Network Management Solutions Market Outlook:

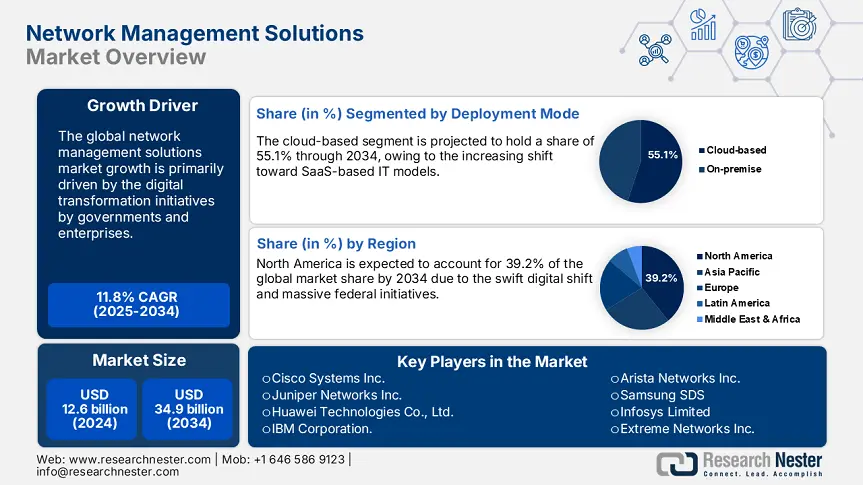

Network Management Solutions Market size was valued at USD 12.6 billion in 2024 and is set to exceed USD 34.9 billion by the end of 2034, registering over 11.8% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of network management solutions is evaluated at USD 14.1 billion.

The global trade of network management solutions is characterized by the import and export of hardware and software components, with major dependencies on semiconductors. The telecom-grade processors and secure data transmission modules are also vital for the production of efficient and effective network management technologies. In 2024, the imports of computer and electronic products crossed USD 480.6 billion, with a 6.1% YoY growth, representing the increasing reliance on global electronics for the assembly of network infrastructure solutions, according to the U.S. Census Bureau.

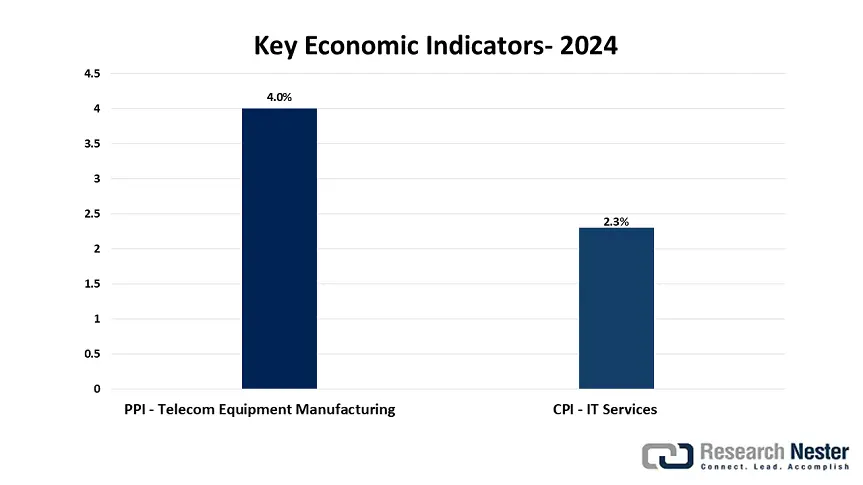

Furthermore, the producer price index for telecommunications equipment manufacturing grew by 4.0% in 2024, owing to the high prices for high-speed transceivers and FPGA-based network interface components, as per the U.S. Bureau of Labor Statistics (BLS) analysis. During the same period, the consumer price index for information technology services rose by 2.3%, reflecting a moderate rise in end-user pricing and also indicating a continuous demand resilience in enterprise segments. Overall, pricing changes and a stable supply chain of raw materials drive high sales of network management solutions.

Network Management Solutions Market - Growth Drivers and Challenges

Growth Drivers

-

Digital transformation initiatives by governments and enterprises: The shift towards digital transformation in both the public and private sectors is projected to fuel the sales of network management technologies. Many governments across the world are allocating hefty funds for infrastructure, connectivity, and automation enhancement, which is further expected to open lucrative earning opportunities for network management solution manufacturers. The U.S. Infrastructure Investment and Jobs Act (IIJA) has earmarked USD 65.5 billion for broadband upgrades, and a significant portion of it is dedicated to management, monitoring, and security systems. Also, in India, the digital and smart city initiatives are fueling the adoption of network management solutions.

