, thereby suitable for increasing the overall market’s exposure in the region.

The atherectomy devices market in Germany is uplifting, owing to innovation and advancements in the reimbursement policy, increased procedural volume, and the freedom to ensure negotiation for pricing. According to an article published by NLM in December 2024, the combined surcharge fee to fund the IQTIG, G-BA, and IQWiG in the country has been lower than 10 cents per treatment, which does not include any overnight accommodation facility, but comprises inpatient treatment within 3 euros per treatment, thus boosting the market’s demand.

The atherectomy devices market in France is developing due to the aspect of transparency to gain market accessibility, centralized procurement, and the presence of government-based health priorities. As per the 2025 Ministry for Europe and Foreign Affairs data report, the country’s president declared an unprecedented provision of €1.6 billion for 2023 and 2025 to cater to diseases, such as malaria, AIDS, and tuberculosis. In addition, an estimated 20% of the allocation is initiated for the L’Initiative, which is a programme integrated by Expertise France. Therefore, funding provision from the government denotes a huge opportunity for the market to grow in the country.

Lasers 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

Germany |

USD 2.2 billion |

USD 784 million |

|

Netherlands |

USD 156 million |

USD 869 million |

|

UK |

USD 460 million |

USD 155 million |

|

France |

USD 158 million |

USD 130 million |

|

Switzerland |

USD 150 million |

USD 189 million |

|

Italy |

USD 51.1 million |

USD 179 million |

|

Spain |

USD 7.0 million |

USD 72.9 million |

|

Belgium |

USD 11.6 million |

USD 33.6 million |

Source: OEC, August 2025

Key Atherectomy Devices Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation (U.S.)

- Philips (Netherlands)

- Abbott Laboratories (U.S.)

- BD (Becton, Dickinson and Company) (U.S.)

- Cardiovascular Systems, Inc. (CSI) (U.S.)

- iVascular (Spain)

- Rex Medical (U.S.)

- Avinger Inc. (U.S.)

- Spectranetics (U.S.)

- Biotronik (Germany)

- Cook Medical (U.S.)

- Cardinal Health (U.S.)

- AngioDynamics (U.S.)

- Lemaitre Vascular (U.S.)

- Straub Medical AG (Switzerland)

The international market is extremely consolidated and highly dominated by Philips, Boston Scientific, and Medtronic, collectively garnering for more than half of the global market share. Their approach is multi-layered, including robust investment in research and development (R&D) for cutting-edge devices that are combined with atherectomy and imaging techniques, tactical acquisitions to adopt advanced technologies, and effectively extend into high-growth outpatient settings, thereby suitable for boosting the market’s development.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, Philips enrolled its first patients in the U.S.-based clinical trial for advanced and implemented a single-device to successfully aid patients suffering from PAD.

- In March 2024, BD, announced that it effectively enrolled the first patient in the investigational device exemption, which assessed the effectiveness and safety of the BD Vascular Covered Stent for the treatment of PAD.

- Report ID: 8102

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atherectomy Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.