12 Channel Electrocardiograph Market Outlook:

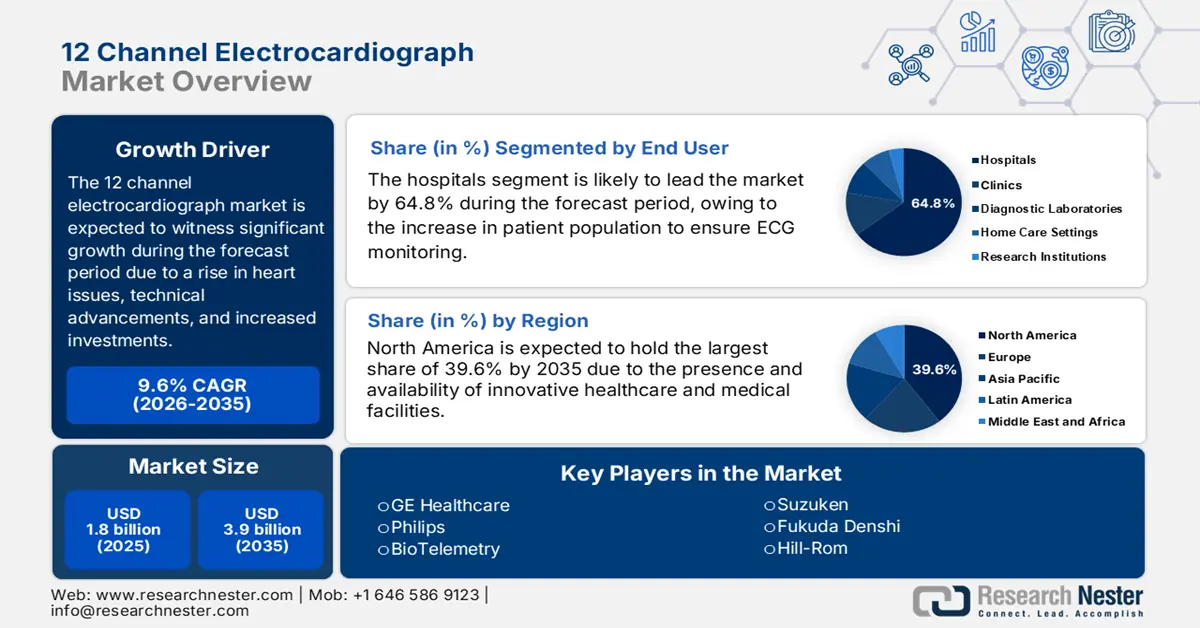

12 Channel Electrocardiograph Market size was over USD 1.8 billion in 2025 and is estimated to reach USD 3.9 billion by the end of 2035, expanding at a CAGR of 9.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of 12 channel electrocardiograph is assessed at USD 1.9 billion.

The international market readily ensures a more comprehensive interpretation of the heart's electrical activity by allowing a surge in precision in the diagnosis of cardiac situations. This is effectively crucial for recognizing abnormalities, such as unequal heart rhythms and heart attacks, which can actually be life-threatening. Meanwhile, according to an article published by the MDPI in May 2023, an estimated 17.9 million people experience death, owing to the occurrence of cardiovascular diseases, which caters to nearly 31.0% deaths internationally. In addition, the disease resulted in 170,000 deaths in Vietnam due to which there is an increase in the need for the market in different countries.

Moreover, the suitability of a nurse‐based in‐hospital monitoring procedure with the application of mobile ECG (iECG) is also another factor responsible for driving the market internationally. Besides, it is essential to evaluate the cost-effectiveness of iECG during the primary hospital accommodation in comparison to the typical 24‐hour Holter monitoring. According to a clinical study published by NLM in April 2022, 1,079 patients were monitored with iECG post‐stroke during the index hospitalization and the pricing strategy was USD 31,196, with a quality of life of almost 6.7 years. In the case of 24‐hour Holter surveillance, the cost was USD 31,095 with 6.6 adjusted life years, thereby driving the market expansion.