-

Need for operational automation due to workforce shortage: The automation trends and limited presence of network engineers and IT security professionals in some regions are likely to promote the sales of network management solutions. ENISA’s Skills Gap Survey discloses that nearly 71.5% of European organizations reported difficulty in filling network security roles in 2024. To bridge this gap, enterprises need to lean on automation and self-healing networks, enabled by modern NMS tools. The advanced solutions with automated ticketing, alert prioritization, and L1 response bots are reducing the need for large teams. Many companies are investing in network management technologies to enhance their performance and minimize operational costs. Also, this is poised to be reported more in areas with aging workforces, such as Japan and China.

Technological Innovations in the Network Management Solutions Market

The AI-driven analytics, cloud-native platforms, and intent-based networking are boosting the sales of network management solutions. Telecom, manufacturing, and logistics industries are leading the sales of advanced network management solutions. The continuous investments in technological innovations are further expected to boost the adoption of network management platforms. The table below reveals the current technological trends and their outcomes.

|

Technology Trend |

Industry |

Example/Statistic |

|

AI-Powered NMS |

Telecom |

Vodafone deployed AI-based NetOps, reducing incident resolution time by 35.5% |

|

Cloud-Native NMS |

Manufacturing |

63.3% of industrial firms in APAC migrated to SaaS NMS platforms in 2024 |

|

Intent-Based Networking |

Utilities |

Siemens Energy cut human errors by 42.6% using Cisco’s Intent-Based Networking |

Sustainability Trends in the Market

|

Company |

Sustainability Initiatives |

Goals & Vision |

Impact on Business |

|

Cisco |

39.5% fall in Scope 1 & 2 emissions (2023); 100% renewable use at HQ |

Net-zero across the value chain by 2040; 75.4% by 2030 |

$1.3B in ESG-driven contract wins |

|

Juniper |

58.6% of electricity from renewables (2023); solar at 5 global sites |

100% renewable power globally by 2030 |

3.6% OPEX savings in 2023 via energy efficiency upgrades |

|

HPE |

Decreased electronic waste by 32.2% through the IT recycling program (2023) |

Circular hardware economy covering 90.5% of product lines |

$651M cost savings through recovered material reuse |

Challenges

-

High cybersecurity compliance costs: The cybersecurity compliance costs are expected to hamper the sales of network manufacturing solutions to some extent. The small and mid-sized companies often find it difficult to expand their operation owing to strict and complex cybersecurity mandates such as the National Institute of Standards and Technology (NIST) Cybersecurity Framework and the European Union Agency for Cybersecurity’s (ENISA) NIS2 Directive. For example, in the U.S., the average cost of cybersecurity compliance for small ICT firms crossed USD 279,000 annually in 2023. Such hefty spending is estimated to limit new companies’ entry into the market.

-

Limited public-sector infrastructure readiness: The lack of reliable telecom and data center infrastructure in some parts of emerging economies is technically hindering the deployment of advanced NMS platforms. Sub-Saharan Africa, Southeast Asia, and some parts of Latin America witness network latency, unstable connectivity, and low cloud penetration, which is likely due to low budgets. The International Trade Union’s Global Connectivity report reveals that in 2023, nearly 31.5% of public institutions in low-income countries had access to stable broadband. The poor infrastructure directly limits the feasibility of SaaS-based or real-time monitoring solutions.

Network Management Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

11.8% |

|

Base Year Market Size (2024) |

USD 12.6 billion |

|

Forecast Year Market Size (2034) |

USD 34.9 billion |

|

Regional Scope |

|

Network Management Solutions Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is projected to capture 55.1% of the global market share through 2034, owing to the increasing shift toward SaaS-based IT models. According to the National Telecommunications and Information Administration (NTIA) more than USD 1.5 billion was allocated in 2024 under the Broadband Equity, Access, and Deployment (BEAD) program for scalable, cloud-managed telecom infrastructure, which directly boosted the demand for cloud-native network management solutions. The favorable funding initiatives are fueling the production and sales of cloud-based NMS solutions. The U.S. General Services Administration (GSA) cloud adoption roadmap, which encourages federal agencies to use centralized cloud-based network monitoring to improve uptime and reduce procurement complexity, is also contributing to the segmental growth.

