Artificial Lift Market Outlook:

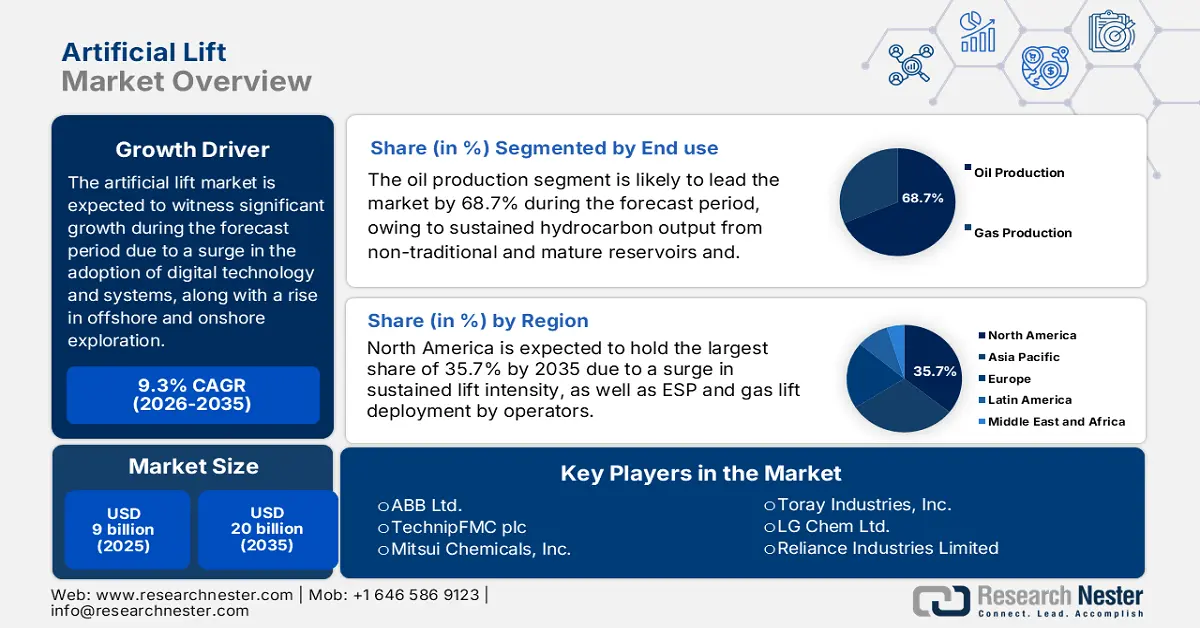

Artificial Lift Market size was over USD 9 billion in 2025 and is estimated to reach USD 20 billion by the end of 2035, expanding at a CAGR of 9.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of artificial lift is assessed at USD 9.8 billion.

The international artificial lift market is continuously growing, highly driven by the adoption of digital lift systems, including ESPs with IoT-based monitoring, along with a rise in offshore exploration and a decline in reservoir pressures in mature oilfields. According to official statistics published by the Global Energy Monitor Organization in March 2025, nearly 8 billion barrels of oil, equivalent of resources, have been declared across the latest offshore discoveries, and about 4 billion barrels of oil equivalent of reserves have been sanctioned for development offshore. In addition, at least 6.5 billion barrels of oil equivalent are projected to be tapped as offshore projects, with a marginal increase since 2023. Besides, 19 offshore projects significantly produced first gas or oil as of 2024, accounting for 71% of the overall field startup volume. Moreover, different regions have undertaken the responsibility to focus on oil and gas discoveries, thereby making it suitable for uplifting the market’s exposure globally.

Worldwide Oil and Gas Discoveries by Region and Sub-Region (2023)

|

Region |

Sub-Region |

Discovery Count |

Total Reserves (Million BOE) |

Annual Total % |

|

Africa |

|

|

|

|

|

America |

|

|

|

|

|

Asia |

|

|

|

|

|

Europe |

|

|

|

|

|

Yearly Total |

- |

10 |

7,708.9 |

- |

Source: Global Energy Monitor Organization

Furthermore, the aspect of digitalization, the shift towards pump-based systems, energy and sustainability efficiency, expansion in offshore deepwater and redevelopment, and brownfield optimization are other factors fueling the market across different regions. As per an article published by MDPI in August 2024, pump stations are largely responsible for massive energy consumption, with electricity utilization demonstrating the largest proportion and reaching 90%. Besides, the March 2023 IEA Organization article noted that there has been a surge in international heat pumps by 11%, ensuring a double-digit growth for the centralized technology in the ultimate shift to sustainable and secure heating. For instance, heat pumps in Europe witnessed a growing sale by almost 40%, while air-to-water models experienced a 50% sale, thereby denoting an optimistic outlook for the artificial lift market growth.

Key Artificial Lift Market Insights Summary:

Regional Insights:

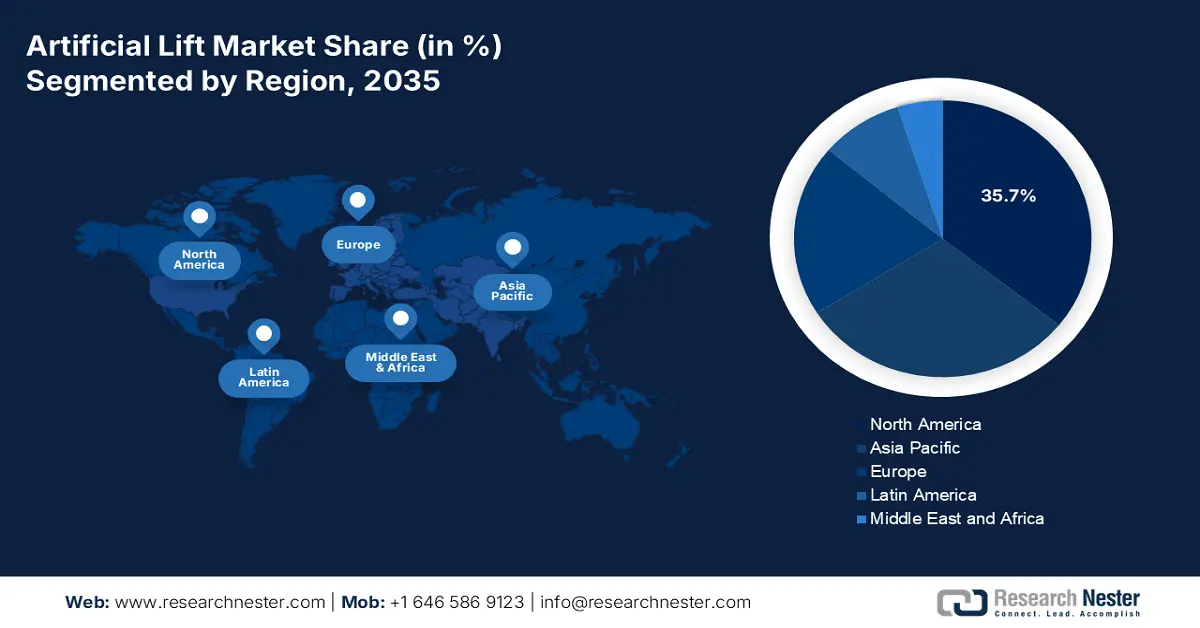

- North America is projected to command a 35.7% share by 2035 in the artificial lift market, supported by intensified lift requirements and widespread gas lift and ESP adoption integrated with digital monitoring to stabilize declining well output.

- Europe is expected to emerge as the fastest-growing region over 2026–2035, benefiting from brownfield optimization, offshore redevelopment in the North Sea and Barents Sea, and accelerated decarbonization-led reinvestment supporting artificial lift deployment.

Segment Insights:

- The Oil Production end-use segment is anticipated to secure a dominant 78.6% share by 2035 in the artificial lift market, underpinned by its indispensable role in sustaining output from mature and unconventional reservoirs amid declining natural pressure.

- The Mature or Declining Reservoirs well-maturity sub-segment is projected to hold the second-highest share during 2026–2035, strengthened by the expanding global base of aging oilfields requiring advanced lift solutions to extend asset life and enhance recovery.

