Wireless LAN Controller Market Outlook:

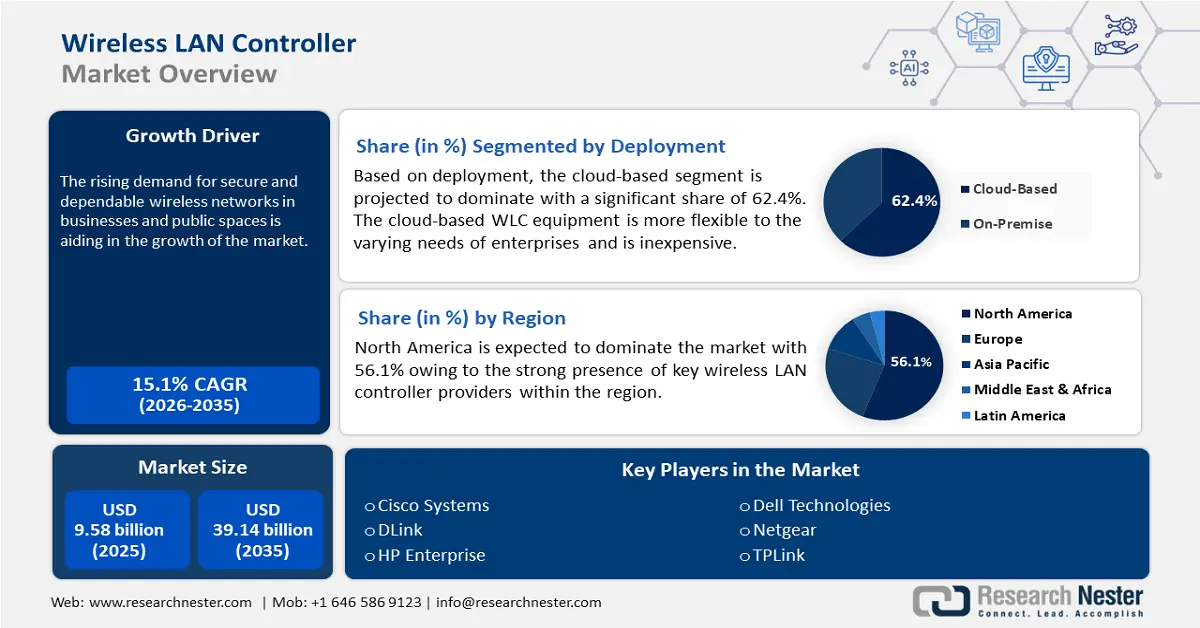

Wireless LAN Controller Market size was valued at USD 9.59 billion in 2025 and is likely to cross USD 39.14 billion by 2035, expanding at more than 15.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless LAN controller is assessed at USD 10.89 billion.

With the increase in reliance on mobile applications and devices for wireless connectivity, wireless LAN controllers have seen an upsurge in demand. Furthermore, the rise of remote working culture and the requirement for tight security in wireless communications push market growth. For instance, in June 2024, Cisco Systems announced the launch of the Cisco Cybersecurity Center for Excellence in Tokyo to strengthen cybersecurity threats and enhance digital resilience in the country.

This is further amplified with the rise of IoT, where businesses and houses are keen on proper management and securing their massive networks. Advances in technology, such as the shift to Wi-Fi 6 and integration of artificial intelligence for network management, make wireless LAN controllers a must-have for organizations aiming at efficiency in their operations as well as improvement in user experience. For instance, in January 2022, D-Link unveiled the DAPX2850 and DAPX2850, two new Wi-Fi 6 access points. These devices are designed to provide a more seamless Wi-Fi experience for bandwidth-intensive applications, particularly in high-density network environments. Thus, these factors contribute to the ever-changing landscape of wireless networking that Wireless LAN Controllers play in enabling seamless connectivity.

Key Wireless LAN Controller Market Insights Summary:

Regional Highlights:

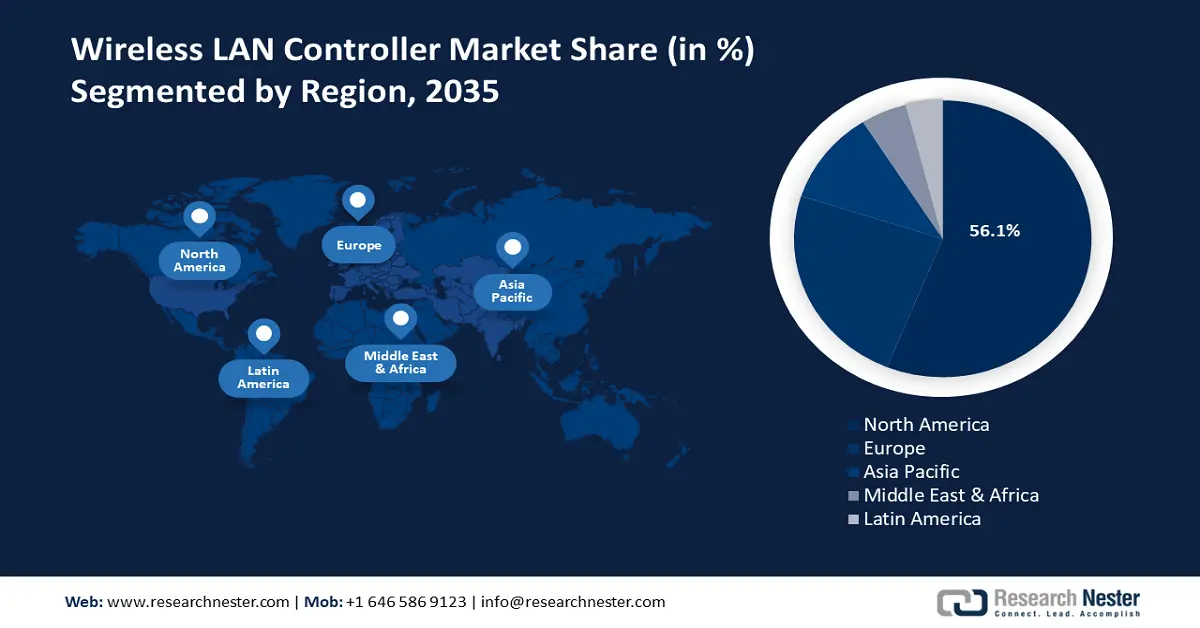

- North America wireless LAN controller market will account for 56.10% share by 2035, driven by the increasing adoption of cloud-based wireless LAN solutions.

- Europe market will register a steady pace CAGR during the forecast period 2026-2035, fueled by IoT adoption and strict data privacy regulations.

Segment Insights:

- The cloud-based segment in the wireless LAN controller market is anticipated to capture a 62.40% share by 2035, propelled by the model’s scalability and centralized control across multiple sites.

- The network management features segment in the wireless lan controller market is projected to see a surge in growth till 2035, driven by the demand for better network visibility, performance optimization, and IT control.

Key Growth Trends:

- Demand for enhanced user experience

- Advancement in wireless technology

Major Challenges:

- High initial investment costs

- Interoperability issues

Key Players: Cisco Systems, Inc., Aruba Networks (Hewlett Packard Enterprise), Ruckus Networks (CommScope), Ubiquiti Inc., Extreme Networks, Inc., Fortinet, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Meraki (Cisco), Aerohive Networks (Extreme Networks).

Global Wireless LAN Controller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.59 billion

- 2026 Market Size: USD 10.89 billion

- Projected Market Size: USD 39.14 billion by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (56.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 18 September, 2025

Wireless LAN Controller Market Growth Drivers and Challenges:

Growth Drivers

- Demand for enhanced user experience: The growth driver in the wireless LAN controller market lies in the increasing need for advanced user experience mainly due to rising dependence on mobile devices and applications both at work and in life. For instance, in November 2023, NETGEAR introduced WAX610 and WAX610Y Wi-Fi 6 wireless access points to enhance network connectivity for all connected users in the workspace. They provide enterprise-grade security to protect the network and linked devices while providing dependable Wi-Fi 6 connectivity in high-density settings. Thus, by focusing on the user experience, productivity can be boosted alongside customer satisfaction and loyalty through optimization of network performance.

- Advancement in wireless technology: Next-generation wireless technologies in the wireless LAN controller market offer better speed, capacity, and efficiency. Thus, organizations are seeking for such reliable and efficient solutions. For instance, in March 2024, Cisco and Intel revealed to broaden their horizons through collaboration to render more dependable Wi-Fi connectivity and new features that are sensitive to latency. With an emphasis on developing Wi-Fi 7 technologies together and enhancing compatibility between Cisco access points and Intel client devices. With these changes that advance connectivity and performance, wireless LAN controllers become a must for businesses seeking to maximize the benefits of these next-generation wireless networks.

Challenges

- High initial investment costs: Wireless LAN controllers involve huge upfront investments in hardware, software, and integration services, which can be too expensive to afford. This financial constraint may prevent organizations from upgrading their wireless infrastructure, thereby inhibiting their ability to improve connectivity and performance. In addition, the integration into the existing system may escalate the cost. Therefore, most SMEs might allow fewer upgraded solutions which indeed reduces their competitive advantage in the market.

- Interoperability issues: In the wireless LAN controller market, predominantly due to disparities in vendor-specific protocols and configurations interoperability poses a significant challenge. This lack of standardization can cause compatibility issues during the integration of devices which may make the network inefficient and hard to manage. In addition, proprietary features may not be compatible across different hardware and may cause a problem for the overall performance and reliability of the wireless network. Therefore, organizations may fail to achieve the best possible network performance and user experience.

