Diagnostic Electrocardiograph Market Outlook:

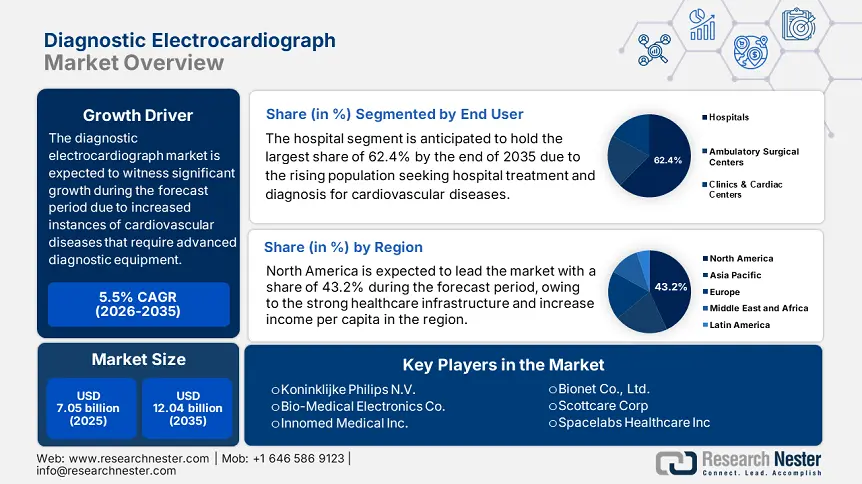

Diagnostic Electrocardiograph Market size was over USD 7.05 billion in 2025 and is projected to reach USD 12.04 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diagnostic electrocardiograph is evaluated at USD 7.4 billion.

The global diagnostic electrocardiograph market is experiencing immense growth driven by the rise in cardiovascular disorders among the aging population across the world. Due to unhealthy, sedentary lifestyle habits, the global population is easily prone to diseases which highly require timely and efficient interventions. As per the World Heart Federation Organization report published in May 2023, the mortality cases surged globally by 60% from 12.1 million to 20.5 million over the past few decades, with the highest prevalence being in Central, East Europe, and Central Asia. Hence, it underscores the requirement of early diagnosis, propelling the market growth further.

Furthermore, the market is expanding rapidly, driven by innovations in the medical field and favorable government approvals, which significantly impact the diagnostic electrocardiograph industry. For instance, in April 2023, Icentia Inc. notified that it received the U.S. FDA 510(k) approval for CardioSTAT, which is a wireless single use ambulatory ECG monitoring solution especially designed to improve cardiac diagnosis in the U.S. Such advancements in medical technology, the rise of developments, and increasing demand for appropriate monitoring devices are driving further market growth.

Key Diagnostic Electrocardiograph Market Insights Summary:

Regional Highlights:

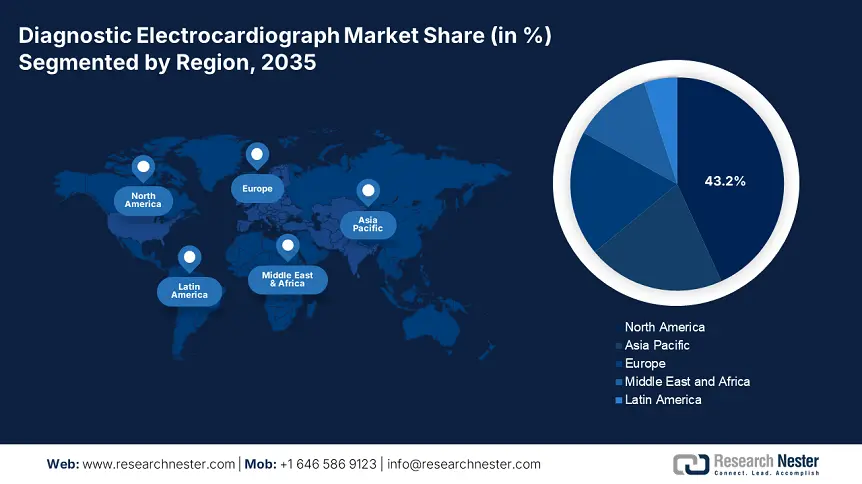

- North America holds a 43.2% share in the diagnostic electrocardiograph market, driven by a huge consumer base including aging population and advanced healthcare infrastructure, ensuring robust growth through 2035.

- Asia Pacific's diagnostic electrocardiograph market expects the fastest growth by 2035, fueled by expanding disposable income and growing demand for advanced diagnostic devices.

Segment Insights:

- Hospitals segment are expected to capture a 62.4% share by 2035, driven by extended demand for diagnostic tools and rising instances of chronic diseases.

- The resting ECG segment is projected to grow at a considerable rate by 2035, driven by its precise and quick identification procedure without prior training, boosting demand and accessibility.

Key Growth Trends:

- Rising demand for advanced diagnostic devices

- Aging global population

Major Challenges:

- High cost of ECG devices

- Shortage of skilled professionals

- Key Players: Koninklijke Philips N.V., Bio-Medical Electronics Co., Innomed Medical Inc., Bionet Co., Ltd., Scottcare Corp.

Global Diagnostic Electrocardiograph Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.05 billion

- 2026 Market Size: USD 7.4 billion

- Projected Market Size: USD 12.04 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Diagnostic Electrocardiograph Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for advanced diagnostic devices: One of the key drivers in the diagnostic electrocardiograph market is the rapid innovation in ECG technology, which is fueling the demand for advanced diagnostic devices. For instance, in June 2024, Royal Philips launched an exclusive workstation in the EMEA region, which uses advanced algorithms to speed up ECG data collection and analysis. The key goal of this launch is to streamline cardiology care and reduce administrative workload for clinicians. Hence, such advancements are readily blistering the market expansion internationally.

- Aging global population: Another significant driver for the diagnostic electrocardiograph market is the rising number of the geriatric population worldwide. The older population is at higher risk of developing heart-associated conditions that require proactive monitoring and early detection. According to the report published by the UNFPA organization in December 2023, India’s elderly population aged 60 and above was reported to be 153 million, which is projected to increase to 347 million by 2050. This surge highlights the growing need for advanced diagnostic devices to address the burden of chronic diseases.

Challenges

-

High cost of ECG devices: One of the primary challenges associated with the market is the high cost of these advanced devices and related infrastructure. These costs are attributable to the contribution of seamless connectivity, AI-driven analytics, and cloud integration, which remain unaffordable for many facilities from price-sensitive regions. This cost barrier restricts the widespread adoption of advanced diagnostic devices, limiting the industry's expansion.

- Shortage of skilled professionals: Another significant restraint in the diagnostic electrocardiograph market is the lack of skilled professionals who are capable of handling the ECG machines and interpreting complex ECG data. Despite the availability of automated and user-friendly technologies, the accuracy of detecting the disease relies on the clinical expertise of the professional. This lack of trained technicians impedes the effective use of diagnostic electrocardiographs, hindering the market penetration

Diagnostic Electrocardiograph Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 7.05 billion |

|

Forecast Year Market Size (2035) |

USD 12.04 billion |

|

Regional Scope |

|

Diagnostic Electrocardiograph Market Segmentation:

End User (Hospitals, Ambulatory Surgical Centers, Clinics & Cardiac Centers)

Based on end user, the hospitals segment is anticipated to register the highest share of 62.4% in the diagnostic electrocardiograph market during the forecast period. The extended demand for diagnostic tools, in addition to the rising instances of chronic diseases, drives the need for efficient and reliable solutions in hospital settings, widening the segment’s scope. For instance, in March 2020, MicroPort EP announced the deployment of its remote ECG technology, which is a single-lead wearable ECG monitor enabling real-time heart monitoring in COVID-19 patients at the Intelligent Shelter Hospital in China. Thus, these factors are expected to augment the segment’s growth, thereby supporting market progression.

Product and Service (Stress ECG Devices, Resting ECG, Implantable Loop Recorders, Smart ECG Monitors, Event Monitors, Holter Monitors, MCT Devices)

Based on the product and service, the resting ECG segment is projected to grow at a considerable rate in the diagnostic electrocardiograph market by the end of 2035. The segment’s growth is attributable to the precise and quick identification procedure without any prior training. In this regard, as per an NLM report in July 2022, QT Medical introduced a mail-based home testing ECG model to meet the rising demand; evaluating 1000 patients demonstrated 92.9% successfully finished 12-lead resting ECGs at home without any training, which is proven to be reliable and patient-friendly. This demand has boosted the production and distribution of resting ECGs and accessibility across the diverse market.

Our in-depth analysis of the global diagnostic electrocardiograph market includes the following segments:

|

End User |

|

|

Product and Service |

|

|

Lead Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diagnostic Electrocardiograph Market Regional Analysis:

North America Market Analysis

The North America diagnostic electrocardiograph market is projected to register the highest share of 43.2% during the forecast period. The region benefits from a huge consumer base that is the country's aging population and rising income per capita. Furthermore, the advanced healthcare infrastructure in the region allows the population to adopt such innovations, allowing a favorable market environment. In January 2022, QT Medical, Inc. and 19Labs launched telehealth solutions featuring 12-lead resting ECG, ultrasound, and others to improve healthcare access globally, particularly in rural areas, workplaces, and schools. Hence, such factors are propelling further market growth in the region.

The diagnostic electrocardiograph market in the U.S. is driven by advancements in technology and the growing demand for diagnostic devices. Additionally, the increasing collaborations between the firms emphasize product efficiency, further boosting investments in healthcare infrastructure. For instance, in January 2025, Anumana, in partnership with AliveCor, Inc., notified to advancement of ECG-AI mechanisms for early diagnosis of cardiovascular diseases in Kardia Devices, beginning with Anumana’s FDA-approved algorithm, ECG-AI LEF. Such moves will facilitate personalized care, supporting the upliftment of market progression.

The Canada diagnostic electrocardiograph market is witnessing growth due to its emphasis on improving healthcare access across its vast geography. The demand for diagnostic ECG devices is expanding rapidly among the country’s patient population, ensuring compliance with the country’s government. In November 2024, CardioComm Solutions, in partnership with Sony, announced to to integrate its ECG technology into the Sony mSafety platform, enabling a seamless ECG monitoring experience for the clients. These collaborations, including real-time detection systems, are being adopted to enhance diagnostic efficiency and overcome challenges posed by the country’s remote and rural regions.

Asia Pacific Market Statistics

The Asia Pacific’s diagnostic electrocardiograph market is projected to witness the fastest growth during the forecast period. The expanding disposable income and the growing population in need of advanced diagnostic devices are improving the medical infrastructure in the region. For instance, as per the International Trade Administration report, in January 2024, India imports nearly 80% of its medical devices, particularly high-end equipment such as cancer diagnostics, medical imaging, and ultrasonic scans. Thus, this underscores the high demand for diagnostic devices in the region, widening the market’s scope.

The India diagnostic electrocardiograph market is expanding majorly due to government support for the private organizations in expanding their business hubs. The rise of lifestyle disorders and home healthcare services further fuels the need for strong diagnostic networks in the country. For instance, in June 2023, OMRON Healthcare Co., Ltd. notified its plans to establish a manufacturing hub at ORIGINS by Mahindra, Chennai, Tamil Nadu, for blood pressure monitor manufacturing. Such factors are significantly boosting market innovation and expansion for a greater outcome during the forecast period.

China's diagnostic electrocardiograph market witnesses growth owing to its advanced manufacturing capabilities and extensive medical infrastructure. The local government’s focus on healthcare rehabilitation and investments in smart medical devices is transforming this sector. In September 2022, Lepu Medical Technology announced that it received the China NMPA registration certificate for Class III Medical Devices for the AI-ECG Tracker, which is designed s designed to evaluate the ECG data using AI. Furthermore, the aging demographic of the country demands efficient diagnostic support, primarily for home-based care and personalized treatments.

Key Diagnostic Electrocardiograph Market Players:

- Koninklijke Philips N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Medical Electronics Co.

- Innomed Medical Inc.

- Bionet Co., Ltd.

- Scottcare Corp

- Spacelabs Healthcare Inc

- VectraCor, Inc.

- Allengers Medical Systems, Ltd.

- Powerful Medical

- HeartBeam, Inc.

- Icentia Inc.

- Royal Philips

- QT Medical, Inc.

- Anumana

- AliveCor, Inc.,

- CardioComm Solutions

- OMRON Healthcare Co., Ltd

- Lepu Medical Technology

Companies involved in the diagnostic electrocardiograph market are focusing on various marketing strategies to enhance their product portfolio in emerging markets by improving supply chain efficiency. The sales strategies will significantly enhance their demand with an increased awareness among the global population. For instance, in June 2022, Astellas Pharma Inc., with Nitto Denko Corporation and M. Heart Co., Ltd., entered into an agreement for the sales pilot of the disposable Holter ECG Device EG Holter in the Japan market. These strategies are boosting companies’ growth and maintaining competition in the market significantly.

Recent Developments

- In March 2025, Powerful Medical notified that its PMcardio STEMI AI ECG model has been granted Breakthrough Device Designation by the U.S. FDA, which is used to diagnose ST-elevation myocardial infarction (STEMI) and STEMI associates.

- In December 2024, HeartBeam, Inc. declared that its arrhythmia assessment ECG system was granted 510(k) approval by the U.S. FDA. This marks the first of its kind, a high-fidelity ECG system with a card-sized form factor and cable-free design, that helps to capture heart signals from three different directions for actionable heart health information.

- Report ID: 7583

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.