Key 12 Channel Electrocardiograph Market Insights Summary:

Regional Insights:

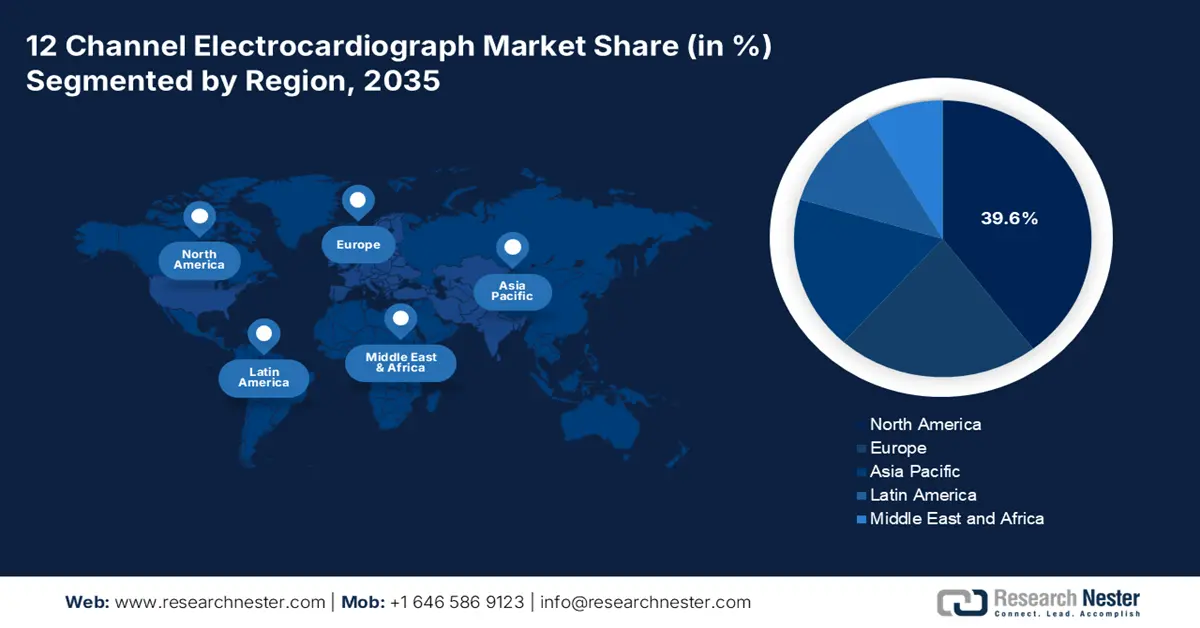

- North America is set to secure a 39.6% share in the 12 channel electrocardiograph market by 2035, attributed to escalating healthcare expenditure, heightened heart failure cases, and broader access to advanced ECG technologies.

- Europe is projected to be the fastest-growing region by 2035, its expansion strengthened by an aging population, rising cardiac disease prevalence, and increasing adoption of AI-enabled ECG interpretation solutions.

Segment Insights:

- The hospitals segment in the 12 channel electrocardiograph market is projected to command a 64.8% share by 2035, underscoring its vital role in advanced cardiac evaluation fueled by increasing patient loads and the push for integrated diagnostic data systems.

- The portable electrocardiographs segment is expected to grow through 2035, its momentum reinforced by rising utilization in rhythm monitoring propelled by the adoption of AI-driven portable ECG innovations.

Key Growth Trends:

- Increased occurrence of heart disorders

- Increased funding for health infrastructures

Major Challenges:

- High cost of ECG systems

- Increased innovation in technology

Key Players: BioTelemetry (U.S.), GE Healthcare (U.S.), Philips (Netherlands), Suzuken (Japan), Fukuda Denshi (Japan), Hill-Rom (U.S.), Mortara Instrument (U.S.), NIHON KOHDEN (Japan), Spacelabs Healthcare (U.S.), Mindray Medical (China), Innomed (Hungary), EDAN (China), Tempus AI, Inc. (U.S.), HeartBeam, Inc. (U.S.), AliveCor (U.S.), Anumana (U.S.), InfoBionic.Ai (U.S.), iRhythm Technologies, Inc. (U.S.), Toray Industries, Inc. (Japan), Comen Medical (China),Mindray, Philips (China; Netherlands), Contec Co., Ltd. (China), Schiler Ag (Switzerland), Toyota Tsusho Corporation (Japan).

Global 12 Channel Electrocardiograph Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 16 October, 2025

12 Channel Electrocardiograph Market - Growth Drivers and Challenges

Growth Drivers

- Increased occurrence of heart disorders: The aspect of unhealthy lifestyles, diabetes, and obesity is the leading cause of heart attack, which readily drives the need for the market across nations. According to the October 2024 CDC report, 1 person in every 33 seconds expires due to cardiovascular conditions, and in 2022, almost 702,880 people died from heart disease. Besides, the burden of heart disease is USD 252.2 billion, which includes productivity loss, medicines, and healthcare services, thereby amplifying the market requirement.

- Increased funding for health infrastructures: The provision of probable financial returns and contributions toward the global economic growth is possible through ample investment to strengthen the 12 channel electrocardiograph market. As per the June 2023 WHO report, low- and middle-income nations are focused on enhancing their health spending and require an investment of USD 371.0 billion by 2030. This fund will assist the population in such countries with access to medical services, and further contribute to developing the latest facilities and provide training to health professionals, thus driving the market upliftment.

- The integration of connectivity and technology: This adoption enhances the value proposition of ECG devices, allowing them to shift from simple data acquisition to integrated diagnostic nodes, which is uplifting the market globally. As stated in the April 2023 NLM article, artificial intelligence (AI) has been effectively useful in arrhythmia detection, with a 99% accuracy rate, particularly in controlled test datasets. In addition, AI can utilize variable heartbeats for this particular detection with a 98% classified accuracy, thereby making it suitable for boosting the market globally.

Electro-Diagnostic Apparatus 2023 Export and Import Driving the 12 Channel Electrocardiograph Market

|

Countries/Components |

Export |

Import |

|

U.S. |

USD 7.1 billion |

USD 6.0 billion |

|

Germany |

USD 4.3 billion |

USD 3.5 billion |

|

China |

USD 3.5 billion |

- |

|

Netherlands |

- |

USD 2.4 billion |

|

Global trade valuation |

USD 30.5 billion |

|

|

World trade share |

0.14% |

|

|

Product complexity |

1.1 |

|

|

Export growth |

9.4% |

|

Source: OEC

Challenges

- High cost of ECG systems: The 12 channel electrocardiograph market growth is being negatively impacted owing to the expensive cost of surgery. This is due to the implementation of advanced systems that are manufactured and adopted in healthcare facilities to evaluate patients with cardiac disorders. Moreover, a few nations are undergoing financial constraints, due to which hospitals in these regions are unable to adopt these sophisticated treatment devices, thus restraining the market growth.

- Increased innovation in technology: The parameter of infusing innovation in medical and healthcare technologies results in short-term productivity of machines and systems, which causes a hindrance in the upliftment of the market globally. The continuous research and development initiated should be aligned with the actual requirement, which is possible with consultations between manufacturers, organizational personnel, and researchers. The purpose is to ensure long-term accessibility of such devices to maintain and evaluate patient health conditions.

12 Channel Electrocardiograph Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

12 Channel Electrocardiograph Market Segmentation:

End User Segment Analysis

The hospitals segment in the market is expected to account for the largest share of 64.8% by the forecast timeline. This particular segment plays a significant role in monitoring, diagnosing, and aiding numerous heart conditions. Besides, hospitals need the diagnostic precision of 12 channel machines, suitable for wide-ranging assessment in severe environments, such as catheter laboratories, ICUs, and emergency departments. Additionally, an increase in the patient volume, along with the demand for seamless data incorporation among hospital information systems, is also bolstering and solidifying the segment’s exposure.

Product Type Segment Analysis

The portable electrocardiographs segment is expected to hold a considerable rate in the 12 channel electrocardiograph market during the forecast period. Portable ECGs are essential for monitoring heart health, owing to their capability to identify and track indiscretions in heart rhythm. In May 2024, OMRON Healthcare India collaborated with AliveCor India to offer AI-based portable ECG technology for enhancing cardiovascular health awareness and overcoming cardiac incidents. Therefore, with such organizational development, the segment is projected to witness growth.

Technology Segment Analysis

The analog ECG devices segment in the market is expected to account for the third-largest share by the end of the forecast timeline. The segment’s exposure is highly driven by its cost-effectiveness, durability, simplicity, and ease of use. These devices provide advanced analysis and superior accuracy, and are considered fundamental tools for recording the heart's electrical activity. According to an article published by NLM in July 2023, a clinical study was conducted on 58 devices, of which 26, which is 45% comprised clinical evidence, readily available to carefully detect heart diseases, thereby denoting an optimistic outlook for the overall segment.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegment |

|

End User |

|

|

Product Type |

|

|

Technology |

|

|

Lead Configuration |

|

|

Application |

|

|

Ambulatory Services |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

12 Channel Electrocardiograph Market - Regional Analysis

North America Market Insights

North America is poised to hold the largest share of 39.6% in the 12 channel electrocardiograph market by the end of 2035. This growth is fueled by the surge in healthcare spending, rising incidence of heart failures, and rapid implementation of cutting-edge ECG technologies. Also, the population and health providers in the region are aware of the benefits pertaining to ECG devices. Few devices, such as continuous ECG monitoring systems, electronic wrist watches, and handheld and portable ECG devices, are readily available in the region, thereby boosting the market.

U.S. market is bolstering based on the availability of devices that are approved by regulatory organizations. For instance, in June 2024, Tempus AI, Inc. received the 510(k) clearance from the U.S. FDA for its Tempus ECG-AF device. The objective of the device is to utilize artificial intelligence to assist in identifying patients with an increased risk of atrial fibrillation or flutter (AF). This was the first clearance for an AF indication in the cardiovascular machine learning-based statement software and which paved the way for physicians to implement this ground-breaking algorithm in the care of patients.

The 12 channel electrocardiograph market in Canada is gaining increasing exposure owing to financial contributions initiated by the government. For instance, as per the May 2022 Government of Canada report, the Parliament Secretary, on behalf of the Health Minister, proclaimed an investment of USD 5.0 million. The purpose was to reinforce the latest national research network that will put emphasis on enlightening the inhibition, diagnosis, treatment, and care of heart failure across the country. Therefore, this is proven to be extremely suitable for the market evolution in the overall country.

Cardiac Electrophysiology Procedures Negotiated Rates in North America (2022 to 2023)

|

Service Type |

Number of Hospitals |

Payer-Specific Negotiated Price, Median (USD) |

Hospital Ratio |

Hospital Ratio Median |

|

EP study, transseptal, and pulmonary vein isolation (atrial fibrillation ablation) |

69% |

21,257 (13,342 to 30,291) |

10.2 |

5.2 (2.3 to 13.9) |

|

AV Node Ablation |

63% |

8,630 (4,969 to 11,731) |

7.3 |

2.6 (1.8 to 7.1) |

|

Permanent pacemaker (with atrial and ventricular leads) |

64% |

10,401 (6,818 to 14,847) |

13.8 |

2.9 (1.9 to 8.6) |

|

Leadless pacemaker (ventricular) |

61% |

14,198 (8,253 to 20,443) |

18.6 |

3.0 (1.8 to 8.2) |

|

ICD generator (with leads, single or dual chamber) |

62% |

21,197 (8,826 to 33,226) |

19.2 |

4.5 (2.5 to 16.6) |

|

2 transvenous leads for a pacemaker or an ICD |

53% |

6,413 (3,517 to 8,193) |

14.3 |

2.7 (1.6 to 8.8) |

|

Pacemaker interrogation |

16% |

68 (48 to 183) |

4.7 |

2.5 (1.4 to 3.3) |

Source: AHAIASA

Europe Market Insights

Europe in the 12 channel electrocardiograph market is expected to emerge as the fastest-growing region during the projected timeline. The market’s development in the region is highly propelled by a surge in aging demographics, increased prevalence of cardiac conditions, AI-based interpretation software adoption, and cloud data management solutions. In this regard, the May 2025 NLM article indicated that there is a huge need for executing daily physical activities for almost 150 minutes per week to effectively maintain a standard body mass index. In addition, for the elderly population in the overall region, a suitable BMI maintenance includes 75 to 150 minutes of exercise every week to combat chronic disorders.

The 12 channel electrocardiograph market in Germany is gaining increased exposure, owing to the presence of technologically advanced health and medical systems, an upsurge in health spending, along with a robust emphasis on precise and early cardiac diagnosis. According to a data report published by the ITA in August 2025, the medical device market in the region accounts for approximately EUR 38 billion (USD 44 billion) in yearly revenue, leading to almost 26.5% of the overall regional market. Additionally, 1 in 6 jobs is linked to the healthcare industry, generating a yearly footprint of EUR 775 billion (USD 838 billion), thereby making it suitable for the market’s upliftment.

France market is also developing due to the existence of robust government support for a tactical shift towards preventative care services as well as healthcare progression. In addition, the French National Authority for Health (HAS) plays a vital role in assessing he clinical valuation of the latest medical devices for reimbursement. As stated in the May 2025 NLM article, the healthcare spending in the country accounts for 12.2% of GDP, which further caters to 79% of overall spending. This is considered one of the highest countries to ensure healthcare spending in the region, thereby boosting the market’s growth.

Healthcare Spending in Europe (2022)

|

Countries |

EUR million |

EUR Per Inhabitant |

PPS Per Inhabitant |

% of GDP |

|

Germany |

488,677 |

5,832 |

5,317 |

12.6 |

|

France |

313,574 |

4,607 |

4,302 |

11.9 |

|

Italy |

175,719 |

2,978 |

2,945 |

9.0 |

|

Hungary |

11,297 |

1,171 |

1,867 |

6.7 |

|

Netherlands |

96,820 |

5,470 |

4,531 |

10.1 |

|

Austria |

49,897 |

5,518 |

4,751 |

11.2 |

Source: Eurostat

APAC Market Insights

Asia Pacific is expected to grow steadily at a considerable rate in the 12 channel electrocardiograph market during the forecast timeline. There is continuous growth in the monitoring and diagnosis of heart health in the region, since there is a growing emphasis on the occurrence of cardiac issues. The population in China is more prone to being severely affected by ECG abnormalities in comparison to the South Asia population. Besides, the overall region is projected to comprise ECG-detected left ventricular hypertrophy (LVH), which effectively drives the market development.

The market in India is deliberately present in urban areas with its increased availability in regional hospitals. According to an article published by MedRxiv Organization in April 2024, cardiovascular disease in the country accounts for almost 24.8% of overall deaths. Besides, the ECG machine availability under the Project Lifeline in Ahmedabad has successfully displayed effective screening to save at least 2.0 life years of the population at USD 31.0 per life-year saved. Therefore, it is essential to provide training to care physicians, with the objective of easily interpreting ECG readings, thus denoting a huge growth opportunity for the overall market in the country.

The 12 channel electrocardiograph market in China is experiencing effective growth owing to its increased utilization and demand. As per an article published by NLM in March 2025, the Type 2 diabetic mellitus incidence resulted in ECG magnitude differences, with 10% as the lowest prevalence. This is because comorbid conditions in the country are readily screened earlier to combat further complications. Besides, in the June 2022 Indian Heart Journal article, there exists 1.3% prevalence for early repolarisation pattern (ERP) in the country, based on which there is a huge growth opportunity for the market.