Wireless LAN Controller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 9.59 billion |

|

Forecast Year Market Size (2035) |

USD 39.14 billion |

|

Regional Scope |

|

Wireless LAN Controller Market Segmentation:

Deployment Segment Analysis

By 2035, cloud-based segment is set to account for wireless LAN controller market share of around 62.4%. It offers scalability and flexibility making it suitable for organizations. In addition, it allows centralized management over various locations without extensive infrastructure needed on-premises. For instance, in March 2024, NVIDIA unveiled a networked NVIDIA 6G Research Cloud platform that provides researchers with a full suite of tools to develop AI for radio access network (RAN) technology. Organizations can use the platform to speed up the development of 6G technologies, which will link trillions of devices to cloud infrastructures. Therefore, the cloud-based model enhances overall efficiency and responsiveness in managing wireless networks.

Management Features Segment Analysis

Network management features of wireless LAN controller market are expected to witness a surge throughout 2035, as enhanced visibility and control over the wireless environment will continue to increase. Advanced management capabilities and analytics will enable IT administrators to optimize network performance and ensure seamless connectivity. For instance, in November 2023, MediaTek updated its Wi-Fi 7 platform with the Filogic 360 and Filogic 860 solutions. The goal of these second-generation additions is to expand MediaTek's state-of-the-art product platform, which leverages the latest advancements in connectivity technology for optimal performance and dependability. With an emphasis on a better user experience and business operation, robust network management features will ensure proactive solutions.

Our in-depth analysis of the global wireless LAN controller market includes the following segments:

|

Deployment |

|

|

WLAN Standards Supported |

|

|

Management Features |

|

|

Hardware Form Factor |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless LAN Controller Market Regional Analysis:

North America Market Insights

In wireless LAN controller market, North America region is predicted to hold more than 56.1% revenue share by 2035. The rise in demand for wireless LAN controllers by organizations is on account of growing interest in the adoption of cloud-based solutions. It assists organizations in managing their network cost-efficiently with scalability and better adaptability to accommodate high performance. These features render easy access across education and healthcare sectors.

The wireless LAN controller market in the U.S. is thriving significantly owing to the surging need for a strong wireless infrastructure. This development in the technology ecosystem will assist in supporting growing network demands by businesses and consumers in their operations for seamless connectivity and operational efficiency. For instance, in June 2022, Qualcomm Technologies, Inc. unveiled radio frequency-based filter technology ultraBAW that allows both Wi-Fi and 5G solutions to access spectrum up to 7 GHz.

In Canada, the wireless LAN controller market is experiencing promising growth based on emerging demand for cloud-managed solutions that support centralized management. For instance, in July 2024, in collaboration with Ericsson, Rogers Communications conducted a 5G cloud-radio access network (cloud RAN) technology trial. This new technology will allow the telco to improve network reliability and make 5G technological advancements. Furthermore, the sustainable practice in the technology industry also molds the product development.

Europe Market Insights

The Europe wireless LAN controller market is growing at a steady pace attributed to the adoption of IoT devices across all industries. This further demands advanced wireless infrastructure regarding connectivity and data exchange for the smart applications of IoT integration. In addition, rigid regulation toward data privacy in Europe makes organizations invest in secure yet efficient wireless solutions, thereby driving the demand for innovative LAN controllers. It will thus guarantee compliance while improving the network's performance and reliability.

The German wireless LAN controller market is growing highly because of the country's focus on digital transformation initiatives. Businesses and public institutions are migrating towards the modernization of their IT infrastructure, so demand for high-performance wireless solutions that guarantee smooth connectivity and efficient operation is on the rise. Moreover, Germany's focus on Industry 4.0, investing in smart manufacturing technologies, fuels the demand for reliable wireless LAN controllers to support such innovations.

The U.K. wireless LAN controller market is showing tremendous growth, primarily because of the rapid proliferation of remote and hybrid work models. With the evolution of organizations, there's a high demand for reliable and secure wireless networks that can support a distributed workforce. For instance, in May 2024, O₂ Telefonica and Samsung Electronics Co., Ltd. announced the opening of their first Open RAN and virtualized RAN (vRAN) commercial sites in Germany. Samsung's 5G vRAN solution is being deployed in a commercial network in Germany for the first time.

Wireless LAN Controller Market Players:

- Cisco Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aerohive Networks

- HP Enterprise

- DLink

- Dell Technologies

- Zyxel Communications

- Netgear

- TPLink

- Ubiquiti Networks

- Ruckus Wireless

- Juniper Networks

The wireless LAN controller market is experiencing fundamental changes due to the top-notch companies striving to discover innovative solutions. They are seeking automation and analytics for more efficient network performance and user experience. Moreover, the IoT revolution has brought transformation in scalability and has coped with robust security measures. For instance, in November 2021, Juniper Networks' cloud-based Mist AI network management software included IoT security. The newest Mist AI-enabled product secures IoT devices and unifies their management through private pre-shared keys.

Here's the list of some key players:

Recent Developments

- In July 2024, Optus and Cisco announced a new multi-year partnership that will provide enhanced network security and data security services for Optus Enterprise and Business customers.

- In January 2024, EnGenius Technologies Inc. introduced the Cloud WiFi 7 series to business clients. It is powered by the Qualcomm Pro 1220 networking platform. This cloud-managed Wi-Fi 7 Wireless Access Point was created for enterprise-level environments.

- Report ID: 6789

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless LAN Controller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.