Alcohol Packaging Market Outlook:

Alcohol Packaging Market size was valued at USD 64.7 Billion in 2025 and is likely to cross USD 101.44 Billion by 2035, expanding at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alcohol packaging is assessed at USD 67.38 Billion.

The growth of the market can primarily be attributed to the rising consumption of alcohol across the globe. Based on the report published by the World Health Organization (WHO), the total consumption of alcohol was stated to be around 6.2 liters per person aged 15 or above in 2018.

Global alcohol packaging market trends such as, the rising demand for alcohol packaging in the soft drinks industry are projected to influence the growth of the market positively over the forecast period. It is estimated that in 2022 about USD 3 billion of revenue was generated by the soft drink segment alone. Additionally, significant growth in disposable income worldwide is further estimated to hike the growth of the market during the forecast period. As per the data provided by the World Bank, it was stated that in 2020, the adjusted net national income hit approximately USD 8,784 per capita. Hence, such factors are anticipated to push the growth of the market during the forecast period.

Key Alcohol Packaging Market Insights Summary:

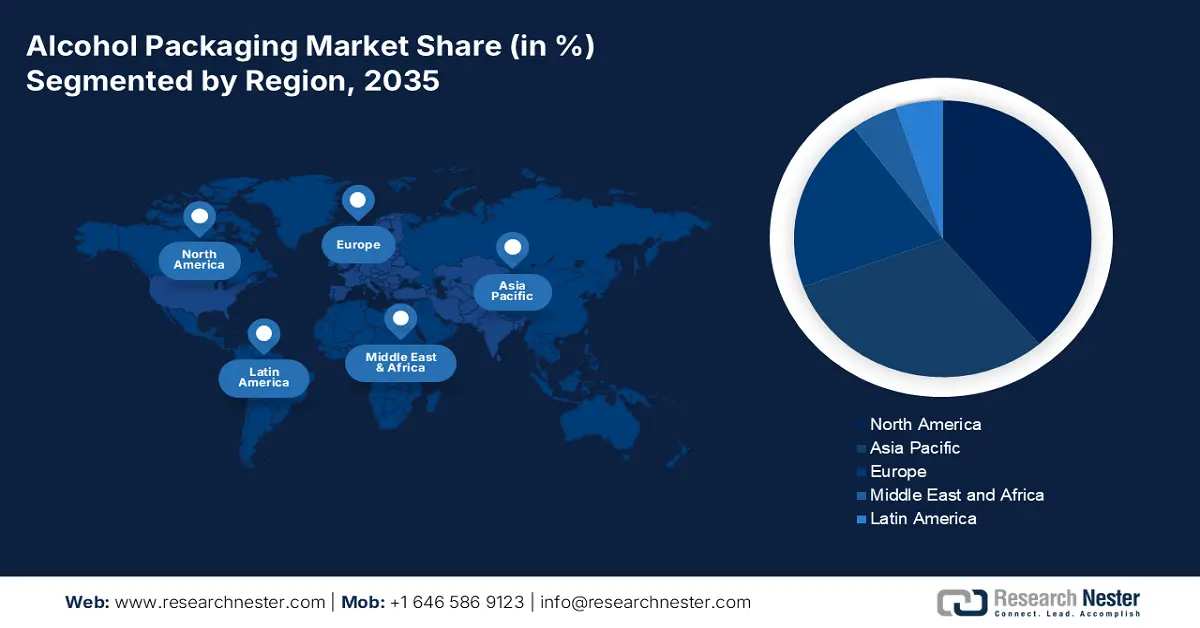

Regional Highlights:

- North America alcohol packaging market, the largest share by 2035, is driven by higher consumption of wine and beer coupled with changing social perceptions of alcohol use.

Segment Insights:

- The wine segment in the alcohol packaging market is projected to capture a significant share by 2035, driven by the growing demand for premium wine owing to its health benefits.

