Utility Terrain Vehicle Market Outlook:

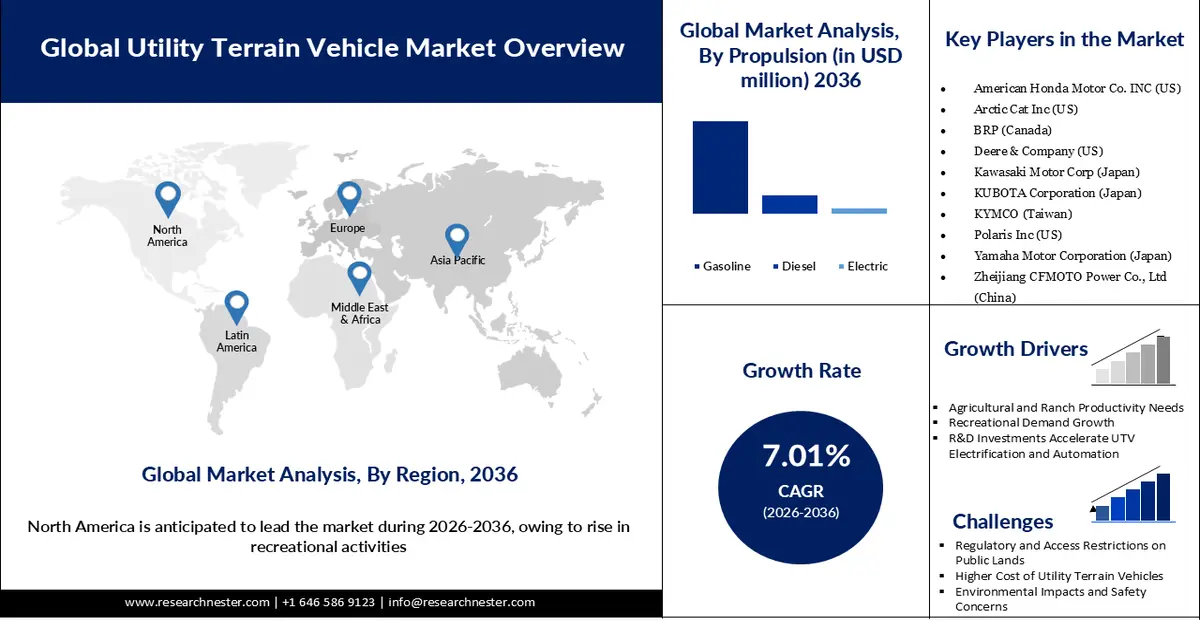

Utility Terrain Vehicle Market size is valued at USD 15.87 billion in 2025 and is expected to grow to USD 33.40 billion by 2036, registering a CAGR of 7.01% during the forecast period, i.e., 2026-2036. In 2026, the industry size of utility terrain vehicle is evaluated at USD 16.95 billion.

The primary growth driver for the utility terrain vehicle market is its extensive use in construction and industrial settings. On construction sites, UTVs efficiently transport workers and small tools across rough terrain, significantly reducing time compared to larger trucks and vehicles. The adoption of electric UTVs (EV UTVs) has further enhanced their appeal due to cost-efficient operation and lower maintenance requirements. Key application areas include mining, large-scale construction projects, and other industrial zones where mobility and quick transportation are critical. Beyond industrial use, UTVs are also widely employed by defense and military forces, capable of traversing challenging terrains such as shallow waters, dense forests, and sandy landscapes thanks to specialized displacement and design features. North America, home to several key market players, continues to dominate the global UTV market, reflecting both high adoption rates and technological advancements in vehicle design.

Key Utility Terrain Vehicle UTV Market Insights Summary:

Regional Highlights:

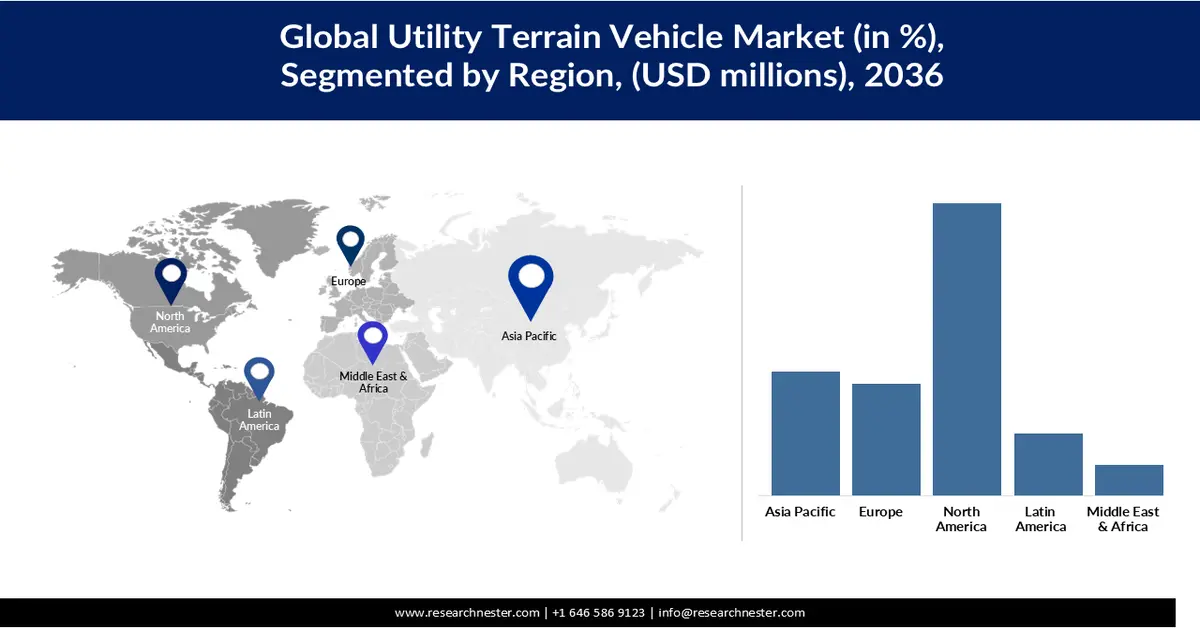

- North America is forecast to command a 45.3% share by 2036 in the utility terrain vehicle market, fueled by robust demand across off-road recreation, agriculture, forestry, and public safety operations.

- Asia Pacific is anticipated to secure around a 23% share by 2036, stimulated by rapid technological uptake, tourism-led off-road mobility demand, and expanding agricultural activities.

Segment Insights:

- The 400 cc to 800 cc segment is projected to account for a 52.34% share by 2036 in the utility terrain vehicle market, supported by its balanced power output and multi-terrain adaptability enabling industrial, military, and defense usage.

- The gasoline-powered segment is anticipated to secure a 75.20% share by 2036, underpinned by widespread fuel availability and ease of refueling sustaining its strong preference across utility applications.

Key Growth Trends:

- Rise in agriculture needs

- Demand for recreation

Major Challenges:

- High cost of UTV

- Environmental impact

Key Players: American Honda Motor Co. INC, Arctic Cat Inc, BRP, Deere & Company, Kawasaki Motor Corp, KUBOTA Corporation, KYMCO, Polaris Inc, Yamaha Motor Corporation, Zheijiang CFMOTO Power Co., Ltd

Global Utility Terrain Vehicle UTV Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.87 billion

- 2026 Market Size: USD 16.95 billion

- Projected Market Size: USD 33.40 billion by 2036

- Growth Forecasts: 7.01% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (45.3% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, China

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 7 January, 2026

Utility Terrain Vehicle Market - Growth Drivers and Challenges

Growth Drivers

- Rise in agriculture needs: The growing demands of agriculture and ranching are driving the global utility terrain vehicle (UTV) market. Large-acre farmlands and rough terrain limit the effectiveness of manual labor, increasing reliance on mechanized solutions. The use of agriculture-oriented UTVs, including models designed for hauling, sowing, and harvesting support, enables faster, more uniform field operations and improves overall productivity. These vehicles offer high payload capacity and enhanced maneuverability, allowing operators to transport equipment and materials efficiently across challenging landscapes. According to Farmnout’s Best UTV for Farm & Ranch: Top Picks & Value 2025, models such as the Polaris Ranger XP 1000 and John Deere Gator XUV 835M have significantly improved farm efficiency and operational performance. Additionally, the integration of GPS mapping and telematics systems is further enhancing precision, monitoring, and operational efficiency in agricultural UTV applications.

- Demand for recreation: Recreational infrastructure has expanded significantly, particularly in coastal areas and forest regions, to cater to the growing interests of tourists and outdoor enthusiasts across terrains that are often impractical to traverse on foot. Utility terrain vehicles (UTVs), with their compact design and wide tires, provide enhanced traction on soft, uneven, and slippery surfaces, making them well suited for such environments. Adventure riding has gained strong momentum, especially among younger demographics, driven by interest in trail riding and outdoor exploration experiences. In 2024, the U.S. recorded approximately 181 million participants in outdoor recreation activities, increasing demand for off-road vehicles capable of navigating challenging landscapes. Additionally, the development of dedicated off-road trails and adventure parks is further strengthening recreational facilities, where UTVs are extensively used, thereby accelerating growth in the global utility terrain vehicle market.

- Acceleration in R&D of UTV electrification: Manufacturers are increasingly investing in the electrification of utility terrain vehicles (UTVs) to enhance durability, sustainability, and operational efficiency. Electric UTVs (ETVs) offer improved automation, safety, and eco-friendly mobility, making them suitable for diverse applications, including industrial, marine, and defense sectors. In February 2024, Polaris Commercial launched its zero-emission XD Full-Size Kinetic, powered by an electric engine, specifically designed for industrial use. The vehicle is reported to reduce maintenance costs by up to 60%, lowering overall operational expenses. Ongoing R&D initiatives are introducing advanced safety features, innovative technologies, and efficient powertrain solutions, further accelerating global adoption of electric UTVs.

Challenges

- High cost of UTV: UTVs are, in general, quite expensive because of the production, material, and financing costs, creating a barrier to the adoption of UTV among entry-level enthusiasts. The growing inflation is impacting the prices of raw materials, which keeps escalating the prices of UTV. In February 2025, the manufacturers of Polaris Ranger XP Kinetic claimed the vehicle to be powerful and durable; however priced higher than some of the competitors, leading to slower adoption in the utility terrain vehicle (UTV) market. Post purchase, the users have to register an insurance and pay other taxes, which increases the overall price of the UTV, further declining the revenues for the utility terrain vehicle market.

- Environmental impact: The environmental guidelines prohibiting the adoption of ETV as off-road constructions are being limited to create a safe space for ecological balance. The protection of habitation is curbing the development of off-road tracks, which is directly impacting the utility terrain vehicle market. In 2024, the National Park Service banned access to ATVs and UTVs within Ozark National Scenic Riverways, which led to a barrier to riverbank trails. The initiative was agreed upon, keeping in mind the need to reduce soil erosion and the environmental protection of the habitats.

Utility Terrain Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

7.01% |

|

Base Year Market Size (2025) |

USD 15.87 billion |

|

Forecast Year Market Size (2036) |

USD 33.40 billion |

|

Regional Scope |

|

Utility Terrain Vehicle Market Segmentation:

Displacement Segment Analysis

The 400 cc to 800 cc UTV segment is expected to dominate the utility terrain vehicle (UTV) market, capturing a projected 52.34% share by 2036, driven by its optimal balance of power and versatility. Vehicles in this range provide sufficient torque and payload capacity to navigate diverse terrains, making them ideal for industrial, military, and defense applications where durability and performance are critical. The under-400 cc segment also holds a notable share, primarily driven by entry-level enthusiasts who seek an accessible introduction to off-road riding before upgrading to higher-capacity models. High adoption of the 400–800 cc segment is particularly observed among professional adventure tourers and trail riders, reflecting its strong appeal for both recreational and tactical use.

Propulsion Segment Analysis

The gasoline-powered UTV segment is projected to hold a dominant share of 75.20% by 2036, driven largely by the limited production scale of alternative fuel UTVs and the widespread availability of gasoline. Gasoline models are preferred for their ease of refueling and favorable environmental rformancepe compared to diesel. Meanwhile, the electric UTV segment is also expected to capture a significant share in the coming years, supported by increasing adoption of EV-based UTVs that offer sustainability and extended driving range. Demand for electric UTVs is particularly strong in the military and defense sectors, prompting manufacturers to develop long-range, all-terrain electric vehicles suitable for fleet operations. Additionally, government initiatives promoting sustainability and green mobility are further accelerating growth in the electric UTV segment.

Engine Segment Analysis

The internal combustion engine (ICE) segment is expected to remain the most dominant in the UTV market, holding a projected 94.44% share by 2036, largely due to consumer familiarity and widespread acceptance. ICE-powered UTVs are cost-effective, easy to refuel with gasoline, and benefit from a well-established spare parts supply chain, which simplifies maintenance and repairs. In contrast, electric engines are relatively expensive, increasing vehicle costs and slowing adoption. The prevalence of ICE UTVs has not only enhanced mobility but also reduced reliance on larger, fuel-intensive vehicles in industries such as construction, enabling efficient operations while lowering diesel consumption.

Our in-depth analysis of the global utility terrain vehicle market includes the following segments:

| Segment | Subsegment |

|

Displacement |

|

|

Propulsion |

|

|

Engine |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Utility Terrain Vehicle Market - Regional Analysis

North America Market Insights

North America is projected to hold 45.3% of the global UTV market share by 2036, driven by strong demand from off-road recreation, hunting, and agricultural activities. The expansion of forestry and farming operations has further amplified market growth, as these sectors require durable and cost-effective all-terrain vehicles for efficient mobility. In April 2025, the Tipp City Police Department received USD 42,000 in funding to purchase a UTV, highlighting the increasing adoption of these vehicles in public safety and emergency response applications. The use of UTVs in government and public sector units (PSUs) has further enhanced their visibility and accelerated utility terrain vehicle (UTV) market penetration.

The U.S. utility terrain vehicle (UTV) market is particularly strong, with dedicated off-road tracks, adventure parks, and national-level competitions for professional drivers, driving high adoption rates. UTVs are also deployed in disaster response; for example, during Cyclone Helene, UTV convoys were used to assess and navigate severely affected areas, demonstrating their versatility in challenging conditions.

Canada represents a mature UTV market, supported by a growing interest in outdoor adventure activities such as river trailing, off-road exploration, and eco-tourism. Rising tourist inflow has increased demand for environmentally friendly and affordable vehicles, with UTVs and ATVs being popular choices for mobility and adventure. Additionally, expanding farming operations provide further opportunities for UTV usage, reinforcing steady market growth across the country.

Asia Pacific Market Insights

APAC is projected to hold approximately 23% of the global market share by 2036, driven by the presence of innovative manufacturers developing off-road-optimized UTVs and strong technological adoption across the region. The market is expected to grow at a CAGR of 8.14%, supported by high tourism demand and expanding agricultural activities. Tourists frequently prefer off-road-capable vehicles that can navigate both paved and rugged terrains, while the growing scope of agriculture further fuels UTV adoption for efficient mobility and operations.

China leads the regional market, leveraging its advanced electronics and industrial integration. UTVs are extensively used in industrial sectors for transporting employees and small components across large facilities with challenging terrain, thanks to their versatility and durability. Recreational use is also rising, as expansive tourist attractions require reliable off-road vehicles to navigate sprawling areas.

India is emerging as a key growth market in the defense and military sector. Rising defense expenditure and modernization efforts are driving demand for high-performance UTVs capable of handling challenging terrains. In February 2024, SHERP Global launched the Ator N1200, an advanced UTV able to overcome obstructions over 1 meter and carry a payload of up to 12,000 kilograms, making it highly suitable for combat and tactical operations. Expanding defense applications are significantly contributing to market growth across India and the wider APAC region.

Europe Market Insight

The European UTV market is projected to hold a 19.9% share of the global market by 2036, driven by increasing outdoor tourism and a growing preference for cost-effective, self-drive vehicles. Municipal operations across the region also rely on UTVs for efficient, low-cost mobility in public services. Stricter emission standards and environmental protection initiatives have further supported market growth. In January 2025, Europe implemented advanced noise and emission regulations, prompting widespread adoption of low-noise, low-emission UTVs, particularly in industrial, agricultural, and municipal applications.

In the UK, UTV adoption is strongly supported by the farming and agriculture sectors, where these vehicles are widely used for transporting equipment and materials efficiently across farms. Construction and industrial sites also rely on rugged UTVs to ensure the timely delivery of small payloads. Recreational activities are further boosting demand, with parks and adventure centers offering UTV-based experiences that attract tourists and adventure enthusiasts, expanding market opportunities.

Germany has demonstrated strong UTV growth due to defense and military applications, where vehicles capable of navigating rough terrains with heavy payloads are required. Government investment in modern, low-emission, and low-noise vehicles has driven the adoption of durable UTVs. Additionally, recreational off-roading activities have gained popularity among citizens, further accelerating market expansion. The combined impact of industrial, defense, and recreational demand is positioning Germany as a key contributor to the European market.

Key Utility Terrain Vehicle Market Players

- American Honda Motor Co. INC (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arctic Cat Inc (U.S.)

- BRP (Canada)

- Deere & Company (U.S.)

- Kawasaki Motor Corp (Japan)

- KUBOTA Corporation (Japan)

- KYMCO (Taiwan)

- Polaris Inc (U.S.)

- Yamaha Motor Corporation (Japan)

- Zheijiang CFMOTO Power Co., Ltd (China)

- KUBOTA Corporation is the leader in agriculture and industrial machinery, such as tractors and crop harvesters, which has a global footprint including regions such as Europe and Asia. The UTVs are entirely focused on construction and agriculture demands, where the primary concentration is on improving capacity, towing strength, and versatility

- KYMCO is the largest manufacturer of scooters, ATVs, and UTVs, and is also considered a significant exporter of these products. The firm has recently shifted to electric mobility. The models are being manufactured keeping in mind the uses of the vehicles, such as recreation and agricultural use.

- Polaris Inc dominates the U.S. and entire North American market owing to the wide range of UTV vehicles. Innovation and performance are the two most important pillars of the business, which enforce the creation of ultra-advanced UTVs. The demand for defence UTVs is largely focused on by the business, as it has a separate entity that modifies and redevelops the UTV for defence purposes.

- Yamaha Motor Corporation is known for the segment in class motorcycles and marine engines, which have diversified into UTV development. The performance and stability of the UTVs manufactured by Yamaha Motors are quite enhanced. The vehicles are further known for their durable engines, suspension systems, and off-road reliability.

Below is the list of the key players operating in the global market:

The players operating in the global utility terrain vehicle market are expected to face intense competition during the forecast period. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global Utility Terrain Vehicle Market

Recent Developments

- In December 2025, Polaris Inc. partnered with MESO to expand the service network of its Pro XD, which will enhance access to timely service intervals and ensure higher uptime of the vehicles for commercial customers. The limited availability of the service centres had immensely impacted the customers with vehicles grounded for a long time. The collaboration will enhance sales of the UTVs as more network service centres have opened.

- In April 202, Kubota Corporation launched an electric retrofit solution for its KK019 excavators that would enhance sustainability and limit air pollution as the product works on all new electric engines that can significantly reduce air pollution. They have also launched a new 3.3-litre engine of the same model, which provides higher torque but is available only in an ICE engine.

- Report ID: 6777

- Published Date: Jan 07, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Utility Terrain Vehicle UTV Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.