End user Segment Analysis

The telecom service providers are expected to account for 34.9% of the global market share throughout the forecast period. The increasing 5G rollout, edge deployments, and virtual network functions are collectively promoting the adoption of network management solutions in the telecom sector. The International Trade Union’s Global Connectivity Report projects that 5G subscriptions are estimated to cross 2.7 billion globally by 2034, with telecom providers heavily spending in automated, scalable network management platforms. The Federal Communications Commission (FCC) also emphasizes network performance monitoring and compliance reporting under 5G fund allocations, which push telcos toward robust NMS tools to maintain service level agreement (SLA) requirements. The telecom companies' move towards scaling real-time diagnostics and performance monitoring tools as part of their 5G architecture is projected to drive substantial growth in the coming years.

Our in-depth analysis of the global network management solutions market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Solution Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Network Management Solutions Market - Regional Analysis

North America Market Insights

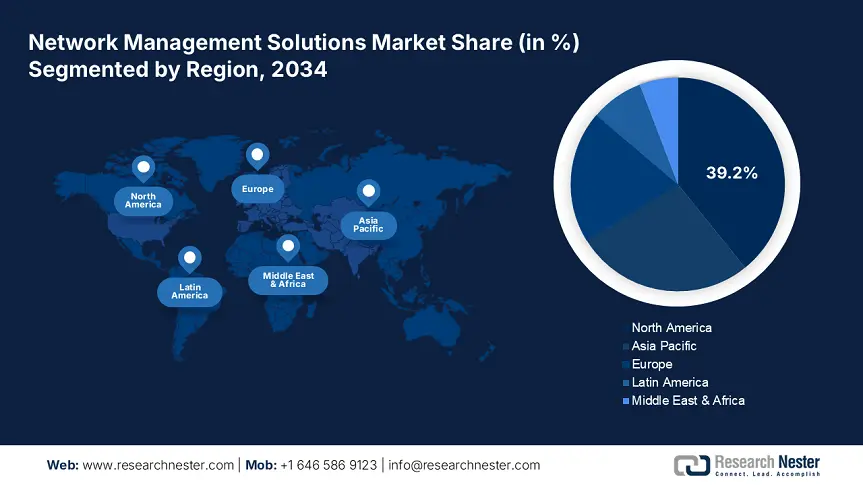

The North America network management solutions market is anticipated to hold 39.2% of the global revenue share by 2034. The massive federal initiatives are boosting the sales of network management technologies in the U.S. and Canada. The FCC allocated nearly USD 42.6 billion under the BEAD program in 2024 for broadband expansion, which boosted the application of advanced NMS tools to monitor performance. During the same period, Canada expanded its Universal Broadband Fund to CAD 3.3 billion, with several ISPs deploying cloud-based NMS to track rural connectivity.

The U.S. leads the sales of network management solutions owing to the hefty federal ICT investments and high-speed broadband rollouts. The federal ICT budget reached USD 130.3 billion in FY 2024, with around ~19.9% directed at network performance and cybersecurity tools. Also, the robust rise in broadband expansion to the last mile is expected to accelerate the deployment of network management technologies. The FCC’s 5G Fund for Rural America has committed USD 9.1 billion over 10 years to enhance the use of advanced NMS tools essential for SLA enforcement and QoS tracking. Furthermore, the strong presence of key producers in the country contributes to the overall market growth.

Europe Market Insights

The Europe network management solutions market is poised to account for 20.1% of the global revenue share throughout the forecast period. The rising digital sovereignty and EU-wide cybersecurity mandates are propelling the sales of network management solutions. The smart infrastructure deployments are also boosting the application of network management technologies. The Digital Europe Programme has allocated €7.6 billion through 2027 to accelerate the demand for cloud-native NMS platforms across various sectors such as energy, transport, and healthcare. France, Germany, and Italy are the most profitable marketplaces for network management solutions in the EU.

Germany leads the sales of network management solutions, owing to the massive government investments and aggressive digital shift. The Federal Ministry for Digital and Transport (BMDV) channels billions into national broadband, 5G infrastructure, and industrial automation, which opens lucrative doors for NMS companies. The country’s Digital Rail Germany program is integrating AI-powered NMS for real-time signaling and predictive diagnostics across more than 33,000 km of track. Furthermore, the push for digital sovereignty, backed by the Gaia-X framework and the EU’s Digital Europe Programme, is accelerating the trade of network management solutions in the country.

Country-Specific Insights

|

Country |

2023 NMS Budget Allocation (% of National ICT Budget) |

2024 NMS Market Demand |

2021-2024 Growth |

|

UK |

18.8% (↑ from 14.4% in 2020) |

€2.9 billion |

+23.5% |

|

Germany |

20.2% (↑ from 16.6% in 2020) |

€4.0 billion |

+31.2% |

|

France |

16.3% (↑ from 13.5% in 2021) |

€2.2 billion |

+19.6% |

APAC Market Insights

The Asia Pacific network management solutions market is foreseen to increase at a CAGR of 12.7% between 2025 and 2034, owing to the massive 5G expansion and rapid cloud migration. The government-backed digital transformation across sectors such as healthcare, telecom, and finance is expected to fuel the sales of network management technologies. Japan, South Korea, and China are leading the adoption of AI-integrated network management solutions. The Ministry of Internal Affairs and Communications of Japan stated that in 2023, more than 68.5% of large enterprises had integrated AI-powered network monitoring tools. The infrastructure modernization moves are attracting several international NMS companies to APAC.

The sales of network management solutions in China are driven by the industrial digitalization strategy and aggressive smart city deployment. More than 3.3 million new companies adopted NMS solutions in 2023, as per the China Academy of Information and Communications Technology (CAICT) report. Furthermore, according to the Ministry of Industry and Information Technology (MIIT), the New Infrastructure policy allocated ¥78.3 billion between 2022 and 2024 for intelligent networking in healthcare, finance, and logistics. The supportive government policies and hefty funding are set to double the revenues of key players in the coming years. The cloud-based and zero-trust NMS platforms are also expected to gain traction owing to their efficiency.

Country-Specific Insights

|

Country |

Govt. NMS Spend (2024) |

Key Metrics |

|

Japan |

¥244.9 billion (8.5% of ICT budget) |

METI reports ¥111B for NMS in smart factories; MHLW allocated ¥62.6B for hospital-grade NMS integration |

|

India |

$3.5 billion (↑222% since 2015) |

6.8M+ Indian MSMEs using NMS tools by 2023; 86% of central e-services integrated with cloud NMS systems |

|

Malaysia |

RM 751 million (↑116% since 2013) |

NMS adoption among firms doubled from 2013 to 2023; KKD mandates real-time monitoring for the national 5G backbone |

|

South Korea |

₩1.6 trillion (↑62% from 2020) |

78.5% of telcos and hospitals deployed AI-based NMS by 2023 (NIPA); MSIT invested ₩500B in NMS-Cloud R&D |

Key Network Management Solutions Market Players:

- Cisco Systems Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Juniper Networks Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Ericsson AB

- Nokia Corporation

- Arista Networks Inc.

- Samsung SDS

- Infosys Limited

- Extreme Networks Inc.

- NEC Corporation

- Telstra Corporation Limited

- Telekom Malaysia Berhad

The global network management solutions market is led by U.S.-based players, with the top 3 representing more than 30.5% of the total share. The leading copies are focused on AI-powered automation, zero-trust security integration, and cloud-native platforms to meet the evolving needs of enterprises. Some of the players are entering into strategic partnerships with other companies to increase their market reach and revenue. Merger & acquisition strategies are also aiding them to boost their product offerings. The organic sales are poised to offer double-digit percent revenue growth to network management solution manufacturers.

Here is a list of key players operating in the global network management solutions market:

Recent Developments

- In May 2024, Juniper Networks Inc. announced the expansion of its AI-powered Virtual Network Assistant (VNA), Marvis, to support multi-cloud environments. The launch reported a 23.4% rise in cloud NMS deployments among U.S. retail clients and a 6.5% growth in service revenue in the second quarter of 2024.

- In March 2024, Vodafone implemented AI-powered predictive NMS in its European core network. This move led to a 35.5% reduction in unplanned outages and 28.4% fewer support ticket volumes.

- In February 2024, Cisco Systems Inc. introduced the Catalyst 9000X series switches with integrated AI-based NMS features. The upgrade contributed to a 12.5% YoY increase in enterprise switching revenue in Q1 2024.

- Report ID: 4275

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Network Management Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert