Exosome Diagnostics and Therapeutics Market Outlook:

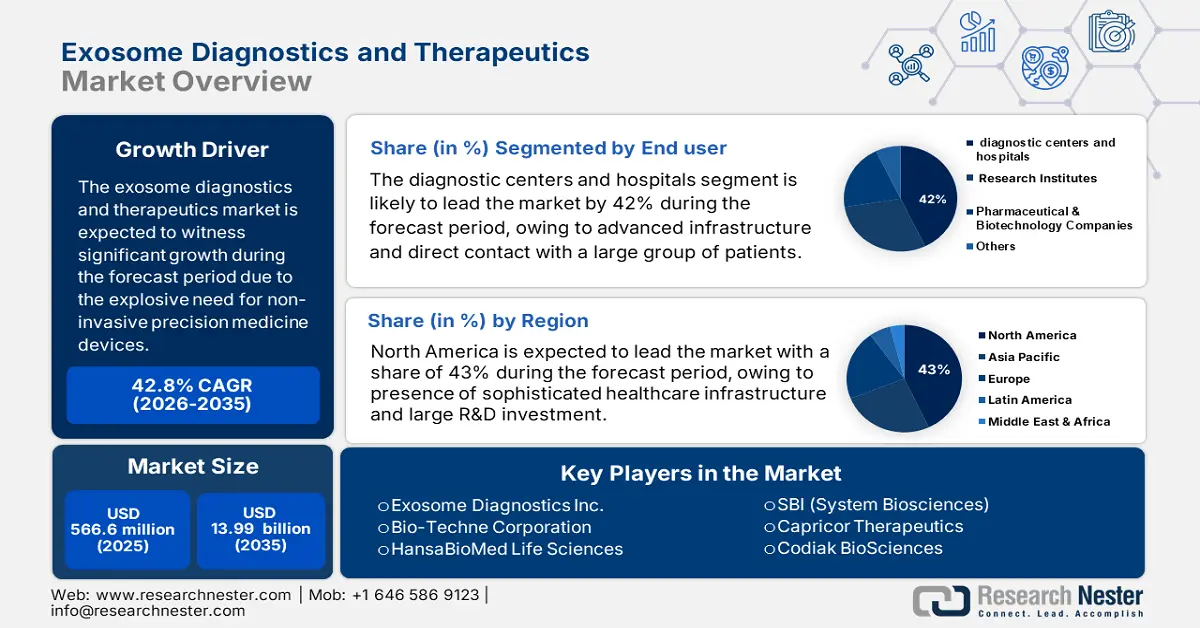

Exosome Diagnostics and Therapeutics Market size is valued at USD 566.6 million in 2025 and is projected to reach USD 13.99 billion by the end of 2035, rising at a CAGR of 42.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of exosome diagnostics and therapeutics is estimated at USD 809.1 million.

The international market is experiencing growth due to the explosive need for non-invasive precision medicine devices. As per a report by NIH, January 2025, the Common Fund program convened researchers to collaborate and create a consortium that produced over 800 publications cited more than 79,000 times. This trial expansion is a reflection of increasing clinical interest in the utilization of exosomes for early disease detection, mainly in oncology and neurodegenerative diseases. Increased use of liquid biopsy technologies and intersection with AI-driven analytics are expected to continue to fuel demand in hospitals, research facilities, and diagnostic labs.

Large-scale investment from the public sector is also driving innovation in exosome technology. The NIH Common Fund's Extracellular RNA (exRNA) Communication program has provided funding to create technologies for the isolation and analysis of exRNA carriers, such as extracellular vesicles, to improve diagnostic and therapeutic value. These federal efforts are designed to surpass technical challenges in sample purification and reproducibility that are essential to therapeutic applications. As these technologies continue to advance, companies are actively partnering with research centers and regulatory authorities to increase production and integrate clinical clearances, enabling bench research to be translated into effective commercial solutions in market.

Key Exosome Diagnostic and Therapeutics Market Insights Summary:

Regional Highlights:

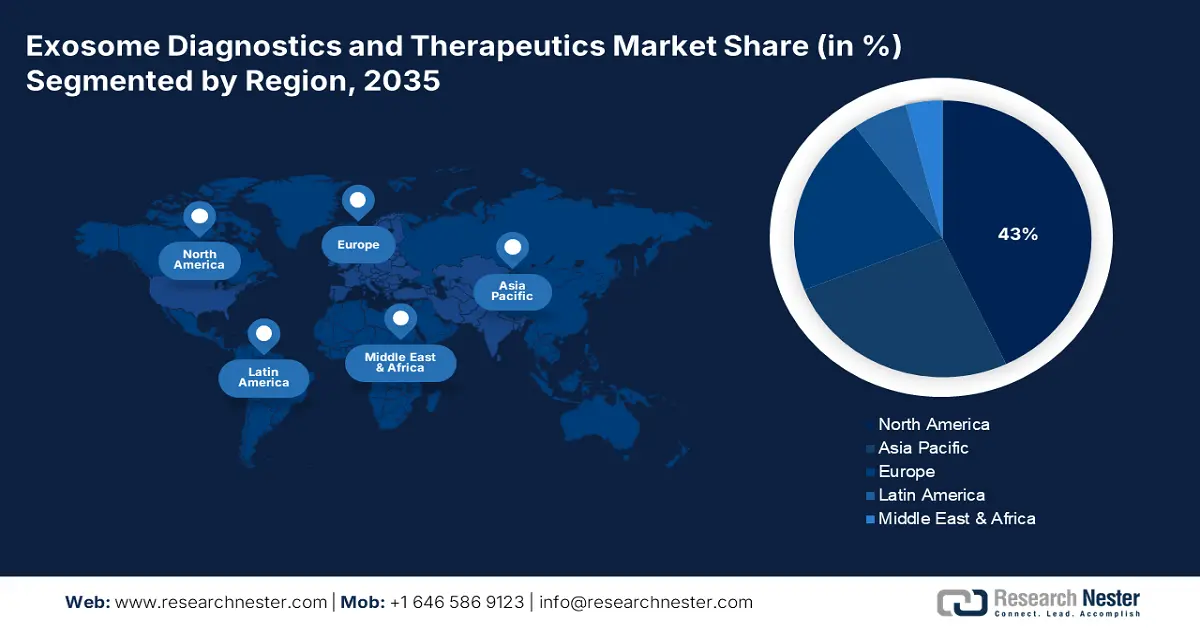

- North America is projected to dominate the exosome diagnostics and therapeutics market with a 43% share during the forecast period, owing to strong healthcare infrastructure, substantial R&D investments, and supportive government initiatives fostering innovation.

- Europe is expected to register the fastest growth through the forecast period, spurred by increasing demand for non-invasive diagnostics, government-backed life sciences programs, and the aging population driving early disease detection.

Segment Insights:

- The diagnostic centers and hospitals segment is projected to lead the exosome diagnostics and therapeutics market with a 42% share during the forecast period, driven by advanced infrastructure, rapid adoption of non-invasive diagnostic tools, and strong collaborations with research institutions.

- The ultracentrifugation segment is anticipated to dominate the market through the forecast period, propelled by its cost-effectiveness, scalability, and reliability in high-quality exosome isolation for clinical and research applications.

Key Growth Trends:

- Increasing funding, accelerating the exosome diagnostics and therapeutics research

- Rising demand for non-invasive diagnostic and therapeutic solutions

Major Challenges:

- Standardization and Isolation Difficulties

Key Players: Exosome Diagnostics Inc., Bio-Techne Corporation, HansaBioMed Life Sciences, SBI (System Biosciences), Capricor Therapeutics, Codiak BioSciences, NanoView Biosciences, Norgen Biotek Corp., Creative Biolabs, Aegle Therapeutics, Hitachi Chemical, ExoCoBio, Isogenica, GeneCell Bioscience, Imugene Limited

Global Exosome Diagnostic and Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 566.6 million

- 2026 Market Size: USD 809.1 million

- Projected Market Size: USD 13.99 billion by 2035

- Growth Forecasts: 42.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: India, China, South Korea, Singapore, Australia

Last updated on : 25 September, 2025

Exosome Diagnostics and Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Increasing funding, accelerating the exosome diagnostics and therapeutics research: The exosome diagnostics and therapeutics market is experiencing a strong growth, largely propelled by increased research funding. As per a report by NLM in January 2025, the NIH has appropriated more than USD 965 million for exRNA research, thus opening this field for utmost interest. These huge funds are directed to groundbreaking research projects that seek to understand and make use of exosomes for diagnostics and therapeutics. The earmark further encourages participation from academia, industry, and healthcare providers, thereby enhancing trade opportunities.

- Rising demand for non-invasive diagnostic and therapeutic solutions: Due to the growing demand for non-invasive, highly specific tools for diagnosis and personalized treatment options, the market is experiencing a strong growth. Exosomes carry molecular signatures from father cells, thereby enabling early diagnosis of diseases and therapies targeted at the disease without having to go through any invasive intervention. Such procedures are fostering adoption in oncology, cardiovascular, and neurological disorders to innovate and extend the entire gamut of exosome-based technologies to clinical applications worldwide.

- Scientific advancements in exosome biology propel market growth: The increasing awareness of exosomes and macrovesicles is fueling the exosome diagnostics and therapeutics market. As per a report by NLM May 2022, microvesicles and macrovesicles are shed directly from the plasma membrane and range from 150 nm to 1 μm, while exosomes, smaller vesicles sized 30 to 150 nm with a density of 1.13 to 1.19 g/mL, derive from multivesicular bodies inside cells before their release. Such detailed knowledge relating to the EV subtypes and biogenesis leads to more precise methods of isolation and characterization, thus ensuring the efficient development of targeted diagnostics and therapeutics.

Emerging Trends in Exosome-Based Biomarkers for Cancer Diagnosis and Prognosis

Clinical Research on Exosomes as Biomarkers for Cancer Diagnosis, Prognosis, or Prediction (2024)

|

Cancer Type |

Exosome Source |

Biomarker(s) |

Results |

|

Prostate cancer |

Serum |

miR-107, miR-574-3p, miR-122-5p |

The exosomal miRNA panel had an AUC of 0.9 for discriminating prostate cancer from healthy controls |

|

Lung cancer |

Serum |

Colorectal neoplasia differentially expressed - h (CRNDE-h) |

Exosomal CRNDE-h levels were elevated and related to a worse prognosis in NSCLC patients |

|

Colorectal cancer |

Plasma |

miR-146a-5p, miR-106b-3p |

Poor overall and disease-free survival correlated with exosomal miR-146a-5p and miR-106b-3p levels |

|

Breast cancer |

Plasma |

Multiple proteins |

Exosomal protein panel had AUC of 0.9 for discriminating breast cancer from healthy controls; associated with survival outcomes |

|

Pancreatic cancer |

Serum |

Prostate cancer-associated transcript 1 (PCAT1) |

High exosomal PCAT1 levels were associated with poor prognosis and overall survival |

|

Melanoma |

Plasma |

Multiple miRNAs |

Exosomal miRNA panel had AUC of 0.9 for discriminating early-stage melanoma from healthy controls |

Source: NLM January 2024

Challenge

- Standardization and Isolation Difficulties: The biggest obstacle to the exosome diagnostics and therapeutics market is the absence of standardized methods to isolate and characterize exosomes and extracellular vesicles. This heterogeneity in size, composition, and origin of the vesicles makes it difficult to develop reliable and reproducible protocols. This variability entails the lack of consistency in diagnostic outcomes and efficacy in therapeutics. Another issue is the exorbitant costs coupled with the technical intricacies of isolating exosomes, which discourage most companies from adopting or investing in it. Solving this will bring great strides in realizing the promise of exosome-based applications.

Exosome Diagnostics and Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

42.8% |

|

Base Year Market Size (2025) |

USD 566.6 million |

|

Forecast Year Market Size (2035) |

USD 13.99 billion |

|

Regional Scope |

|

Exosome Diagnostics and Therapeutics Market Segmentation:

End user Segment Analysis

The diagnostic centers and hospitals in the end user segment are likely to possess the largest market share of 42% during the forecast period in the exosome diagnostics and therapeutics market, as they have advanced infrastructure and direct contact with a large group of patients. Furthermore, these centers are adopting advanced diagnostic techniques at a faster pace to improve patient outcomes. The increasing incidence of cancer and chronic diseases is pushing the demand for accurate and non-invasive diagnostic equipment. Also, relationships between hospitals and research institutions are propelling exosome therapies towards clericalizations and commercialization at a faster pace.

Technology Segment Analysis

The ultracentrifugation in the technology segment is expected to hold the highest market share within the forecast period in the exosome diagnostics and therapeutics market owing to its affordability, scalability, and documented reliability in high-quality exosome isolation. As per a report by NLM in January 2024, ultracentrifugation is still the highest standard for exosome isolation, with an estimated 56% of all exosome isolation methods utilizing this procedure. Its widespread use continues to affirm the important position that it occupies in the creation of exosome-based diagnostics and therapeutics. To reduce additional restrictions as regards to ultracentrifugation protocol, increased yield and purity are being made possible by increased improvements, leading to more clinical and research uses worldwide.

Product Type Segment Analysis

The exosome isolation kits are expected to have the largest market size in the product type segment in the exosome diagnostics and therapeutics market during the forecast period due to their simple design to deliver rapid, reproducible, and high-purity exosome isolation. The kits are low-tech in their requirements and will be accessible to a high number of clinical and research laboratories. The growing demand for standard and efficient methods of isolation to aid in the growing research in liquid biopsies and precision medicine further enhances the market. Additionally, ongoing innovation by market leaders to advance cost-saving and multipurpose kits also further increases their use. Increasing focus on early disease detection and therapy monitoring also drives the demand for such pre-activated kits.

Our in-depth analysis of the exosome diagnostics and therapeutics market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Application |

|

|

Therapeutics |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Exosome Diagnostics and Therapeutics Market - Regional Analysis

North America Market Insight

The global exosome diagnostics and therapeutics market in North America is expected to hold the highest market share of 43% within the forecast period due to the presence of sophisticated healthcare infrastructure, large R&D investment, and wide presence of prominent players. As per a report by NLM 2022 January, the encouraging government policies, such as President Biden's USD 2.7 trillion jobs plan in America, focus on refurbishing infrastructure, including caregiving and healthcare systems, which indirectly enhance the healthcare ecosystem and facilitate long-term innovation in therapeutic and diagnostic technologies. In addition, the dearth of available childcare, currently accommodating only 23% of infants and toddlers, has pushed many mothers out of the labor force and hence caused economic instability, a recognized social determinant of health.

The global exosome diagnostics and therapeutics market in the U.S. is growing due to a rising incidence of cancer and neurological diseases, positive government policies, and faster-than-expected uptake of precision medicine tools. As per a report by the CDC in January 2025, more than USD 4.4 billion investments under the Public Health Infrastructure Grant program have benefited 107 health departments in the ability to adopt and install cutting-edge diagnostic technology. Furthermore, a USD 1.2 billion federal budget prioritized across 34 budget lines is indicative of the government's emphasis on seamless, data-informed healthcare platforms, providing an environment that facilitates growth and scaling of innovative technologies such as exosome-based diagnostics and therapeutics.

Europe Market Insight

The exosome diagnostics and therapeutics market in Europe is expected to hold the fastest market share within the forecast period due to a high demand for non-invasive diagnosis techniques, increasing government initiatives for life sciences research, and the growing awareness of exosome-based technologies. As per a report by OECD in November 2024, demographic shifts in the Europe made profound changes, where the population aged 65 and above has increased beyond 21% in 2023 and is set to grow to nearly 30% by 2050. This aging population consequently sets the standards for early and accurate diagnosis, especially for age-related diseases, where the exosome technologies show great promise. In this case, urgent strengthening of the health workforce thus becomes fundamental vis-à-vis the demands of our people.

The global exosome diagnostics and therapeutics market in the UK is growing due to a robust biotechnology sector, a proper regulatory framework, and rising academic research into application uses for exosomes. As per a report by ONS in April 2025, as of 2024, healthcare spending as a percentage of GDP 2024 was 11.1%, unchanged from 2023, showing ongoing national investment in the health sector. Healthcare expenditure was £258 billion (USD 320 billion) in 2024, having risen by 2.5% in real terms from 2023. This real growth in funding for healthcare CBD expenditure is consistent with the increased use of new diagnostic technology, such as exosome-based platforms for early diagnosis and personalized measures of disease, more common in the UK.

Current healthcare expenditure relative to GDP (2022)

|

Country |

Healthcare Expenditure (% of GDP) |

|

Germany |

12.6% |

|

France |

11.9% |

|

Belgium |

10.8% |

|

Sweden |

10.7% |

|

Denmark |

9.5% |

|

Greece |

8.5% |

|

Switzerland |

11.7% |

|

Norway |

7.9% |

Source: Eurostat, November 2024

Asia Pacific Market Insight

The global exosome diagnostics and therapeutics market in the Asia Pacific is expected to hold steady market growth within the forecast period due to increasing healthcare expenditure, growing prevalence of chronic diseases, and widening biotechnology research infrastructure in emerging economies. Rapid urbanization and improving healthcare access in countries such as India and Southeast Asia are also at the forefront in boosting demand for advanced diagnostic and therapeutic solutions. Additionally, exosome-based technology innovation and commercialization are being fast-tracked by government initiatives promoting partnership along public and private lines.

The global exosome diagnostics and therapeutics market in China is growing due to government backing for biomedical innovation, rising cancer incidence, and a growing biopharmaceutical sector investing in exosome-based R&D. As per a report by ITIF in August 2024, Roche’s alliance with the biotech firm Zion Pharma from China was made public in May 2023, and Roche had invested USD 70 million upfront for the development of a new oral formulation for breast cancer targeted toward the HER2 protein. This is a testimony to China's strengthening role in personalized cancer therapy, with an exosome diagnostic being one of the pathways toward early detection and treatment monitoring.

Key Exosome Diagnostics and Therapeutics Market Players:

- Exosome Diagnostics Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Techne Corporation

- HansaBioMed Life Sciences

- SBI (System Biosciences)

- Capricor Therapeutics

- Codiak BioSciences

- NanoView Biosciences

- Norgen Biotek Corp.

- Creative Biolabs

- Aegle Therapeutics

- Hitachi Chemical

- ExoCoBio

- Isogenica

- GeneCell Bioscience

- Imugene Limited

The exosome diagnostics and therapeutics market is highly competitive, mostly dominated by U.S.-based companies engaged in novel research activities and product development. The key players are driven by strategic partnerships, acquisitions, and platform technologies, are spending billions to further advance their product lines and ensure that they find global application. Additionally, companies and industries from the Asia Pacific and Europe are expanding at an aggressive rate, focusing on regional market penetration through cost-effective offerings to ensure global competition.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Bio-Techne Corporation (NASDAQ: TECH) announced an agreement that Mdxhealth SA will acquire its Exosome Diagnostics Inc. business, including the ExoDx Prostate (EPI) test and CLIA-certified lab. Bio-Techne will retain access to the proprietary exosome-based technology for ongoing kit development in its precision diagnostics growth pillar.

- In April 2024, Lonza and NeuroSense Therapeutics announced a collaboration to study biological changes in neurodegenerative diseases such as ALS. Lonza provides expertise in extracellular vesicles, aiding biomarker measurement development, which NeuroSense will integrate into its ALS treatment candidate, PrimeC.

- Report ID: 7857

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Exosome Diagnostic and Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.