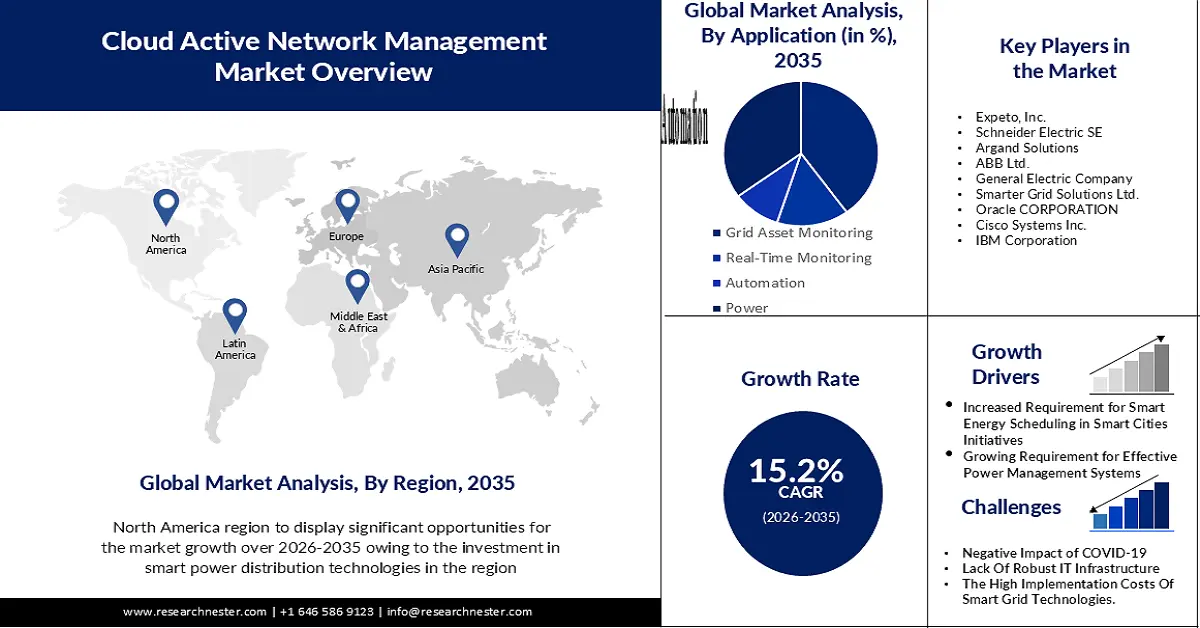

Active Network Management Market Outlook:

Active Network Management Market size was over USD 1.45 billion in 2025 and is poised to exceed USD 5.97 billion by 2035, witnessing over 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of active network management is estimated at USD 1.65 billion.

The market is growing owing to the increased deployment of IoT throughout utility ecosystems. For instance, the number of Internet of Things (IoT) devices worldwide is expected to nearly double from 15.1 billion in 2020 to over 29 billion by 2030.

The abilities and viability of dynamic organization the board arrangements are worked on by persistent advancements in information examination, man-made consciousness, correspondence advancements, and control calculations.

In addition to this, factor that is believed to fuel the active network management market growth is company’s growing need to increase operational efficiencies, save costs and capital expenditures. Moreover, business requirements for adopting cloud apps largely rely on their digital transformation plans and network development. A lot of companies are changing the way they measure the delivery of customer experiences and traditional network performance parameters.

Key Active Network Management Market Insights Summary:

Regional Highlights:

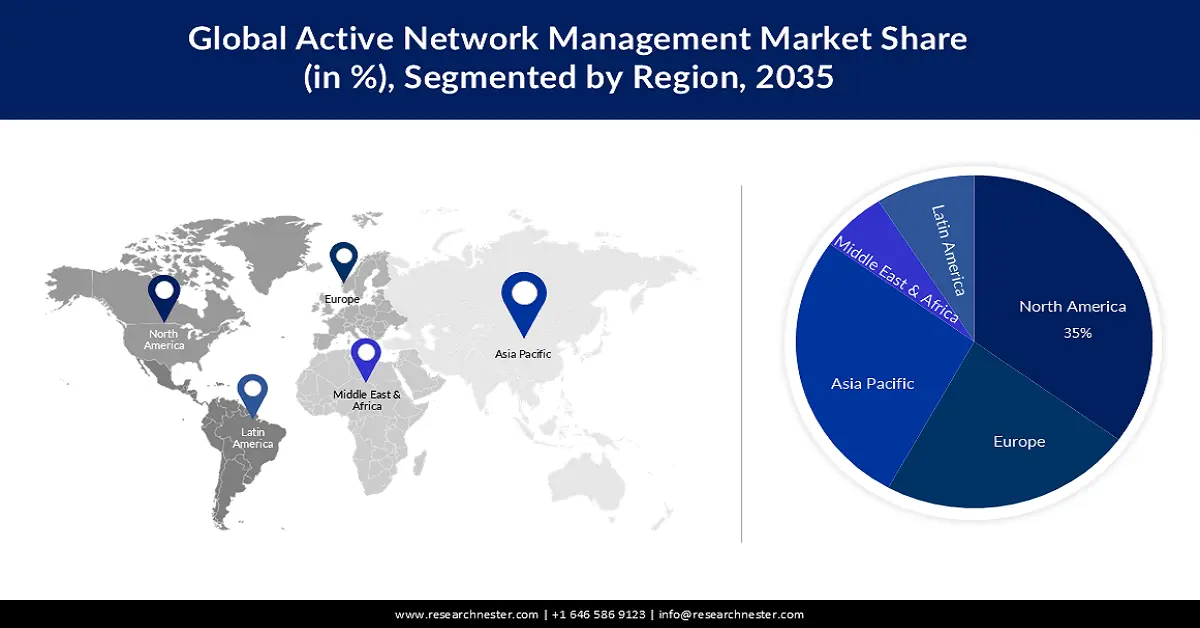

- North America active network management market will hold more than 35% share by 2035, driven by well-equipped infrastructure and significant investments in smart power distribution technologies by major companies like General Electric and Oracle Corporation.

- Asia Pacific market will attain the second largest share by 2035, attributed to growing adoption of automated applications and rapid industrialization in countries like China, South Korea, and India.

Segment Insights:

- The software segment in the active network management market is expected to capture a 55% share by 2035, fueled by rising demand for load-balancing and power distribution management systems.

- The grid asset monitoring segment in the active network management market is projected to hold a 50% share by 2035, driven by growing global environmental concerns and investments in energy storage and smart grids.

Key Growth Trends:

- Increased requirement for smart energy scheduling in smart cities initiatives

- Growing requirement for effective power management systems

Major Challenges:

- Negative impact of COVID-19

- It is anticipated that emerging countries lack of robust IT infrastructure will restrict market expansion.

Key Players: General Electric, ABB Ltd., Siemens AG, Schneider Electric SE, Itron, Landis+Gyr, Cisco Systems, Inc., IBM Corporation, Oracle Corporation, Smarter Grid Solutions.

Global Active Network Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.45 billion

- 2026 Market Size: USD 1.65 billion

- Projected Market Size: USD 5.97 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 16 September, 2025

Active Network Management Market Growth Drivers and Challenges:

Growth Drivers

- Increased requirement for smart energy scheduling in smart cities initiatives - Smart city development is receiving significant investment from some North American, European, and Asian nations, such as Canada, the United States, the United Kingdom, Germany, the Netherlands, Spain, Sweden, India, China, and Japan. Energy management and power distribution monitoring are regarded as the two essential components of city planning that ensure a continuous and smooth supply of electricity throughout the city.

In order to sustain a city's power distribution platform, active network management provides sophisticated analytics for network control, high grid stability, real-time power evaluation, and many other operational needs. Furthermore, a major driver of the global market's growth has been the integration of Internet of Things (IoT) devices into the infrastructure of smart cities. By 2050, it's predicted that 60% of people on Earth will reside in smart cities. Over 73% of all connected devices will have something to do with smart cities by 2021. - Growing requirement for effective power management systems - Global demand for effective power distribution and real-time energy supply control is estimated to drive the growth of the active network management market. Furthermore, the active network management module processes a number of smart grid applications, including sensor communication, communication controls, real-time grid system monitoring, and substation automation.

Active network monitoring is being adopted at a rapid rate by several industries, including oil and gas, mining, transportation, and government agencies, thanks to improved efficiency and precise grid control systems. Additionally, the improved demand response method that the active network management solution offers for power distribution in both rural and densely populated locations is projected to propel active network management market expansion throughout the research period. - Government initiatives to boost market growth - Around the world, governments aimed to implement smart governance to tackle the issues of urban densification and insufficient provision of essential utilities, including water, sanitation, and electricity. In addition, the digital revolution has altered every significant industry and permeated almost every facet of urban life. As a result, during the past few months, the market has been steadily rising. Moreover, growing expenditures from solution providers are observed to support R&D efforts to create ANM solutions.

Challenges

- Negative impact of COVID-19 - Practically every business in the world has experienced a setback as a result of the COVID-19 epidemic. This can be attributed to significant interruptions in their individual supply chains and manufacturing processes as a result of numerous precautionary lockdowns and other restrictions put in place by governments across the globe.

The global market for active network management is no different. Furthermore, as the outbreak has badly impacted the general economic status of most individuals, there has been a decline in consumer demand as people are now more focused on cutting non-essential expenses from their budgets. The revenue trajectory of the worldwide market is probably affected by the aforementioned variables. - It is anticipated that emerging countries lack of robust IT infrastructure will restrict market expansion.

- It is projected that in the near future, the expansion of the active network management industry would be constrained by the high implementation costs of smart grid technologies.

Active Network Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 1.45 billion |

|

Forecast Year Market Size (2035) |

USD 5.97 billion |

|

Regional Scope |

|

Active Network Management Market Segmentation:

Component Segment Analysis

The software segment in the active network management market is estimated to gain the largest revenue share of about 55% in the year 2035. The segment growth can be credited to the rise in demand for effective load-balancing modules and power distribution management systems in power grids. Several European nations, such as Belgium, the Netherlands, Germany, and the United Kingdom, are putting smart energy distribution systems into place to allocate power more efficiently.

A variety of management suites and platforms, including advanced metering infrastructure (AMI), distribution automation, geographic information systems, outage management, and telecommunication network management, are included in active network management software solutions.

For example, ABB introduced its new ABB Ability e-mesh solution in February 2019. An integrated, unified, and single picture of the distributed energy resources (DERs), such as microgrids, battery energy storage systems (BESS), and renewable power generation, will be made available to power grid operators by this solution.

Application Segment Analysis

The grid asset monitoring segment is set to account for a share of 50% during the forecast timeframe. The segment’s growth is impelled by the growing environmental concerns globally. Energy consumption has increased dramatically over time, and between January 2022 and September 2022, almost USD 25 billion was invested globally in energy storage and smart grids.

Energy storage firms are essential to the switch from fossil fuels to sustainable energy sources, hence it is anticipated that these investments will increase. Grids are receiving more input from renewable energy sources than they were intended to because of the rising demand for electricity.

Given that over 70% of downtime and maintenance expenses are attributed to malfunctioning or aged transformers, transformer monitoring is crucial. Active network management (ANM) and asset performance management (APM) are crucial technologies for implementing this transformation. The US Department of Energy (DoE) projects that by 2026, US electric utilities would have invested a total of 24.5 billion USD in capital projects related to IT and OT digital technologies. 16.4 billion USD of this will go into smart grid systems and technologies. The market is predicted to propel in this segment as a result.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

Enterprise Size |

|

|

Verticals |

|

|

Applications |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Network Management Market Regional Analysis:

North America Market Insights

Active Network Management market in the North America, amongst the market in all the other regions, is anticipated to hold the largest with a share of about 35% by the end of 2035. The market growth in the region is also expected on account of presence of the well-equipped infrastructure. Additionally, two of the biggest companies in North America's market, General Electric and Oracle Corporation, are making significant investments in smart power distribution technologies. Innovative active network management solutions are developed by vendors in this market to meet the needs of several business verticals, such as government, transportation, and energy & utilities. According to a report in 2021, the advanced (smart) metering infrastructure (AMI) installations held by US electric utilities accounted for around 111 million installations, or almost 69% of all electric meter installations.

APAC Market Insights

The APAC region will also encounter huge growth for the active network management market during the projection period and will hold the second position owing to the growing adoption of automated applications. Industry players understand how critical it is to integrate the production of conventional and renewable energy sources effectively.

Moreover, the market is anticipated to expand quickly throughout the projection period due to the spike in industrialization in rising nations like China, South Korea, and India.

Active Network Management Market Players:

- General Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Itron

- Landis+Gyr

- Cisco Systems, Inc.

- IBM Corporation

- Oracle Corporation

- Smarter Grid Solutions

Recent Developments

- Schneider Electric introduced Grids of the Future Lifecycle Management. Electricity, according to Schneider Electric, the leader in digital energy management and automation and The World's Most Sustainable Corporation in 2021, is the only energy that offers the fastest vector for decarbonization through a combination of digital software-led solutions and renewable energy.

- Siemens unveiled its newly developed software for low-voltage grids, a first in the industry. This is yet another significant step Siemens is taking to accelerate the energy transition. LV Experiences X programming, part of the Siemens Xcelerator portfolio, empowers dispersion network administrators (DSO) to handle their most squeezing challenge: the need to fundamentally increment lattice limit while frameworks are now moved as far as possible by the quick increment of decentralized environmentally friendly power infeed and extra shoppers, for example, EV chargers or intensity siphons.

- Report ID: 5605

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Network Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.