Key Growth Trends:

- Decline in reservoir pressure

- Rise in global energy demand

Major Challenges:

- Increase in installation and maintenance expenses

- Environmental and regulatory pressures

Key Players: Halliburton Company (U.S.), Baker Hughes Company (U.S.), Weatherford International plc (U.S.), NOV Inc. (U.S.), Dover Corporation (U.S.), Apergy Corporation (U.S.), Borets International Limited (UK), John Crane (UK), Sulzer Ltd. (Switzerland), Siemens Energy AG (Germany), ABB Ltd. (Switzerland), TechnipFMC plc (UK), Mitsui Chemicals, Inc. (Japan), Toray Industries, Inc. (Japan), LG Chem Ltd. (South Korea), Reliance Industries Limited (India), Indian Oil Corporation Limited (India), Petronas Chemicals Group Berhad (Malaysia), Orica Limited (Australia).

Global Artificial Lift Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9 billion

- 2026 Market Size: USD 9.8 billion

- Projected Market Size: USD 20 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Saudi Arabia, Russia, China, Canada

- Emerging Countries: Brazil, India, United Arab Emirates, Norway, Australia

Last updated on : 8 January, 2026

Artificial Lift Market - Growth Drivers and Challenges

Growth Drivers

- Decline in reservoir pressure: The artificial lift market is crucial to sustain production based on international oilfields that are classified as mature. As per official statistics published by ITA in December 2025, Oman produced 775,000 barrels per day in the middle of 2025. In addition, the country’s government derives approximately 70% of its yearly budget from oil and gas revenues through joint ownership and taxation of a few productive fields. Meanwhile, the industry accounts for 30% of the country’s gross domestic product (GDP). By the end of 2024, the country’s crude oil, along with oil condensate reserves, stood at an estimated 4,825 million barrels, as well as natural gas reserves at almost 23 trillion cubic feet. Therefore, with such development in oil reserves, the market is gradually gaining increased exposure.

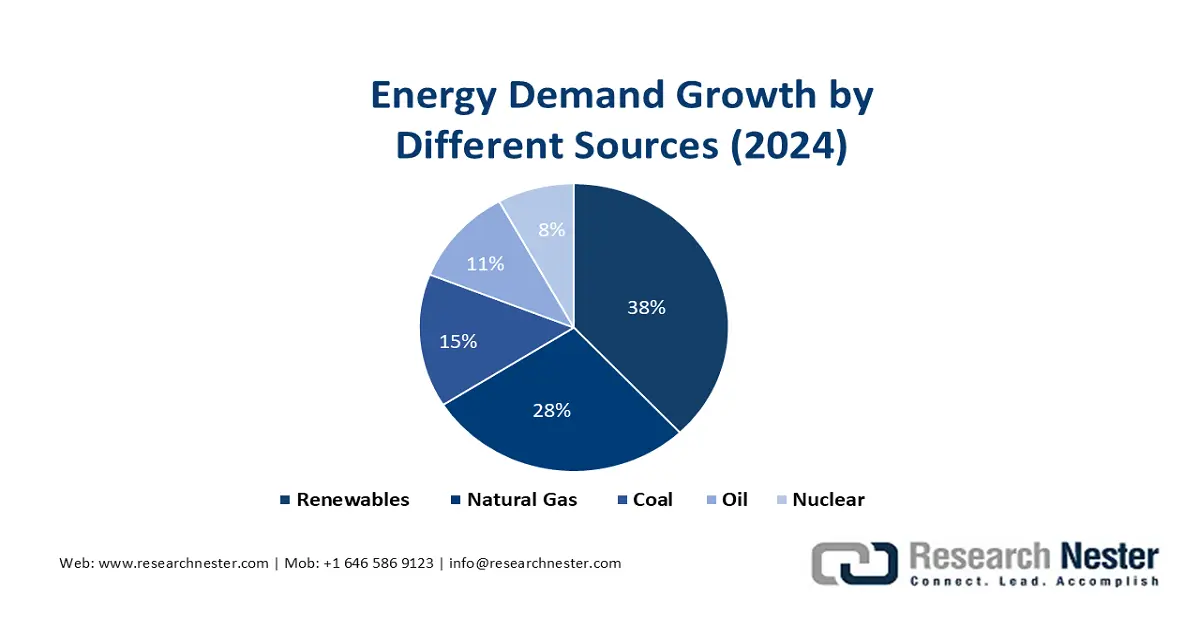

- Rise in global energy demand: Despite an increase in energy transition trends, the oil and gas industry remains critical, and the market ensures supply security. Based on official statistics put forward by the IEA Organization in 2025, there has been an increase in the energy demand by 2.2% as of 2024, denoting a higher rate than the yearly average of 1.3% as of 2023. This particular growth is partly owing to extreme weather events, which have been estimated to account for 0.3% points, further projected to increase to 2.2% growth. Despite this effect, the energy demand grew slowly and later on expanded by 3.2% in 2024. Besides, the electricity demand also grew increasingly by 4.3% as of 2024, which is positively uplifting the overall energy demand. In addition, renewables, natural gas, coal, oil, and nuclear are all responsible for boosting the overall artificial lift market exposure.

Source: IEA Organization

- Focus on technological innovation: The aspect of innovations in gas lift values, PCP materials, and ESP materials has improved efficiency and durability, which positively impacts the market internationally. According to an article published by NLM in September 2024, an electrostatic precipitator has been evaluated with a 125 lpm flow rate, along with an applied positive voltage of 11 kV. This has resulted in a lower ozone generation of 133 ppb as well as a particle collection efficiency increasing between 80% to 90% in different size ranges. Therefore, based on this, smart lift systems diminish downtime and optimize recovery, thus enhancing their demand and expansion across different nations.

Challenges

- Increase in installation and maintenance expenses: Systems in the artificial lift market, particularly ESPs, involve significant upfront investment and ongoing maintenance expenses. Installation requires specialized equipment, skilled labor, and often complex well interventions, driving costs higher than conventional production methods. Maintenance is equally challenging since ESPs and PCPs are prone to wear due to abrasive fluids, high temperatures, and corrosive environments. Frequent failures lead to costly workovers, downtime, and production losses. In offshore wells, replacement costs can exceed millions of dollars per intervention, making operators cautious about large-scale deployment. Smaller independent producers often struggle to justify these expenses, limiting adoption in marginal fields.

- Environmental and regulatory pressures: The artificial lift market witnesses increasing scrutiny from environmental regulators worldwide. Agencies such as the EPA (U.S.), ECHA (EU), and MOE (Japan) enforce strict standards on chemical usage, emissions, and waste disposal. Artificial lift systems rely on oilfield chemicals (scale inhibitors, demulsifiers, corrosion inhibitors), many of which are subject to tighter restrictions due to environmental risks. Compliance adds costs and complexity, as companies must reformulate products, adopt greener chemistries, and invest in monitoring systems. Regulatory uncertainty also delays project approvals, particularly in offshore environments where environmental sensitivity is high. For instance, strict chemical regulations in Europe under REACH have increased compliance costs for oilfield service providers.

Artificial Lift Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 9 billion |

|

Forecast Year Market Size (2035) |

USD 20 billion |

|

Regional Scope |

|

Artificial Lift Market Segmentation:

End use Segment Analysis

The oil production segment in the artificial lift market is anticipated to garner the highest revenue share of 78.6% by the end of 2035. The segment’s upliftment is highly driven by underscoring its critical role in sustaining hydrocarbon output from mature and unconventional reservoirs. Artificial lift systems such as electric submersible pumps (ESPs), progressive cavity pumps (PCPs), and gas lift systems are deployed extensively to maintain production rates when natural reservoir pressure declines. The dominance of oil production as an end-use segment is driven by the sheer scale of global demand for crude oil, which continues to underpin transportation, petrochemicals, and industrial energy needs despite energy transition trends. Mature oilfields, particularly in North America, the Middle East, and the Asia Pacific, rely heavily on artificial lift to extend field life and maximize recovery factors.

Well Maturity Segment Analysis

Based on the well maturity segment, the mature or declining reservoirs sub-segment in the artificial lift market is projected to hold the second-highest share during the forecast period. The sub-segment’s growth is highly fueled by a rise in global oilfields that are classified as mature, particularly in regions such as North America, the Middle East, and Russia. Artificial lift technologies, especially rod lift, ESPs, and PCPs, are deployed to counter declining productivity, enabling operators to maximize recovery factors and extend the lifespan of assets. Mature reservoirs also present unique challenges, including high water cut, gas interference, and abrasive fluids, which necessitate advanced lift designs and durable materials. The adoption of digital monitoring systems and predictive maintenance has become critical in these environments, reducing downtime and optimizing lifting efficiency.

Application Segment Analysis

By the end of the stipulated timeline, the onshore sub-segment, part of the application segment, is projected to account for the third-largest share in the artificial lift market. The sub-segment’s development is highly propelled by its importance for maintaining gas and oil production from wells, since there has been a decline in natural reservoir pressure. Additionally, it also ensures economic viability by combating pressure loss and uplifting fluids to the surface. According to official statistics published by the IEA Organization in 2025, there has been a projected increase in onshore wind capacity by 45% by the end of 2030, significantly reaching 732 GW. Besides, wind is the most impactful technology, with both onshore and offshore capacity growth significantly being revised by nearly 60%, further accounting for 57 GW, thereby making it suitable for the market’s welfare.

Our in-depth analysis of the artificial lift market includes the following segments:

|

Segment |

Subsegments |

|

End use |

|

|

Well Maturity |

|

|

Application |

|

|

Power and Control |

|

|

Mechanism |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Lift Market - Regional Analysis

North America Market Insights

North America artificial lift market is anticipated to garner the highest revenue share of 35.7% by the end of 2035. The market’s upliftment in the region is highly driven by a decline in production rates to sustain lift intensity, along with gas lift and ESP deployment by operators with digitalized monitoring for stabilizing lower and output lifting expenses. According to official statistics stated by the EIA Government in December 2025, the oil production in the U.S., including lease and oil condensate, averaged 13.3 million barrels per day, as well as the national gas production averaged 128.0 billion cubic feet per day. In addition, both natural gas and oil production increased as of 2024, with natural gas averaging 128.8 billion cubic feet per day and oil production averaging 13.4 million barrels per day in December 2024. Therefore, with an increase in well production for both oil and natural gas, there is a huge growth opportunity for the overall market in the region.

The U.S. in the artificial lift market is growing significantly, owing to the presence of mature shale basins, an increase in technological adoption, onshore dominance, regulatory and government influence, along with safety standards. Based on government data published by the EPA Government in August 2025, chemical management in huge quantities represents 65% of the waste as of 2023. For instance, dichloromethane waste has been managed effectively, denoting an increase of 972 million pounds or more than 56%, further fueled by recycling from resin and plastic material manufacturing hubs. Meanwhile, n-hexane accounts for a 4.6-billion-pound surge, which is over 11%, highly attributed to an increase in the recycling process by two soybean processing infrastructures that cater to nearly half of the n-hexane waste as of 2023, thereby denoting an optimistic outlook for the market’s exposure.

Waste Management by Chemical in the U.S. (2020-2023)

|

Chemical Type |

2020 (Billion lb) |

2021 (Billion lb) |

2022 (Billion lb) |

2023 (Billion lb) |

|

Cumene |

3.6 |

3.2 |

3.1 |

2.7 |

|

Dichloromethane |

3.0 |

3.0 |

2.6 |

2.7 |

|

n-Hexane |

1.4 |

1.5 |

4.1 |

8.7 |

|

Methanol |

1.9 |

2.0 |

2.0 |

1.9 |

|

Toluene |

1.4 |

1.4 |

1.5 |

1.3 |

|

Ethylene |

1.4 |

1.8 |

1.7 |

1.6 |

|

Zinc |

1.1 |

1.1 |

1.1 |

1.2 |

|

Lead |

0.9 |

0.9 |

1.0 |

1.1 |

|

Ammonia |

0.9 |

1.0 |

0.9 |

0.8 |

|

Others |

12.3 |

13.0 |

12.6 |

11.9 |

Source: EPA Government

The artificial lift market in Canada is also growing due to oil and heavy oil sands, an increase in offshore development, government sustainability programs, the presence of mature reservoirs, and environmental compliance. A government report published by the Government of Canada in March 2023 has estimated that USD 100 million has been readily invested to reduce the carbon footprint and optimize worker safety at BHP’s USD 7.5 billion Jansen Stage 1 mine in Saskatchewan. Additionally, Umicore declared an investment of USD 1.5 billion in a net-zero facility, particularly in Ontario, for producing crucial components of electric vehicles. Besides, in Quebec, Rio Tinto Fer et Titane notified its plans to enhance the critical minerals production process, lower emissions, and assist in building clean technology supply chains, with USD 222 million as a support in federal funding. Therefore, with all such generous investments, the market is significantly growing in the overall country.

Europe Market Insights

Europe artificial lift market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by immense support from mature onshore fields, brownfield improvement, as well as offshore redevelopment in the Barents Sea and North Sea. As per official statistics published by Eurelectric Organization in March 2023, the region originally committed to reducing at least 40% of carbon dioxide emissions by the end of 2030 and significantly set a standard aspiration of 80% to 95% reduction by 2050. However, the latest targets are aimed at diminishing the region’s net greenhouse gas emissions by almost 55% by 2030 and, at the same time, gain climate neutrality by the end of 2050. Furthermore, to end the region’s reliance on Russia, the domestic Commission has readily enhanced its decarbonization objective with its newest REPowerEU proposal. This particular plan has provided an additional 41 GW of wind power, along with 62GW of solar PV, to the Fit For 55 targets, thus suitable for the market’s growth.

The artificial lift market in Germany is gaining increasing traction, owing to the robust policy momentum towards sustainable processes, an increase in the industrial scale in equipment and chemical manufacturing, and the presence of mature onshore assets. As per industry-validated analysis by GTAI as of 2025, the country’s machinery and equipment industry has successfully reached a standard turnover of EUR 262.9 billion, with the export valuation reaching EUR 208 billion in 2023. In addition, the overall regional recorded sales volume was worth EUR 908 billion in the same year, and machinery-based exports totaled EUR 618 billion. Besides, machinery and equipment are the nation’s largest industry, comprising more than 6,600 organizations, of which 90% are small and medium-sized enterprises, along with a value chain, which is suitable for bolstering the artificial lift market.

Mechanical Engineering Turnover by Sector in Germany (2023)

|

Components |

Turnover Amount (EUR Billion) |

|

Machinery Tools |

22.9 |

|

Conveyer Systems |

21.5 |

|

Driver or Propulsion Systems |

21.0 |

|

Agricultural Machinery |

18.6 |

|

Construction or Building Materials Machinery |

16.7 |

|

Pumps and Compressors |

14.3 |

|

Refrigeration and Air Technologies |

14.0 |

|

Fittings and Mountings |

12.2 |

|

Foodstuffs and Packaging Machinery |

6.1 |

Source: GTAI

The artificial lift market in the UK is also developing due to the adoption of digital lift-systems, brownfield optimization, and offshore redevelopment in the North Sea, along with the presence of regional research programs and national co-funding mechanisms for supporting advanced materials and sustainable chemicals. Derived from custom statistics published by the UK Government in October 2022, there has been an increase in private capital flow into the country’s technology, amounting to £27.4 billion, which is double the level of Germany and also more than triple the French level. Moreover, the approach to strengthen and support the overall digital economy denoted growth in the domestic tech industry’s yearly gross value added (GVA) by £41.5 billion as of 2025 and ensure 678,00 employment opportunities. Therefore, due to an increase in digital development, the market is flourishing in the country.

APAC Market Insights

The Asia Pacific artificial lift market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly attributed to rapid digitalization in Australia, South Korea, and Japan, offshore redevelopment in Indonesia and Malaysia, and the existence of mature onshore fields in India and China. Based on government data published by METI in October 2025, toward the objective of gaining carbon neutrality by the end of 2050, METI has successfully established a Green Innovation Fund, with an amount of 2 trillion yen under the Tertiary Supplementary Budget. Besides, according to the 2024 ESCAP data report, the overall average progress towards gaining all 17 sustainable and developmental goals in the region has increased from 4.4% to 17.0% as of 2023. Therefore, with all these developments in the region, the market is gradually growing and expanding.

The artificial lift market in China is gaining increased exposure due to an increase in the adoption of pump-assisted systems with digitalized monitoring, expansion in brownfield optimization, and the presence of large mature onshore production. As per official statistics published by the ITIF Organization in April 2024, the country accounted for 44% of international chemical production, along with 46% of capital investment. For instance, the country caters to nearly 55% of the international acetic acid capacity, almost 50% of the carbon black capacity, and about 45% of the titanium dioxide capacity. Therefore, for such commodity-based chemicals, the country commenced as a notable importer, and then developed domestic capacity, thereby denoting an optimistic outlook for the artificial lift market exposure.

The artificial lift market in India is also growing, owing to the rapid upscaling of the chemical ecosystem, modernization of mature fields, and expansion of upstream activity. Based on government data published by NITI Government in July 2025, the chemical industry in India accounts for a market size worth USD 220 billion as of 2023, and it is further poised to reach nearly USD 400 billion to USD 450 billion by the end of 2030, as well as USD 850 billion to USD 1,000 billion by the end of 2040. Besides, the country is regarded as the sixth-largest and Asia’s third-largest chemical producer globally and regionally, readily supplying crucial raw materials to sectors, including agriculture, automotive, textiles, and pharmaceuticals. Therefore, as per this continuous development of the industry, there is a huge demand for the artificial lift market in the overall country.

Key Artificial Lift Market Players:

- Schlumberger Limited (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Halliburton Company (U.S.)

- Baker Hughes Company (U.S.)

- Weatherford International plc (U.S.)

- NOV Inc. (U.S.)

- Dover Corporation (U.S.)

- Apergy Corporation (U.S.)

- Borets International Limited (UK)

- John Crane (UK)

- Sulzer Ltd. (Switzerland)

- Siemens Energy AG (Germany)

- ABB Ltd. (Switzerland)

- TechnipFMC plc (UK)

- Mitsui Chemicals, Inc. (Japan)

- Toray Industries, Inc. (Japan)

- LG Chem Ltd. (South Korea)

- Reliance Industries Limited (India)

- Indian Oil Corporation Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Orica Limited (Australia)

- Schlumberger Limited is one of the largest providers of artificial lift systems globally, with a strong portfolio in electric submersible pumps (ESPs) and digital monitoring solutions. The company leverages advanced analytics and IoT integration to optimize production efficiency, particularly in mature reservoirs.

- Halliburton Company has a significant presence in artificial lift technologies, focusing on ESP and rod lift systems. The company emphasizes cost-effective production optimization and has invested in automation and smart lift systems to enhance recovery from aging wells.

- Baker Hughes Company offers a comprehensive artificial lift portfolio, including gas lift, ESPs, and surface pumping systems. Its strategy centers on integrated digital solutions and predictive maintenance, helping operators maximize uptime and reduce lifting costs.

- Weatherford International plc is a key player in artificial lift, particularly in rod lift and gas lift systems. The company has expanded its footprint in the Asia Pacific and focuses on smart lift technologies to address challenges in aging oilfields and unconventional reservoirs.

- NOV Inc. provides artificial lift equipment and services, with strengths in progressive cavity pumps (PCPs) and surface systems. The company’s focus is on engineering innovation and modular lift solutions, supporting both conventional and unconventional wells.

Here is a list of key players operating in the global market:

The international artificial lift chemical market is significantly competitive, with U.S. companies such as Schlumberger, Halliburton, and Baker Hughes dominating alongside strong European players like Borets, Sulzer, and TechnipFMC. Asia-based manufacturers, including Mitsui Chemicals, LG Chem, and Reliance Industries, are expanding rapidly, supported by government-backed sustainability initiatives. Strategic priorities include digitalization, IoT-enabled monitoring, and environmentally friendly chemical formulations to meet tightening regulations. Partnerships, mergers, and research and development investments are common, with companies focusing on efficiency, cost reduction, and sustainability. Besides, in July 2025, SLB notified that it has successfully completed its previously declared acquisition of ChampionX Corporation, with former shareholders owning an estimated 9% of SLB’s outstanding shares of common stock. ChampionX’s complementary artificial lift and digital technologies enhanced SLB’s portfolio for boosting the production lifecycle, thus suitable for uplifting the artificial lift market globally.

Corporate Landscape of the Market:

Recent Developments

- In December 2025, Baker Hughes notified a huge demand from the Kuwait Oil Company for providing innovative artificial lift systems as well as associated services to bolster the overall production in Kuwait’s gas and oil fields.

- In March 2025, Lufkin Industries has announced the sale of its business in North America to Q2 Artificial Lift Services, and this readily aligns with the company’s focus on its key surface business, along with Q2’s focus on sub-surface business.

- In November 2024, Levare International Limited demonstrated its cutting-edge solutions in the form of artificial lift technology, which have been designed to transform energy efficiency and production within geothermal, gas, and oil industries.

- Report ID: 8333

- Published Date: Jan 08, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Lift Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.