BNP and NT-proBNP Market Outlook:

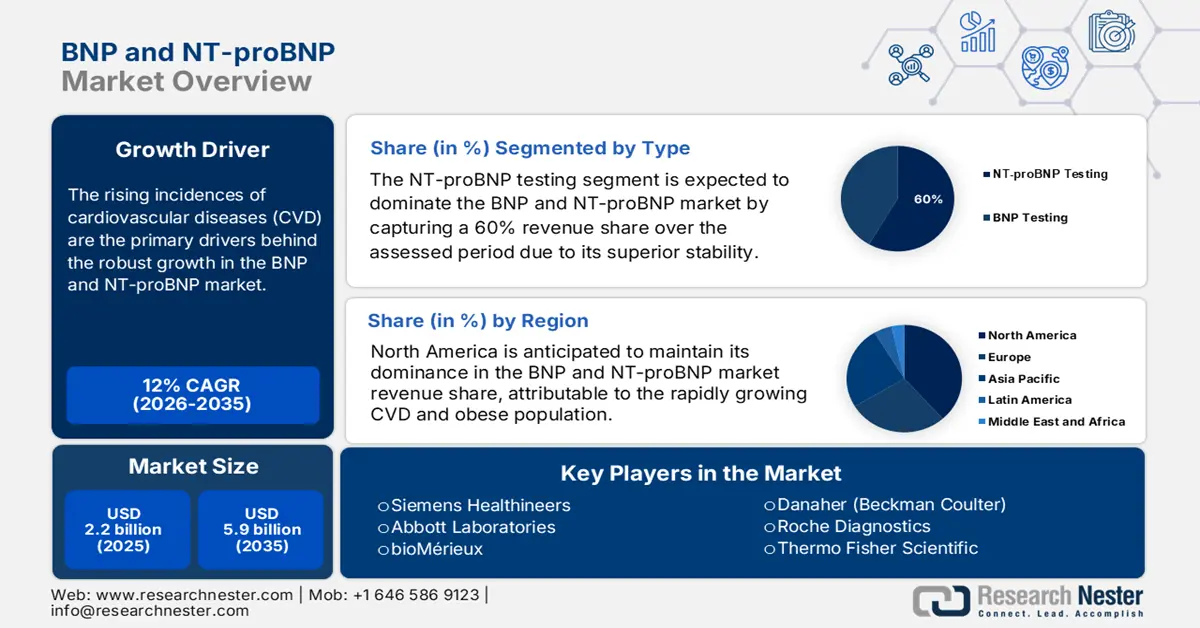

BNP and NT-proBNP Market was over USD 2.2 billion in 2025 and is projected to reach USD 5.9 billion by 2035, witnessing a CAGR of around 12% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of BNP and NT-proBNP is assessed at USD 2.4 billion.

The rising incidence of cardiovascular diseases (CVD) is the primary driver behind the robust growth of the market. According to data published by the World Health Organization, cardiovascular disease is the leading cause of death worldwide, taking more than 17.9 million lives each year. BNP (B-type Natriuretic Peptide) and NT-proBNP (N-terminal pro B-type Natriuretic Peptide) are pivotal biomarkers extensively utilized for prognosis and management of heart failure. In recent years, there has been an exponential surge in awareness among healthcare providers regarding the importance of risk stratification in CVD patients.

Despite the growing surge, the markets still face payers' pricing pressures, with a notable rise in production costs. These factors have resulted to rethink companies to focus on cost-optimized process of production. Firms are endeavoring to provide widespread access to crucial cardiac biomarker testing for patients. The market players are consistently bringing changes through innovations in testing technologies as well as streamlining the supply chain to sustain growth.

Key BNP and NT-proBNP Market Insights Summary:

Regional Highlights:

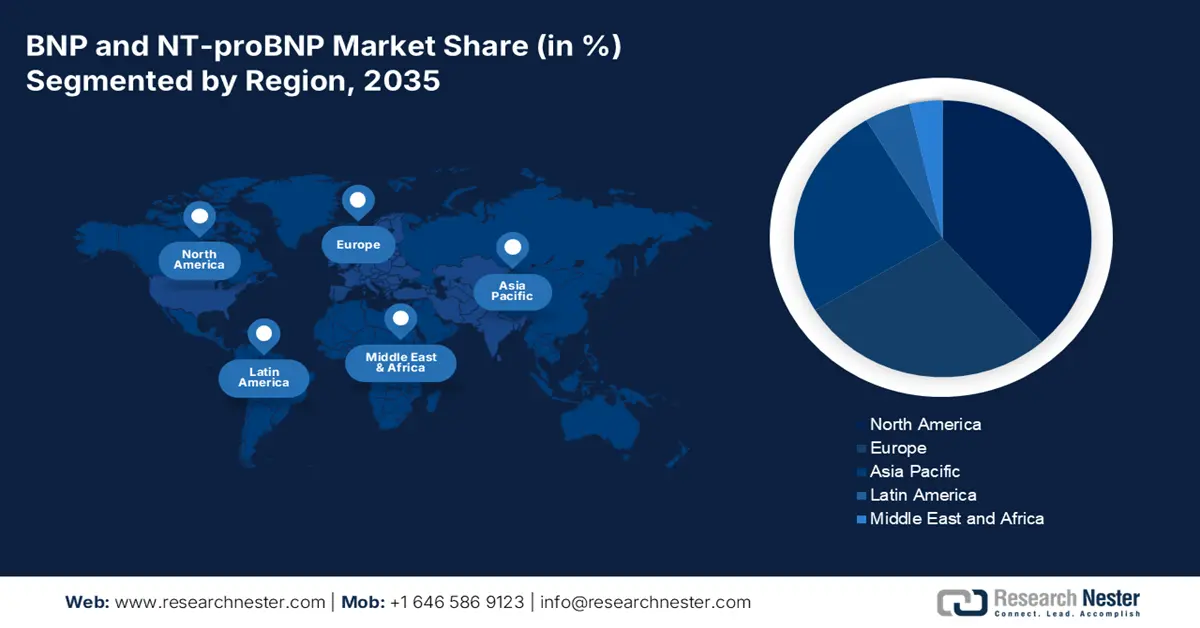

- By 2035, North America is expected to command a leading share in the bnp and ntprobnp market, spurred by the high prevalence of cardiovascular diseases and advanced healthcare infrastructure.

- Asia Pacific is anticipated to record the highest CAGR by 2035, anchored by the region’s high CVD burden.

Segment Insights:

- By 2035, the NT-proBNP testing segment of the bnp and ntprobnp market is projected to capture a 60% share, propelled by its superior stability and worldwide recognition.

- By 2035, the heart failure diagnosis segment is set to secure a 65% revenue share, impelled by the enlarging burden of heart-related disorders and underlying comorbidities.

Key Growth Trends:

- Surge in incidences of comorbidities

- Government initiatives and public health programs

Major Challenges:

- Pricing pressure and reimbursement issues

- Competition from alternative biomarkers and diagnostic tools

Key Players: Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, bioMérieux, Danaher (Beckman Coulter), Ortho Clinical Diagnostics, Thermo Fisher Scientific, Randox Laboratories, Mindray Medical.

Global BNP and NT-proBNP Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 5.9 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (Leading Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 10 November, 2025

BNP and NT-proBNP Market - Growth Drivers and Challenges

Growth Drivers

- Surge in incidences of comorbidities: The rising cases of comorbidity conditions such as kidney diseases, obesity, etc., are closely associated with cardiovascular complications, which have further instilled the necessity of BNP and NT-proBNP monitoring. These biomarkers are adequate tools for clinicians to obtain crucial insights into cardiac stress for providing timely therapeutic interventions. With the rising incidence of chronic diseases globally, the demand for biomarkers is mushrooming significantly. Also, combined with telemedicine solutions, these biomarkers are becoming a crucial tool in providing comprehensive cardiovascular care pathways.

Global Prevalence of Diabetes, Obesity, and Chronic Kidney Disease (2022)

|

Condition |

Estimated Number of People Affected Globally in Million |

|

Diabetes (adults 18+) |

830 |

|

Obesity (adults 18+, BMI ≥ 30) |

890 |

|

Chronic kidney disease (all ages) |

800 |

Source: WHO, NIH

- Government initiatives and public health programs: Supportive policies from the government and various campaigns by the government organizations are targeting early diagnosis, which is acting as a key driver for the market expansion. For instance, the World Heart Federation commemorated World Heart Day on 20th September to ignite global conversation and raise awareness for heart health. These initiatives usually promote routine screening, enabling mushrooming demand for BNP and NT-proBNP tests. Various public health programs also encourage the incorporation of biomarker testing, ensuring swift uptake in the market.

- Expansion of clinical research and trials: In the last few years, research funding has increased, and the number of clinical trials has also expanded, fostering a need for accurate and reliable testing and further boosting the market demand. BNP and NT-proBNP testing has amalgamated with patient stratification as well as drug development, aiding researchers in identifying the high-risk patients and optimizing dosage regimens. In 2023, the U.S. Food and Drug Administration approved 55 novel drugs. Also, the widening of multicenter clinical studies is propelling the demand for scalable testing solutions, further augmenting the growth of the market.

Challenges

- Pricing pressure and reimbursement issues: Payers and insurance provider companies are imposing strict pricing and reimbursement policies on conducting biomarker tests. Limited coverage or any deterrent in reimbursement can discourage hospitals and laboratories from adopting BNP and NT-proBNP testing, hampering the overall market growth.

- Competition from alternative biomarkers and diagnostic tools: The modern imaging techniques, such as galectin-3 and troponins, are rendering alternative ways to detect the dysfunctionality of cardiac health. The widespread availability of a plethora of alternative options can lower the dependency on BNP and NT-proBNP tests, posing a competitive challenge.

BNP and NT-proBNP Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 5.9 billion |

|

Regional Scope |

|

BNP and NT-proBNP Market Segmentation:

Type Segment Analysis

In terms of type, the NT-proBNP testing segment is expected to dominate the BNP and NT-proBNP market by capturing a 60% market share over the assessed period. This is primarily propelled by its superior stability and worldwide recognition. NT-proBNP testing has become important in analyzing and monitoring the chances of heart failure, mainly in cases of chronic comorbidities. The surge in adoption of PoC testing and mushrooming awareness among healthcare practitioners and widespread inclusion of NT-proBNP in worldwide clinical guidelines are augmenting the segment growth.

Application Segment Analysis

Based on applications, the heart failure diagnosis segment is poised to represent the largest revenue share of 65% in the market by the end of 2035. This proprietorship is backed by the enlarging burden of heart-related disorders and underlying comorbidities. This dominant position is also propelled by the reformed guidelines from the American Heart Association (AHA) that promote BNP/NT-proBNP testing as first-line diagnostics for heart failure evaluation. Moreover, such clinical recognition and government-backed preventive initiatives are establishing this medical discipline as a critical source of revenue generation for this merchandise.

End-user Segment Analysis

The hospitals & clinics segment is predicted to attain the predominant share of 47% in the market throughout the discussed timeframe. This leadership reflects the critical role of these healthcare settings as a primary point of care for diagnosis and management in cardiac cases. Additionally, these biomarkers are incorporated into the mainstream practice in hospitals for heart failure evaluation and treatment monitoring. This dominance underscores the central position of these institutions and is empowered by continued government investment in advanced diagnostic infrastructure.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

End user |

|

|

Application |

|

|

Test Setting |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

BNP and NT-proBNP Market - Regional Analysis

North America Market Insights

The market in North America is set to register significant growth on the back of the high prevalence of cardiovascular diseases and advanced healthcare infrastructure. Also, the significant patient population is propelling these tests, as clinicians depend on biomarkers for guiding therapeutic decisions and monitoring disease progression. The U.S. benefits from the presence of specialized cardiac centers and well-established hospitals. Also, the country has significant per capita healthcare spending, and people can afford advanced biomarker testing solutions. The financial ability of people in the country is supporting widespread adoption of such tests, further propelling the market growth.

In Canada, the presence of well-established infrastructure facilitates the adoption of automated immunoassays. Also, public health authorities in the country are actively encouraging early screening programs and adopting preventive cardiac care. These initiatives are raising awareness regarding the importance of biomarker-based cardiac testing and propelling the adoption rates. Furthermore, BNP and NT-proBNP biomarkers are playing a significantly important role in rendering personalized cardiac care in Canada, which enables practitioners to predict the disease progression, further augmenting the market growth.

APAC Market Insights

Asia Pacific is estimated to exhibit the highest CAGR in the global BNP and NT-proBNP market by the end of 2035. The high CVD burden, where the ailment causes a lot of deaths in the region, is a source of continuous surge for commodities available. Additionally, the trend of healthcare modernization in emerging economies is pushing more medical settings to procure these diagnostic solutions. In China, the surge in prevalence of hypertension cases, fueled by sedentary lifestyles and dietary changes, is also augmenting the market growth. Additionally, China’s growing geriatric population, rising participation in cardiovascular clinical research, and the adoption of advanced diagnostic technologies have further contributed to market expansion.

In India, the market growth is propelled by a surge in urbanization and exponentially rising cases of obesity and diabetes. The government initiatives are promoting the improvement of cardiac care and conducting awareness campaigns that are encouraging early diagnosis. Other than this, the country’s large population makes a huge pool of patients, allowing market players to harness. Furthermore, a surge in clinical research activities, inclusion of modern diagnostic technologies, and huge investment in healthcare services are driving the sustained growth of the market across urban as well as semi-urban regions of India.

Europe Market Insights

Europe is expected to gain the second-largest revenue share in the global BNP and NT-proBNP market during the timeline between 2026 and 2035. The aging citizens and coordinated health initiatives are propelling adoption in this sector. The region's significance in this category is also being transformed by the expanded reimbursement for high-sensitivity assays by the insurers in various countries. In Germany, BNP and NT-proBNP tests are widely used for early intervention and routine monitoring. Also, the government authorities are promoting to adoption of preventive cardiac care and supporting the widespread utilisation of BNP and NT-proBNP testing.

The market in the UK is witnessing significant growth owing to a surge in the aging population and NHS initiatives. Also, the country is witnessing high rates of diabetes and obesity, which are closely associated with cardiovascular complications. BNP and NT-proBNP testing are helpful for clinicians in identifying dysfunction or the presence of any cardiac stress in the population with multiple comorbidities. Additionally, ongoing research in cardiac biomarkers in the UK is significantly supported by pharmaceutical companies and is enhancing the development of reliable BNP/NT-proBNP tests, further augmenting the market growth.

Key BNP and NT-proBNP Market Players:

- Roche Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers

- bioMérieux

- Danaher (Beckman Coulter)

- Ortho Clinical Diagnostics

- Thermo Fisher Scientific

- Randox Laboratories

- Mindray Medical

The BNP and NT-proBNP testing remains highly concentrated, with Roche, Abbott, and Siemens collectively controlling a significant portion global revenue share. This is gained through technological leadership in automation and AI, coupled with extensive global distribution. On the other hand, Roche dominates this sector with the launch of Medicare-backed Elecsys tests in key landscapes. Simultaneously, Abbott competes with cost-optimized systems in emerging markets. Similarly, Mindray and Transasia are also gaining traction in this aspect with affordable POC solutions

The cohort of such key players includes:

Recent Developments

- In January 2025, bioMérieux acquired SpinChip Diagnostics, a Norwegian company specializing in rapid point-of-care immunoassays, for €138 million. The acquisition strengthens bioMérieux’s presence in the point-of-care diagnostics market, complementing its existing immunoassay and molecular testing portfolio.

- In October 2025, Thermo Fisher Scientific announced a definitive agreement to acquire Clario Holdings, Inc., a clinical‑data solutions company. The acquisition is expected to be immediately accretive to Thermo Fisher’s adjusted earnings per share, with projected synergies and a strong return profile, further expanding Thermo Fisher’s digital‑data and AI capabilities in drug development.

- Report ID: 7866

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

BNP and NT-proBNP Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.