Global Market Size, Forecast, and Trend Highlights Over 2025-2037

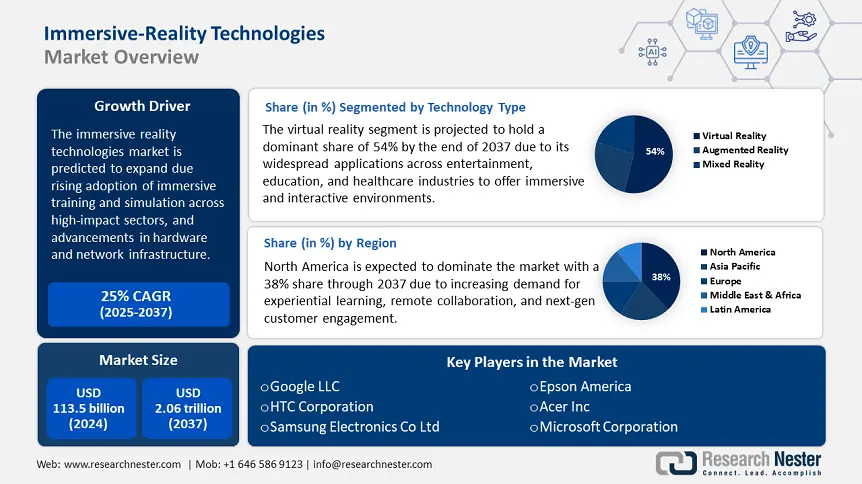

Immersive-Reality Technologies Market size was valued at USD 113.5 billion in 2024 and is projected to reach USD 2.06 trillion by the end of 2037, rising at a CAGR of 25% during the forecast period, i.e., 2025-2037. In 2025, the industry size of immersive-reality technologies is assessed at USD 141.8 billion.

A key growth driver of the market is the rising adoption of immersive training and simulation across high-impact sectors such as healthcare, defense, and aerospace. Government agencies such as the U.S. Department of Defense and the National Institutes of Health have validated the effectiveness of VR-based training tools for improved decision-making and reducing expensive errors. These immersive training environments not only replicate real-world scenarios with high fidelity but also offer scalability and cost efficiency making them ideal for training large workforces in critical operations. For instance, the U.S. Department of Veterans Affairs expanded its use of VR-based therapy and training with an Immersive Technology Center offering simulations for mental health therapy and clinician training. This federally backed program supports broader acceptance of VR in government and healthcare domains.

A recent example highlighting the growth driver is the Indian Air Force’s use of a Virtual Reality Training System (VRTS) for Agniveers. In December 2024, the Indian Air Force (IAF), in collaboration with Chitkara University developed an advanced Virtual Reality (VR) training system aimed at instructing newly inducted Agniveers in aircraft refueling procedures. This VR based system immerses trainees in realistic virtual environments, allowing them to interact with detailed 3D models of aircraft and their subsystems without the need for physical aircraft. The initiative significantly reduces training time and costs while enhancing safety and operational efficiency. This development shows the expanding application of immersive reality technologies in military training, contributing to the broader growth of the market.

Immersive-Reality Technologies Sector: Growth Drivers and Challenges

Growth Drivers

-

Technological advancements in hardware and network infrastructure: Innovations in lightweight head-mounted displays, spatial computing, AI-driven environments, and sensor fusion are enabling enterprise-grade performance. Simultaneously, 5G connectivity and edge/cloud integration is making immersive experiences smoother and more realistic boosting adoption in both consumer and industrial settings. For instance, in March 2025, Ericsson, Volvo Group, and Bharti Airtel announced a partnership that focuses on exploring the potential of Extended Reality (XR), Digital twin technologies, and artificial intelligence in the manufacturing sector. By leveraging 5G advanced networks, the collaboration aims to enhance real-time data processing and immersive experiences which are important for applications such as digital twins and field service AR.

-

Increased demand for remote collaboration and training: Post-pandemic shifts have normalized remote work and virtual learning, driving the need for more interactive, immersive environments. Enterprises are leveraging VR/AR platforms for employee onboarding, soft skill development, and real-time collaboration especially when physical presence isn’t feasible. A recent case illustrating how remote workforces and virtual training reshaped the workforce during COVID-19 is the use of augmented reality headsets from RealWear by Surespan, a UK-based manufacturer. These devices enabled engineers to guide on-site technicians in real-time, facilitating document sharing and live annotations resulting in cost savings. This implementation not only enhanced collaboration but also resulted in cost savings of USD 54,000 as it reduced the need for travel and minimized project delays.

-

Growing consumer demand for immersive content: The proliferation of immersive gaming, interactive social platforms and virtual real estate is normalizing AR/VR for consumers, paving the way for major investment in consumer-grade VR and AR. Even traditionally conservative sectors such as financial services and insurance are exploring immersive client management and virtual storefronts. For instance, in June 2024, HSBC acquired virtual real estate in The Sandbox, a decentralized gaming virtual world to engage with tech-savvy customers and explore new customer experiences. This initiative highlights how traditional financial institutions are leveraging immersive platforms to connect with a new generation of consumers, thereby driving investment and innovation within the metaverse ecosystem.

Challenges

-

High development costs and hardware accessibility: Developing immersive experiences requires significant investment in hardware, software, content creation, and skilled talent. Advanced headsets, spatial sensors, and haptic devices are expensive and often lack interoperability. For small to mid-sized enterprises, this high entry cost can be a major adoption barrier. Additionally, the rapid pace of technological change risks quick obsolescence of hardware, deterring long-term investment.

-

User experience and health-related limitations: Despite technological advancements, user comfort and physical limitations remain significant barriers to the mainstream adoption of immersive reality. Extended use of VR headsets can lead to motion sickness, eye strain, disorientation, and fatigue especially when frame rates, latency, or tracking accuracy fall short.

