Compact Utility Vehicles Market Outlook:

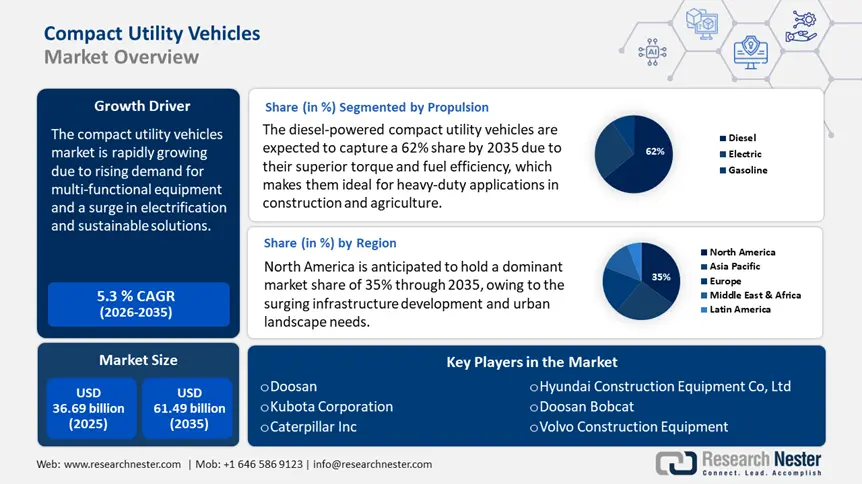

Compact Utility Vehicles Market size was valued at USD 36.69 billion in 2025 and is expected to reach USD 61.49 billion by 2035, expanding at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of compact utility vehicles is evaluated at USD 38.44 billion.

The market is mainly driven by the rising demand for multi-functional equipment. End users across sectors prioritize versatility and value, driving robust demand for compact utility vehicles. These machines are designed to perform a wide range of tasks, from digging and hauling to mowing and plowing, using easily interchangeable attachments. Their ability to consolidate multiple functions into a single piece of equipment reduces fleet size, lowers operational costs, and maximizes return on investment, which are key considerations for businesses seeking streamlined operations.

The demand for versatile machinery is reflected by John Deere’s expansion of its compact utility tractor line. In May 2023, John Deere introduced the 4075R Compact Utility Tractor as part of its 2024 model year lineup. This model is engineered for heavy-duty applications, featuring a 75-horsepower engine and a robust front axle. Notably, it includes an electrohydraulic rear hitch control, enhancing precision and repeatability during rear implement operations. These features cater to customers requiring versatile machinery capable of handling tasks such as snow removal, landscaping, and material handling, thereby reducing the need for multiple specialized vehicles. This highlights a shift where businesses prefer adaptable vehicles to minimize capital and operational expenditures.

Key Compact Utility Vehicles Market Insights Summary:

Regional Highlights:

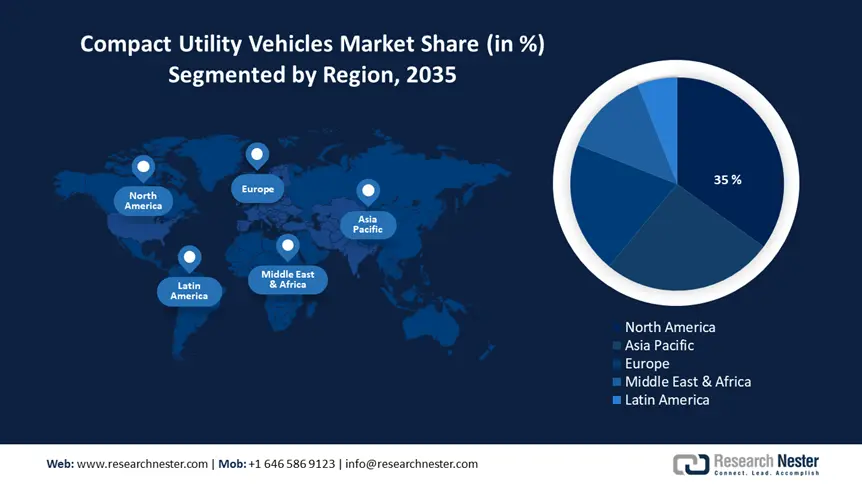

- North America leads the Compact Utility Vehicles Market with a 35% share, driven by surging infrastructure development and urban landscape needs, positioning it as a market leader through 2026–2035.

- The Asia Pacific Compact Utility Vehicles Market is forecasted to achieve robust growth by 2035, driven by rising urbanization and demand for fuel-efficient vehicles.

Segment Insights:

- The Diesel-powered Compact Utility Vehicles segment is projected to capture 62% market share by 2035, fueled by superior torque and fuel efficiency ideal for heavy-duty applications.

- Skid Steer Loaders segment are projected to hold a 45% share by 2035, driven by their versatility and growing use in construction, agriculture, and landscaping.

Key Growth Trends:

- Surge in electrification and sustainable solutions

- Technological advancements and automation integration

Major Challenges:

- High initial acquisition and maintenance costs

- Competition from low-cost alternatives and used equipment

- Key Players: Doosan, Kubota Corporation, Doosan Bobcat, CNH Industrial America LLC, Volvo Construction Equipment, Caterpillar Inc.

Global Compact Utility Vehicles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.69 billion

- 2026 Market Size: USD 38.44 billion

- Projected Market Size: USD 61.49 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Compact Utility Vehicles Market Growth Drivers and Challenges:

Growth Drivers

- Surge in electrification and sustainable solutions: The shift towards sustainable practices is fueling the rise of electric and hybrid compact utility vehicles. Driven by tightening emissions regulations and corporate ESG goals, manufacturers are introducing models with reduced carbon footprints and lower total cost of ownership. Further, electric CUVs offering quiet operation and minimal maintenance are becoming popular among municipalities and commercial users committed to green initiatives, creating a pivotal growth opportunity for the market.

- Technological advancements and automation integration: Compact utility vehicles are rapidly evolving into smart machines equipped with advanced technologies such as telematics, GPS navigation, and semi-autonomous features. For instance, in June 2023, Bobcat launched the AT450 Articulating tractor. This model incorporates smart attachments, operator assist tech, and telematics for remote monitoring. Integration of IoT-enabled systems allows for real-time fleet management, predictive maintenance, and improved safety. These advancements enhance productivity, lower downtime, and attract tech-savvy operators, positioning CUVs as important assets in modern fleet strategies.

- Urbanization and infrastructure development: The rising urbanization and expanding infrastructure projects are significantly boosting demand for compact, maneuverable equipment. Compact utility vehicles, with their smaller footprints and agile handling, are ideal for tasks in confined urban spaces and complex job sites. Investment in smart city projects, public infrastructure upgrades, and residential developments is creating sustained need for high-performance, space-efficient vehicles, reinforcing long-term market growth. The U.S. Bipartisan Infrastructure Law (BIL), passed in late 2021 and actively funding projects through 2025, allocates USD 1.2 trillion for rebuilding roads, bridges, and urban infrastructure. This surge in urban construction and maintenance activities increases the need for compact, agile equipment such as CUVs that can operate efficiently in restricted spaces.

Challenges

- High initial acquisition and maintenance costs: Compact utility vehicles, especially those equipped with advanced attachments and smart technologies, often require a substantial upfront investment. Additionally, the costs associated with regular maintenance, specialized parts, and skilled operators can burden small and mid-sized businesses. While the multi-functionality of CUVs offers long term savings, the initial financial outlay can be a deterrent for wider adoption across price-sensitive sectors such as agriculture and municipal services.

- Competition from low-cost alternatives and used equipment: In developing markets and budget-conscious industries, compact utility vehicles often face competition from low-cost imported machinery and the well-established market for used heavy equipment. Buyers may opt for lower-cost, single-function machines or second-hand alternatives that meet immediate operational needs without the premium price tag of new, multi-functional CUVs. This competitive pressure challenges manufacturers to balance innovation with affordability.

Compact Utility Vehicles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 36.69 billion |

|

Forecast Year Market Size (2035) |

USD 61.49 billion |

|

Regional Scope |

|

Compact Utility Vehicles Market Segmentation:

Propulsion (Diesel, Electric, Gasoline)

The diesel-powered segments in compact utility vehicles market are expected to capture a 62% share by 2035 due to their superior torque and fuel efficiency, which makes them ideal for heavy-duty applications in construction and agriculture. For instance, Mahindra’s Scorpio N and XUV700 diesel variants accounted for over 80% of their sales in November 2024, reflecting strong consumer preference for diesel models in India’s SUV market. Similarly, the Mahindra Bolero and Thar, both diesel-exclusive models, are performing well in the Indian market, indicating a sustained demand for diesel-powered CUVs. This highlights the relevance of diesel engines in meeting the performance needs of compact utility vehicles.

Vehicle Type (Skid Steer Loaders, Excavators, Detachable Accessory Based Vehicles)

The skid steer loaders segment is predicted to hold a notable share of 45% through 2035, as they are a very integral part of the compact utility vehicles market. The growth can be attributed to its versatility and efficiency in various applications. These machines are increasingly used in construction, agriculture, and landscaping for tasks such as excavation, grading, and material handling. In March 2023, Bobcat’s introduction of the S7X, the world's first all-electric skid-steer loader, showcases the industry’s shift towards sustainable and efficient machinery. This model offers zero emissions and reduced operating costs, aligning with the growing demand for eco-friendly construction equipment.

Our in-depth analysis of the global compact utility vehicles market includes the following segments:

|

Propulsion |

|

|

Vehicle Type |

|

|

Application |

|

|

Platform |

|

|

Rated Power |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Compact Utility Vehicles Market Regional Analysis:

North America Market Analysis

North America is anticipated to hold a dominant compact utility vehicles market share of 35% through 2035, owing to the surging infrastructure development and urban landscape needs. Major players such as Kubota and John Deere have expanded their compact lineups to meet rising demand from the construction and municipal sectors. In 2024, Kubota launched the LXe-261 electric tractor in the U.S., reinforcing the region’s shift towards eco-friendly, versatile equipment. This blend of urbanization and electrification is propelling the market in North America to grow.

In the U.S., strong demand for multi-purpose, rugged equipment is fueling compact utility vehicle sales, particularly in agriculture, construction, and recreational sectors. Polaris Industries reported record sales for its Ranger utility vehicle series in 2024, highlighting the appeal of powerful yet compact machines. Additionally, government investments under the Infrastructure Investment and Jobs Act are boosting demand for equipment that fits into confined construction zones.

Canada’s compact utility vehicle market is expanding rapidly due to growth in agriculture modernization and the adoption of sustainable machinery. The Canada Federal Clean Technology Program is also encouraging farmers and contractors to adopt more efficient, low-emission vehicles, positioning compact utility vehicles as essential tools for modern operations across the rural and urban landscape.

Asia Pacific Market Analysis

Asia Pacific is anticipated to garner a robust share from 2026 to 2035. The market growth can be attributed to rising urbanization and the demand for versatile, fuel-efficient vehicles. Many countries in the region are investing in smart city developments, infrastructure upgrades fueling the growth of these vehicles. In February 2025, Mazda announced a USD 150 million investment to produce electric compact SUVs in Thailand, aiming for an annual output of 100,000 units. Thus, the growing push for electrification and government incentives for sustainable vehicles is accelerating the adoption of compact utility vehicles in the region.

China’s compact utility vehicles market is experiencing significant growth owing to the country’s rapid urbanization and the increasing demand for versatile, space-efficient vehicles. The rise of new energy vehicles (NEVs) has played a pivotal role, with NEV sales surpassing traditional fuel vehicles in April 2024, marking a historic shift in consumer preferences. Domestic manufacturers such as BYD have capitalized on this trend, selling over 4 million vehicles globally in 2024 and leading the market in both innovation and volume. Additionally, China’s strategic investments in EV infrastructure and supportive government policies have created a conducive environment for compact, energy-efficient vehicles.

The compact utility vehicles market in South Korea is expanding due to the country’s focus on sustainable urban mobility and technological innovation. The government’s commitment to reducing carbon emissions has led to increased support for electric vehicles, including subsidies and investments in charging infrastructure. For instance, in May 2024, Kia’s launch of EV3, a compact electric SUV, reflects the industry’s response to this demand, aiming to offer affordable and efficient transportation solutions. Additionally, the models such as the Kia Ray EV, which became the best-selling domestically produced EV in the first quarter of 2024, highlight the growing consumer preference for compact, eco-friendly cars.

Key Compact Utility Vehicles Market Players:

- Hyundai Construction Equipment Co, Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Doosan

- Kubota Corporation

- Doosan Bobcat

- CNH Industrial America LLC

- Volvo Construction Equipment

- Caterpillar Inc.

- Yanmar Holdings Co. Ltd

The key companies dominating the compact utility vehicles market gain a competitive edge through continuous innovation, offering versatile, eco-friendly models tailored to diverse applications. The robust supply chains, global distribution networks, and strong brand reputation enable them to capture a significant market share and maintain leadership. Here are some leading players in the compact utility vehicles market:

Recent Developments

- In March 2025, Volvo Construction Equipment upgraded its compact excavators with new hydraulic breakers New hydraulic breakers. These breakers are specially made for the newest compact models, giving better precision and more power for breaking tasks.

- In January 2025, the Kia Syros compact SUV received 10,258 pre-launch bookings. The production has started, and the first customer unit is being established at the Anantapur plant in Andhra Pradesh.

- Report ID: 7638

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Compact Utility Vehicles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.