Key 12 Channel Electrocardiograph Market Players:

- BioTelemetry (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare (U.S.)

- Philips (Netherlands)

- Suzuken (Japan)

- Fukuda Denshi (Japan)

- Hill-Rom (U.S.)

- Mortara Instrument (U.S.)

- NIHON KOHDEN (Japan)

- Spacelabs Healthcare (U.S.)

- Mindray Medical (China)

- Innomed (Hungary)

- EDAN (China)

- Tempus AI, Inc. (U.S.)

- HeartBeam, Inc. (U.S.)

- AliveCor (U.S.)

- Anumana (U.S.)

- InfoBionic.Ai (U.S.)

- iRhythm Technologies, Inc. (U.S.)

- Toray Industries, Inc. (Japan)

- Comen Medical (China)

- Mindray, Philips (China; Netherlands)

- Contec Co., Ltd. (China)

- Schiler Ag (Switzerland)

- Toyota Tsusho Corporation (Japan)

- BioTelemetry is a pioneer in providing remote cardiac monitoring services, and has significantly made advancements in the market by adopting 12-channel ECG data into mobile cardiac telemetry and wireless systems. This advancement ensures real-time and ambulatory monitoring outside clinical environments to optimize cardiac arrhythmia detection.

- GE Healthcare is one of the global medical technology leaders, providing a wide-ranging portfolio of high-fidelity 12 channel ECG machines, such as the MAC series, which is known for its reliability across hospital environments. The organization readily drives market upliftment by incorporating innovative analysis and seamless data connectivity into devices.

- Philips is considered a dominating force in the overall cardiac care landscape, ensuring suitable 12 channel ECG solutions, such as the PageWriter TC70 cardiograph, which connects to broader telehealth and patient monitoring ecosystems. The company’s successful acquisition has further solidified its position in the market by merging hospitals with ambulatory monitoring services.

- Suzuken is one of major forces in Asia-based healthcare economies, and it functions as a leading distributor by offering severe sales and logistical support for 12 channel ECG devices from different manufacturers to clinics and hospitals. Its extended distribution network is crucial for developing innovative ECG technology and make it available throughout the region.

- Fukuda Denshi is one of the specialist cardiology companies, and is well-known for its stress testing systems and precise 12 channel ECG machines, which are readily trusted for achieving diagnostic accuracy in global clinical environments. The organization has significantly contributed to the market development through user-friendly design and continuous innovation in signal processing.

Here is a list of key players operating in the global market:

Organizations in the global market are gaining momentum through mergers and acquisitions, product launches, service expansions, and partnerships. For instance, in April 2025, HeartBeam, Inc. declared its strategic collaboration with AccurKardia to augment the availability of cardiac monitoring solutions and effectively focus on creating AccurKardia’s FDA-cleared ECG analysis software, AccurECG, which is readily available on HeartBeam’s devices. Therefore, with such an association between organizations, the market is expected to gain more exposure and cater to both providers and patients to combat heart diseases globally.

Corporate Landscape of the 12 Channel Electrocardiograph Market:

Recent Developments

- In June 2024, AliveCor publicized the U.S. FDA clearance and commercial launch of KAI 12L AI technology and the Kardia 12L ECG System to detect life-threatening cardiac conditions.

- In June 2024, Anumana and InfoBionic.Ai broadcasted a joint research collaboration agreement to develop and commercialize the next generation of remote cardiac care solutions, combining Anumana’s breakthrough ECG-AI technology and InfoBionic.Ai’s MoMe ARC platform.

- In March 2025, Toray Industries, Inc. declared that it has introduced a multi-institutional observational study to assess the effectiveness of its electrocardiogram (ECG) testing service.

- In September 2024, iRhythm Technologies, Inc. received the regulatory approval from the Japan Pharmaceutical and Medical Device Agency (PMDA) for the Zio fourteen-day, long-term continuous ECG monitoring system.

- Report ID: 7673

- Published Date: Oct 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.