Immersive-Reality Technologies Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

25% |

|

Base Year Market Size (2024) |

USD 113.5 billion |

|

Forecast Year Market Size (2037) |

USD 2.06 trillion |

|

Regional Scope |

|

Immersive-Reality Technologies Segmentation

Application (Entertainment & Gaming, Healthcare, Education & Training, Manufacturing & Industrial, Retail & E-commerce, Automotive, Aerospace & Defense)

The entertainment and gaming segment in immersive-reality technologies market is expected to hold a dominant 35% share by 2037 due to its ability to offer deeply engaging and interactive experiences that captivate users. A notable example is the success of Black Myth: Wukong, an action role-playing game released in August 2024, which sold over 20 million units within its first month. This high demand highlights strong consumer demand for immersive gaming content. This trend is further supported by continuous advancements in VR hardware and software, enhancing the realism and accessibility of these experiences. Additionally, the integration of immersive technologies into popular gaming franchises attracts a broad audience, solidifying the dominance of this segment in the market.

Technology Type (Virtual Reality, Augmented Reality, Mixed Reality)

The virtual reality segment in immersive-reality technologies market is projected to hold a significant share of 54% by the end of 2037, due to its widespread applications across entertainment, education, and healthcare industries to offer immersive and interactive environments. Continuous improvements in hardware, such as lighter headsets and better graphics are boosting adoption. The technology’s ability to replicate real-world scenarios safely and cost-effectively makes it attractive for enterprise use. Additionally, growing investments from tech giants are accelerating content development and market expansion.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Technology Type |

|

|

Component |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immersive-Reality Technologies Industry - Regional Scope

North America Market Analysis:

North America is expected to dominate the immersive-reality technologies market with a 38% share through 2037 due to increasing demand for experiential learning, remote collaboration, and next-gen customer engagement. Businesses are leveraging AR/VR to enhance workforce training, especially in high-risk industries such as manufacturing and healthcare. The surge in content creation for virtual platforms is also fueling innovation in hardware and software. Additionally, the region’s mature startup ecosystem and investor interest are accelerating XR product development. This convergence of enterprise needs, consumer curiosity, and technological readiness is driving rapid market expansion.

The immersive-reality technologies market in the U.S. is rising due to the increasing adoption of these technologies in the education and training sectors. The integration of virtual reality and augmented reality by educational institutions is a key driver in providing interactive and engaging learning experiences. For instance, in September 2023, Meta collaborated with 15 U.S. universities to incorporate immersive technologies into their curriculum, enhancing student engagement and comprehension. This trend reflects a broader movement towards innovative education tools that cater to diverse learning styles.

The immersive-reality technologies market in Canada is also predicted to rise, particularly in the entertainment sector. The Festival of International Virtual & Augmented Reality Stories (FIVARS) has emerged as a platform showcasing innovative storytelling through VR and AR. This festival highlights the commitment to embracing immersive technologies in creative industries, fostering a vibrant ecosystem for content creators and technologists. Such events contribute to the growing acceptance and integration of immersive experiences in mainstream media and entertainment.

Asia Pacific Market Analysis:

Asia Pacific is anticipated to garner a significant immersive-reality technologies market share from 2025 to 2037 driven by several key factors. The widespread adoption of smartphones and other devices has created a large user base for AR and MR applications, making these technologies more accessible to consumers. Additionally, collaborations between technology companies and industries are also accelerating the adoption of AR and MR. For instance, in November 2022, Meta and Tourism Authority of Thailand (TAT) launched virtual tours that allow users to explore Bangkok, Phuket, Chiang Mai, and Surat Thani in immersive 360-degree experiences. These virtual tours provide potential visitors with a captivating preview of attractions, encouraging future physical visits. This initiative leverages virtual reality to enhance engagement and promote destinations.

The immersive-reality technologies market in China is expanding rapidly driven by substantial government support and a growing tech industry. The government in China actively promotes AR and VR development through initiatives such as Made in China 2025, to encourage innovation and investment in these technologies. Major companies such as Baidu, Alibaba, and Tencent are investing in AR and VR leading to advancements in hardware and software solutions. Additionally, the country’s large tech-driven population shows high interest in gaming, entertainment, and education propelling market growth.

The market in India is expanding rapidly driven by initiatives to integrate advanced technologies into education. In February 2025, the Coimbatore Corporation introduced Augmented Reality and Virtual Reality labs in two schools as a pilot project. These labs aim to enhance student engagement and comprehension through immersive learning experiences. This development towards immersive education is fostering early exposure to AR/VR technologies accelerating demand for better infrastructure and broader adoption across public sector ecosystems.

Companies Dominating the Immersive-Reality Technologies Landscape

- Google LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Facebook Technologies LLC (Meta Platforms Inc.)

- HTC Corporation

- Microsoft Corporation

- Samsung Electronics Co. Ltd

- Magic Leap Inc.

- Qualcomm Incorporated

- Epson America Inc.

- Pimax Technology (Shanghai) Co. Ltd

- Acer Inc.

- Avegant Corporation

The immersive-reality technologies market is characterized by intense competition among major tech companies striving for dominance. Apple’s Vision Pro, Meta’s Quest Series and Microsoft’s HoloLens are prominent products shaping the landscape. These companies continuously innovate to enhance user experiences and expand their market presence. Given below are some leading players in the market:

Recent Developments

- In March 2025, GovCIO launched advanced AR/VR training tools for the U.S. government use. These tools help operators improve the accuracy and handle new security challenges more effectively.

- In March 2025, Vivo introduced its first mixed reality headset named Vivo Vision at a tech event in China. It is expected to officially release in mid-2025

- Report ID: 7593

- Published Date: May 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert