X-Ray Security Screening Market Outlook:

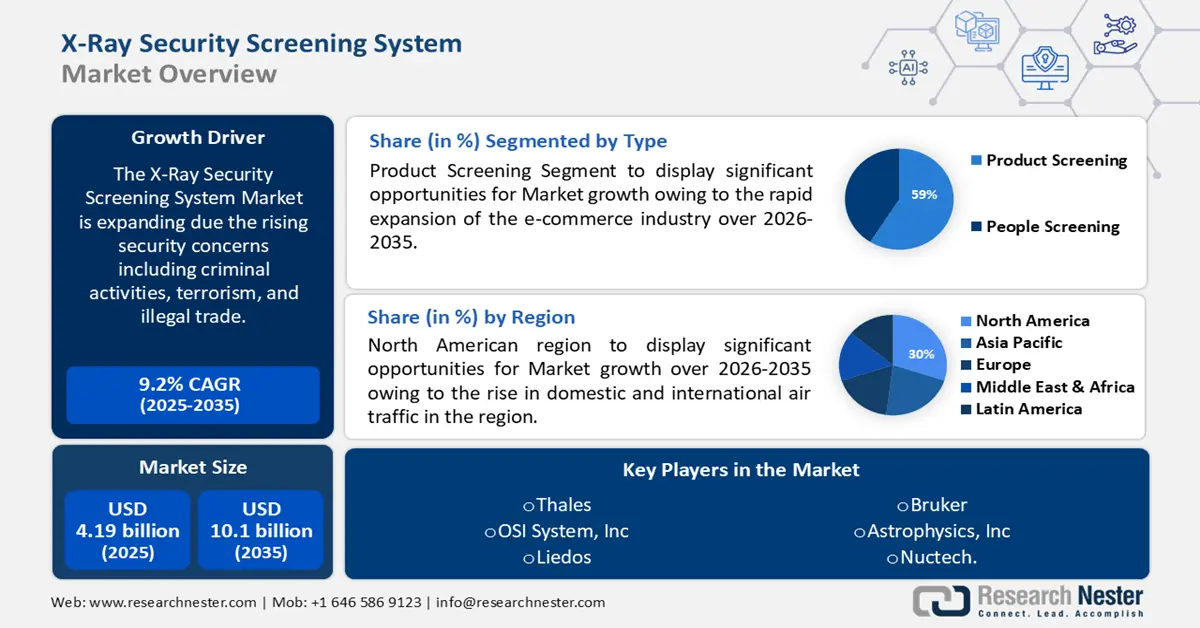

X-Ray Security Screening Market size was over USD 4.19 billion in 2025 and is poised to exceed USD 10.1 billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of x-ray security screening is estimated at USD 4.54 billion.

The growth of X-ray security screening market is on account of the rising security concerns including criminal activities, terrorism, and illegal trade. According to research the illegal drug trade reached USD 650 billion globally and has a devastating economic impact. These concerns result in a need for the adoption of high-quality security measures like an X-ray security screening which allows officials to check the bags and luggage of people entering any space to uncover any possible hidden contraband or smuggled goods, as well as explosives, guns, drugs, or weapons. This makes it possible to find these things before any harm or damage is done.

In addition to that, the rising need for X-ray security screening equipment is also due to increased investments in infrastructure development projects, such as airports and governmental & commercial buildings, which are intended to ensure public safety and thwart possible threats.

Key X-Ray Security Screening Market Insights Summary:

Regional Highlights:

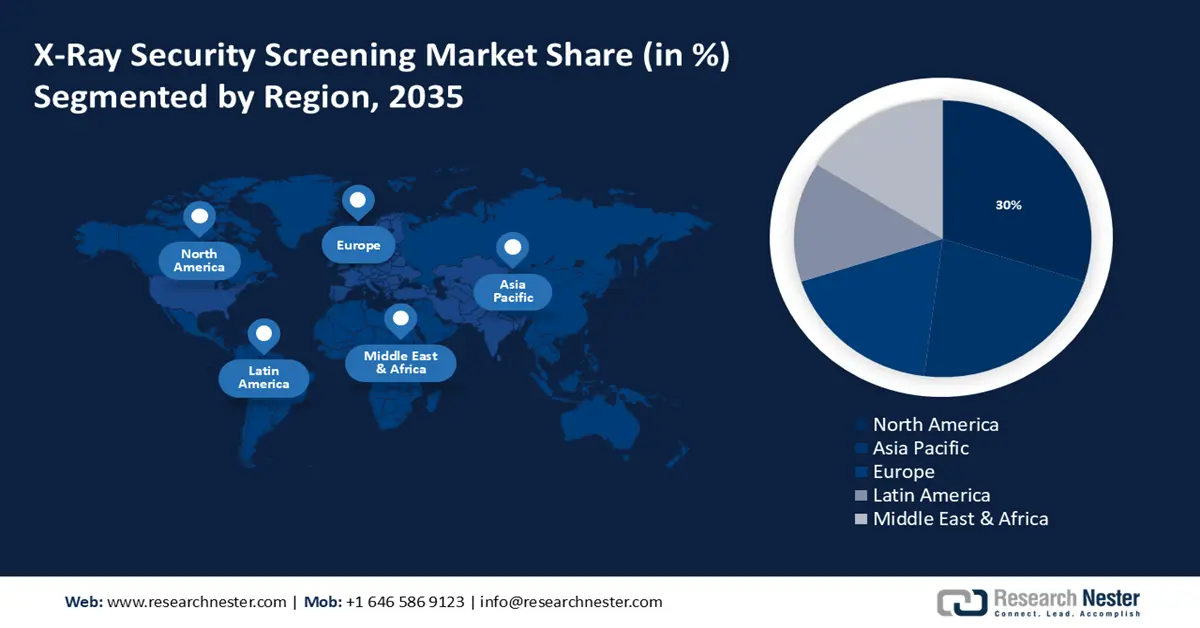

- North America x-ray security screening market will hold more than 30% share by 2035, driven by strong government investments in public security and airport screening.

- Asia Pacific market will capture a 22% share by 2035, driven by increased air traffic and booming e-commerce.

Segment Insights:

- The transit segment in the x-ray security screening market is expected to hold a 60% share by 2035, attributed to the surge in passengers worldwide and enhanced security measures at transit hubs.

- The product screening segment in the x-ray security screening market is projected to hold a 59% share by 2035, driven by rapid expansion of the e-commerce industry and the increase in parcel shipments.

Key Growth Trends:

- Increasing Demand in Airports and Other Transportation Hubs

- Integration of AI in X-ray Security Screenings

Major Challenges:

- Health Concerns

Key Players: OSI Systems, Inc., Smiths Detection Group Ltd., Leidos, Thales, Teledyne Technologies Incorporated, Bruker, Analogic Corporation, Astrophysics Inc., LINEV Group, Nuctech.

Global X-Ray Security Screening Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.19 billion

- 2026 Market Size: USD 4.54 billion

- Projected Market Size: USD 10.1 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

X-Ray Security Screening Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand in Airports and Other Transportation Hubs: There is a high demand for X-ray security screenings in airports and other transportation hubs due to an increase in various security threats such as terrorism, illegal immigration, and illicit trafficking of firearms & drugs. In addition to that, the high volume of transportation hubs creates a high risk of various security threats which is expected to drive the growth of the X-ray security screening market. For instance, currently, there are around 40,000 airports, airstrips & heliports in the world. Additionally, there are around 4200 seaports globally.

- Integration of AI in X-ray Security Screenings: One of the main factors driving demand in the X-ray security screening industry is the incorporation of AI into these systems. Because AI allows machines to learn and adapt, it improves the accuracy of threat identification and increases screening efficiency. Machine learning (ML) algorithms can quickly and accurately discern between benign objects and possible hazards in complex X-ray images. This feature improves the efficiency of the screening process by lowering false positives and streamlining security protocols. As security threats evolve, so does the need for sophisticated screening solutions. To keep ahead of new dangers, governments, airports, and other security-sensitive organizations invest in AI-integrated X-ray equipment. This provides a strong push for ongoing market expansion in the forecast period.

- Surge in Global Trade Activities: According to data published by World Bank currently the trade growth is 12.59% compared to a world growth of 12.59%. Due to this rise in international trade activities, there is an increased need to protect products in transit from potential dangers. Both corporations and governments make large investments in cutting-edge screenings to find bombs, drugs, and other illegal items that could jeopardize supply chain security, further propelling the market growth of X-ray security screenings.

Challenges

- Health Concerns: The use of X-ray equipment raises health concerns due to exposure to ionizing radiation which can lead to acute radiation sickness, multi-system syndromes, and genetic abnormalities at the cellular level. Due to this people may become skeptical to consent to X-ray screening as a result especially when body scanners hampering the X-ray security screening market in the forecast period.

- Due to the high cost of application of X-ray security systems some companies may find the large upfront costs unaffordable which can hold back the market growth

- The growing use of X-ray screening devices, especially in public places, has sparked debates concerning privacy and the possibility of invasive scanning due to legal and ethical issues.

X-Ray Security Screening Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 4.19 billion |

|

Forecast Year Market Size (2035) |

USD 10.1 billion |

|

Regional Scope |

|

X-Ray Security Screening Market Segmentation:

Type Segment Analysis

The product screening segment in the X-ray security screening market is estimated to gain a significant share of about 59% in the year 2035. The segment growth can be attributed to the rapid expansion of the e-commerce industry. According to research in 2021 were there 160 billion parcels shipped worldwide. The figure has tripled in the last 7 years. Because of the increase in e-commerce sales, many parcels and small packages are being transported, making parcel screening essential. Although convenient for both businesses and consumers, the massive volume of post and package deliveries to homes and businesses poses a growing security vulnerability, necessitating the screening of mail and parcels.

End Use Segment Analysis

The transit segment in the X-ray security screening market is estimated to gain the largest revenue share of about 60% in the year 2035. The segment growth can be attributed to the surge in passengers worldwide and continuous efforts to apply security measures to provide total safety for locals and visitors from abroad. According to studies, there are roughly 100,000 flights every day, encompassing all kinds of aircraft, such as military, freight, and passenger aircraft. Furthermore, security compliances by various regulatory bodies and governments compelling airports and transportation hubs to adopt security measures are also expected to spur the growth of the transit segment in the forecast period.

Our in-depth analysis of the X-ray security screening market includes the following segments:

|

Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

X-Ray Security Screening Market Regional Analysis:

North American Market Insights

X-ray security screening market in the North American region market amongst the markets in all the other regions, is anticipated to hold the largest with a share of about 30% by the end of 2035. The market growth in the region is also expected on account of significant government spending on enhancing public safety and security infrastructure, especially in response to challenges like illegal immigration and terrorism. According to studies, the US spends an estimated 4.9 billion on Border patrol to tackle illegal immigration and illicit trafficking. Furthermore, stringent rules and regulations by bodies like The Canadian Air Transport Security Authority (CATSA) have set strict security screening protocols at airports for people, baggage, and the administration of identity cards which has resulted in a demand for X-ray screenings adoption in the region. Additionally, the USA’s status as a major economic force in the world and its many busy international airports contribute to the demand. also expected to spur the growth of X-ray security screening market in the North American region.

APAC Market Insights

The Asia Pacific X-ray security screening market is estimated to be the second largest, registering a share of about 22% by the end of 2035. The market’s expansion can be attributed majorly to the rise in air traffic in the region as a result of more accessible fares, a rise in both business and leisure travel, and a rise of the middle class in countries like India, Indonesia, China, Philippines, Thailand, Japan, and South Korea. Data provided by an analytics firm suggest that domestic air traffic in India had an estimated all-time high passenger count of 150 million passengers in 2023 beating the previous record of 144 million passengers in 2019. Furthermore, the swift expansion of e-commerce and international trade in countries like China and India has boosted the market growth in the region. For instance, China alone delivered and handled an estimated 110 billion parcels in the year in 2022 which has resulted in an increased requirement for strong security protocols. Thus, is attributed to the growth of X-ray security screening market in the Asia Pacific region.

X-Ray Security Screening Market Players:

- OSI Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smiths Detection Group Ltd.

- Leidos

- Thales

- Teledyne Technologies Incorporated

- Bruker

- Analogic Corporation

- Astrophysics Inc.

- LINEV Group

- Nuctech

Recent Developments

- OSI Systems, Inc. announced that a non-intrusive inspection system from the Company’s Security division was used to detect six and a half tons of methamphetamine in a tractor-trailer truck at the Eagle Pass Port of Entry, the largest such seizure ever at a U.S. port of entry.

- Bruker Corporation (Nasdaq: BRKR) announced the launch of the new BEAM – the first dedicated single-point spectrometer unleashing the full power of FT-NIR spectroscopy, taking in-process control for solid samples to the next level. The BEAM uses FT-NIR technology, which is based on Bruker's RockSolidTM interferometer, in contrast to common single-point analyzers that are based on filter or diode-array technology, to ensure that it can perform the same applications with the same precision, accuracy, and long-term stability you would expect from a high-end lab-based system.

- Report ID: 5993

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

X-Ray Security Screening Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.