Airport Kiosk Market Outlook:

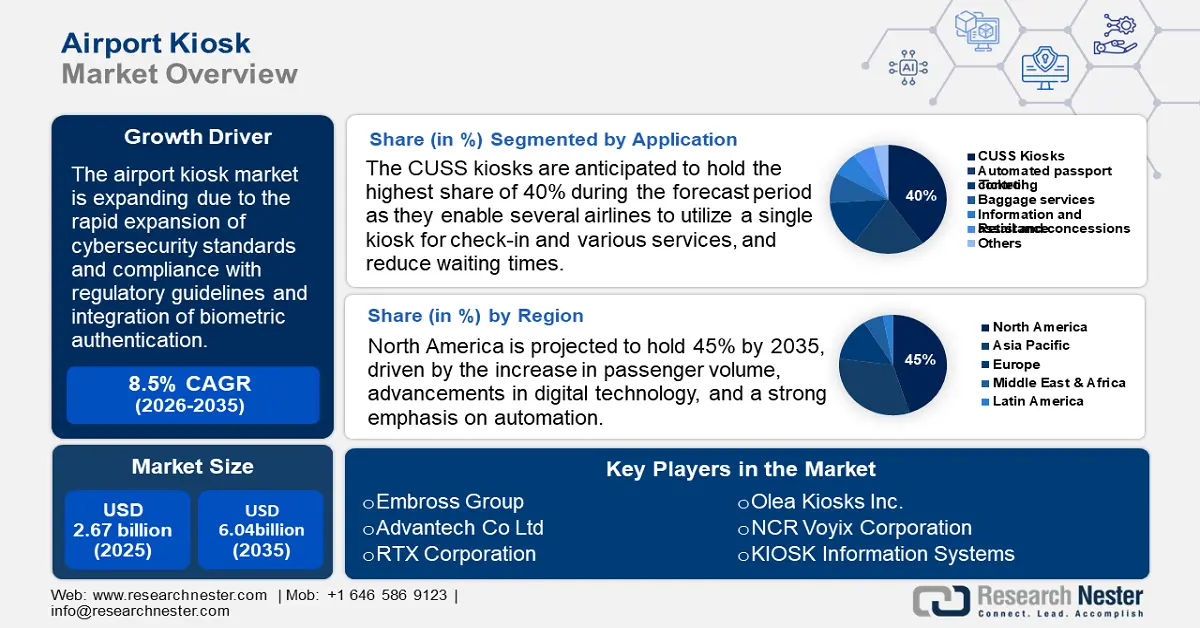

Airport Kiosk Market size was over USD 2.67 billion in 2025 and is poised to exceed USD 6.04 billion by 2035, witnessing over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airport kiosk is estimated at USD 2.87 billion.

The global market for airport kiosks functions within a multifaceted supply chain that includes design, manufacturing, assembly, and distribution processes. The essential components comprise hardware such as touchscreens, biometric scanners, printers, and software for user interfaces and systems integration. Manufacturers obtain materials like metals, plastics, and electronic components from a variety of regions. For instance, the Producer Price Index (PPI) for airport operations in the U.S. was recorded at 173.30 in November 2024, which marks a 0.10% increase from the previous month, reflecting the economic trends in the industry.

The trade of raw materials and finished kiosks is significant, with key players such as the U.S, Germany, and China heavily involved in both exporting and importing. According to the U.S. Bureau of Labor Statistics, the PPI for scheduled air transportation reached 315.14 in November 2024, reflecting the economic elements affecting the sector. Typically, assembly lines situated near major airports or logistics hubs facilitate distribution and installation processes efficiently. Furthermore, investments in technology with an increasing focus on incorporating biometric authentication, AI-powered interfaces, and IoT connectivity are becoming popular to improve user experience and operational effectiveness. These technological advancements are supported by both public and private investments, aiming to upgrade airport facilities and adapt to the changing needs of air travel.

Key Airport Kiosk Market Insights Summary:

Regional Highlights:

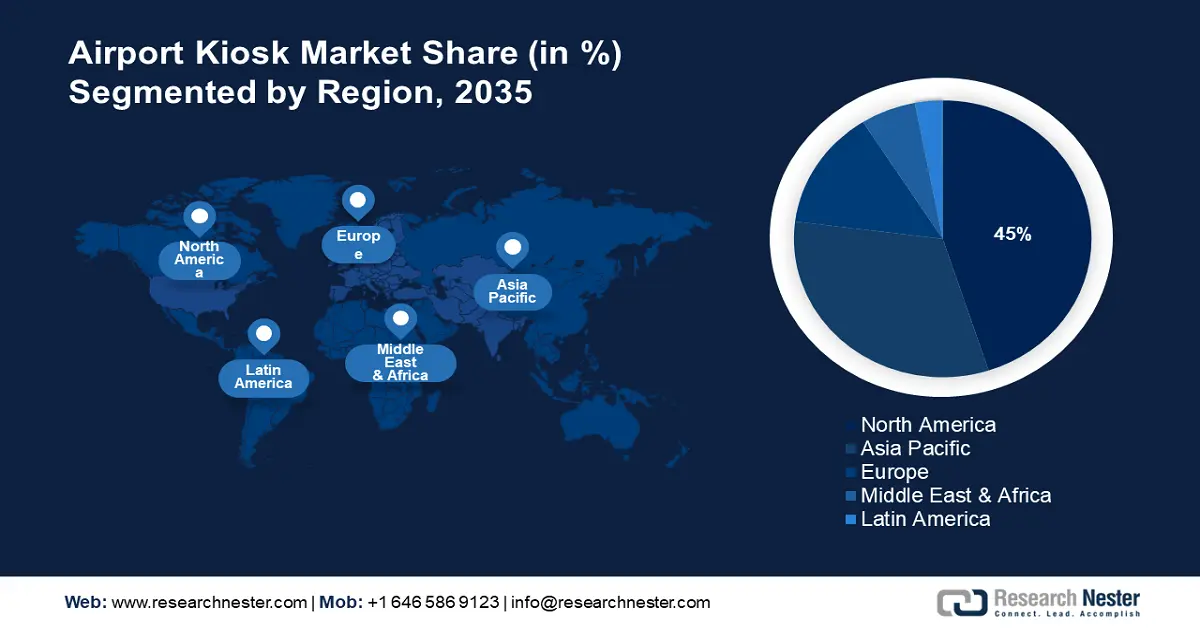

- North America airport kiosk market will dominate over 45% share by 2035, fueled by high passenger volume and strong automation emphasis.

- Asia Pacific market will register remarkable growth from 2026 to 2035, attributed to rising air travel and modernization of airport infrastructure.

Segment Insights:

- The cuss kiosks segment in the airport kiosk market is anticipated to achieve a 40% share by 2035, driven by their effectiveness in reducing wait times and enhancing airport experience.

- The self-service kiosks segment segment in the airport kiosk market is expected to capture a 35% share by 2035, fueled by demand for contactless and automated airport solutions.

Key Growth Trends:

- Cybersecurity standards and compliance with regulatory guidelines

- Expansion of AI and data analytics

Major Challenges:

- High initial set up and ongoing costs

- Compliance with data privacy and security

Key Players: SITA, NCR Voyix Corporation, Fujitsu Ltd., Materna IPS GmbH, Embross Group, Elenium Automation Pty Ltd, KIOSK Information Systems, Olea Kiosks Inc., IER SAS, Amadeus IT Group SA, Phoenix Kiosk Inc., Innovative Travel Solutions (Vancouver Airport Authority), Advantech Co., Ltd., Parabit Systems Inc., SKIDATA GmbH.

Global Airport Kiosk Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.67 billion

- 2026 Market Size: USD 2.87 billion

- Projected Market Size: USD 6.04 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Brazil

Last updated on : 9 September, 2025

Airport Kiosk Market Growth Drivers and Challenges:

Growth Drivers

- Cybersecurity standards and compliance with regulatory guidelines: The establishment of strong cybersecurity networks is essential in the airport kiosk market. A recent example highlighting the importance of cybersecurity standards in the market is the Transportation Security Administration (TSA)'s issuance of new cybersecurity requirements for airport and aircraft operators in March 2023. For example, the European Union Agency for Cybersecurity (ENISA) has stressed the necessity for secure digital infrastructures in airports to reduce potential cyber threats. These frameworks not only improve security but also comply with regulatory requirements, promoting smoother operations across different regions.

- Expansion of AI and data analytics: The combination of artificial intelligence and data analytics is transforming airport operations. AI-enabled kiosks can predict passenger behavior, streamline resource distribution, and deliver customized services, resulting in greater efficiency and enhanced customer satisfaction. For instance, Delta Airlines has implemented AI-powered kiosks that provide tailored flight information and services, improving the passenger experience. Additionally, the integration of AI facilitates predictive maintenance, minimizing downtime and lowering operational expenses.

Major Technological Innovations in the Airport Kiosk Market

The global market for airport kiosks is rapidly evolving owing to technological innovations that improve the passenger experience and optimize airport operations. The implementation of artificial intelligence and machine learning allows for tailored services and advanced crowd management. Meanwhile, biometric authentication methods like facial recognition are speeding up check-in processes and enhancing security. Cloud computing facilitates centralized system management and real-time data retrieval, increasing both scalability and efficiency.

|

Technology |

Adoption Rate |

Impact |

|

Artificial Intelligence |

45% |

Delta Airlines AI kiosks for flight info personalization |

|

Biometric Authentication |

56% |

Lyon Airport's facial recognition for check-in |

|

Cloud Computing |

72% |

Telefonica Germany's 5G migration to AWS cloud |

|

Contactless Technology |

65% |

NFC-enabled touchless airport kiosks |

|

Internet of Things (IoT) |

52% |

IoT integration with baggage and flight info systems |

Sustainability Initiatives in the Airport Kiosk Market

The global airport kiosk market is moving toward more eco-friendly practices as airports focus on reducing carbon emissions, using renewable energy, and cutting down on waste. Many airports are now using solar or wind power, installing energy-saving systems, and improving how they handle waste to lower their environmental impact. These efforts also help airports save money and build a better public image. For example, Cochin International Airport’s solar project greatly cut its carbon output, while GMR Airports and Clay Lacy Aviation are using clean energy and electric vehicles in their operations. These steps shape how airport kiosks are designed and run, promoting greener solutions across the industry.

|

Company |

Description |

Goals and Vision (2030) |

Impact on Business |

|

Cochin International Airport |

Installed 50 MW solar power plant; reduced emissions by 330,000 tons over 25 years |

Achieve carbon neutrality; expand solar capacity |

Enhanced brand reputation; operational cost savings |

|

GMR Airports |

100% renewable energy at Hyderabad Airport; 5 MW solar at Goa Airport; EV fleet integration |

Achieve net-zero emissions; LEED certifications for terminals |

Improved sustainability credentials; reduced energy costs |

|

Clay Lacy Aviation |

30,000 sq ft solar array; 44 EV stations; LED lighting upgrades |

Achieve carbon-neutral operations; expand renewable energy use |

Increased customer loyalty; reduced carbon footprint |

Challenges

- High initial set up and ongoing costs: The considerable upfront investment required for hardware, software, and infrastructure, coupled with ongoing maintenance expenses, can make kiosk solutions less feasible for smaller airports. This financial obstacle is often increased by varying regulations in different regions, necessitating customization of kiosk systems, which further escalates costs and extends implementation times.

- Compliance with data privacy and security: Strict data protection regulations like the General Data Protection Regulation in the EU impose rigorous standards for managing and storing data. Meeting these requirements necessitates substantial changes in kiosk design and operations, which can hinder market entry and increase costs for suppliers.

Airport Kiosk Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 2.67 billion |

|

Forecast Year Market Size (2035) |

USD 6.04 billion |

|

Regional Scope |

|

Airport Kiosk Market Segmentation:

Application Segment Analysis

The CUSS kiosks segment in airport kiosk market are anticipated to hold the highest share of 40% during the forecast period as they enable several airlines to utilize a single kiosk for check-in and various services. The market demand for these kiosks is rising due to their effectiveness in managing passenger processing and reducing leisure times, which enhances the overall experience at airports. The key factors fueling their expansion include the growing need for automation, heightened passenger numbers, and the associated cost-saving advantages. For instance, in 2023, Dubai International Airport (DXB) observed a notable surge in the usage of CUSS kiosks, which are employed by multiple airlines for passenger check-ins and congestion reduction. During peak travel times, the airport managed to assist over 1.2 million passengers through these kiosks, leading to a 40% decrease in wait times and improved check-in efficiency.

Technology Segment Analysis

The biometric recognition technologies, such as facial recognition and fingerprint scanning, are projected to capture a significant portion of the market. The growth can be attributed to improved security and minimizing manual intervention, important for both travelers and airport operators. The increasing emphasis on contactless travel options and enhanced security measures is propelling the use of biometric systems. For instance, in 2024, Singapore Changi Airport fully rolled out biometric-based check-ins utilizing facial recognition technology across all terminals. This effort led to a 30% reduction in check-in times and a more efficient flow of passengers.

Device Type Segment Analysis

The self-service kiosks segment in airport kiosk market is anticipated to hold a 35% share during the stipulated time frame. These machines offer functionalities such as check-in, ticketing, and baggage drop, which help minimize lengthy lines and improve the customer experience. The growing demand for contactless and automated solutions, particularly in the aftermath of the pandemic, is driving the swift expansion of self-service kiosks in airports around the globe. According to a 2023 report by ACI World, airports that have adopted self-service kiosks have experienced a 20-30% boost in overall passenger satisfaction, owing to quicker processing times and shorter queues.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Technology |

|

|

Device Type |

|

|

End user |

|

|

Frequency Band |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airport Kiosk Market Regional Analysis:

North America Market Insights

The airport kiosk market in North America is projected to hold the highest share of 45% by 2035, driven by the increase in passenger volume, advancements in digital technology, and a strong emphasis on automation. In the U.S. and Canada, government investments in airport modernization are focused on installing self-service kiosks to improve passenger experiences and operational effectiveness. For instance, the U.S. government has committed considerable funding for airport infrastructure enhancements that incorporate self-service kiosks to facilitate check-in and security procedures.

In the U.S., the airport kiosk market is expanding due to increasing passenger numbers and the implementation of cutting-edge technologies. Airports are adopting self-service kiosks to minimize wait times and enhance customer satisfaction. A prime example is the deployment of Amadeus’ Auto Bag Drop and Next Generation Kiosk technologies at Terminal 4 of John F. Kennedy International Airport. These kiosks allow passengers to check in, print bag tags, and efficiently drop off their luggage while integrating biometric features for improved security.

Canada airport kiosk sector is growing as airports focus on enhancing passenger convenience and improving operational efficiency. The Canada government has allocated more than USD 570 million to upgrade airport facilities, which includes the deployment of self-service kiosks. For example, Vancouver International Airport has implemented self-service check-in kiosks that enable travelers to check in, print their boarding passes, and tag their luggage on their own, thereby alleviating congestion and enhancing the overall travel experience.

Asia Pacific Market Insights

The airport kiosk market in the Asia Pacific is witnessing remarkable growth, propelled by rising air travel, increasing urbanization, and the adoption of self-service technologies throughout the area. To improve passenger experience and operational efficiency, governments and airport authorities are investing in the modernization of infrastructure and digital solutions. For example, SITA has collaborated with the Airports Authority of India to implement self-service kiosks in 43 airports, aiming to simplify the check-in and baggage handling processes.

The airport kiosk market in China is anticipated to expand due to the country's swift urbanization, a growing middle class, and heightened demand for air travel, which are key contributors to this growth. The Chinese government is proactively backing the development of airport infrastructure, including the construction of more than 220 new airports by 2035. This expansion offers significant prospects for the installation of self-service kiosks to effectively manage the increasing volume of passengers.

The market in South Korea is predicted to hold a notable share due to the adoption of cutting-edge biometric technologies. For instance, in July 2023, Incheon International Airport launched the SmartPass system, which enabled travelers to use facial recognition for identity verification at both departure and boarding gates. This initiative is designed to improve passenger processing efficiency and strengthen security protocols. Following the rollout, more than 25,000 users had registered their biometric data, showcasing a favorable response to the innovative system.

Airport Kiosk Market Players:

- SITA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NCR Voyix Corporation

- Fujitsu Ltd.

- Materna IPS GmbH

- Embross Group

- Elenium Automation Pty Ltd

- KIOSK Information Systems

- Olea Kiosks Inc.

- IER SAS

- Amadeus IT Group SA

- Phoenix Kiosk Inc.

- Innovative Travel Solutions (Vancouver Airport Authority)

- Advantech Co., Ltd.

- Parabit Systems Inc.

- SKIDATA GmbH

The global market for airport kiosks is extremely competitive, dominated by key players such as NCR Voyix, Materna IPS (SITA), and Amadeus IT Group, who focus on innovation and forging partnerships, such as SITA’s collaboration with the Airports Authority of India aimed at enhancing passenger services. Emerging companies such as Advantech, Aila Technologies, and DynaTouch are making strides by providing AI and biometric-based solutions specifically designed for airport applications. These companies are broadening their product offerings, enhancing their software, and forming strategic collaborations with both airports and airlines. Here is a list of key players operating in the market:

Recent Developments

- In March 2025, Delhi Airport introduced advanced self-service kiosks at Terminals 1 and 3 to enhance passenger convenience. These include the Self Service Bag Drop (SSBD) system and Virtual Information Display (VID) kiosks. The SSBD cuts baggage drop time to 30 seconds, improving efficiency. VID kiosks offer real-time flight info, 3D maps, and live video support.

- In July 2023, SITA entered into a partnership with the Airports Authority of India to enhance technology at 43 major airports across the country. The agreement includes the deployment of SITA's IATA-certified systems, such as SITA Flex, CUPPS, SITA CUSS, and SITA Bag Manager, aimed at increasing efficiency for airlines and ground services.

- Report ID: 4135

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airport Kiosk Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.