Acne Medication Market Outlook:

Acne Medication Market size was over USD 14.27 billion in 2025 and is poised to exceed USD 23.47 billion by 2035, growing at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acne medication is estimated at USD 14.92 billion.

The rising prevalence of acne or skin disorders such as acne, eczema, and psoriasis is the prime reason fuelling the acne medication market. A 2023 report published by the World Health Organization (WHO) stated that skin conditions are estimated to impact 1.8 billion people at any point in time.

Antibiotics, retinoids, and isotretinoin are some medications used for acne treatment, wherein antibiotics are the most used drugs for acne treatment and are expected to exhibit high global demand throughout the forecast period. According to a report by the National Center for Biotechnology Information (NCBI) published in June 2023, the prevalence of acne among teenagers worldwide is around 80%. The same source also estimates that adult acne problem affects 40% of the population.

Additionally, companies are launching new formulations that combine existing ingredients with advanced delivery systems are also driving the acne medication market. For instance, in July 2024, Crown Laboratories announced that its brand PanOxyl has come with the latest innovations in acne-banishing body spray. Body sprays formulated with 2% salicylic acid are now aiding in clearing blemishes and unclogging pores more effectively, leading to long-lasting results.

Key Acne Medication Market Insights Summary:

Regional Highlights:

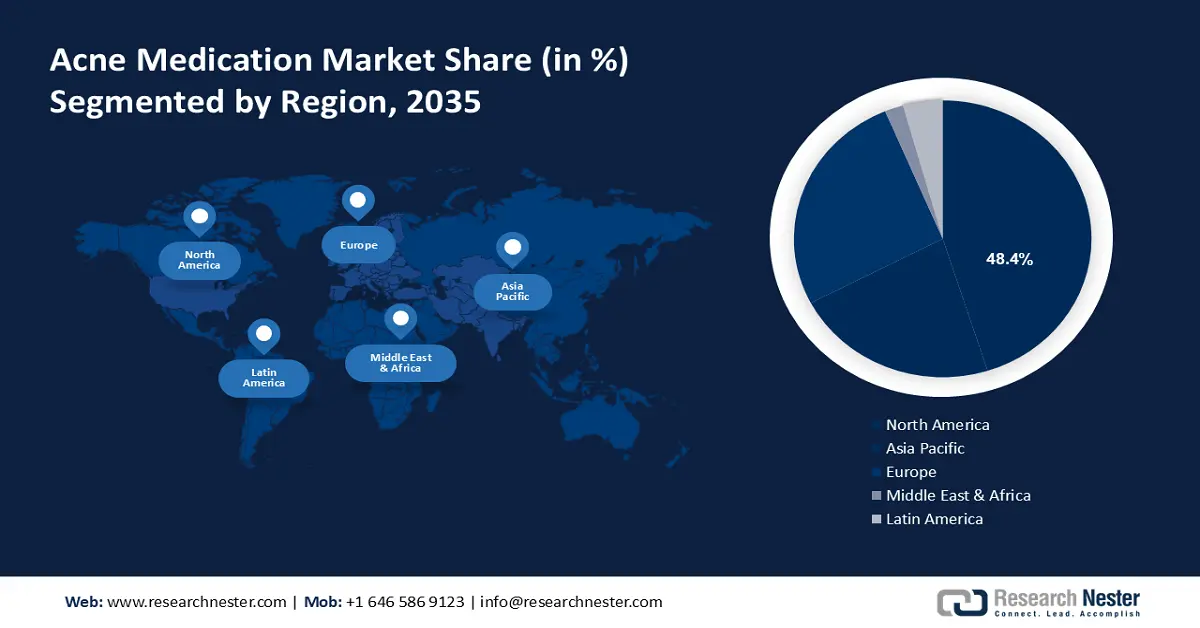

- North America acne medication market will account for 48.40% share by 2035, driven by the increasing prevalence of acne and advancements in drug formulation.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rising awareness of skincare, increasing consciousness about physical appearance, and improved healthcare infrastructure in countries such as China, India, and Japan.

Segment Insights:

- The antibiotics segment in the acne medication market is expected to achieve significant growth till 2035, driven by the use of antibiotics as first-line treatment for mild to moderate acne.

- The retail and online pharmacies segment in the acne medication market is anticipated to see high growth over 2026-2035, driven by ease of access to OTC acne medications and availability of discounts online.

Key Growth Trends:

- Over-the-counter (OTC) innovations

- Acne patients opting for personalized solutions

Major Challenges:

- Risk of side effects

- High cost of advanced acne treatment options

Key Players: Galderma S.A., Bausch Health Companies Inc., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline Plc., and Pfizer Inc.

Global Acne Medication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.27 billion

- 2026 Market Size: USD 14.92 billion

- Projected Market Size: USD 23.47 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Acne Medication Market Growth Drivers and Challenges:

Growth Drivers

- Over-the-counter (OTC) innovations: New OTC products feature improved formulations with higher efficacy, combining active ingredients such as benzoyl peroxide, salicylic acid, and niacinamide in innovative ways to better target acne and reduce adverse effects. Moreover, microencapsulation or slow-release technologies ensure that active ingredients penetrate the skin more effectively and provide prolonged actions, leading to better results with less frequent application. These innovations contribute to increased consumer confidence, better management of acne, and greater market growth. For instance, in 2023, OTC revenues of acne products and medicines in the U.S. totaled USD 540 million.

- Acne patients opting for personalized solutions: The personalization trend is expected to boost the acne medication market growth in the coming years as many individuals across the world are opting for skin-specific solutions. The increasing awareness that the one-size-fits-all strategy may not offer effective outcomes is driving the demand for customized acne therapeutics. Innovations in the skin care field such as the implementation of artificial intelligence (AI) are aiding dermatologists to offer personalized care to target patients. AI-driven tests and specialized skin care routines are enhancing treatment efficacy and boosting patient satisfaction. For instance, Nivea offers an AI skin care app SKiN GUiDE for optimal skin care routines including freckles, acne, and pigmentation.

