aSAH Drugs Market Outlook:

aSAH Drugs Market size was over USD 1.58 billion in 2025 and is estimated to reach USD 3.32 billion by the end of 2035, expanding at a CAGR of 8.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the aSAH drugs is estimated at USD 1.66 billion.

The growing incidence of aneurysmal subarachnoid hemorrhage (aSAH) is becoming a global health concern, which is pushing medical authorities worldwide to seek effective therapeutics. According to the Journal of Neurology Research, in the United States, there are approximately six to ten cases of subarachnoid hemorrhage (SAH) caused by ruptured cerebral aneurysms per 100,000 person-years, with an estimated 30-40% mortality rate among affected individuals. According to the Journal of Neurology Research, in the United States, there are approximately six to ten cases of subarachnoid hemorrhage (SAH) caused by ruptured cerebral aneurysms per 100,000 person-years, with an estimated 30-40% mortality rate among affected individuals. Moreover, a notable advancement in the field is the development of novel formulations of nimodipine, the current standard of care, including intravenous (IV) versions such as GTx-104 and sustained-release microspheres designed to enhance efficacy while minimizing adverse effects like hypotension. Additionally, regulatory progress has been evident, with the approval of clazosentan in Japan and the granting of fast-track and orphan drug designations for several emerging therapies in the U.S. and Europe.

The market is transitioning from a focus on vasospasm prevention to broader goals of neuroprotection and functional recovery, driven by the emergence of new agents targeting inflammation, secondary brain injury, and delayed cerebral ischemia. Growing investment in personalized medicine is also enabling patient stratification based on biomarkers, thereby improving treatment decision-making. Moreover, the rising prevalence of aSAH is expected to further propel market growth. Overall, the market presents significant opportunities for innovation and for addressing unmet clinical needs that will shape its future direction.

Key aSAH Drugs Market Insights Summary:

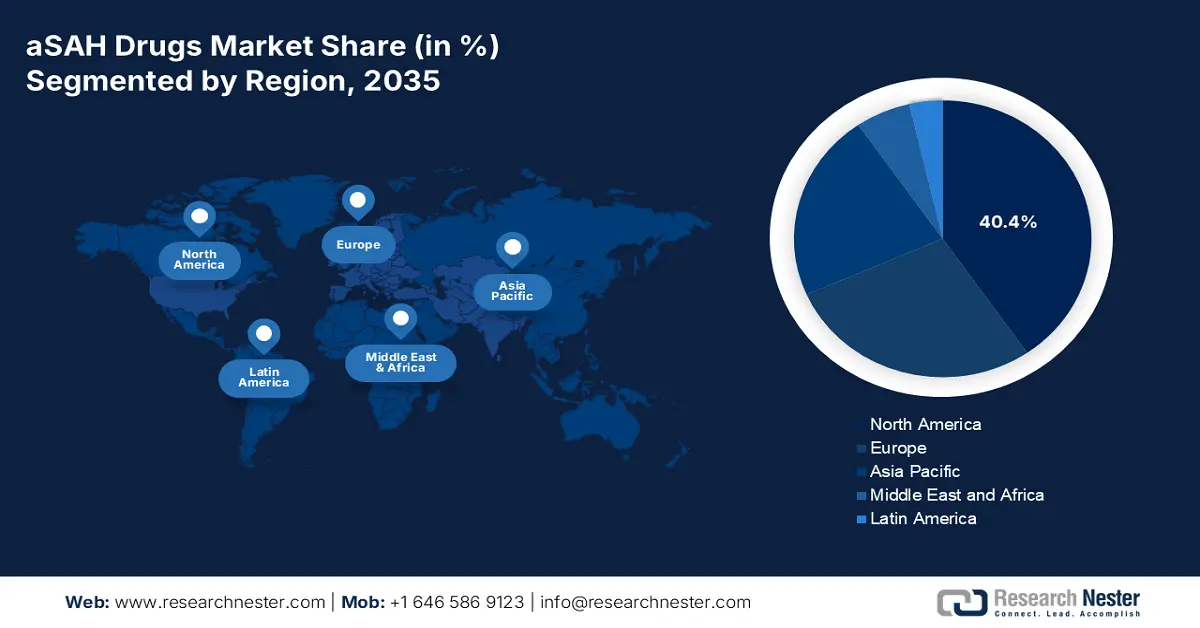

Regional Insights:

- North America is predicted to hold a 40.4% share by 2035 (impelled by rising stroke incidence and advanced healthcare infrastructure).

- Asia Pacific is expected to register the fastest growth during 2026–2035 (driven by increasing prevalence of cardiovascular diseases and healthcare modernization).

Segment Insights:

- Hospitals segment is projected to account for 52.4% share by 2035 (propelled by the presence of specialized departments and capacity for delivering new therapies).

- Intravenous segment is expected to capture 45.1% share by 2035 (driven by its rapid and targeted drug delivery in emergency care).

Key Growth Trends:

- Importance of early intervention

- Continuous R&D investments and participation

Major Challenges:

- Complex pathophysiology and multifactorial nature of aSAH

- High costs and regulatory hurdles:

Key Players: Johnson & Johnson, Novartis AG, Pfizer Inc., Bayer AG, Roche Holding AG, Merck & Co., AstraZeneca, CSL Limited, Sun Pharmaceutical, Lupin Limited, Hetero Drugs, Yuhan Corporation, Hikma Pharmaceuticals, Cipla Limited, Pharmaniaga Berhad, BioGen, Zuellig Pharma.

Global aSAH Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.58 billion

- 2026 Market Size: USD 1.66 billion

- Projected Market Size: USD 3.32 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries – United States, Germany, Japan, France, United Kingdom

- Emerging Countries – China, India, South Korea, Brazil, Malaysia

Last updated on : 31 October, 2025

aSAH Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Importance of early intervention: Clinical validations from various studies and trials have established a strong foundation for deeper penetration of the market. These evaluations have demonstrated the cost-effectiveness and long-term benefits of early-stage treatment with these therapies, reinforcing pharmacotherapy as a value-based approach to improving patient outcomes. Furthermore, the promising results are attracting increased investment and participation from both pharmaceutical companies and healthcare payers, further driving market advancement.

- Continuous R&D investments and participation: The expansion of pipelines and applications in the market is largely driven by extensive research initiatives and emerging scientific findings. Continuous exploration leading to improved therapeutic kinetics has further encouraged both public and private investors to allocate significant resources toward R&D. Moreover, collaborations between biotechnology startups, academic institutions, and industry players are fostering a more agile and innovative approach to drug discovery. These partnerships are accelerating preclinical and clinical trial timelines while attracting venture capital and grant funding for therapies featuring novel mechanisms of action or specialized delivery routes.

- Regulatory support and orphan drug incentives: Many drug candidates qualify for orphan drug designation, fast-track status, and accelerated approval pathways due to the life-threatening nature and relative rarity of aSAH. These regulatory incentives help reduce development time and costs, enabling companies to commercialize niche prescription products for orphan diseases. Recognition by regulatory bodies in the U.S., EU, and Japan has led to increasingly favorable frameworks aimed at addressing the unmet medical needs in this area. Consequently, this supportive regulatory environment serves as a key growth driver for both emerging biotech startups and established pharmaceutical companies in the market.

Challenges

- Complex pathophysiology and multifactorial nature of aSAH: aSAH involves a complex interplay of biological processes such as vasospasm, inflammation, oxidative stress, and neuronal injury, making it highly challenging to develop a single drug capable of addressing all these mechanisms simultaneously. This biological complexity also contributes to slower drug development and regulatory approval timelines, as therapies must demonstrate efficacy across multiple clinical endpoints. Furthermore, variability in patient responses to treatment increases the likelihood of clinical trial failures, adding to the difficulty of bringing effective therapies to market.

- High costs and regulatory hurdles: Developing treatments for rare diseases, such as aSAH, is a highly costly and time-intensive process, requiring substantial investment in research, clinical testing, and regulatory compliance. Biopharmaceutical companies must allocate significant resources to navigate these stages, often with uncertain returns. While some international markets offer economic incentives and advantages through orphan drug designations, financial and regulatory uncertainties still deter many companies from entering or expanding in this space. As a result, innovation and patient access to advanced therapies remain limited.

aSAH Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 1.58 billion |

|

Forecast Year Market Size (2035) |

USD 3.32 billion |

|

Regional Scope |

|

aSAH Drugs Market Segmentation:

Distribution Channel Segment Analysis

Based on distribution channels, the hospitals segment is expected to hold the largest share of 52.4% over the assessed timeline. The presence of specialized departments and professionals makes these organizations the first choice for associated patients to achieve better outcomes. Moreover, hospitals have the capacity to deliver clinical trials and pilot approved therapies, which allow them the opportunity to deliver new therapies such as sustained release formulations and targeted biologics. Integrated health care pathways and multidisciplinary teams provide holistic management of patients that may include surgical intervention, pharmacotherapy, and rehabilitation after acute care.

Route of Administration Segment Analysis

In terms of the administration route, the intravenous segment is poised to capture a considerable share of 45.1%. Its growing adoption is driven by its crucial role in emergency care. The National Institute of Neurological Disorders and Stroke (NINDS) identifies intravenous (IV) nimodipine as the gold standard for vasospasm prevention in post-aSAH cases. Furthermore, the rapid and targeted drug delivery capabilities of this formulation are gaining traction in managing stroke and other cardiovascular events. The improved clinical outcomes associated with its prompt therapeutic response further reinforce its strong preference in this domain.

Drug Class Segment Analysis

Calcium channel blockers are expected to maintain and augment the largest market share across the forecast period, among the various drug classes. This is driven primarily by nimodipine’s status as the only FDA-approved drug that is specifically indicated for the improvement of neurological outcomes in patients with aneurysmal subarachnoid hemorrhage (aSAH). Furthermore, nimodipine has demonstrated efficacy in reducing the incidence of delayed cerebral ischemia (DCI), one of the leading causes of death and long-term disability after aSAH, and has become standard therapy for patients with aSAH in both developed and developing healthcare settings.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Distribution Channel |

|

|

Route of Administration |

|

|

Drug Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

aSAH Drugs Market - Regional Analysis

North America Market Insights

North America is predicted to dominate the aSAH drugs market with a share of 40.4% by the end of 2035. The region’s dominance is strongly attributed to the rising incidence of strokes, advanced healthcare infrastructure, and robust R&D initiatives. For instance, as of 2024, the U.S. reported over 300,000 aSAH cases annually. This sustained demand, along with expedited regulatory approvals, is motivating global leaders to develop more innovative vasospasm therapies. Moreover, the region’s leadership in neurocritical care innovation continues to position it at the forefront of global advancements in this field.

The U.S. holds a dominant position in the regional aSAH drugs market, driven by a high stroke burden and strong federal investment. According to the Centers for Disease Control and Prevention (CDC), strokes accounted for 1 in 6 cardiovascular-related deaths (17.5%) in the U.S. in 2022. Federal initiatives and funding from agencies such as the National Institutes of Health (NIH) continue to advance stroke and aSAH research, fostering innovation in drug development and treatment protocols. Furthermore, the FDA’s Orphan Drug and Fast Track programs provide substantial financial and regulatory incentives, encouraging pharmaceutical companies to pursue novel aSAH therapies.

In Canada, the aSAH drugs market is expected to expand due to the country’s universal healthcare system, which ensures access to acute neurosurgical and stroke care. Rising investments in neurological research and stroke prevention by provincial health authorities, combined with a growing elderly population and increasing stroke incidence, are driving market demand. Additionally, Canada’s supportive regulatory framework, including early-access pathways for innovative therapies, continues to strengthen opportunities for market entry and development.

APAC Market Insights

The Asia Pacific aSAH drugs market is expected to register the fastest CAGR during the forecast period, driven by the rising prevalence of cardiovascular diseases (CVDs), a rapidly aging population, and the modernization of healthcare infrastructure. Reflecting these trends, Malaysia’s patient pool reportedly doubled between 2013 and 2023. In emerging economies such as China and India, market expansion is further supported by substantial public and private investments in healthcare innovation. Moreover, government-led initiatives aimed at improving access to advanced medical services in rural areas are unlocking new growth opportunities. The ongoing establishment of specialized neurocritical care departments across the region’s healthcare systems is also contributing to increased treatment adoption and revenue generation.

The aSAH drugs market in India is witnessing rapid growth, driven by the increasing incidence of stroke linked to high rates of hypertension, smoking, and sedentary lifestyles. Improved access to healthcare in urban centers, coupled with the growing presence of private hospitals, is enhancing diagnosis and treatment outcomes for aSAH patients. India is also emerging as a favorable hub for clinical research and the production of cost-effective generic drugs, supporting broader treatment accessibility. As healthcare infrastructure continues to expand, particularly across tier-2 and tier-3 cities, the demand for advanced aSAH therapies is expected to rise significantly.

China is steadily advancing toward a leading position in the regional aSAH drugs market, driven by its high patient volume and growing healthcare investments. The combination of substantial unmet medical needs and strategic advancements in healthcare infrastructure is accelerating progress in the country. Furthermore, nationwide initiatives are reinforcing domestic pharmaceutical production and the development of aSAH therapeutics, enhancing both prevention and treatment accessibility across diverse population segments.

Europe Market Insights

The market for drugs in Europe treating aneurysmal subarachnoid hemorrhage (aSAH) is undergoing rapid growth as a result of several demographic, clinical, and regulatory forces. One key driver is the aging population in this region that is increasingly susceptible to cerebrovascular diseases like aSAH. This creates a need for effective treatment options. Europe has a well-developed healthcare system that allows access to stroke centers and neurocritical care units to ensure these patients are diagnosed and treated early.

The aSAH drugs market in France is experiencing steady growth, supported by a robust public healthcare system and comprehensive national stroke prevention programs. Hospitals across the country are equipped with advanced neurology and neurocritical care units, ensuring timely and effective aSAH management. France’s active involvement in clinical trials and neuroscience research further strengthens its position in this domain. A favorable reimbursement framework and the swift adoption of innovative medical technologies are creating additional market opportunities. Moreover, the nation’s strong emphasis on rare disease research continues to foster the development and adoption of aSAH therapeutics.

Germany’s aSAH drugs market is poised for growth, driven by its aging population, high prevalence of cardiovascular and cerebrovascular diseases, and strong emphasis on early stroke intervention. The country’s well-established hospital network and advanced critical care infrastructure position it as a major consumer of acute-phase drugs such as nimodipine. Germany’s leadership in medical research and innovation is evident, with several drug candidates currently in clinical trials for aSAH management and recovery. Additionally, substantial healthcare expenditure, comprehensive insurance coverage, and robust academia-industry collaborations are fostering rapid adoption of new therapies and ongoing advancements in pharmacological development.

Key aSAH Drugs Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Roche Holding AG

- Merck & Co.

- AstraZeneca

- CSL Limited

- Sun Pharmaceutical

- Lupin Limited

- Hetero Drugs

- Yuhan Corporation

- Hikma Pharmaceuticals

- Cipla Limited

- Pharmaniaga Berhad

- BioGen

- Zuellig Pharma

The global dynamics of the market are characterized by strong competency and strategic commercial operations conducted by key pharmaceutical leaders and regional distributors. Following the same pathway, Johnson & Johnson, Novartis, and Pfizer collectively established their dominance over this landscape with their extensive R&D capabilities and international brand recognition. Specifically, in Japan, the accomplishments gained through the development and launch of neuroprotective therapies highlighted the contributions of Takeda and Daiichi Sankyo in establishing a region-specific market for this product. On the other hand, the leading generics manufacturers in India, such as Sun Pharma and Lupin, are enhancing affordability and accessibility to widen adoption.

Here are some of the major key players of the market:

Recent Developments

- In June 2025, Grace Therapeutics officially submitted a New Drug Application (NDA) to the U.S. Food and Drug Administration for GTx‑104 — a novel injectable formulation of nimodipine being developed for the treatment of aneurysmal subarachnoid hemorrhage (aSAH). This submission is supported by data from the Phase 3 STRIVE-ON safety trial, which showed meaningful improvements in key outcomes compared to oral nimodipine.

- In December 2021, NeurOp, Inc. declared that the company's experimental candidate NP10679, which is intended to treat subarachnoid hemorrhage (SAH), has been designated as an orphan medication by the U.S. Food and Drug Administration (FDA). SAH is a potentially fatal kind of stroke brought on by bleeding into the area around the brain.

- Report ID: 7737

- Published Date: Oct 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

aSAH Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.