Anime Market Outlook:

Anime Market is valued at USD 30.71 billion in 2025 and is expected to grow to USD 129.72 billion by 2037, registering a CAGR of 12.72%. In 2026, the industry size of anime is assessed at USD 34.76 billion.

The rise of streaming platforms is one of the primary growth drivers, fueling the market's growth. The emergence of streaming partners like Netflix and Crunchyroll has increased the viewership of anime. Moreover, their widespread geographical extension of these platforms has further increased their popularity globally. Netflix has registered more than 300 paid subscribers across the globe in 2025, while Crunchyroll has recorded more than 15 million as of 2024, demonstrating the large-scale adoption of anime movies and series. Countries like Japan are booming for Anime because of the storyline and the graphical art derived from their deep-rooted culture. Many countries have approved the streaming platforms because of the rising demand for entertainment, which is further associated with consistently increasing fan base, supporting the expansion of the market globally. Large production houses of anime films and series have a high budget, allowing them to improve the graphics and visuals to gain more viewers and boost market expansion.

Key Anime Market Insights Summary:

Regional Highlights:

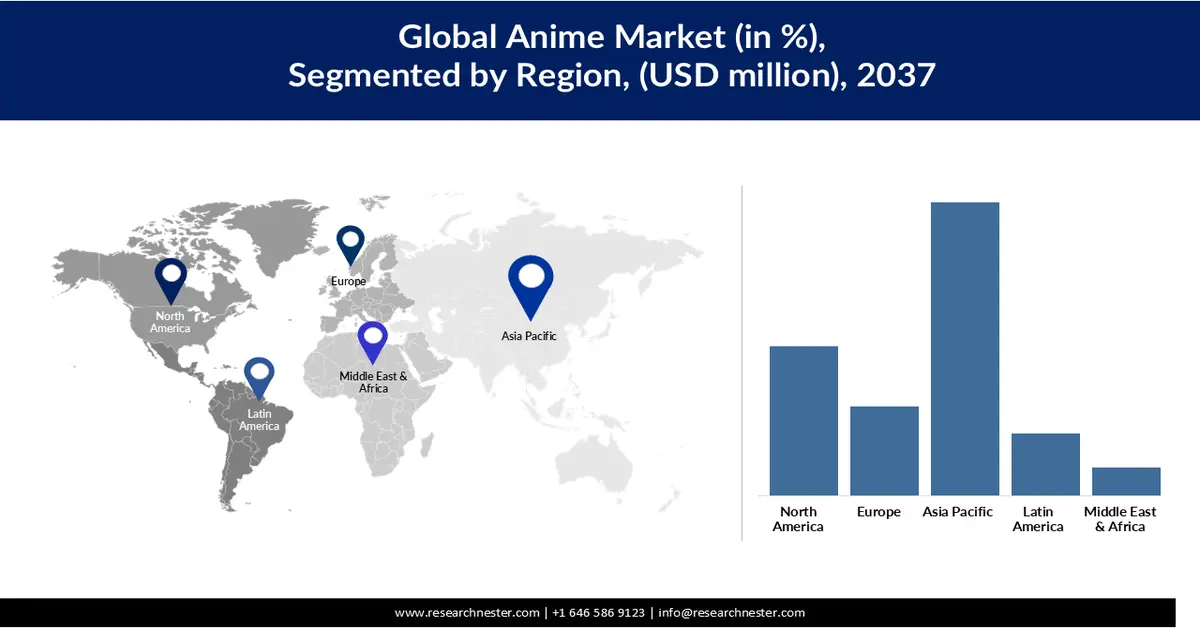

- Asia Pacific is projected to command a 47.2% share by 2037 in the anime market, underpinned by its deep-rooted anime production culture, mobile-first gaming audiences, mature merchandising exports, and rising simulcasting adoption.

- North America is anticipated to hold around 24% of the market while expanding at a 12.47% CAGR through 2037, fueled by gaming crossovers, robust merchandising ecosystems, rapid dubbing capabilities, and collaborations between studios and streaming platforms.

Segment Insights:

- The internet distribution segment is projected to account for a 40% share by 2037 in the anime market, underpinned by the expanding reach of global streaming platforms and official digital channels broadening worldwide content accessibility.

- The action and adventure segment is anticipated to command a 31.9% share by 2037, stimulated by sustained viewer engagement driven by high-intensity storytelling and action-centric narratives.

Key Growth Trends:

- Anime-based mobile gaming

- Hunger for Japanese storytelling

Major Challenges:

- Regulatory restrictions for content

- Dependency on outsourced studios

Key Players: Anima INC, Aniplex INC, Bones INC, Dandelion Animation Studio Inc, Kyoto Animation Co, Ltd, MAPPA Co, Ltd, Sunrise

Global Anime Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.71 billion

- 2026 Market Size: USD 34.76 billion

- Projected Market Size: USD 129.72 billion by 2037

- Growth Forecasts: 12.72% CAGR (2026-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.2% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: Japan, United States, China, South Korea, France

- Emerging Countries: India, Brazil, Mexico, Indonesia, Thailand

Last updated on : 22 December, 2025

Anime Market - Growth Drivers and Challenges

Growth Drivers

- Anime-based mobile gaming: Filmmakers are going beyond streaming to monetize the content by developing games that will increase the adoption of anime culture. Mobile-based games have seen a rise globally, which is being leveraged by the film makers to develop theme and character-based games, which increases the scope of the anime market globally. In February 2025, Bandai Namco, a popular Japanese gaming company, claimed that its profits soared to USD 452 million and were entirely driven by the hit of anime-based games, showcasing the strong power of beyond streaming potential. The rising popularity of the anime series globally is powering the growth of anime gaming, enhancing the scope of the anime market.

- Hunger for Japanese storytelling: Viewers are gravitating towards emotional depth as fascinating storylines are grabbing the interest is supporting the anime growth globally. The Japanese storytelling and conceptual meaning have made a much larger contribution to the market growth. The compelling visual effects and catalogues bring more interest among the viewers and layers, leading to wider adoption of the market. In March 2024, the Federation of Indian Chambers of Commerce and Industry highlighted that 60% of the demand is being driven by India, which is primarily because of the creative storylines and the stunning visual graphics, which help in strengthening the global market.

- Product merchandising: As demand for anime is increasing, manufacturers are collaborating with production houses to manufacture merchandise with IP allowances to a handful of companies and supporting the enhancement of the market. The merchandise is widely being sold to the existing and potential fanbase, which amplifies the adoption of anime games and series, leading to higher market growth. Apparel and collectables have become quite popular among anime fans, and the manufacturers are leveraging this popularity to expand the market, as these collectables and apparel are often given as gifts, which tend to generate interest among a non-anime fan base.

Challenges

- Regulatory restrictions for content: The anime series and films are streamed on platforms such as Netflix and Prime Video, which adhere to certain rules and regulations with respect to content publishing. Producers may include scenes and visuals that may trigger viewers, and as a result, the streaming platforms may reject the publishing of the content until modification. This can significantly cause a barrier to the market as the producers will have to spend a large amount to modify the script and change the content. Thus, studios and producers need to maintain minimal compliance that will allow them to publish their content on the streaming platform.

- Dependency on outsourced studios: The reliance on outsourced studios for sound and animation is a significant issue in the production of anime-based content. Extreme workload because of intense competition and a shortage of skilled labor creates a delay in the production of the content. The delay in content production tends to delay the release schedule, which directly impacts the market growth. In October 2024, Japan Research Institute highlighted the reduction in pay per hour of animators, which was recorded at USD 8.31/hour. These prevalent factors of the market are significantly slowing down the market adoption.

Anime Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2037 |

|

CAGR |

12.72% |

|

Base Year Market Size (2025) |

USD 30.71 billion |

|

Forecast Year Market Size (2037) |

USD 129.72 billion |

|

Regional Scope |

|

Anime Market Segmentation:

Type Segment Analysis

The internet distribution segment is poised for significant growth and is expected to hold a market share of 40% in 2037. This is fuelled by the growing demand of streaming partners such as Netflix and Amazon, which have a wide geographical reach and are successful in producing some great content. Official websites and digital downloads are also contributing largely to the segment’s growth. Streaming partners such as Crunchyroll have reached a subscriber figure of 13 million, which shows the strong demand for global adoption of streaming platforms. The segment is quite promising in distributing the content globally through a single source that increases the global reach of the content, enhancing the market expansion of anime content.

Genre Segment Analysis

The action and adventure segment will hold the largest market share of 31.9% in 2037, fueled by the growing demand for intensive narratives and daring explorations based on which tend to generate interest and desire among the viewers. The collaboration of compelling storylines and action-filled scripts tends to increase demand for the segment. Action-filled franchises such as Naruto, One Piece, and Attack on Titan have experienced significant revenue, which are core action-based. The segment is also expected to hold the largest viewership through the forecast period because of long-term audience retention.

Our in-depth analysis of the global anime market includes the following segments:

| Segment | Subsegment |

|

Type |

|

|

Genre |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anime Market - Regional Analysis

Asia Pacific Market Insights

The market in the Asia Pacific is expected to grow at a market share of 47.2% by 2037. The demand is highly driven by the rich culture of anime production and mobile-first customers who are highly engaged in gaming, which is amplifying the growth of the market. The merchandising of products is also quite advanced, which is adopted by the locals and is often exported. The region further holds some of the key and experienced producers of anime content, accelerating the expansion of the market. Simulcasting has also gained popularity in the market, which is demonstrating the rising demand for anime culture across the globe.

Japan is the home of Anime production, which is dominated by players who are well-established in Japan. The penetration of smartphones and low-cost data has allowed users to increase viewing time of the anime, fuelling the market expansion. The demand for anime is local as well as international, making Japan one of the largest hubs for anime series. The popularity has gained so much that collectables and merchandise have penetrated widely, amplifying the expansion of the market.