Key Growth Trends:

- Growing Production and Sales of Beer Across the Globe

- Higher Consumption of Cider to Boost the Market Growth

Major Challenges:

- Disrupted Supply-Chain on account of COVID-19

- Requirement for Higher Initial Investment

Key Players: Vetreria Etrusca S.p.A., WestRock Company, Tetra-Pak India Private Limited, Stora Enso Oyj, Saint Gobain SA, Amcor Limited, DS Smith Plc, Crown Holdings, Inc., Intrapc International Corporation, Beatson Clark Ltd.

Global Alcohol Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 64.7 Billion

- 2026 Market Size: USD 67.38 Billion

- Projected Market Size: USD 101.44 Billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Alcohol Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing Production and Sales of Beer Across the Globe - As of 2021, the total production of beer was estimated to be about 1.8 billion hectoliters worldwide up from around 1 billion hectoliters in 2018.Beer has been designated as one of the most consumed alcoholic drinks across the globe. Beer is generally produced by extracting raw materials along with water and fermenting. A moderated amount of beer that is nearly 11 ounces can be consumed on a daily basis since higher consumption of beer can cause low blood sugar, vomiting, blackouts, and others. Beer is mostly sold out in cans and glass bottles and requires airless packaging.

- Higher Consumption of Cider to Boost the Market Growth- For instance, in 2020, approximately 11% of cider was consumed solely in the North America region.

- Increasing Prevalence of Spirits Alcohol - In 2021, the total consumption of spirits was estimated to be approximately 4% while around 15 billion liters of spirits were sold out across the globe.

- Escalating Utilization of Paper & Paperboard in the Alcohol Packaging - The production volume of packaging paper and paperboard was estimated at about 200,000 metric tons which reached approximately 240,000 metric tons in 2020.

Challenges

- Possibility of Several Lung Diseases due to Alcohol Consumption

- Disrupted Supply-Chain on account of COVID-19

- Requirement for Higher Initial Investment

Alcohol Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 64.7 Billion |

|

Forecast Year Market Size (2035) |

USD 101.44 Billion |

|

Regional Scope |

|

Alcohol Packaging Market Segmentation:

Liquor Type Segment Analysis

The global alcohol packaging market is segmented and analyzed for demand and supply by liquor type into wine, sprites, beer, cider, and others, out of which, the wine segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the growing demand for premium wine owing to its health benefits.

Our in-depth analysis of the global alcohol packaging market includes the following segments:

|

By Material Type |

|

|

By Packaging |

|

|

By Liquor Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alcohol Packaging Market Regional Analysis:

Regionally, the global alcohol packaging market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in North America region is projected to hold the largest market share by the end of 2035. The growth of the market in the region can be accounted to higher consumption of wine and a significant change if the perception of social drinking. For instance, the total production of wine in the United States was estimated to be approximately 690 million gallons in 2020 summing up to nearly 8% of the global wine production. Additionally, mounting production of beer and rising penetration of major key players in the region are further projected to propel the growth of the alcohol packaging market positively over the forecast period. In 2021, the total production of beer solely in the United States was estimated to reach about 160 million barrels.

Alcohol Packaging Market Players:

- Vetreria Etrusca S.p.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- WestRock Company

- Tetra-Pak India Private Limited

- Stora Enso Oyj

- Saint Gobain SA

- Amcor Limited

- DS Smith Plc

- Crown Holdings, Inc.

- Intrapc International Corporation

- Beatson Clark Ltd

Recent Developments

-

WestRock Company to introduce a packaging solutions, PETCollar, CaseCollar, and EcoCase at drinktec, a global trade fair for the liquid food industry. WestRock Company is one of the leading providers of sustainable packaging products.

-

Tetra-Pak India Private Limited to unveil its new product, holographic packaging under the brand name Tetra Pak Reflect. The product has been launched in a collaboration with Warana. Tetra Pak Reflect is developed to assist food and beverage brands to bring more clarity to their packs.

- Report ID: 4475

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alcohol Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.