Global All-terrain Vehicle Market Size, Forecast and Trend Highlights Over 2025-2037

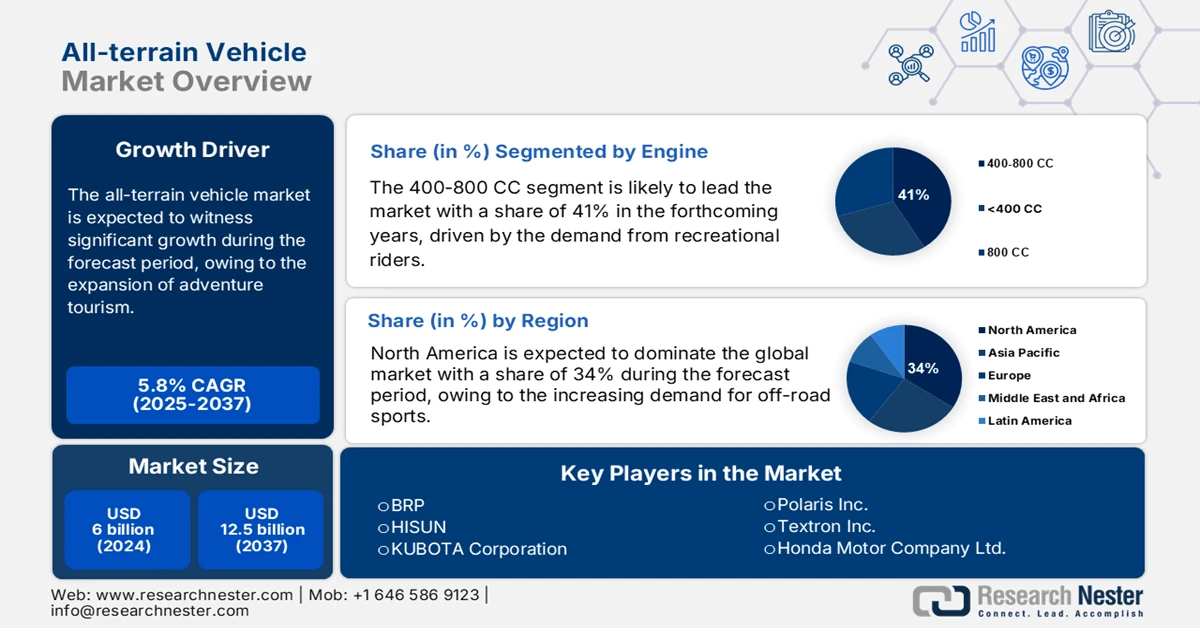

All-terrain Vehicle Market size was valued at USD 6 Billion in 2024 and is expected to reach USD 12.5 Billion by the end of 2037, registering around 5.8% CAGR during the forecast period i.e., between 2025-2037. In 2025, the industry size of all-terrain vehicles is evaluated at USD 6.2 billion.

The all-terrain vehicle (ATV) market is witnessing exponential growth due to military requirements for agile tactical systems that execute border protection duties, reconnaissance, and rapid deployment operations. For instance, in May 2024, Polaris Government and Defense introduced broadened MRZR Alpha light tactical vehicle versions to meet advancing military requirements. The new offering, including an autonomous model, export power variants, and a 6x6 configuration, forms part of the latest product lineup, which increases the cargo bed size by 65% to reach 3,600 lbs payload capacity. The updated enhancements enable military forces to execute mortar deployment and drone operations, as well as manage, command, and control assets in harsh settings.

The demand for all-terrain vehicles is constantly rising as military forces prefer lightweight vehicles to enhance their ability so that they can navigate remote regions at high altitudes. In March 2024, the Polaris Government and Defense introduced two new military snowmobiles, the 2025 Military 850 PRO RMK 155 and the 2025 Military 650 TITAN 155. Besides, the light tactical vehicles provide the military with operational benefits such as navigation of difficult terrain, rapid deployment, and versatile operation for battle tasks. Defense agencies utilize ATVs as part of specialized units, as these vehicles boost operational efficiency and reach in tough geographical zones.

Key All-terrain Vehicle Market Insights Summary:

Regional Highlights:

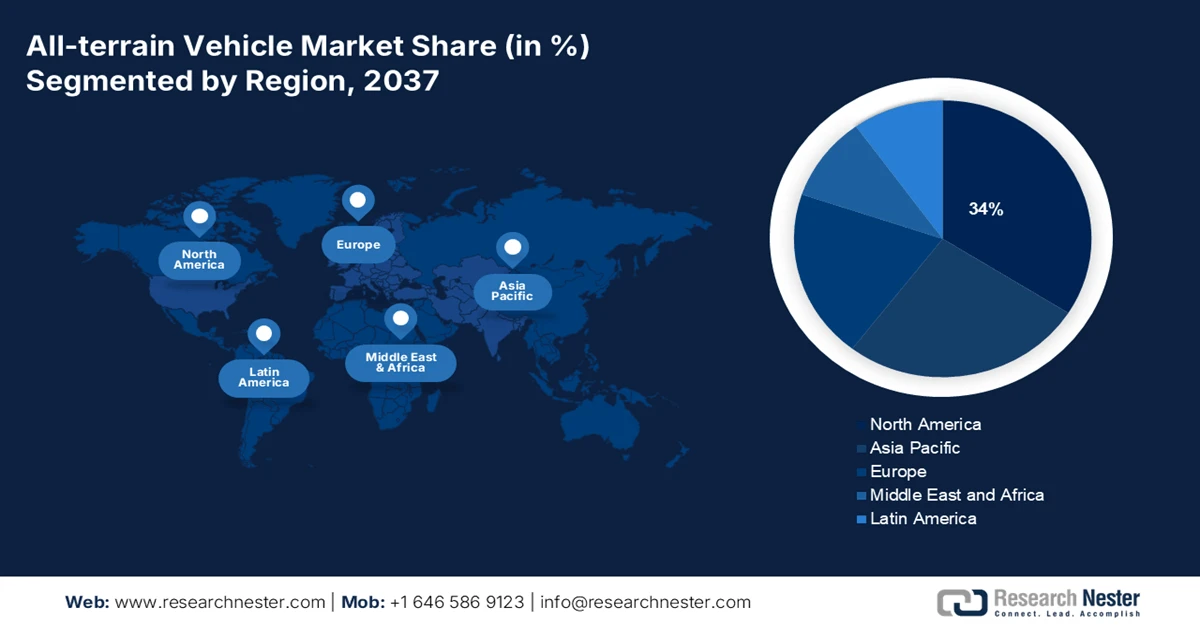

- North America is projected to command a 34% revenue share by 2037 in the all-terrain vehicle market, supported by surging participation in off-road sports, adventure tourism, and expanding use of high-performance ATVs across recreational, military, and law-enforcement applications.

- Asia Pacific is expected to emerge as the fastest-growing region with a 24.0% share by 2037, stimulated by rising rural mobility needs, agriculture-focused ATV deployments, and increasing adoption of cost-effective vehicles across populous farming economies.

Segment Insights:

- The agriculture application segment is estimated to capture a 38% share by 2037 in the all-terrain vehicle market, fueled by increasing uptake of electric utility ATVs aligned with emission regulations and the shift toward sustainable, eco-friendly farming practices.

- The 400–800 CC engine segment is forecast to secure around a 41.0% share by 2037, encouraged by growing preference for versatile, performance-balanced ATVs that deliver fuel efficiency and affordability across recreational and utility uses.

Key Growth Trends:

- Integration of advanced features

- Expansion of adventure tourism

Major Challenges:

-

High risk of accidents

-

Key Players:

Global All-terrain Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 6 billion

- 2025 Market Size: USD 6.2 billion

- Projected Market Size: USD 12.5 billion by 2037

- Growth Forecasts: 5.8% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Japan, Germany

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 5 May, 2025

All-terrain Vehicle Sector: Growth Drivers and Challenges

Growth Drivers

- Integration of advanced features: The all-terrain vehicle market is gaining momentum from the rising interest in eco-friendly and sustainable vehicle types. Green technologies are driving manufacturers to develop environmentally friendly and energy-efficient ATV models, which is attracting consumers to sustain demand for these vehicles. For instance, in January 2025, DRR USA announced the production of its EV Safari 4x4 electric ATV and gas-powered mini ATVs. The new vehicle is designed for silent, emission-free operation, making it ideal for both recreational enthusiasts and professionals in search and rescue or remote operations. This development highlights the company’s efforts to create immense opportunities for the market.

- Expansion of adventure tourism: Adventure tourists and recreational off-roaders are significantly adopting all-terrain vehicles. The popularity of recreational vehicles demonstrates increasing demand for outdoor activities, while expanding motorsport travel experiences in mountain areas. Several companies are introducing high-performance ATVs for off-road adventures and recreational motorsports. In August 2024, Yamaha Motor Corporation introduced its 2025 off-road ATV models for recreational use and adventure. The new vehicle lineup is available with optional EPS and Special Edition packages with added accessories and features. Some innovations feature automatic diagnostic tools, sophisticated suspension technology, and adjustable performance settings that adapt to various terrains.

Challenges

- High risk of accidents: A significant risk of accidents and safety concerns is a major factor limiting the growth of the ATV market. The design features of ATVs and their operational environment elevate the risk for rollovers and collisions alongside handling mistakes that occur with inexperienced riders. The safety concerns bring risks for ATV operation, as families and youth riders often fail to master proper ATV handling.

All-terrain Vehicle Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.8% |

|

Base Year Market Size (2024) |

USD 6 billion |

|

Forecast Year Market Size (2037) |

USD 12.5 billion |

|

Regional Scope |

|

All-terrain Vehicle Segmentation

Application (Mountaineering, Military, Agriculture)

The agriculture segment is estimated to hold 38% share of the all-terrain vehicle market by 2037. The growing demand for electric utility ATVs is fueling the segment's growth as these vehicles enable sustainable and low-noise farm operations. Various organizations are working on developing advanced vehicles for the agriculture sector. For instance, in April 2023, Polaris released the RANGER XP Kinetic, specifically for agricultural usage, as it features zero-emission production with immediate torque delivery and big towing abilities, which attracts environmentally mindful farmers. The emission regulations and a rising interest in ec0-friendly farming practices are driving the agriculture sector toward adopting electric ATVs.

Engine (<400, 400-800, >800 CC)

The all-terrain vehicle market from the 400-800 CC segment is expected to garner a significant share of around 41.0% in the year 2037, as customers seek powerful multipurpose models that include outstanding performance with fuel economy benefits. Such ATVs are increasingly adopted by recreational riders and utility users due to the vehicles’ ability to tackle demanding terrains at a lower cost than larger engines in the market. Consumers are increasingly choosing advanced automobiles for agricultural operations, which is further fostering the segment’s growth.

Our in-depth analysis of the all-terrain vehicle (ATV) market includes the following segments:

|

Application |

|

|

Engine

|

|

|

Fuel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

All-terrain Vehicle Industry - Regional Scope

North America Market Statistics

The all-terrain vehicle market in North America is likely to account for the largest revenue share of 34%, owing to rising consumer interest in off-road sports. The demand for active outdoor adventure tourism is driving consumers to adopt high-performance ATVs for climbing rocks, exploring trails, and participating in race competitions. As per an article published by the Outdoor Industry Association in 2024, the outdoor recreation participant base in the U.S. increased by 4.1% to a record 175.8 million participants, accounting for 57.3% of all participants aged six and older. The demand for these vehicles is rising as organized off-road events and recreational trails are becoming more popular.

The U.S. market benefits from the rising demand for ATVs from military and law enforcement across their operations. Law enforcement services and military teams rely on ATVs for border enforcement, disaster relief operations, and tactical missions in challenging terrain environments. Additionally, the market expansion is significantly boosted by non-recreational applications of ATVs.

APAC Market Forecasts

The all-terrain vehicle market in Asia Pacific is estimated to be the fastest-growing region with a share of 24.0% by the end of 2037, due to the accelerating demand for rural mobility and agriculture. Manufacturers are introducing new ATVs for farming purposes, for instance, in September 2024, China’s Linhai launched a four-seater all-terrain vehicle, Linhai T-Archon 550L, for agricultural users. The vehicles are considered to be cost-effective and can assist farmers in handling transportation needs, managing their territories, and accessing difficult-to-reach fields. These vehicles thrive in diverse agricultural operations due to their adaptable capabilities, allowing their widespread adoption in rural areas with large populations.

The ATV market in China is experiencing rapid growth with the rising demand for outdoor activities. Following this trend, the industry players are partnering and coming out with new vehicles. For instance, in January 2024, Hisun Motors Corp. proclaimed a tactical partnership with Remington to unveil the Remington Pursuit 750, a utility terrain vehicle, designed to meet the diverse needs of outdoor enthusiasts. This collaboration highlights a shift towards specialized, utility-focused off-road vehicles in the rural and recreational sectors.

Companies Dominating the All-terrain Vehicle Landscape

- Suzuki Motor Corporation

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honda Motor Company Ltd.

- Yamaha Motor Co., Ltd.

- BRP

- Kawasaki Heavy Industries. Ltd.

- KWANG YANG MOTOR CO., LTD.

- HISUN

- KUBOTA Corporation

- ZHEJIANG CFMOTO POWER CO., LTD

- Polaris Inc.

- Textron Inc.

The presence of several dominant companies, including Honda Motor Co., Yamaha Motor Co., and Polaris, is dominating the all-terrain vehicle market, providing a wide assortment of off-road vehicles. These corporations invest resources into innovative product development, including advanced engines, electric systems, and sustainable solutions, allowing them to lead the market. The market is being transformed by the strategic alliances between companies and through mergers and acquisitions.

Here are some key players operating in the global market:

Recent Developments

- In January 2025, Polaris unveiled a new range of high-performance and reliable all terrain vehicles including the Sportsman 450, Sportsman 570, Sportsman XP 1000, and others for recreation and utility purposes.

- In August 2024, Can-Am launched the 2025 Outlander 850 and 1000R ATVs, offering industry-leading horsepower and advanced suspension systems. The Maverick R Max lineup was also introduced, providing a new four-seat configuration for side-by-side vehicles.

- In January 2024, Kawasaki Motors announced the launch of the 2024 model year lineup, which includes exciting new additions to its off-road vehicle range. The new models feature improved performance, enhanced durability, and upgraded features designed to meet the growing demand for adventure and utility vehicles.

- Report ID: 5006

- Published Date: May 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

All-terrain Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.