Challenges

-

Risk of side effects: To treat acne, various medications are used such as antibiotics, retinoids, and isotretinoin, these medications offer effective results when administrated correctly. Some studies reveal that improper or excessive use of acne medications may result in severe side effects such as scaling and dryness. For instance, according to the Centers for Disease Control and Prevention (CDC) report, more than 2.8 million antimicrobial-resistant infection cases are detected in the U.S. each year.

- High cost of advanced acne treatment options: Advanced acne treatment solutions and dermatology medical devices such as AI skin detectors and laser treatments are quite expensive than conventional treatment patterns. Patients with low earnings are deterred from advanced treatment options because of their high costs and unawareness. Acne treatment also often requires multiple visits to the doctor and a long medication course, which increases the overall treatment cost.

Acne Medication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 14.27 billion |

|

Forecast Year Market Size (2035) |

USD 23.47 billion |

|

Regional Scope |

|

Acne Medication Market Segmentation:

Product Segment Analysis

Antibiotics segment is projected to account for more than 46.5% acne medication market share by the end of 2035. According to NCBI, pharmacological drugs such as antibiotics are the first line of treatment for mild to moderate-stage acne. Antibiotics effectively kill skin bacteria and reduce inflammation surrounding the affected area and are available in two forms topical and oral, wherein clindamycin and erythromycin are widely adopted topical antibiotics, and tetracyclines and macrolide are oral ones. American Academy of Dermatology (AAD) estimates that the use of topical antibiotics alongside retinoids or benzoyl peroxide in acne treatment offers effective results.

Distribution Channel Segment Analysis

Sales of acne medications through retail and online pharmacies in acne medication market are anticipated to rise at a high CAGR throughout the forecast period. The easy availability of over-the-counter (OTC) medications is driving the online sales of acne drugs. Patients can easily compare and buy acne OTC medications without a prescription and a direct visit to physical stores, this convenience is contributing to their online sales growth. Retail pharmacies are also equipped with advanced and latest medications, which reduces the need to visit hospital pharmacies. Furthermore, online and retail pharmacies offer various discounts and offers, which make them the most sought-after mode of distribution channel.

Our in-depth analysis of the acne medication market includes the following segments:

|

Product |

|

|

Route of Administration |

|

|

Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acne Medication Market Regional Analysis:

North America Market Insights

North America in acne medication market is projected to hold more than 48.4% revenue share by 2035. The increasing prevalence of acne and advancements in drug formulation are prime factors boosting acne medication sales in North America. According to the American Academy of Dermatology, acne is the most common skin disorder among American people, affecting around 50 million individuals annually. Around 85% of people between ages 12 and 24 experience acne-related issues once in their lifetime.

The U.S. acne medication market is foreseen to increase at a CAGR of 5.5% from 2026 to 2035. Favourable government regulations and rising patient adoption of teledermatology promote market expansion. For instance, according to data published in the Journal of the American Academy of Dermatology, teledermatology consultations reached from 263 to 21,385 annually by 2020. Furthermore, guidelines for the use of telemedicine to provide patients with high-quality treatment during the pandemic were established by the Center for Disease Control and Prevention in 2020.

In Canada, acne is also one of the major skin issues affecting many individuals, hormonal changes and heredity are some of the prime reasons responsible for acne medication market growth. According to the Canadian Dermatology Association, 5.6 million individuals in the country are living with acne issues. Moreover, several companies in the country are actively launching innovative products that are fuelling the growth of the acne medication market. For instance, in December 2022, Bausch Health Companies Inc. announced the launch of ARAZLO a topical prescription medication for acne vulgaris treatment in Canada.

APAC Market Insights

Asia Pacific market is expected to increase at a fast pace during the forecasted period owing to the rising awareness of skincare and related products and increasing consciousness about physical appearance among youngsters and adults. Additionally, rising disposable incomes and improved healthcare infrastructure in countries such as China, India, and Japan contribute to increased spending on acne treatments.

In China, the expanding middle class and increased disposable incomes, are rising investments in healthcare and skincare products, including acne medications. Additionally, the rise in e-commerce platforms and online pharmacies has made acne medications more accessible to a broader audience, particularly in urban areas.

Acne Medication Market Players:

- Bausch Health Companies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mayne Pharma Group Limited

- GlaxoSmithKline Plc.

- Pfizer Inc.

- Mylan N.V.

- Galderma S.A.

- Cosmo Pharmaceuticals SA

- Teva Pharmaceutical Industries Ltd.

- Johnson & Johnson

- Zydus Lifesciences Limited

- Almirall Sa

- Crown Laboratories

- Nivea

- Sun Pharmaceutical Industries Limited

The acne medication market is quite competitive owing to the presence of established players and the entry of start-ups such as Stryke Club, Derm-Biome Pharmaceuticals, Legit Health, and Dermatica. The key players in the market are mainly focused on the production of advanced medications for acne care, whereas new companies on offering cutting-edge AI-based skin care solutions.

Recent Developments

- In December 2022, Beiersdorf AG announced the acquisition of S-Biomedic NV to expand its expertise in acne treatment. S-Biomedic NV is a life science company advancing in skin microbiome research.

- In July 2021, Sol-Gel Technologies received U.S. FDA Approval of TWYNEO a cream medication for treating acne vulgaris. TWYNEO is manufactured from the combination of tretinoin and benzoyl peroxide.

- Report ID: 6417

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acne Medication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.