India also holds a strong market in anime content streaming. The growth of OTT platforms and streaming platforms has exponentially increased the growth of the anime market. The demand for merchandise has also increased significantly in the country, driven by the penetration of engaging, thoughtful, and compelling stories. Cross-cultural understanding of Japan and India is significantly expanding the market, allowing higher adoption of anime-based content.

North America Market Insights

North America holds approximately 24% of the global anime market, which has ensured a strong position in the market. The region is expected to grow by a CAGR of 12.47% owing to the gaming crossovers and merchandising ecosystems. The fast dubbing and large-scale libraries are further enhancing the demand for the global anime market. Popular production houses include Hollywood studios, where producers are collaborating to amplify the anime culture on streaming platforms. North America is also quite open to new games, with some key players who have mastered anime animation.

The U.S. is widely open to new as well as older streaming platforms, which is raising the demand in the country. Key players such as Netflix, Crunchyroll, and Prime are constantly dominating the anime market with new releases and powerful scripts, which directly enhance the market expansion. Moreover, the large number of regulations and compliance ensure a safe production with minimal rejections. The rising number of production houses across the country is leading to immense competition, leading to a delay in release.

Canada has seen a strong surge in the adoption of the anime market primarily because of the rising culture of anime series and content on streaming platforms. The demand for rich, action-oriented anime is increasing, especially among Gen Z, which is effectively managing the market expansion. It is estimated that Canada holds more than 7 million Gen Z people, which creates a high potential in the adoption of the anime merchandizes. The fan culture and events have also increased over the past few years, increasing the collaboration between fans and studios.

Europe Market Insights

The region is also quite dominated by the anime market and currently holds a share of 14.27%. Europe has allowed the penetration of streaming platforms such as Netflix and Prime Video, which are successfully bringing the anime culture to the region. In July 2024, Crunchyroll rolled out its first store in the UK, enabling fans to effectively buy products and other merchandise. This has enabled access to the potential fan base, which is increasing the expansion of the market in the region. The streaming partners have also ensured to streamline the language, as the geographical challenges include a language barrier, which is significantly impacting the growth of the market.

The UK has also seen a surge in the adoption of anime products, which include the series, movies and merchandizes. The country also has well-established regulations that qualify the content, enabling higher adoption and expansion of the market. The culture of anime has become so deeply rooted that events and cosplays are quite common in the country, which increases engagement with the producers. The engagement also allows the producers and the makers to assess the specific demand from the audience, supportive in shaping the anime market.

Germany is experiencing a rise in Gen Z and millennial populations, which is directly fuelling the expansion of the anime market. The retail and e-commerce sectors of the country are quite strong, which has fuelled the sales of merchandise and other anime products, increasing the demand for anime. Anime is quite popular among Gen Z as well as Millennials, which is increasing the viewership of anime series and the purchase of small collectables and apparel. These factors are significantly impacting the growth of the business.

Key Anime Market Players:

- Anima INC (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aniplex INC (Japan)

- Bones INC (Japan)

- Dandelion Animation Studio Inc (Japan)

- Kyoto Animation Co, Ltd (Japan)

- MAPPA Co, Ltd (Japan)

- Sunrise (Japan)

- Dandelion Animation Studio Inc. is based in Japan and is a small-sized animation firm that specializes in high-quality animations for TV and OVAs. The business may not have a wide geographical footprint; however, it has been a contributor to some of the most popular shows and TV series.

- Kyoto Animation Co., Ltd is one of the most respected and beloved studios of Japan. The firm has a strong expertise in non-generic narratives, which gives emotional depth to the viewer, keeping them engaged for a longer time. Some of the notable works they have contributed to are K-on, Violet Evergarden, and Clannad.

- MAPPA Co., Ltd is one of the fastest-growing animation firms that is based in Japan. The business specializes in non-action-based themes and compelling storylines, which makes the brand one of the most sought-after. Some of the popular works done by the firm are Attack on Titan, Yuri on Ice, and Jujutsu Kaisen.

- Sunrise is one of the most iconic and oldest, operating in the market with a strong legacy. The animation works are mainly targeted towards Sci-fi and mecha, which are considered to be challenging when it comes to generating interest

Below is the list of the key players operating in the global anime market:

The players operating in the global anime market are expected to face intense competition during the forecast period. The market is associated with both established key players and new entrants. However, the anime market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global Anime Market Key Players

Recent Developments

- In June 2025, Crunchyroll received the theatrical rights for Miss Kobayashi’s Dragon Maid, a feature film that is produced by Kyoto Animation. The movie will be released in North America in Japanese with English subtitles. This will significantly enhance the Kyoto Animations ' domination over the global market as a worldwide theatrical release is expected.

- In February 2025, Anima Inc. received its SOC 2 Type II security for its design-to-code tool, which ensured more security and safety to the designed workflows. The certification is expected to enhance trust among the users and bring compliance within the operations. The certification highly prioritizes data privacy and workflow development, enabling better work management.

- Report ID: 6101

- Published Date: Dec 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anime Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.